Market Overview - Page 97

August 17, 2022

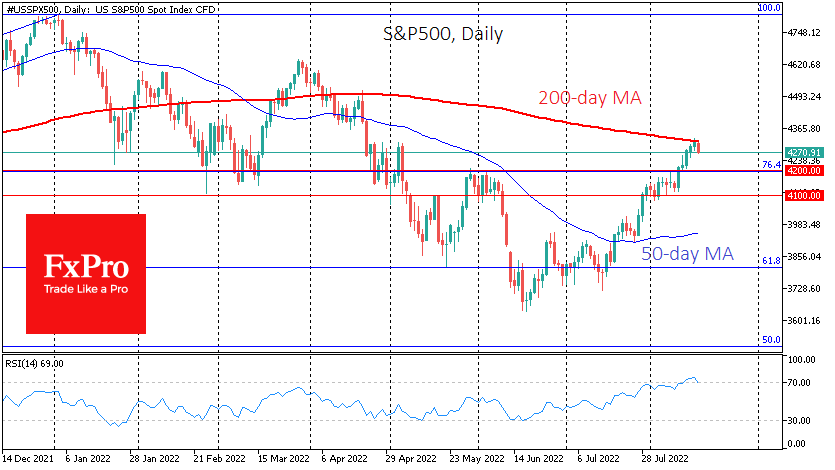

The S&P500 index has gained 4.2% in the previous five trading sessions, ending Tuesday’s trading above the 4300 mark. However, two ingredients are missing for the bulls to win. Firstly, consolidation above the 200 SMA is an essential technical indicator.

August 17, 2022

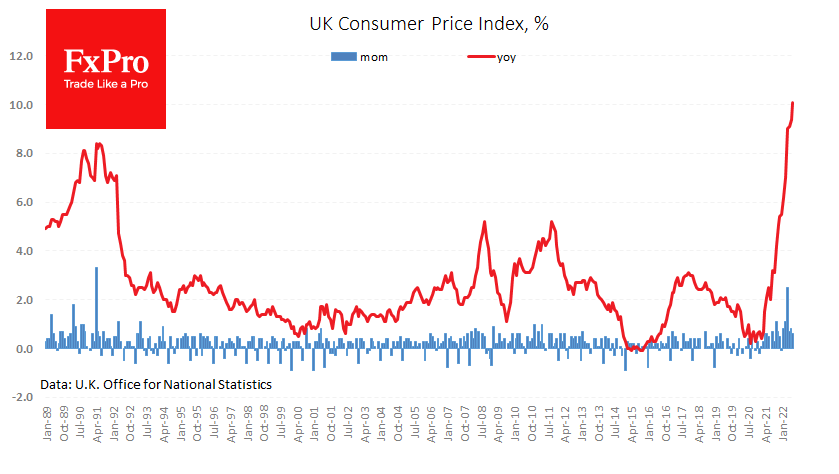

While economists in the US and Canada, and later policymakers, are talking about peak inflation, that moment is yet to come for the UK. Annual inflation has reached double-digit territory at 10.1%. At the same time, the monthly price growth.

August 16, 2022

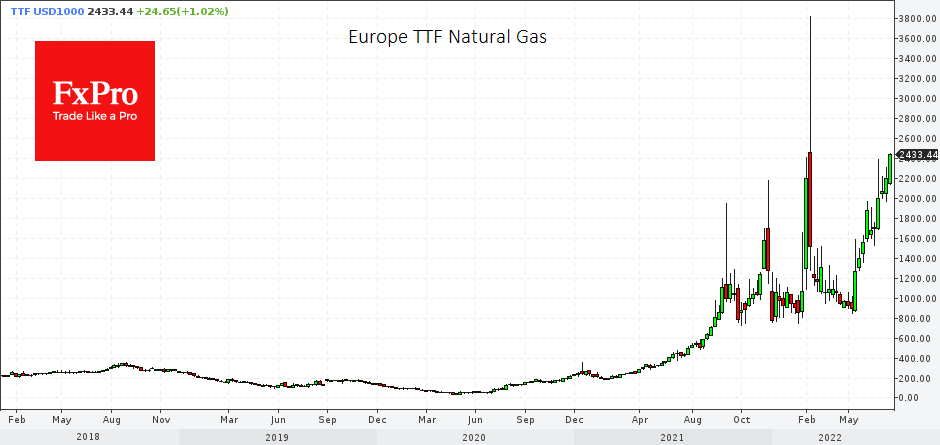

Oil experienced intense pressure on Monday, but the price of natural gas continued its upward trend. This contrast is due to an under-supply of Russian gas to the European market and more speculation around Iranian oil, which could quickly add.

August 16, 2022

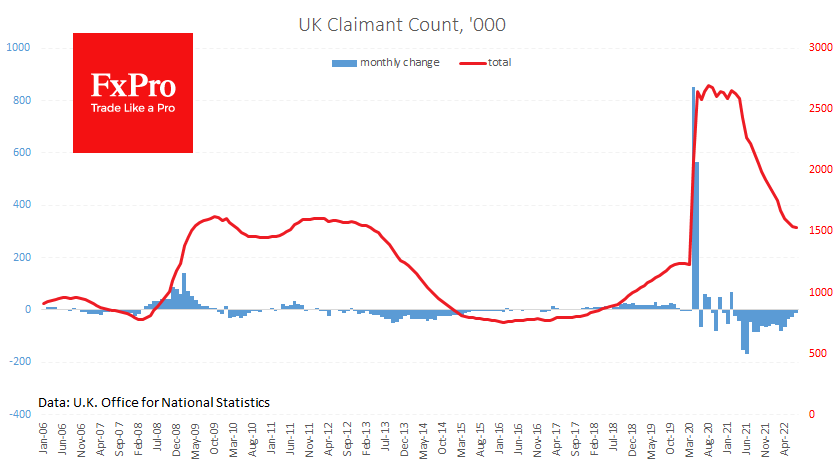

The UK employment statistics package failed to inspire the currency market to buy the Pound. The released data showed a slowdown in the labour market, which is still far from recovering to pre-coronavirus levels. Analysts were tuning in for acceleration,.

August 15, 2022

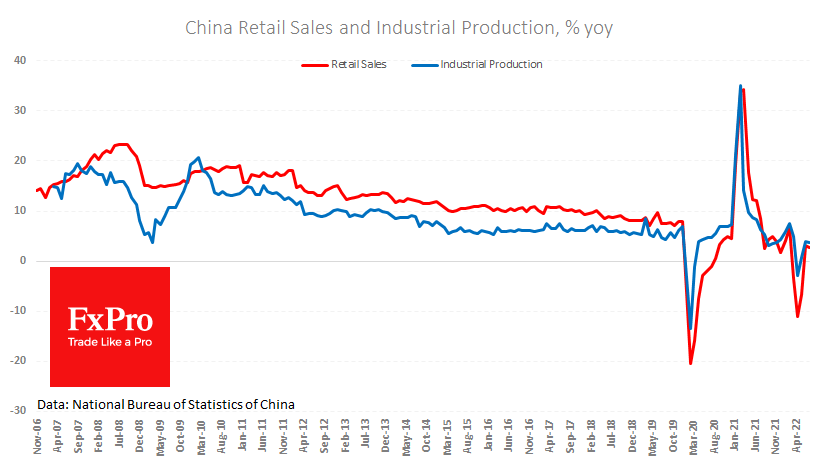

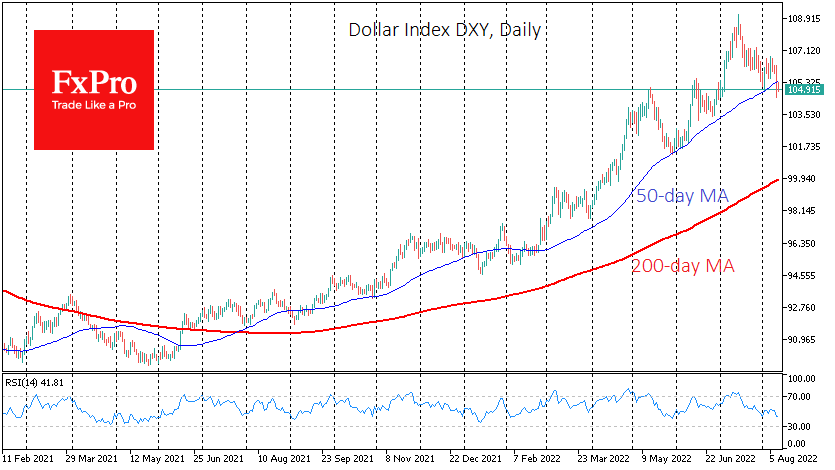

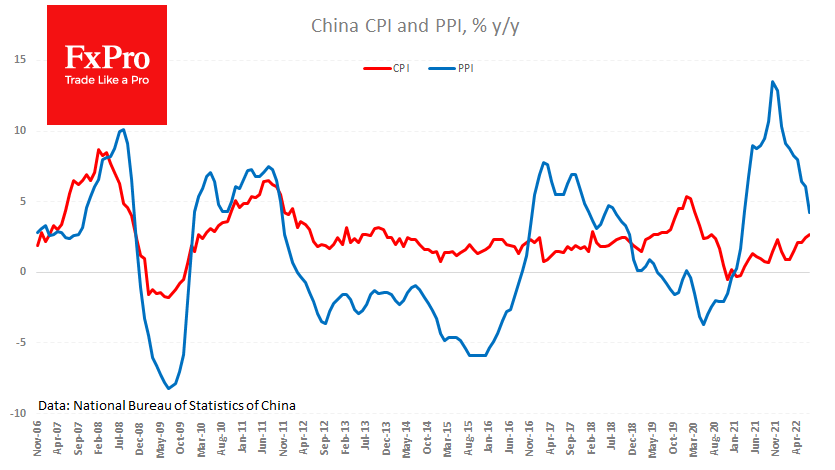

The statistics released from China today raise concerns about the economy’s near-term prospects, preventing the USDCNH from bucking the uptrend. July data showed a slowdown in retail sales growth from 3.1% y/y to 2.7%, in stark contrast to the average.

August 15, 2022

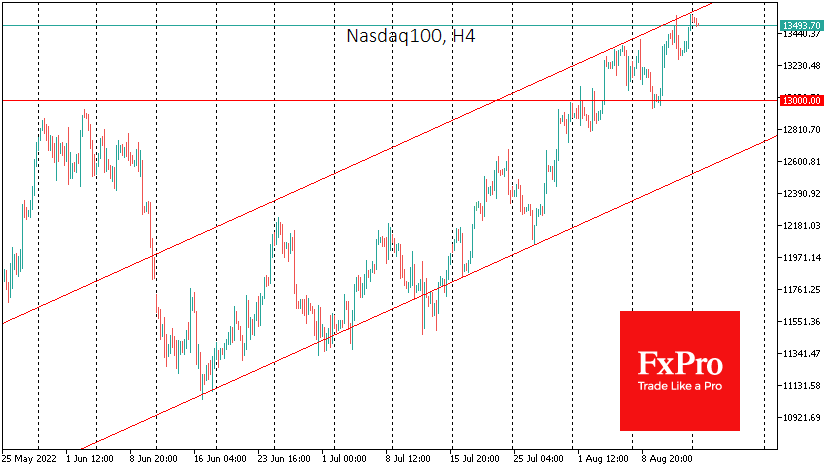

The US stock market recorded the third week of gains, allowing the Nasdaq100 to add 2.1% and overcoming several meaningful resistances, potentially clearing the way for a further leg up. At the same time, local technical overbought conditions have accumulated..

August 12, 2022

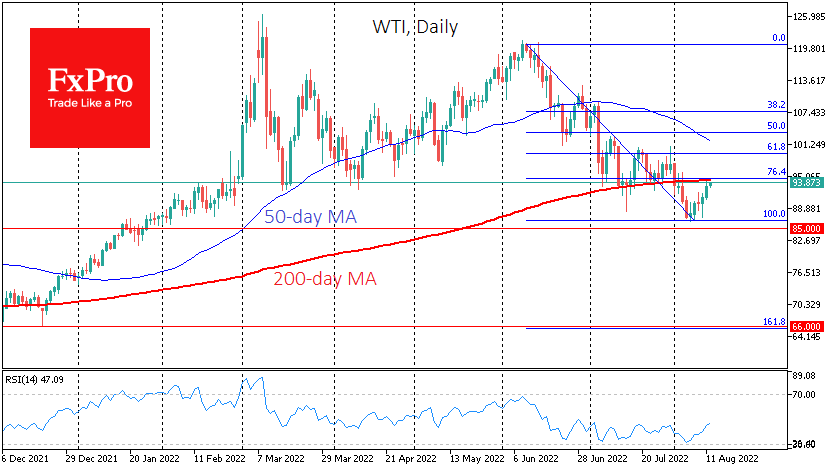

WTI crude has gained more than 6.5% this week, and this strengthening has a pinch of irony. Stock indices managed to surpass the highs of the previous week’s pullback and the weak inflation report’s main driver of increased risk appetite..

August 12, 2022

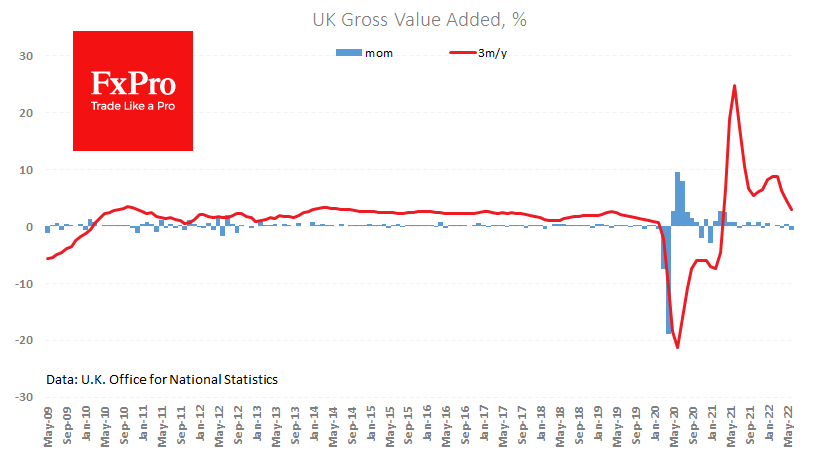

The UK monthly statistics package showed that the economy lost 0.1% in the second quarter (0.2% expected), and the annual growth rate collapsed from 8.7% to 2.9% (2.8% expected). For the month, the decline was 0.6%, half the forecasts. A.

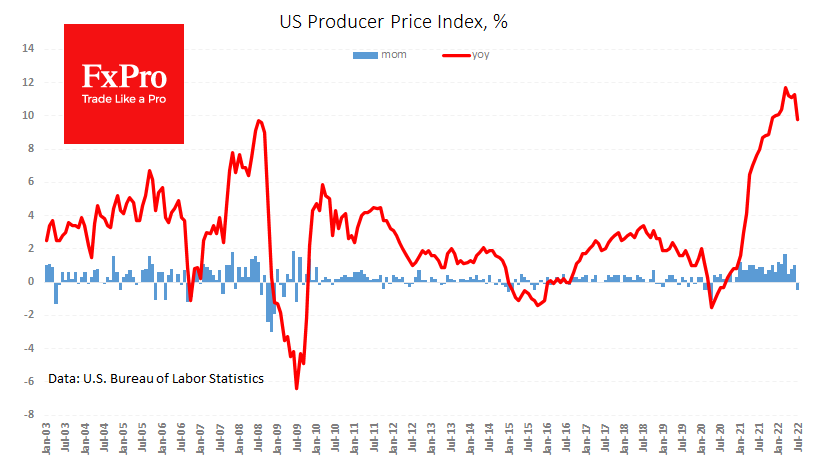

August 11, 2022

US producer prices fell by 0.5% in July, the first decline after 26 months of growth. The year-over-year PPI rate returned to the single-digit territory at 9.8% against a peak of 11.7% in March and 11.3% a month ago. Producer.

August 11, 2022

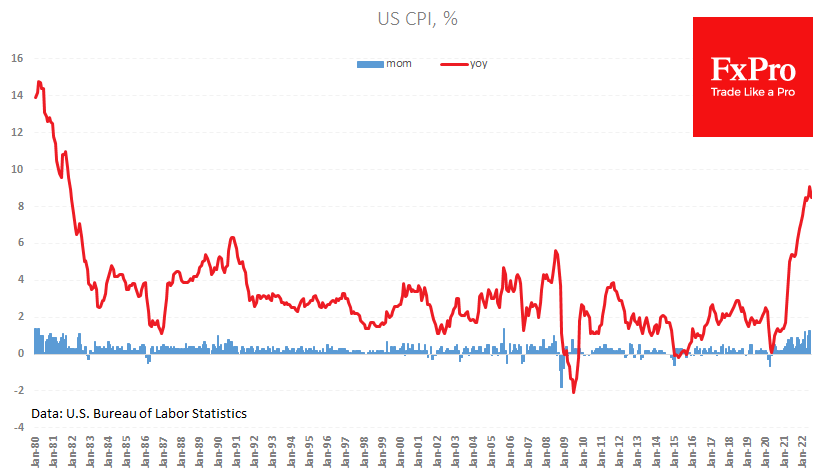

The US inflation data published on Wednesday triggered a strong and unequivocal reaction from financial markets, allowing more certainty about starting a new market cycle. Yesterday’s report showed close to zero price growth for July, while annual CPI growth slowed.

August 10, 2022

US consumer inflation slowed to 8.5% in July from 9.1% a month earlier. As we had pointed out, the fact was noticeably lower than the forecasted 8.7%, and this caused an immediate market reaction. FedWatch Tool showed the market’s estimate.