Inflation surprises threaten the market rebound

October 17, 2022 @ 18:30 +03:00

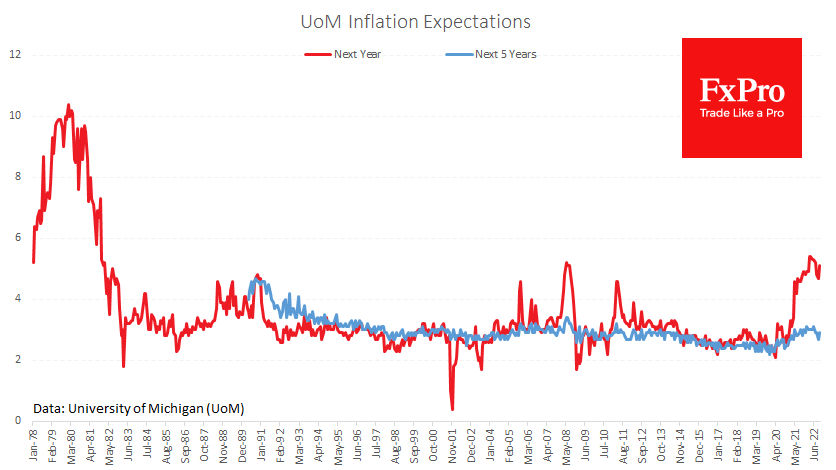

Last week brought two inflation surprises to the US markets. The first was the sensational CPI data for September. But on Friday evening, we turned our attention to another equally important indicator, inflation expectations.

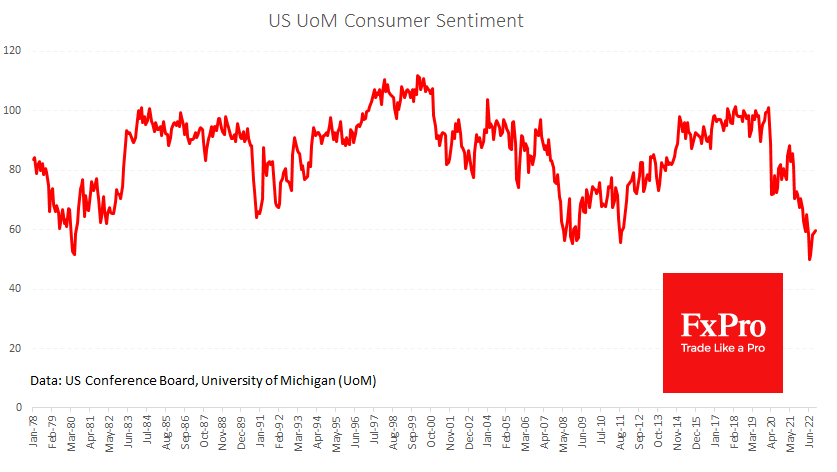

The University of Michigan Consumer Sentiment Index is up for a fourth month, reaching 59.8 in its preliminary October estimate. At the same time, the trend of falling inflation expectations has broken. Americans forecast prices to rise 5.1% in a year versus 4.7% in September and 4.8% in August. Five-year expectations are back from 2.7% in September to 2.9%, where they held in July and August.

This significant shift in expectations indicates that inflationary pressures are becoming entrenched, which also showed in the rise in the core inflation index. It will not be surprising if this leads to another round of tightening rhetoric from the Fed. The most significant focus for traders may be whether there will be two more 75-point rate hikes or whether the FOMC will slow down or stop early after tightening in November.

On Monday, markets try to turn a blind eye to these risks by wagering on reports above depressed expectations. However, without comments from the Fed confirming a slower pace of rate hikes, this could be another bear market rally.

The FxPro Analyst Team