March 12, 2026 Crypto Review

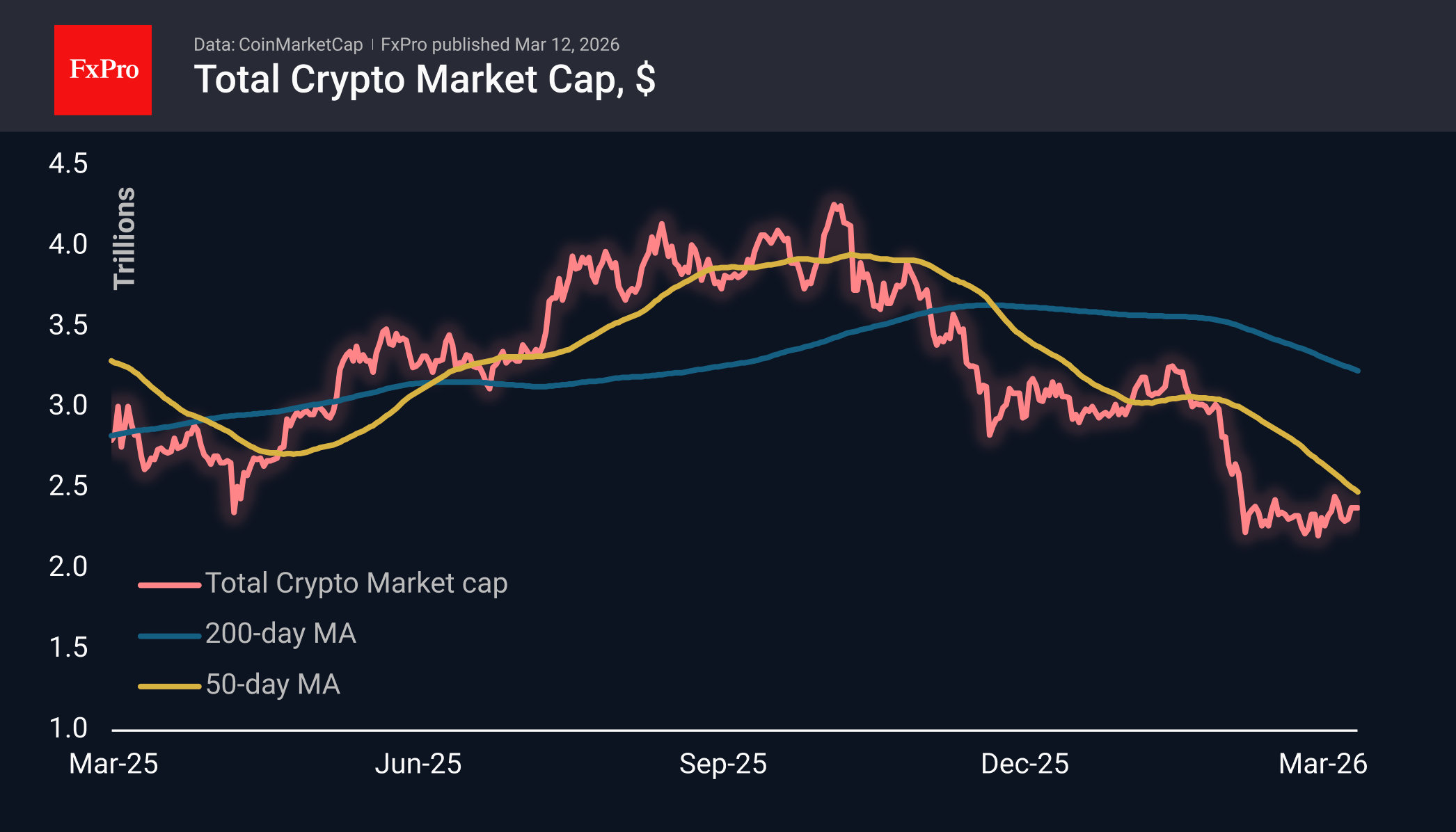

The crypto market is consolidating at $2.4T; BTC is holding steady at around $70K despite the strong dollar and weak stock indices. The RWA sector and asset tokenisation continue to grow rapidly.

March 12, 2026 Market Overview

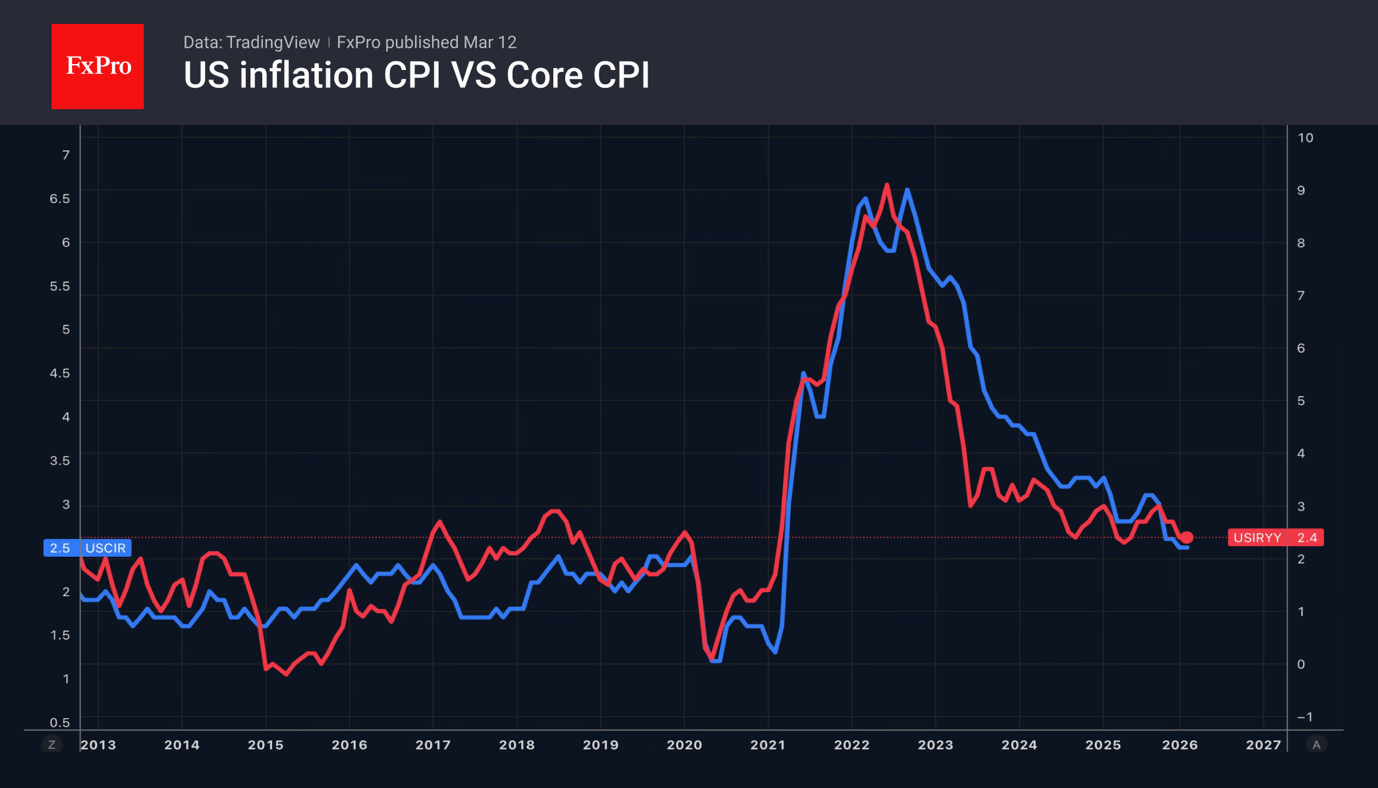

The rise in oil prices has been a key driver of the dollar's strengthening; Brent above $100 increases inflation risks for the EU and pushes USDJPY towards a zone of possible intervention.

Today is Thursday, the 12th of March 2026.

Right now, silver is probably one of the hottest markets, maybe second only to oil, which is clearly being driven by news.

#tradelikeapro #trading #silver #silverprice #tradingshorts #tradingshortvideo

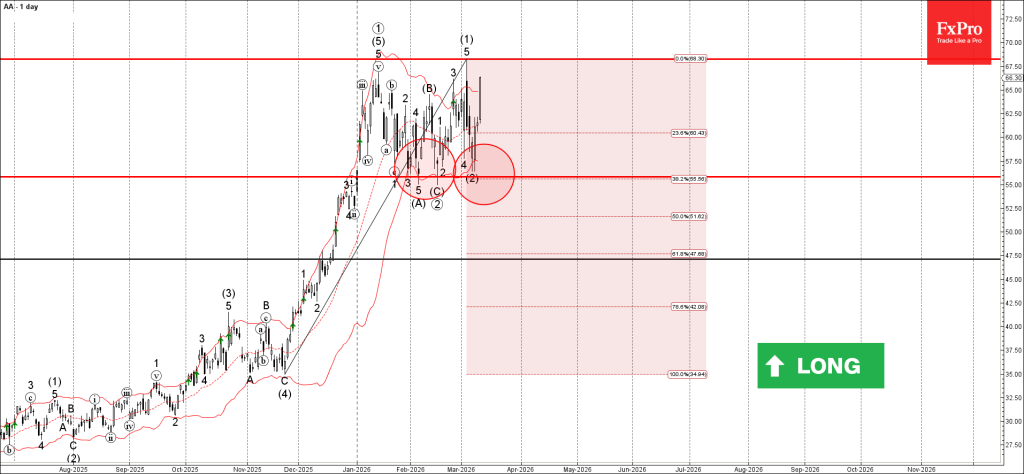

Alcoa: ⬆️ Buy – Alcoa reversed from support area – Likely to rise to resistance level 68.20 Alcoa reversed from the support area between the support level 55.80 (which has been repeatedly reversing the price from the end of January).

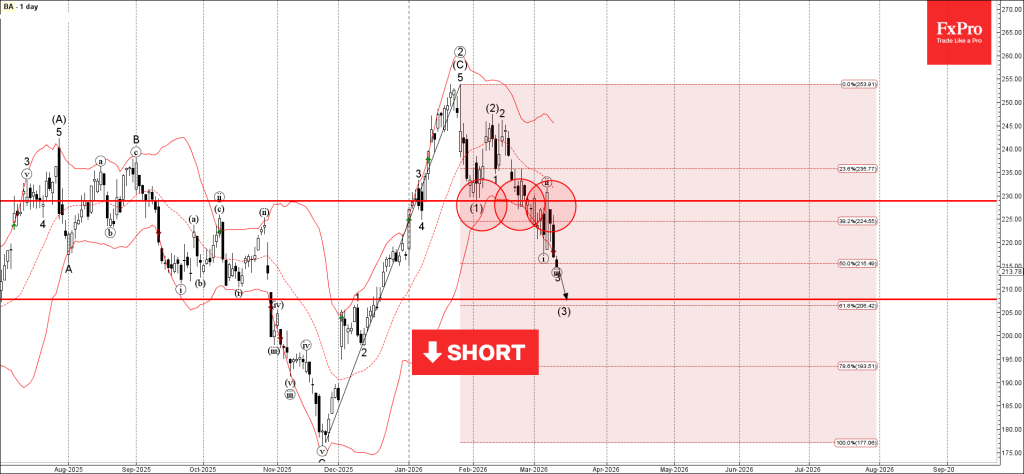

Boeing: ⬇️ Sell – Boeing falling inside impulse wave iii – Likely to fall to support level 207.85 Boeing recently reversed down from resistance zone between the resistance level 230.00 (former strong support from February) and the 38.2% Fibonacci correction.

March 11, 2026 Market Overview

Brent under pressure: the market is torn between expectations of a quick end to the conflict and the risks of it dragging on. Sales of IEA reserves not a sure cure for rising prices.

March 11, 2026 Market Overview

The dollar and oil are moving in tandem: conflict in the Middle East is weighing on markets, changing expectations for Fed and ECB rates, and shifting investor interest towards commodity currencies.

March 11, 2026 Crypto Review

Crypto market remains under the bear’s control, with top coins down and smaller ones up. BTC and ETH face key resistance, while the market awaits new capital for a bullish reversal.

Zcash: ⬆️ Buy – Zcash reversed from round support level 200.00 – Likely to rise to resistance level 250.00 Zcash cryptocurrency recently reversed up from the support area between the round support level 200.00 (which has been reversing the price.

Halliburton: ⬆️ Buy – Halliburton reversed from support area – Likely to rise to resistance level 36.35 Halliburton previously reversed up from the support area between the support level 33.40 (low of the previous correction b) and the lower daily.

AUDNZD: ⬆️ Buy – AUDNZD broke resistance zone – Likely to rise to resistance level 1.2100 AUDNZD currency pair recently broke through the resistance zone between the resistance level 1.923 and the resistance trendline of the sharp daily up channel.

EURAUD: ⬇️ Sell – EURAUD falling inside daily down channel – Likely to fall to support level 1.6200 EURAUD currency pair has been falling in the last few trading sessions inside the sharp daily downward channel from the end of.