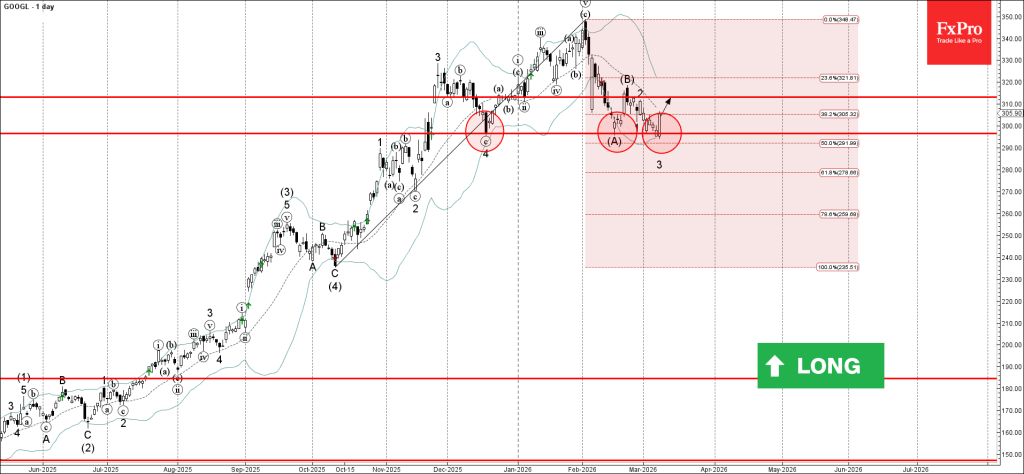

Google: ⬆️ Buy – Google reversed from key support level 296.40 – Likely to rise to resistance level 313.00 Google recently reversed from the support zone between the key support level 296.40 (which stopped earlier waves 4 and (A)), lower.

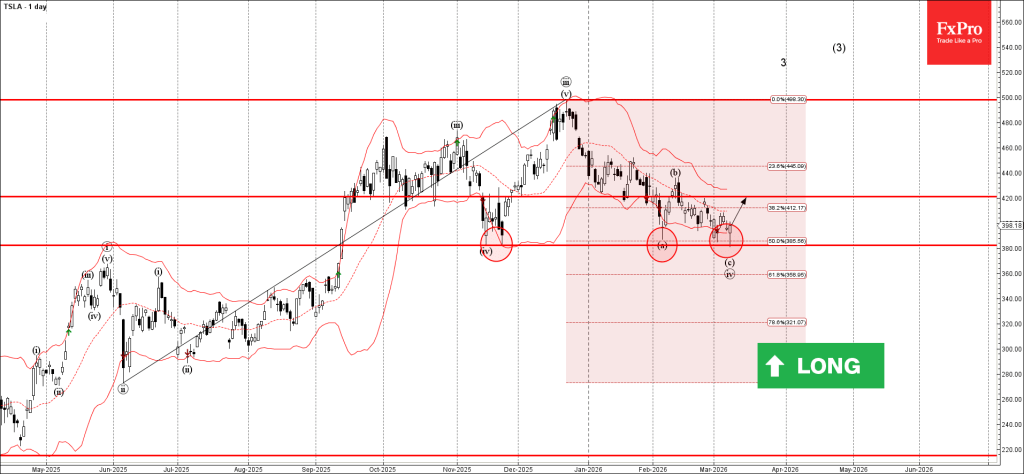

Tesla: ⬆️ Buy – Tesla reversed from strong support level 380.00 – Likely to rise to resistance level 420.00 Tesla recently reversed from the support area between the strong support level 380.00 (which has been reversing Tesla from November) and.

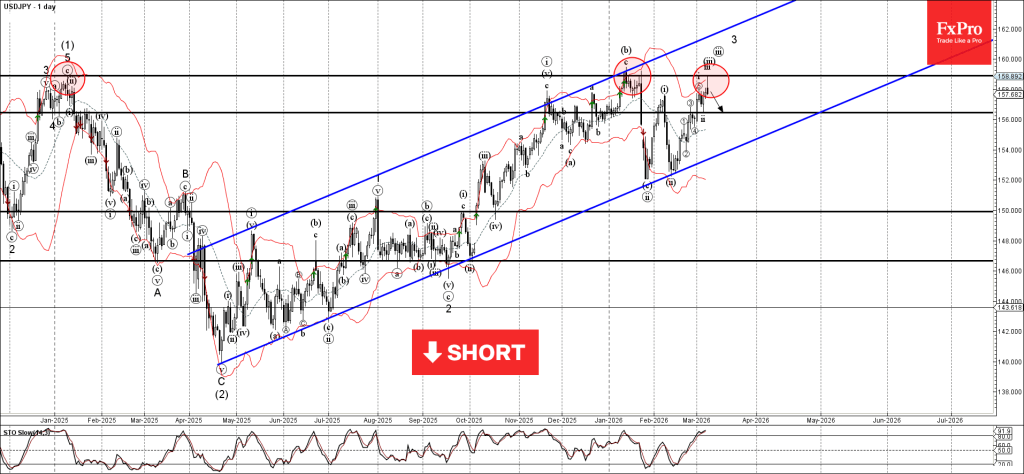

USDJPY: ⬇️ Sell – USDJPY reversed from resistance area – Likely to fall to support level 158.1 USDJPY currency pair recently reversed from the resistance area between the long-term resistance level 159.00 (which has been reversing the pair from the.

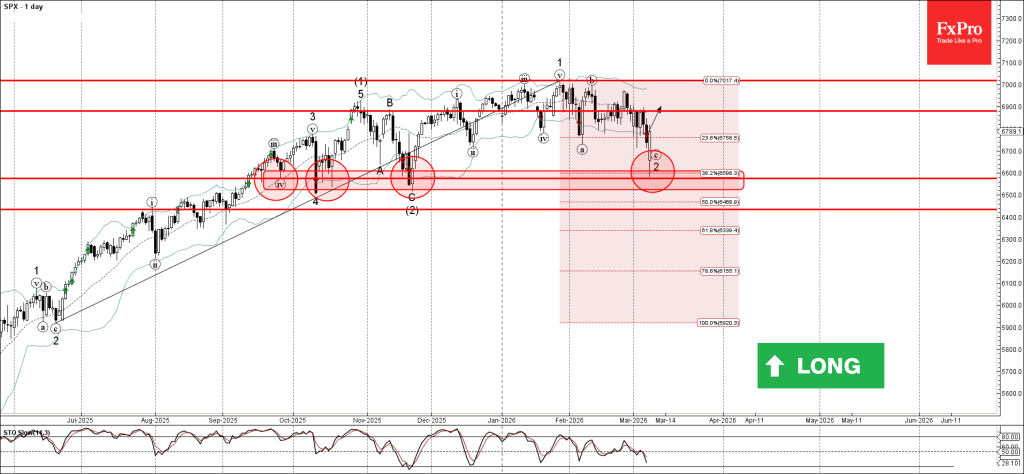

S&P 500: ⬆️ Buy – S&P 500 reversed from support zone – Likely to rise to resistance level 6900.00 S&P 500 index recently reversed from the support zone between the key support level 6600,00 (which has been reversing the price.

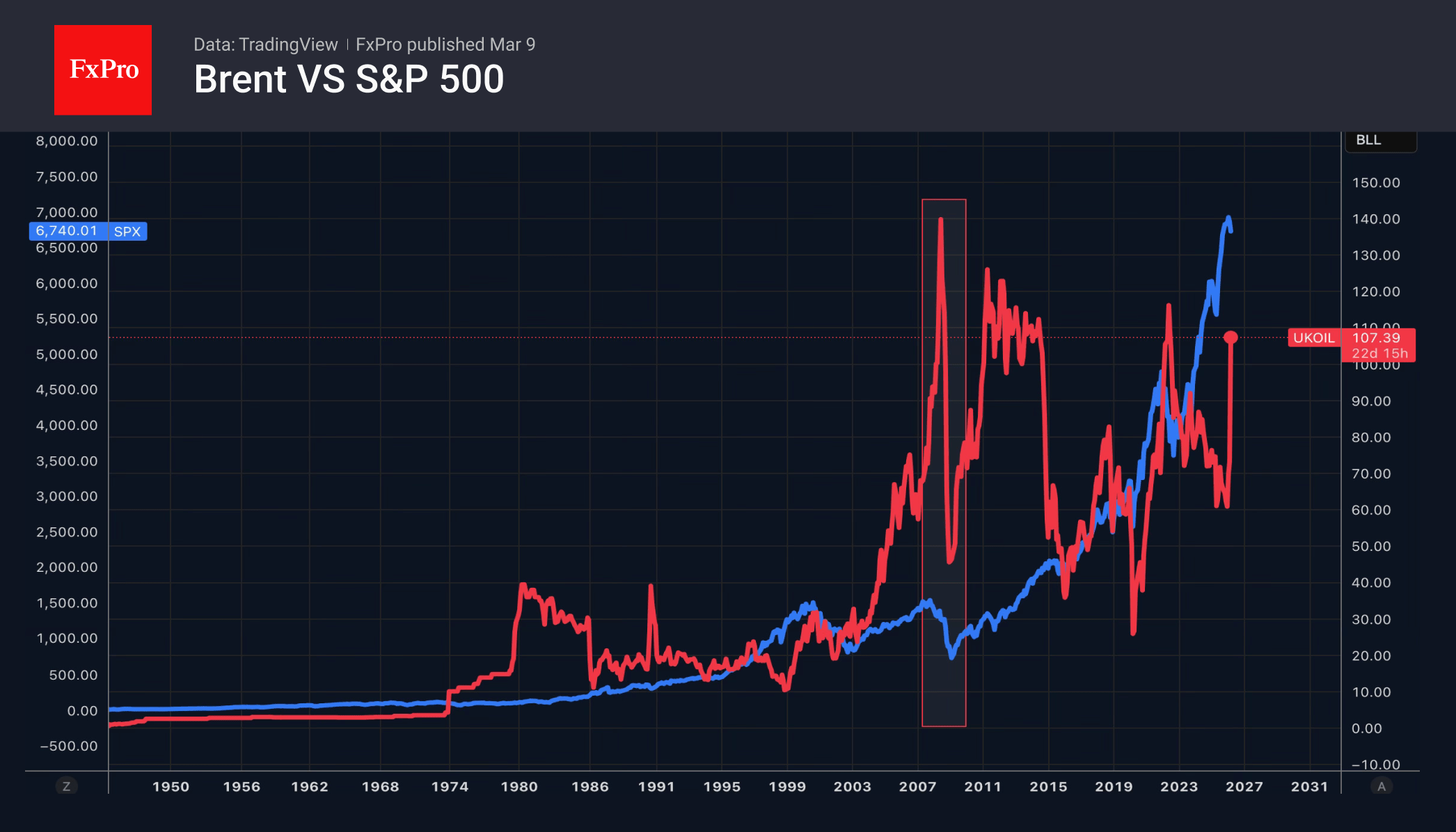

Geopolitics and rising energy prices are weighing on the euro: even a possible tightening of ECB policy is not supporting EURUSD amid mounting risks.

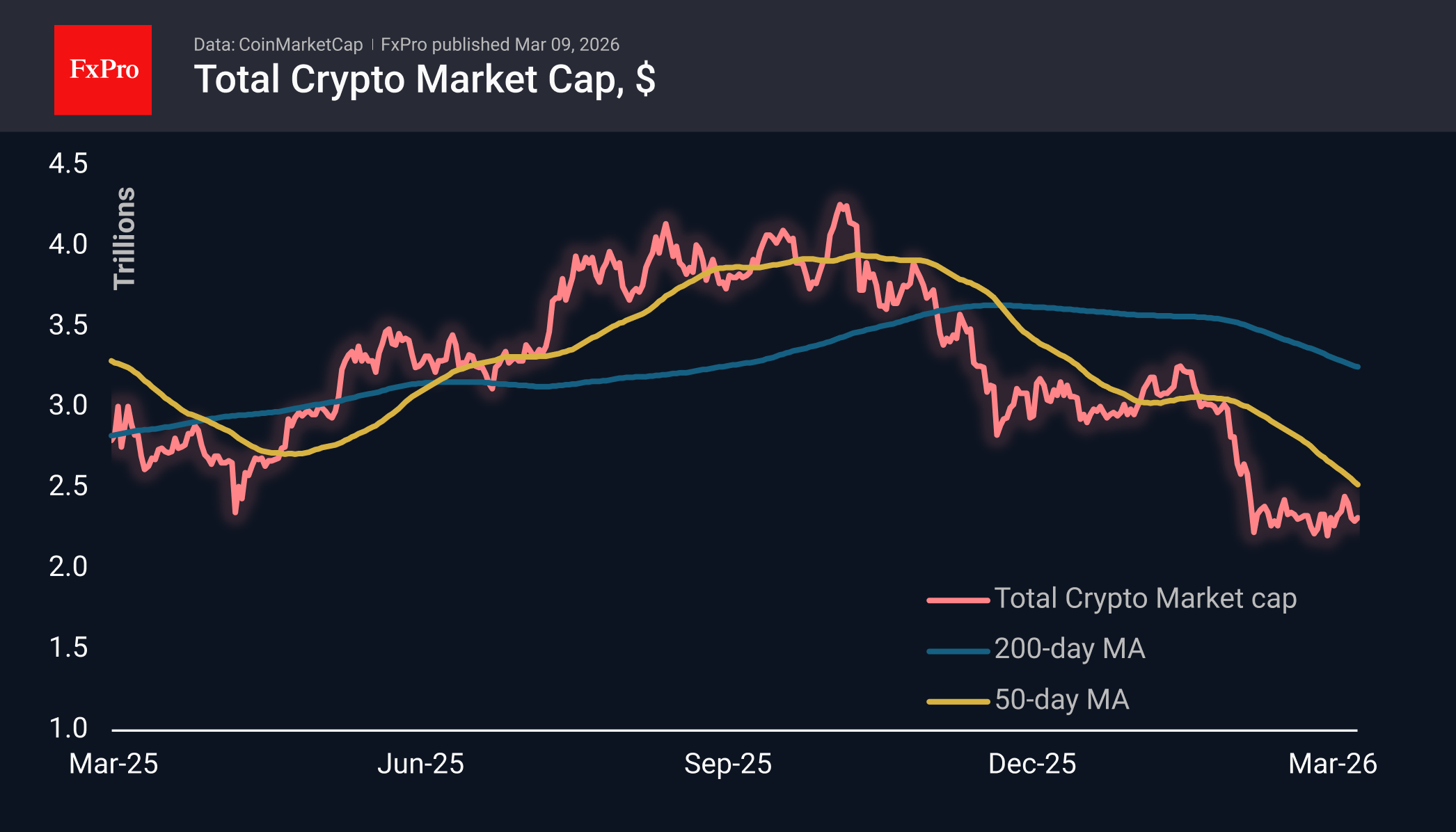

March 9, 2026 Crypto Review

The crypto market is holding a fragile balance: volatility has decreased, BTC and altcoins are at risk of falling, and news about regulation and investigations is increasing uncertainty.

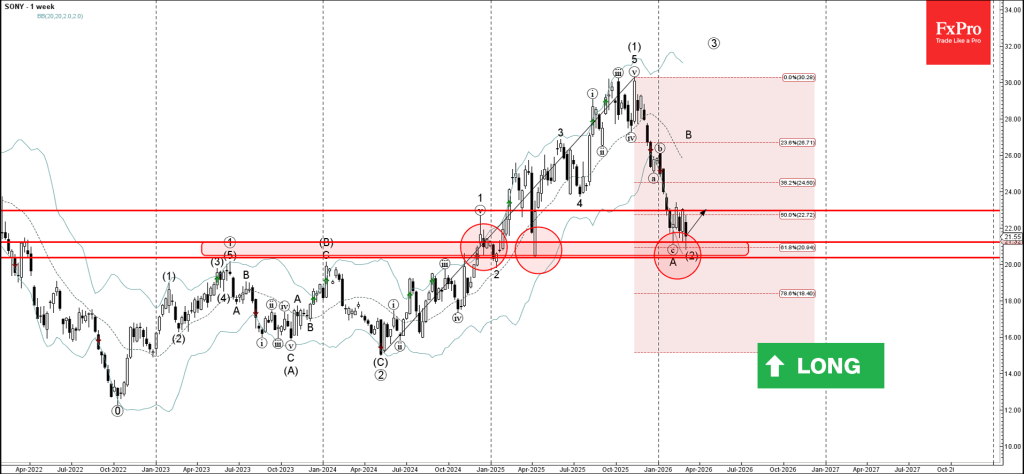

Sony: ⬆️ Buy – Sony reversed from support zone – Likely to rise to resistance level 23.00 Sony recently reversed from the support zone between the pivotal support level 20.40 (which has been reversing the price from the end of.

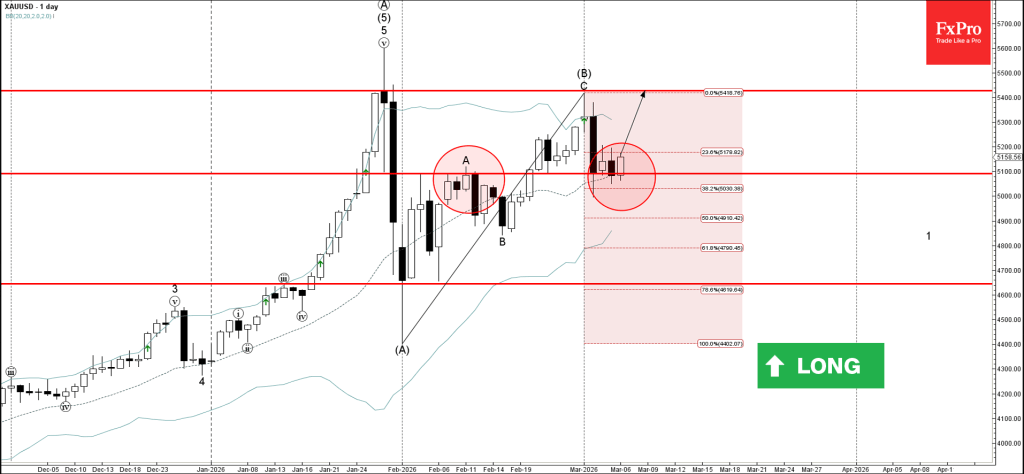

Gold: ⬆️ Buy – Gold reversed from pivotal support level 5100,00 – Gold to rise to resistance level 5425.00 Gold recently reversed from the support zone between the pivotal support level 5100,00 (former top of wave A from February) and.

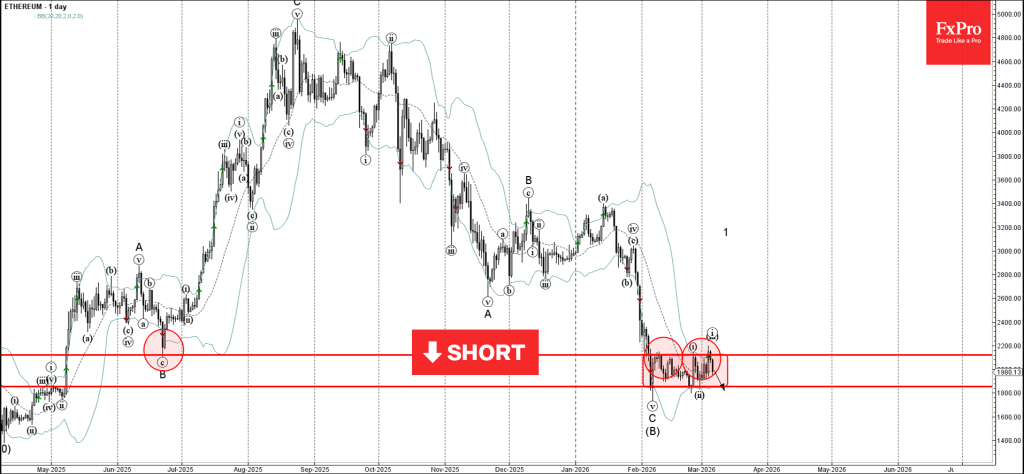

Ethereum: ⬇️ Sell – Ethereum reversed from resistance level 2120,00 – Likely to fall to support level 1855.00 Ethereum cryptocurrency recently reversed down from the resistance zone between the resistance level 2120,00 (former strong support from June) and the upper.

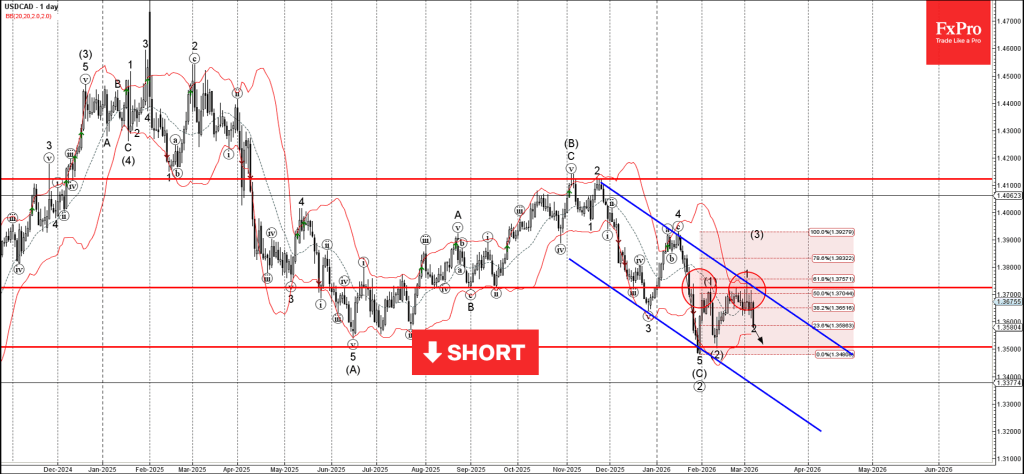

USDCAD: ⬇️ Sell – USDCAD reversed from resistance zone – Likely to fall to support level 1.3500 USDCAD currency pair recently reversed down from the resistance zone between the resistance level 1.3725 (top of the previous impulse wave (1)), resistance.

Welcome to Pro News Weekly!

💵 U.S. dollar strengthens as Middle East tensions and strong U.S.

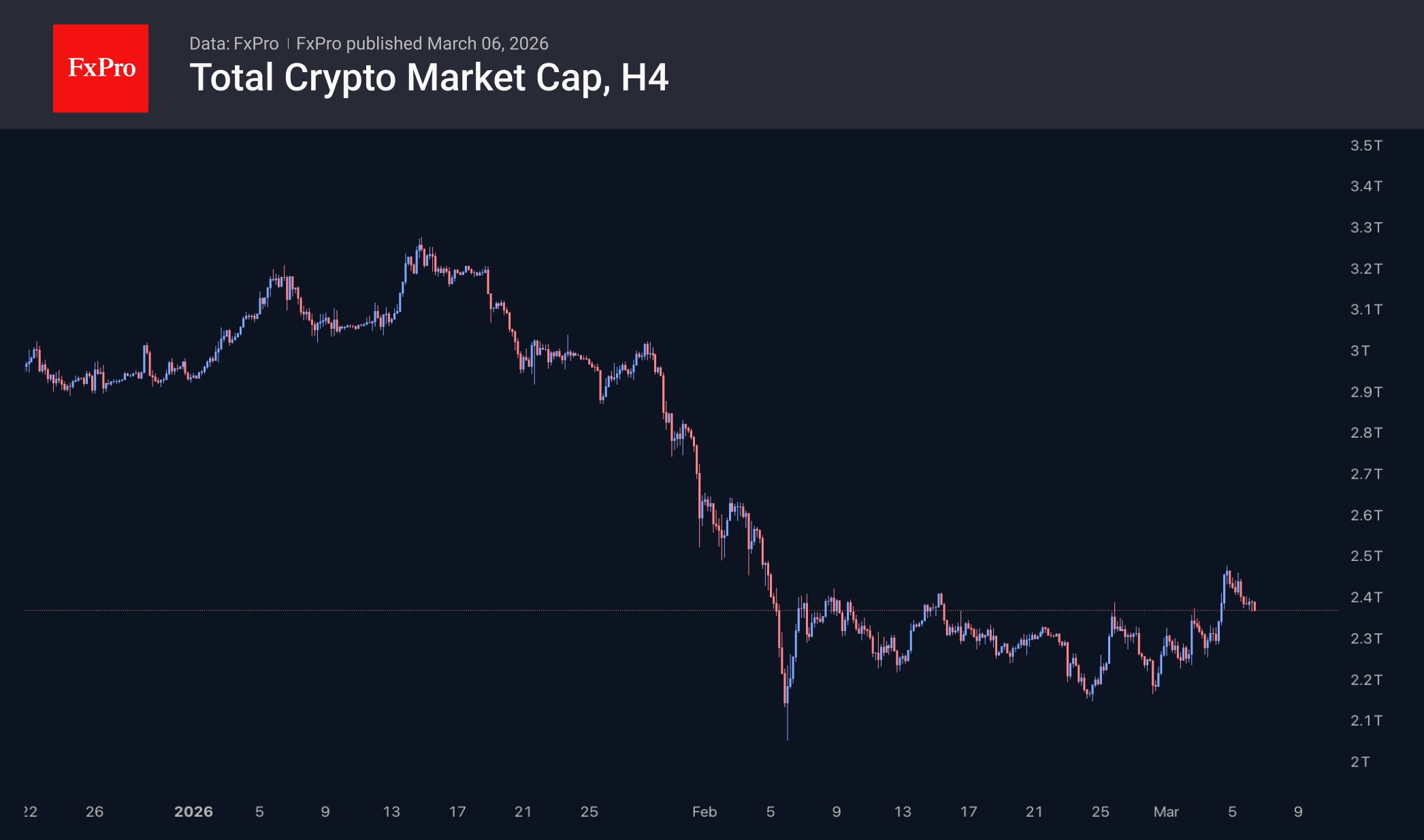

March 6, 2026 Crypto Review

The crypto market cap is falling, Ethereum is holding above the trend, Bitcoin is in correction, retail investors are returning, and pressure from miners remains.