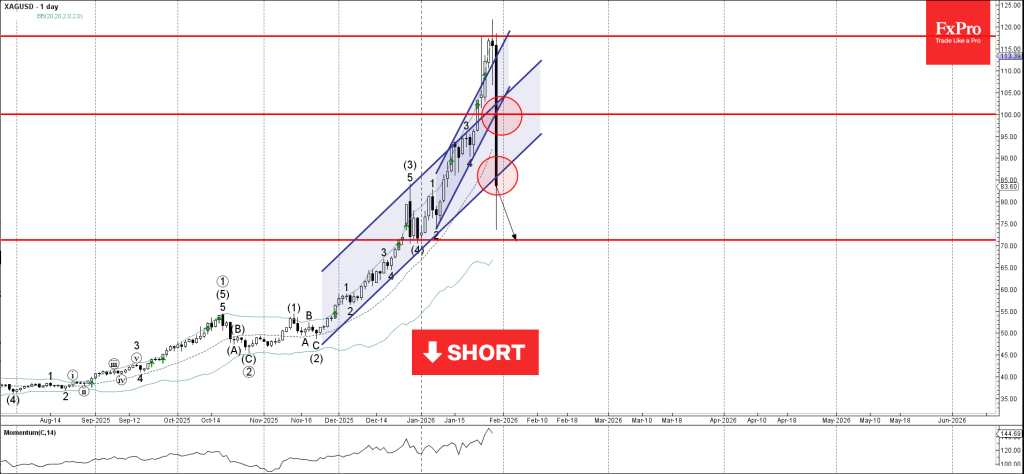

Silver: ⬇️ Sell – Silver broke the round support level 100.00 – Likely to fall to support level 70.00 Silver under strong bearish pressure after the price broke the round support level 100.00, intersecting with two up channels from January.

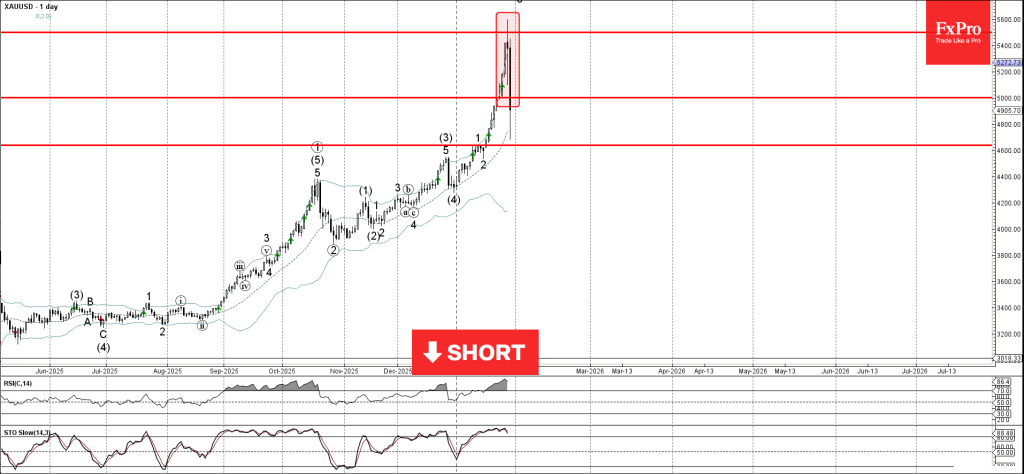

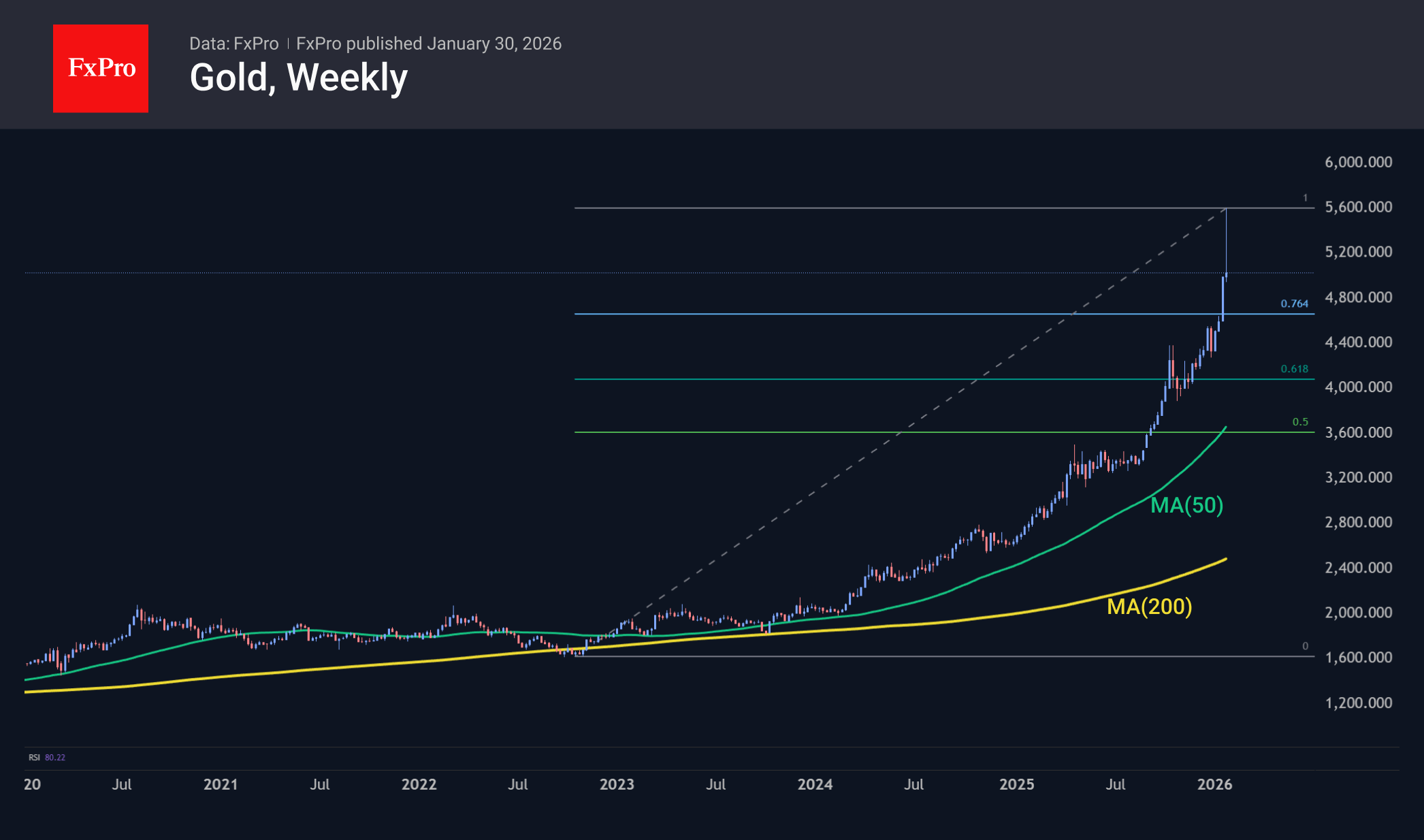

Gold: ⬇️ Sell – Gold formed daily Evening Star – Likely to fall to support level 4600.00 Gold today fell down sharply after the price failed to close above the major resistance level 5500.00, as can be seen from the.

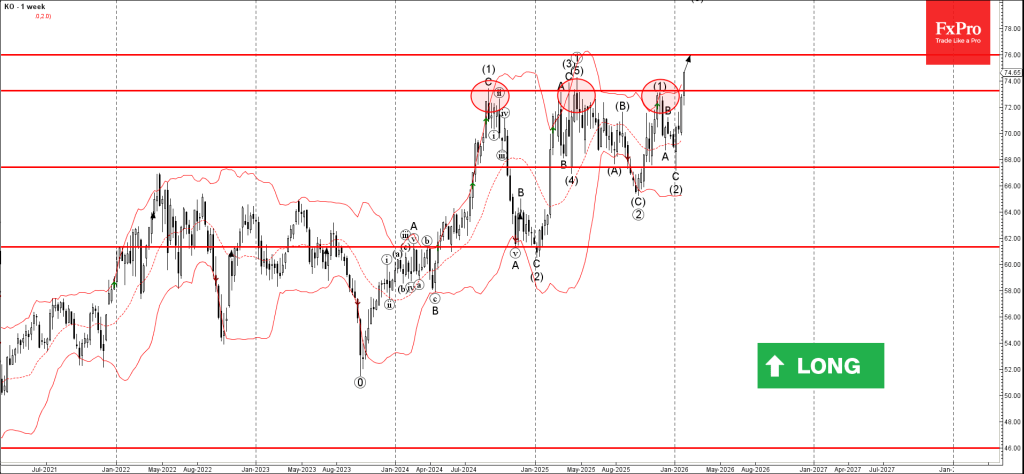

Coca-Cola: ⬆️ Buy – Coca-Cola broke long-term resistance level 73.25 – Likely to rise to resistance level 76.00 Coca-Cola recently broke above the major, long-term resistance level 73.25 (which has been reversing the price from the middle of 2024, as.

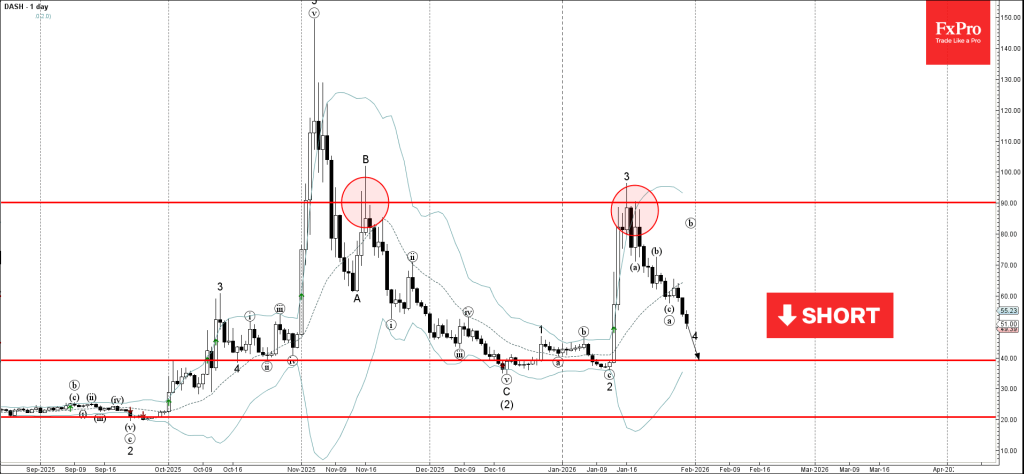

DASH: ⬇️ Sell – DASH falling inside minor correction 4 – Likely to test support level 40.00 DASH cryptocurrency recently continues to fall inside the minor correction 4, which started earlier from the resistance area between the strong resistance level.

January 30, 2026 Market Overview

This week, we saw the long-awaited upward slide, which finally knocked out the short sellers and triggered a powerful sell-off, which often follows moments of final destruction for those who stood against the market. Interestingly, Thursday and Friday’s dramatic events,.

January 30, 2026 Market Overview

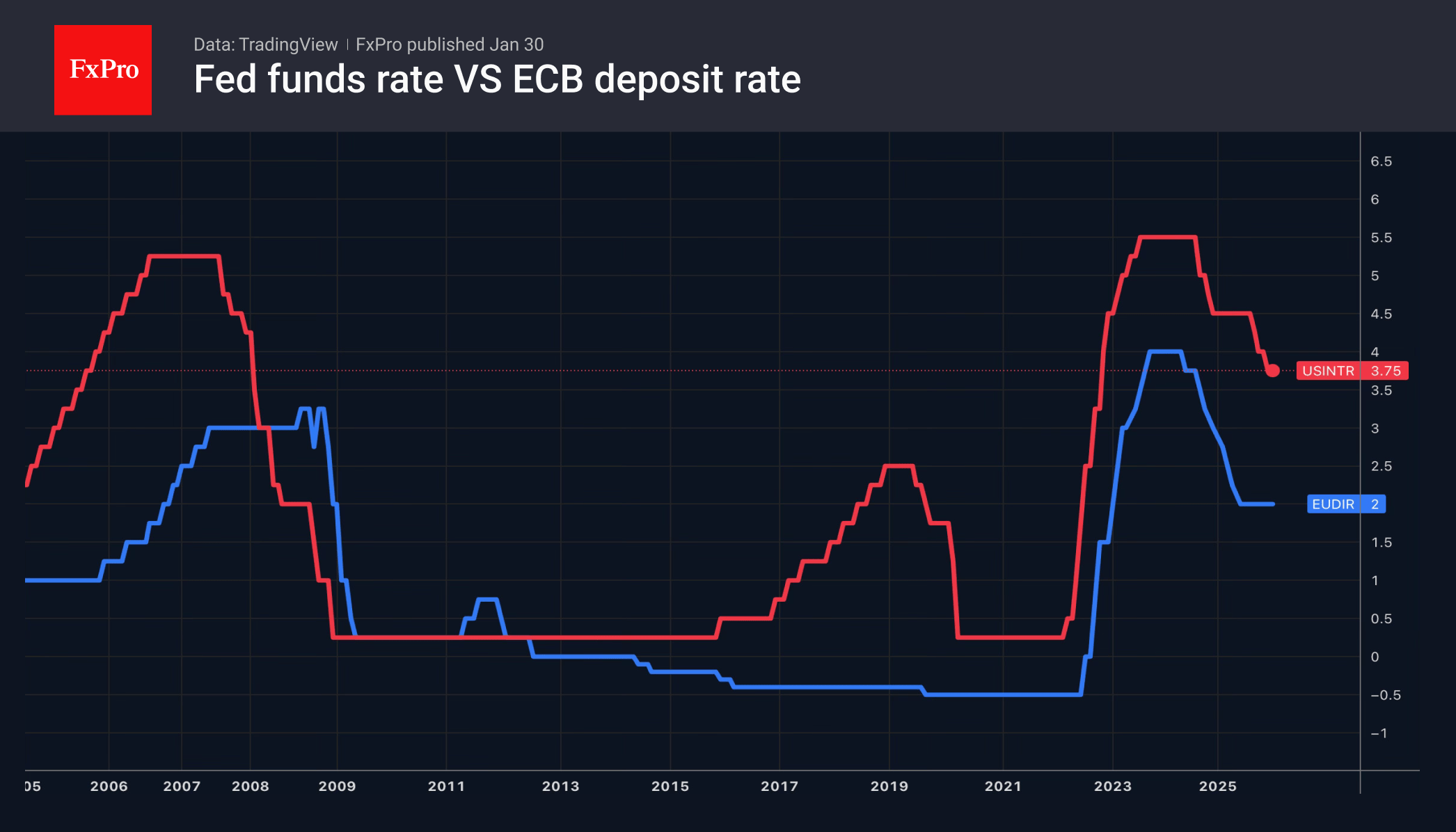

The euro's rally worries the ECB; possible rate cuts may follow. U.S. dollar strengthens, casting doubt on Japan's solo interventions.

Welcome to Pro News Weekly!

Here’s what’s moving global markets this week:

💵 The U.S.

Manage your trades right from the chart.

View all open positions in relation to the current price for instant clarity.

Tap any position to adjust it, drag TP and SL levels to set targets visually, and tap the X on the chart to close the order instantly.

Total control, right where you need it.

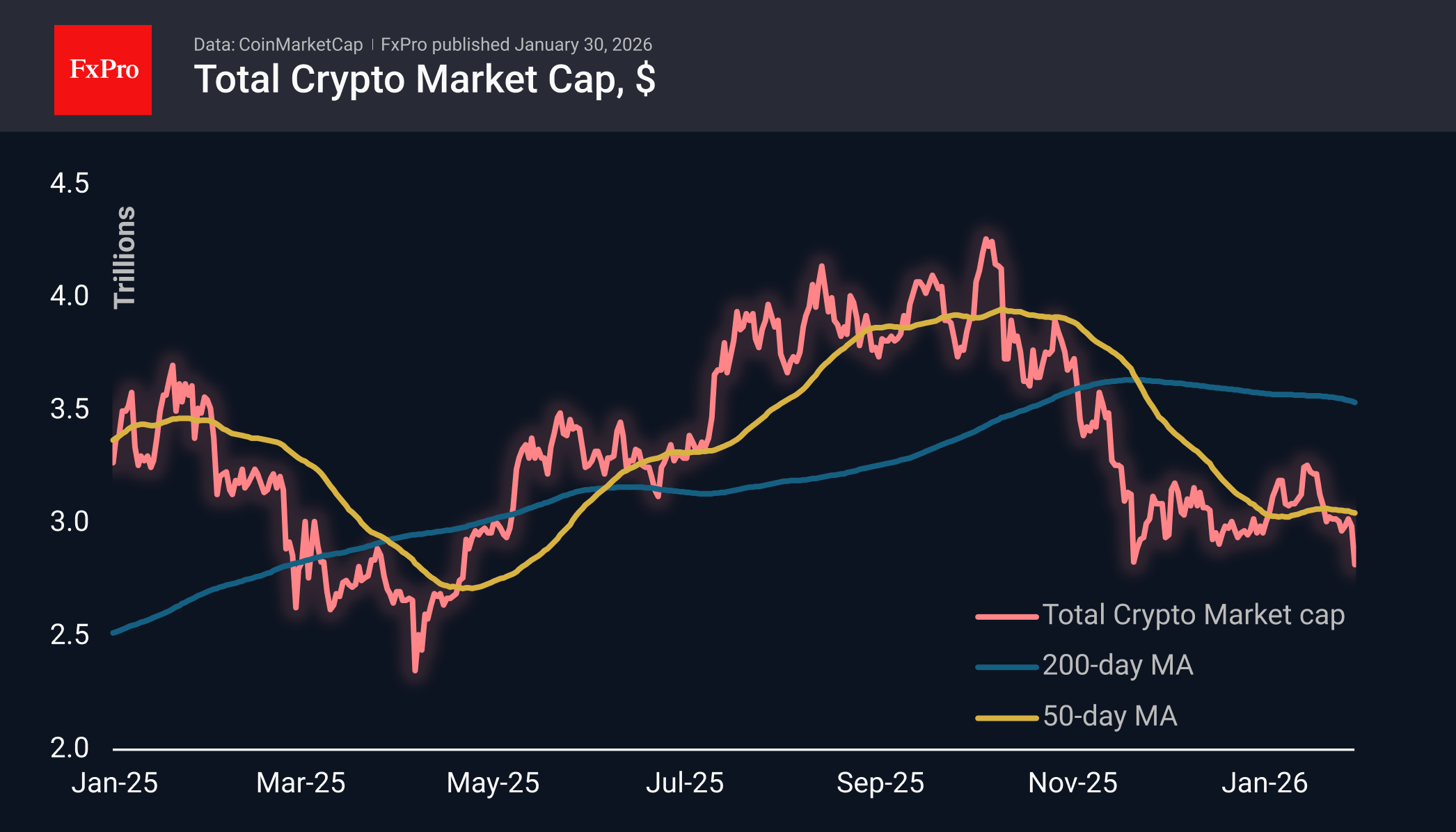

January 30, 2026 Crypto Review

Crypto market dips, Bitcoin tests key support, sentiment at extreme fear; stablecoins grow, illegal activity rises, Ethereum supply drops.

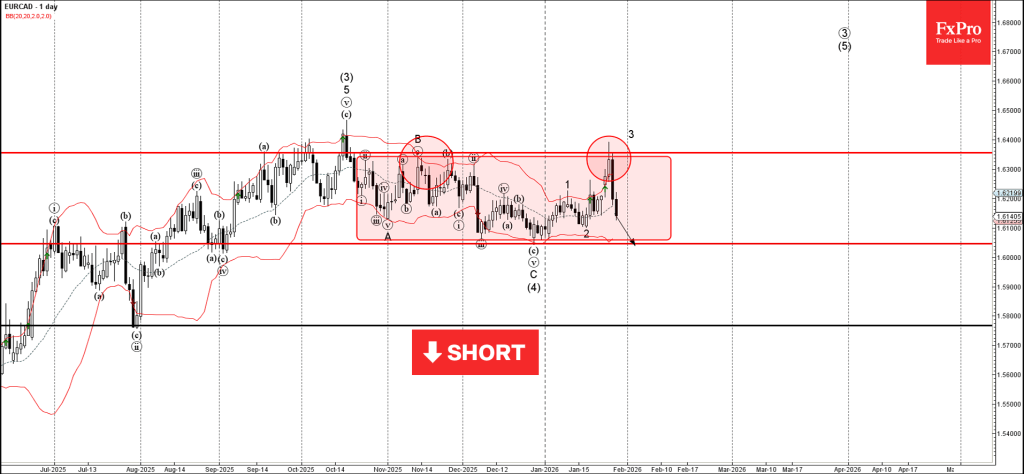

EURCAD: ⬇️ Sell – EURCAD reversed from resistance area – Likely to fall to support level 1.6045 EURCAD currency pair recently reversed from the resistance area between the strong resistance level 1.63549 (upper border of the sideways price range inside.

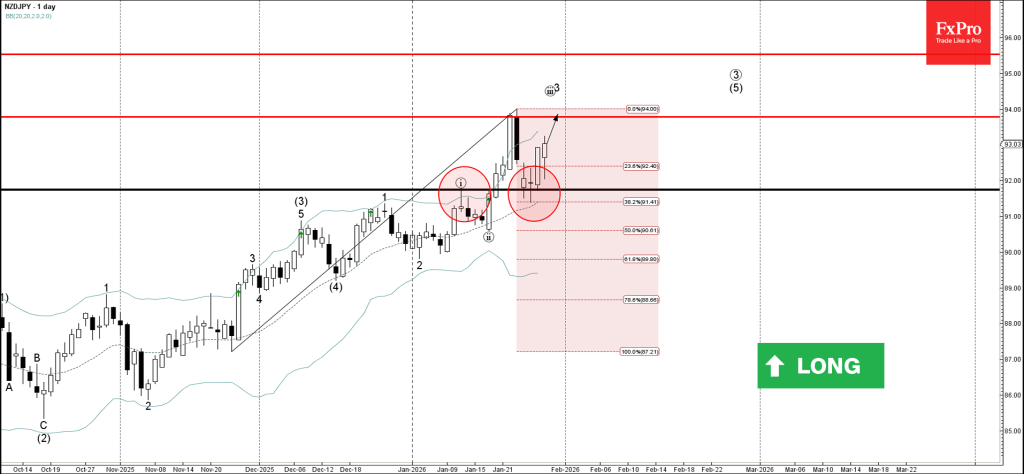

NZDJPY: ⬆️ Buy – NZDJPY reversed from support area – Likely to rise to resistance level 93.80 NZDJPY currency pair recently reversed from the support area between the key support level 91.75 (former top of wave i from the start.

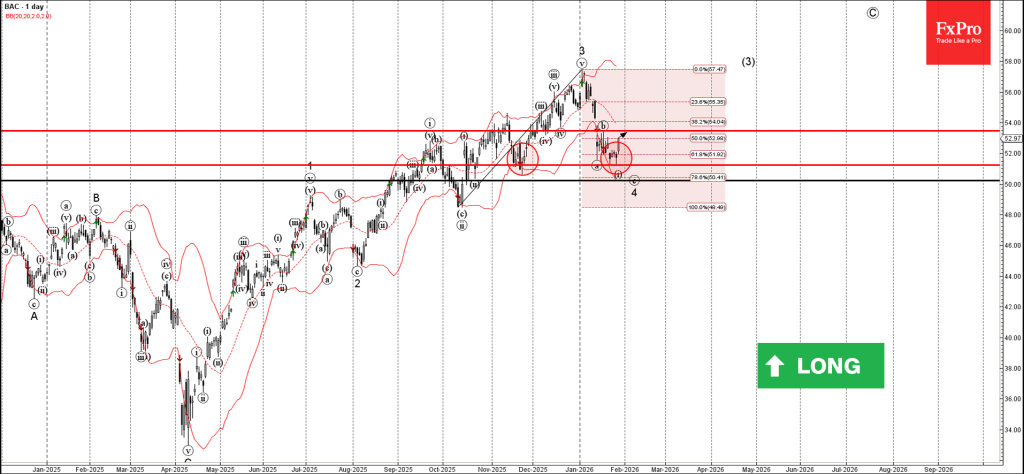

Bank of America: ⬆️ Buy – Bank of America reversed from support area – Likely to rise to resistance level 53.45 Bank of America recently reversed from the support area between the pivotal support level 51.20 (which has been reversing.