Market Overview - Page 95

September 15, 2022

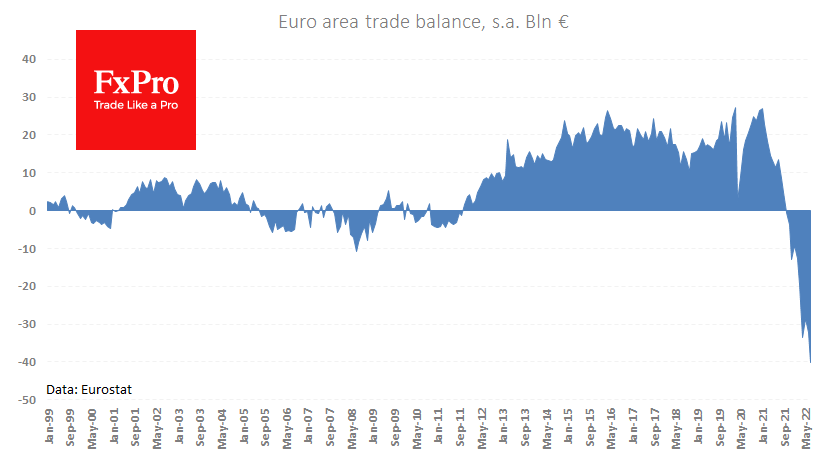

According to a new Eurostat publication, the eurozone’s seasonally adjusted foreign trade deficit widened to 40bn in July. Since last October, the region has found itself in the unfamiliar role of a net importer. That is a notable reversal after.

September 15, 2022

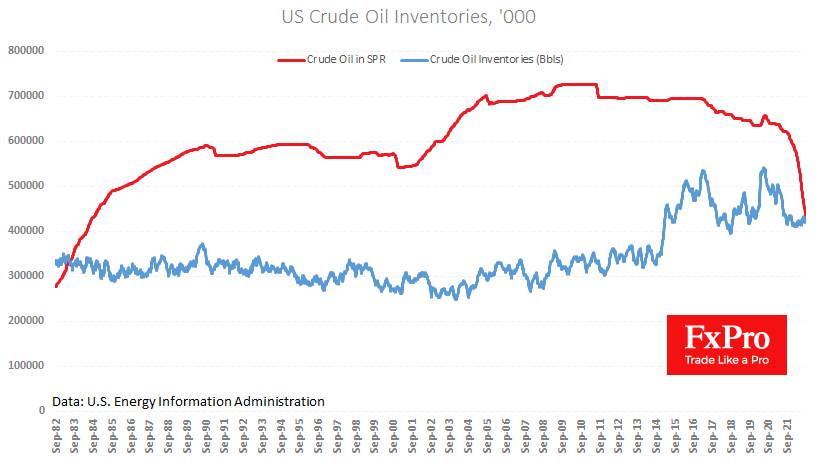

US commercial oil inventories rose by 2.4M barrels last week following an increase of 8.8M earlier. This dynamic fits in with seasonal trends, with inventories starting to fill at some point in September. Around the same time and volume levels,.

September 15, 2022

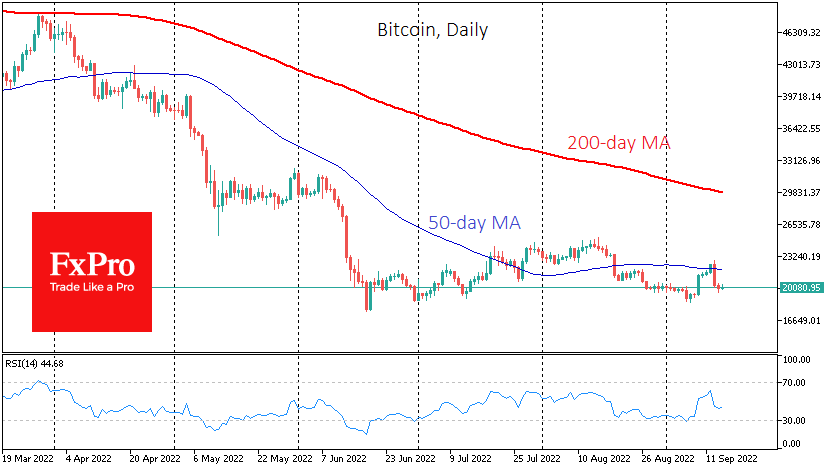

Market picture Bitcoin has lost 1.2% in the last 24 hours, trading at $20.1K. The plunge below a meaningful round level late Wednesday afternoon did not last long. Ethereum pulled down 0.3% to $1610 while the crypto community awaits the.

September 14, 2022

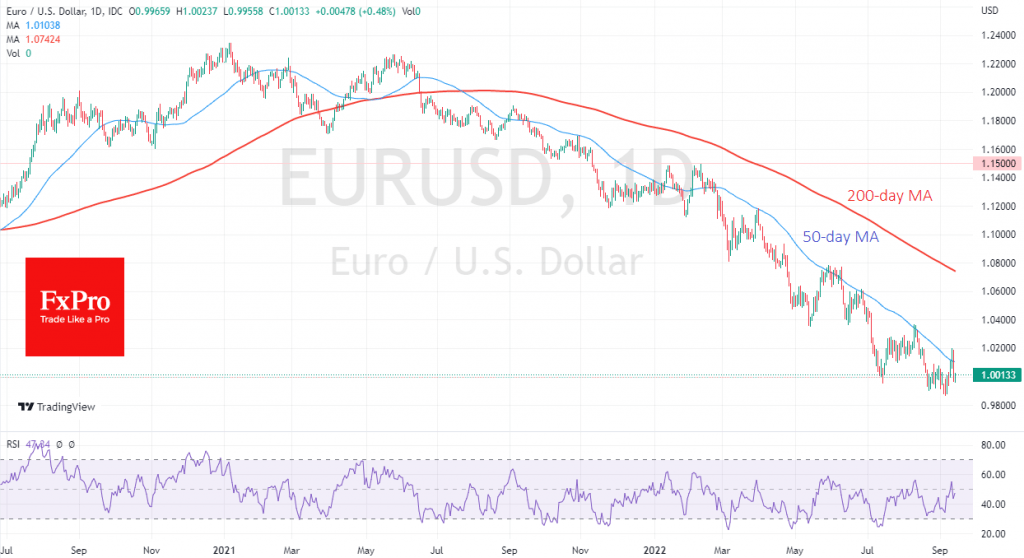

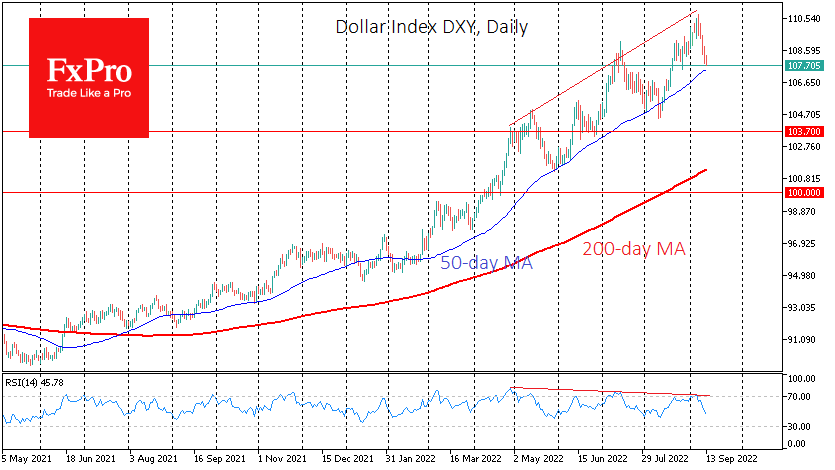

Yesterday we wondered whether the dollar retreat was a correction or a reversal. But the reaction of the financial markets to the US inflation report has put everything in its place by confirming that we are still in a bull.

September 14, 2022

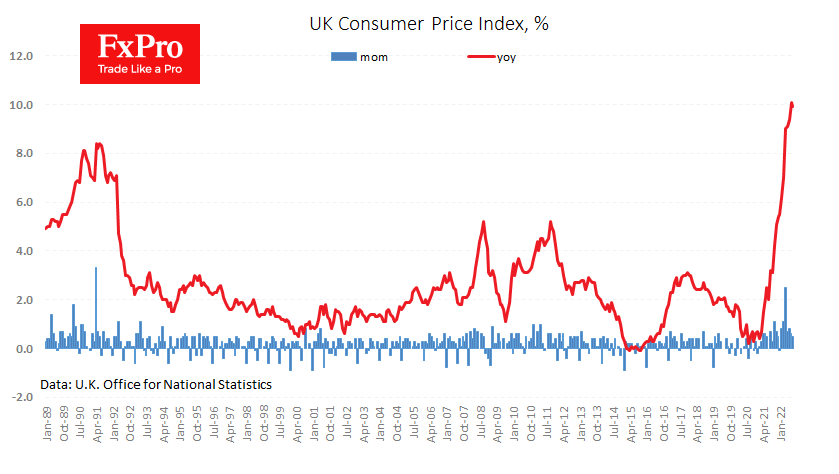

The inflation report marathon continues; it was the UK’s turn this morning. Traditionally, the consumer price change figures attracted the most attention. For the month, they rose by 0.5% (slightly less than the 0.6% expected), and annual inflation fell from.

September 13, 2022

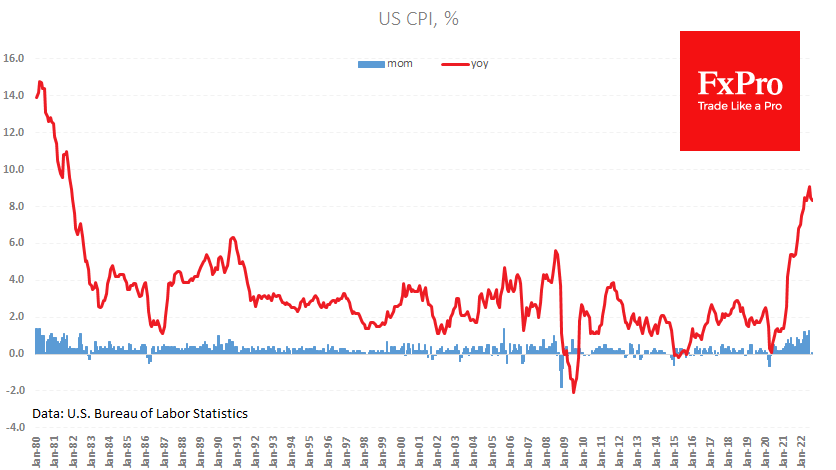

US inflation turned out to be wider and hotter than expected, confirming markets for another 75-point rate hike next week. Published data showed a 0.1% increase in prices for August, against expectations of a decline of the same magnitude. Annual.

September 13, 2022

The US dollar had reversed, losing 2.6% to a basket of major currencies from last Wednesday’s highs when the DXY was making multi-year highs. Although the dollar sell-off is very active, it looks more like a profit taking than a.

September 13, 2022

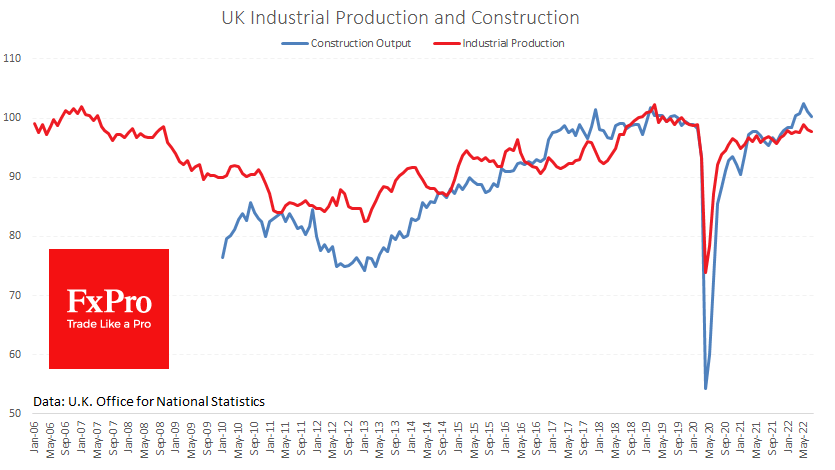

Monthly estimates showed that the UK economy added 2.5% over the three months to July vs the same period a year earlier. The negative surprise was a 0.3% decline in Industrial Production in July compared to expectations of a 0.4%.

September 12, 2022

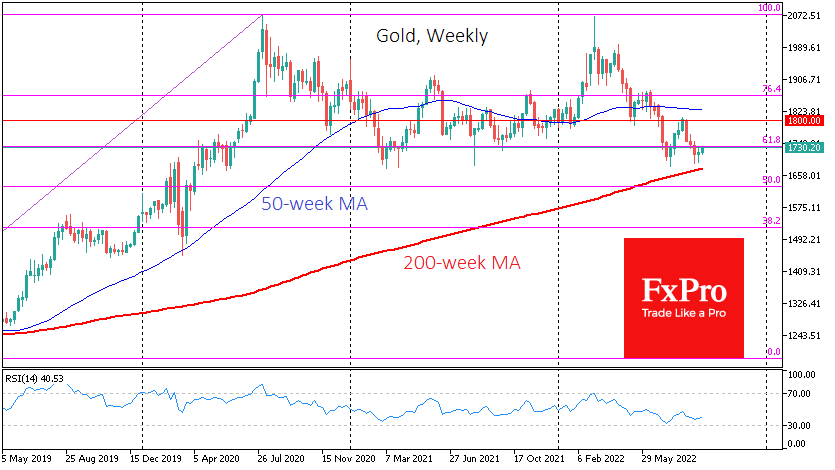

Gold dynamic reverses smoothly on the daily charts, setting up a double-bottom formation. Gold is forming a local uptrend after touching the lows near $1680 at the very beginning of the month. The daily charts show that the area near.

September 12, 2022

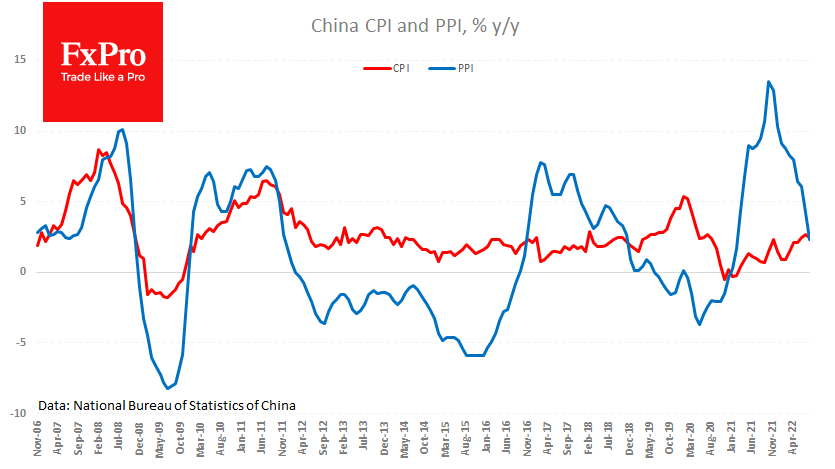

China is at the other end of the spectrum, while the developed world is facing the highest inflation rate in two generations. The published CPI and PPI data for August marked another drop in inflationary pressures and fell well below.

September 9, 2022

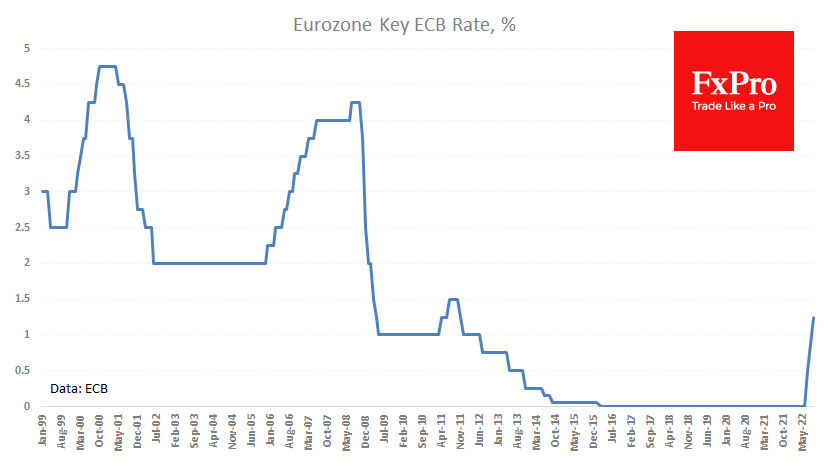

The European Central Bank, at the end of its regular meeting, raised the interest rate by a record 75 points after increasing it by 50 in July. The move was almost entirely priced into the debt market, as Bank officials.