Market Overview - Page 52

April 10, 2024

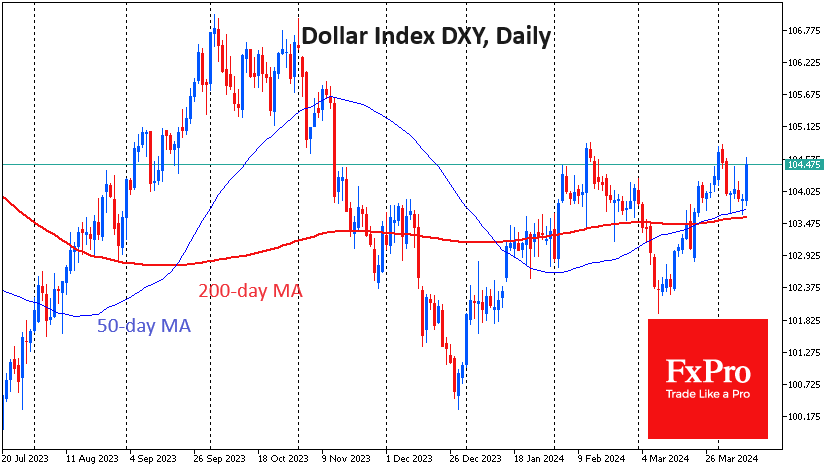

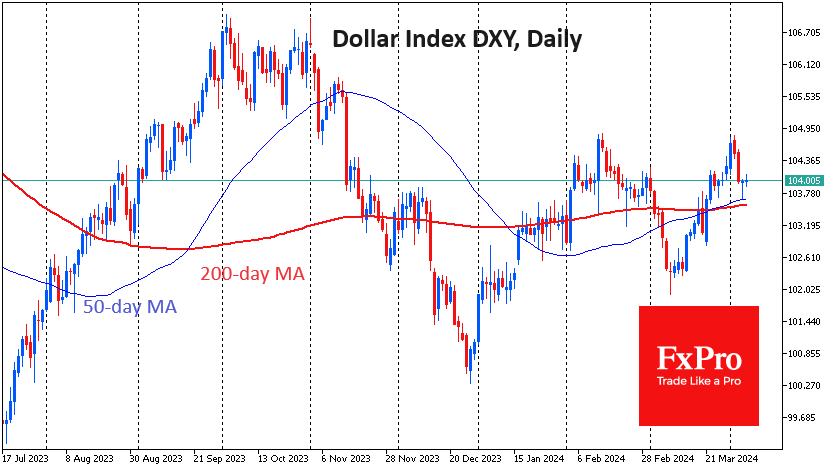

Financial markets ended last year with expectations of six Fed rate cuts totalling 1.5 percentage points. Speculation has been circulating in recent days that there may be no cuts at all in this one. In the previous three years, a.

April 9, 2024

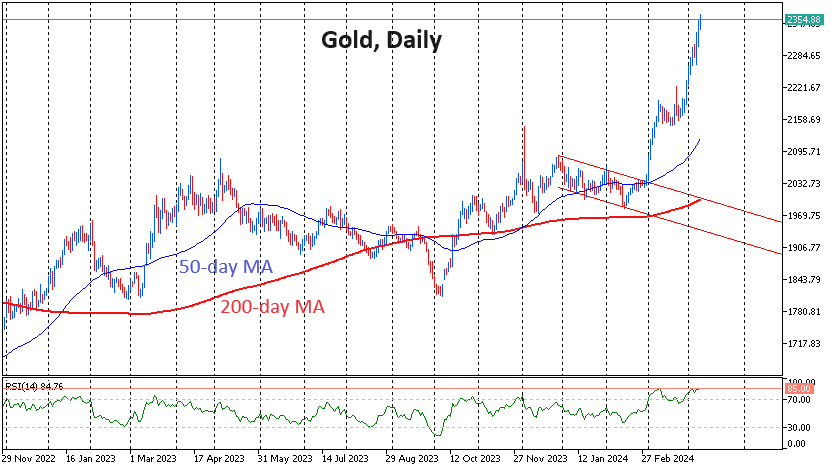

Gold has been hitting all-time highs almost daily for the past two weeks, reaching $2365 in the spot market on Tuesday before the start of US trading. The ability to rise above $2070 per ounce, which gold found in late.

April 5, 2024

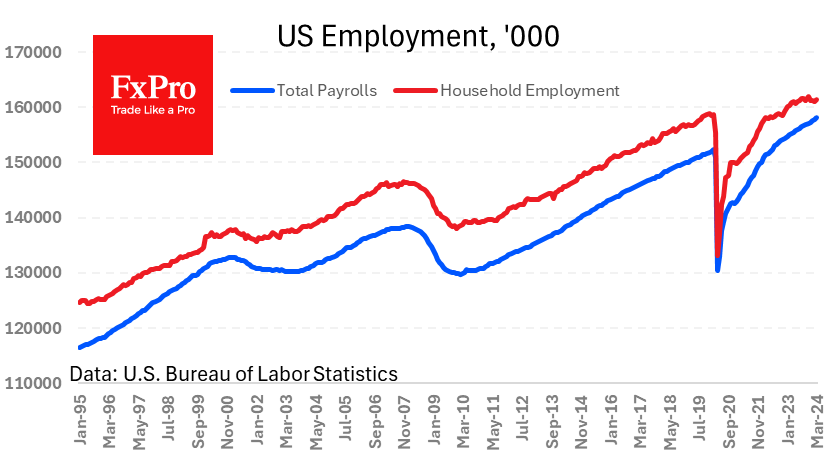

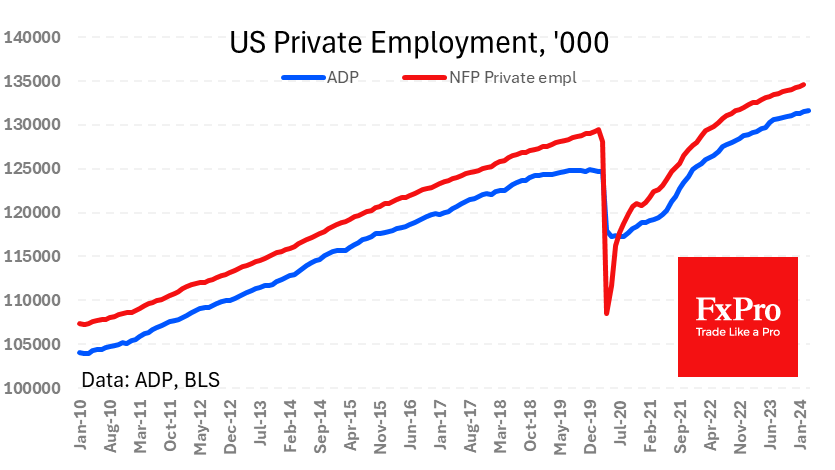

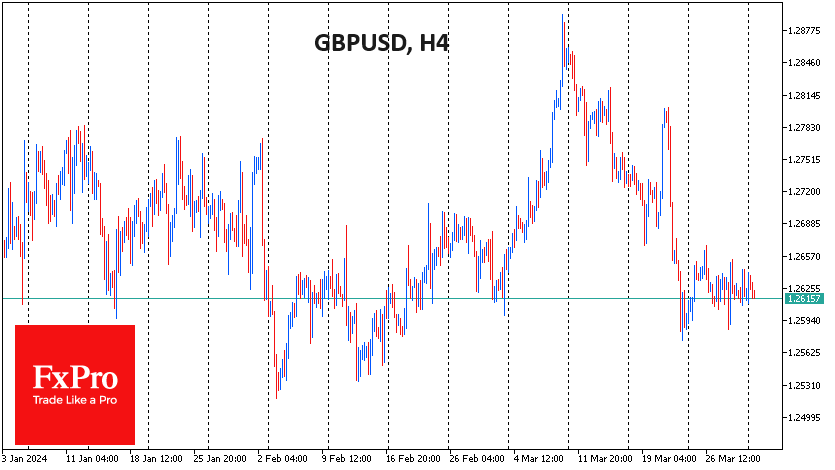

The US economy continues to create jobs above expectations. Employment grew by 303k in March versus 270k previously, and 200K expected. Over ten years, the average monthly gain is 170k, and a gain of 190-200k per month is associated with.

April 5, 2024

The monthly jobs report has enough potential for the market to set the trend for the coming weeks. However, there is also a risk that the extensive list of indicators, from employment change and unemployment rate to the pace of.

April 4, 2024

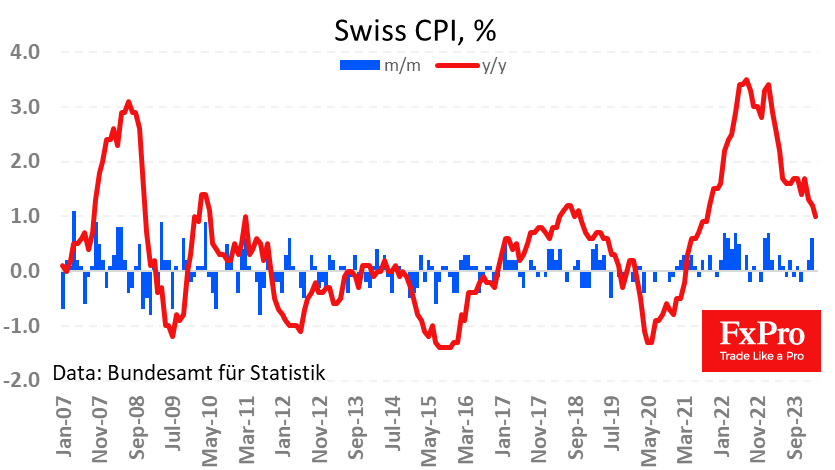

Weak Swiss inflation renewed the downward momentum of the franc, which is losing over 0.5% against the euro, sending EURCHF to highs last seen in May 2023. The Swiss Consumer Price Index was virtually unchanged for March, with annual inflation.

April 4, 2024

Overnight, the gold price briefly exceeded $2300, recording another round level, not counting an update of the all-time high. This is an occasion to assess gold’s prospects, which are becoming a little less unambiguous. Touching the level of $2300 marked.

April 3, 2024

Ahead of Friday’s employment report, we turn our attention to other labour market releases. ADP’s estimates for March showed private sector employment rising by 184K, the highest since July 2023 and above the expected 150K. In a commentary on the.

April 3, 2024

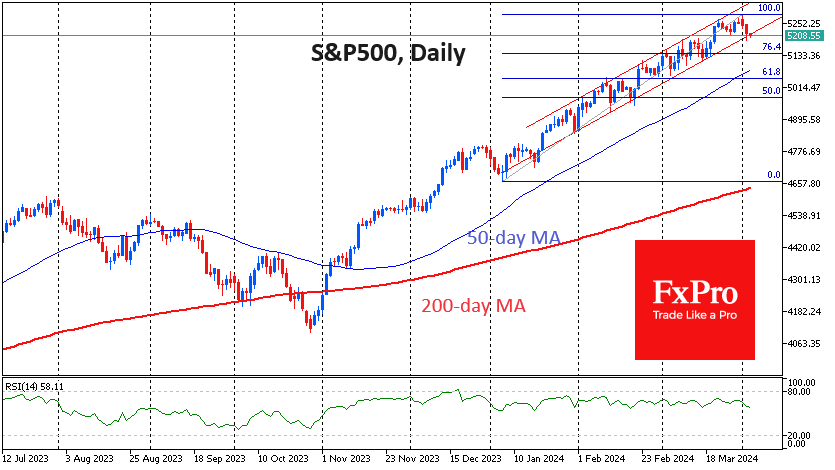

The US markets start the new quarter with a decline and are already testing the support of the uptrend. The S&P500 index is moving in a rather narrow uptrend from the January lows. The index tested the lower boundary of.

April 2, 2024

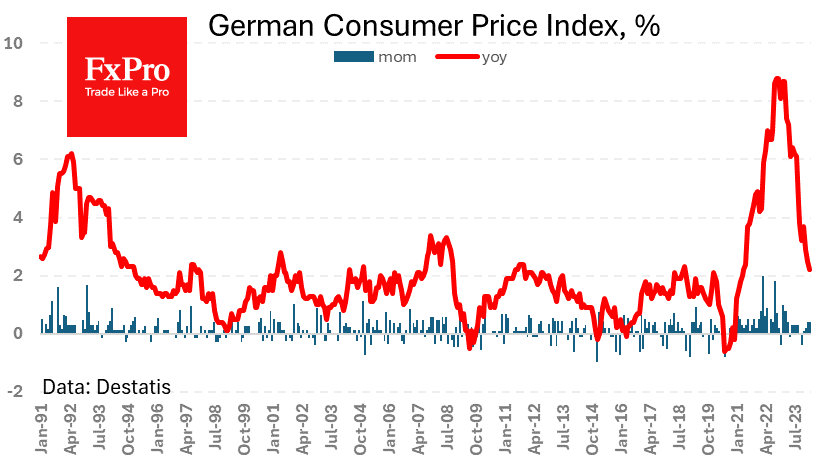

The slowdown in German inflation is fuelling hopes that the ECB will ease policy in the coming months. German CPI rose 0.4% m/m, weaker than the 0.5% expected. Annual inflation slowed from 2.5% in February to 2.2% in March, the.

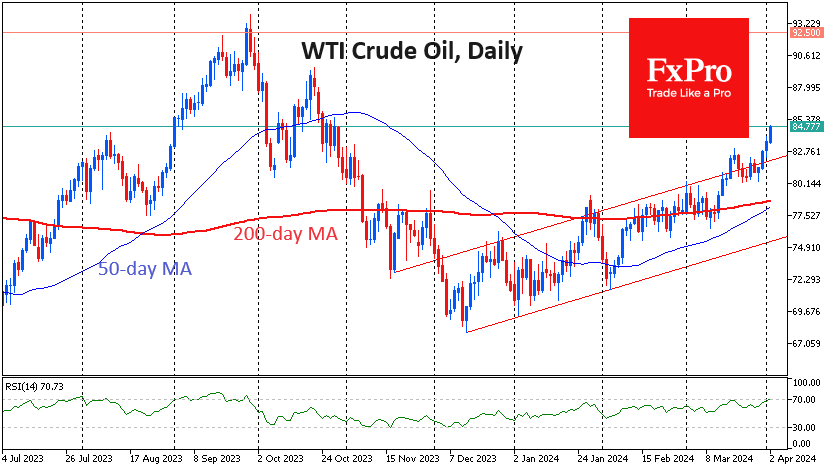

April 2, 2024

Oil prices have been hitting five-month highs, and every trading session has been rising since 27 March. The price of a barrel of WTI reached $84.6 at the start of the day on Tuesday before retreating slightly by midday in.

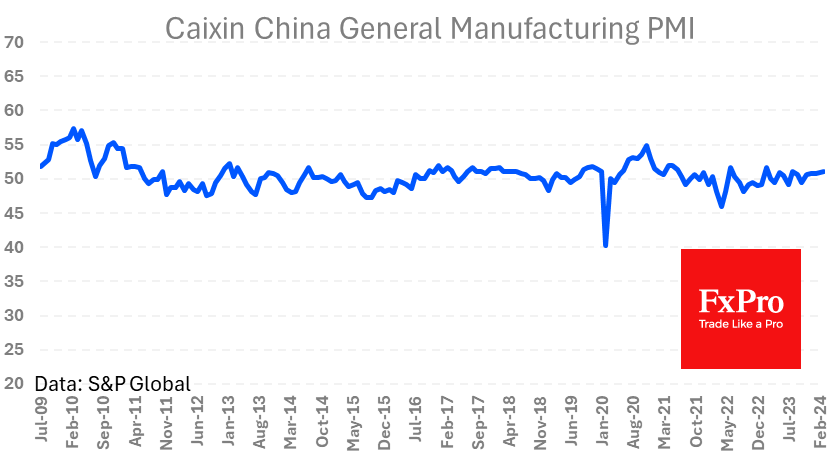

April 1, 2024

During a relatively quiet Monday trading session, the main trend was set by China’s manufacturing PMI data. The index came in at 51.1 for March, just above the expected 51.0 and the previous 50.9. On a positive note, this is.