Oil has closed the gap but is ready to go lower

May 01, 2023 @ 11:45 +03:00

WTI oil stabilises near $75 for the third day at the lowest monthly level. The economic slowdown is dragging down the Crude, but OPEC+ coordination supports the market. Oil has returned to a range from which an exit promises to have a dam-breaking effect.

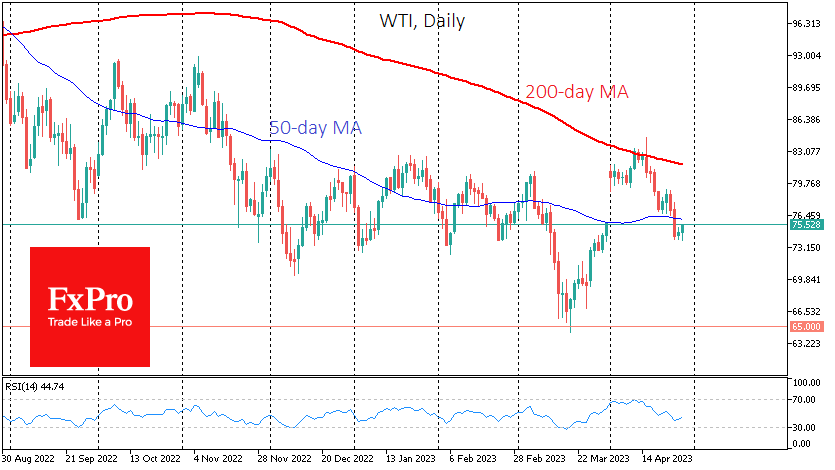

Volatility in oil declined after the market closed a 7% gap that had formed following an unexpected OPEC+ quota cut over the weekend in early April. The current level of around 75 also acted as the bottom of the trading range from December to March.

Oil’s decline accelerated in the first half of March, finding support only near $64 as markets began to price in a reversal of the Fed’s rate cut. OPEC quota cuts and Russia’s voluntary production cuts pushed the price up to $83 by mid-month.

The 200-day moving average was a critical resistance level in the second half of April. Oil failed to breach this line and remained within the bearish trend. At the beginning of the week, the price fell below the 50-day moving average in a sharp move. The dynamics of oil near key moving averages prove that the market remains bearish, with deteriorating macroeconomic conditions.

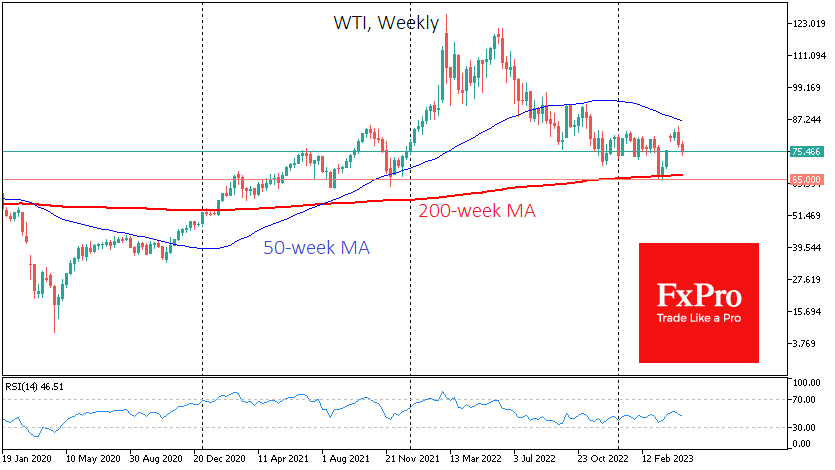

The $65-67 area looks like an attractive target for the bears. There are many pivot points from 2021 onwards. Before that, there was significant resistance in 2019. In addition, the 200-week moving average, the most crucial indicator of the long-term trend in commodities, is close to $67.

Nevertheless, sellers should remain cautious, as a sustained decline in prices will almost certainly attract the attention of OPEC.

The FxPro Analyst Team