Dollar’s return to growth?

April 17, 2023 @ 17:15 +03:00

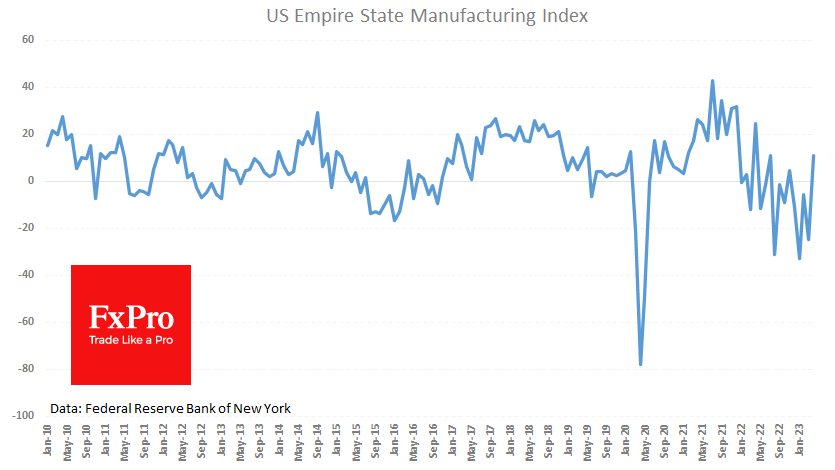

Today is not a day rich in economic data. The most important is the Empire State manufacturing index, which came in well above expectations for April. The New York Fed’s index rose to 10.8 from -24.6 the previous month, although a slight increase to -17.7 was expected. A reading above 0 indicates increased activity; the current level is the highest since last July.

Although this indicator has been somewhat volatile in recent years, its sharp improvement against expectations in a quiet market supported expectations of another rate hike.

At the start of US trading, the interest rate futures market was pricing at an 87% chance of a 25bp hike, up from 78% last Friday to 72% the week before. This reassessment of the outlook supports the demand for the dollar, which benefits from higher interest rates.

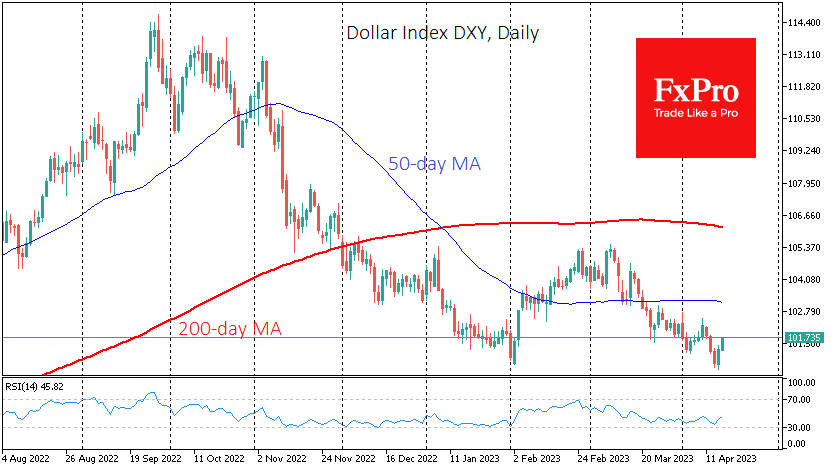

The Dollar Index has rallied on the news to 101.55 (+0.9% from Friday’s lows), and EURUSD is trading near 1.0950, back below the important 1.10 ground level. GBPUSD has also pulled back 100 pips below 1.2500.

The resumption of dollar buying questions whether the DXY’s new lows and EURUSD and GBPUSD’s new highs were a false break. To say that the dollar has managed to defend a vital level will only be possible if it rises another 0.9%, which would take the DXY back above the previous highs and form a bullish trend. The EURUSD is at 1.0850, and the GBPUSD is at 1.2350.

The FxPro Analyst Team