Swiss price pressure almost neutralised

April 14, 2023 @ 14:58 +03:00

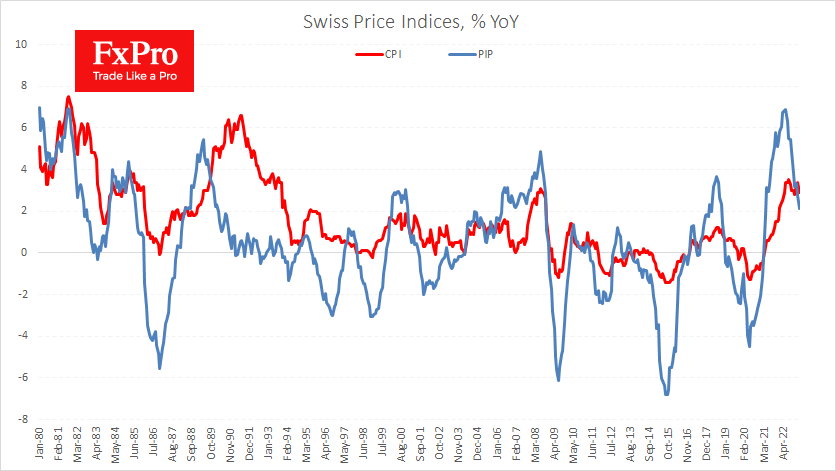

The Swiss Producer and Import Price Index rose by 0.2% in March, slowing the annual growth rate to 2.1% from 2.7%. Producer price pressures are easing faster than expected (2.7% y/y expected). Easing inflation is a long-awaited signal for the SNB, which has raised its rate by 225 percentage points since the middle of last year to 1.5%, the highest since 2008.

Consumer inflation in Switzerland accelerated unexpectedly in January and February. Still, a continued slowdown in producer and import prices will likely keep a lid on consumer inflation in the coming months.

The Swiss franc exchange rate is also playing its role in easing inflation. From its peak in November to Thursday’s low, the USDCHF exchange rate has lost more than 12.5%, taking prices back to February 2021 levels. The current rate of 0.8880 is quite close to multi-year lows near 0.8800.

Switzerland is now entering a situation where inflation is on a steady downward path, and the franc is close to historically uncomfortable levels for the SNB.

The central bank may start to change its rhetoric to a more dovish one, satisfied with the policy tightening that has already taken place and fearful of tightening the screws too much on the economy. This is all the more true after the Credit Suisse story exposed banks’ vulnerability.

The FxPro Analyst Team