Market Overview - Page 76

May 1, 2023

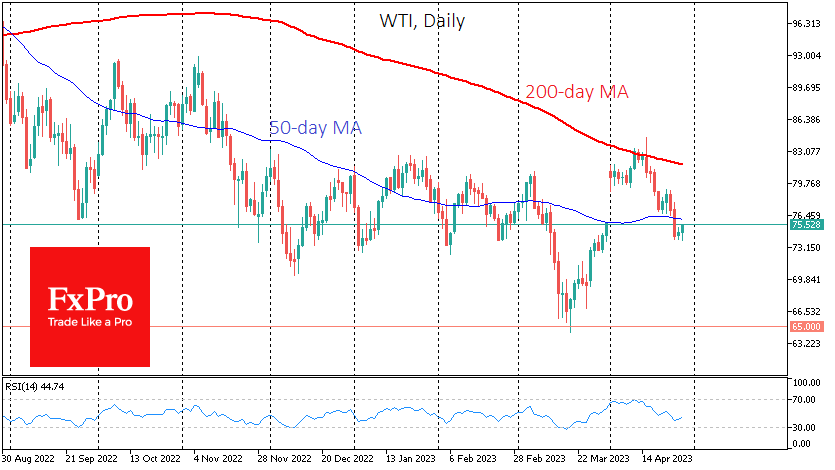

WTI oil stabilises near $75 for the third day at the lowest monthly level. The economic slowdown is dragging down the Crude, but OPEC+ coordination supports the market. Oil has returned to a range from which an exit promises to.

April 27, 2023

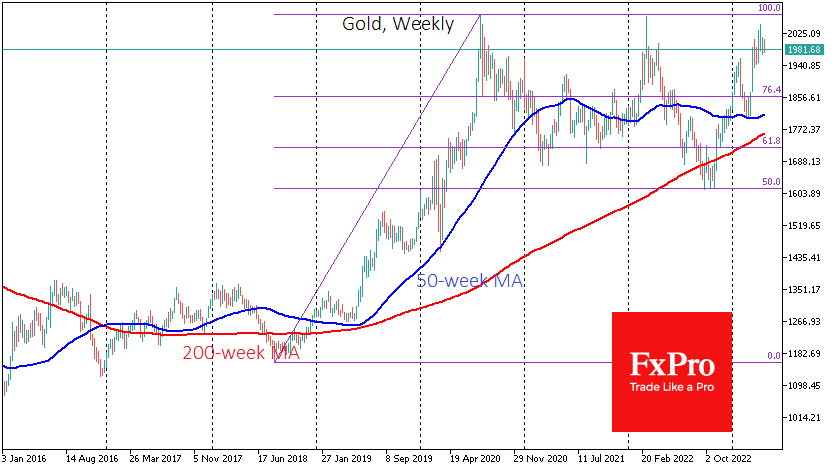

Gold has flirted with $2000 three times in the last three years. This time, however, it is more likely that the bulls will soon be able to hold higher for longer, as gold’s rally now has a slightly different character..

April 21, 2023

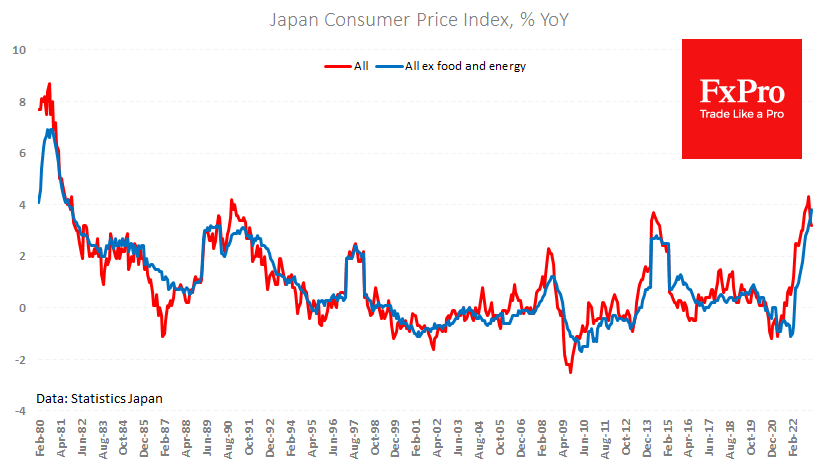

Consumer price inflation in Japan is in no hurry to slow down. In March, prices rose 3.2% y/y, compared with 3.3% in February and an expected 2.6%. The core price index excludes food and energy but has not yet peaked,.

April 20, 2023

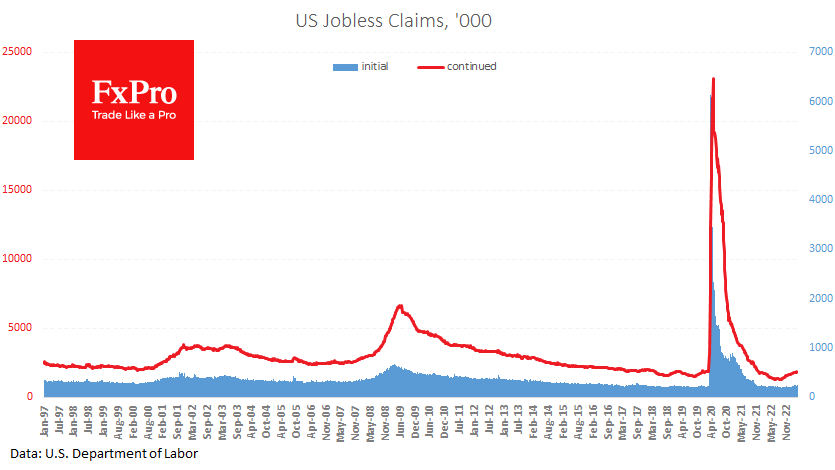

Initial jobless claims in the US came in at 245K last week, compared with the previous and expected level of 240K. This figure has been rising since the beginning of the year. It is not a pandemic spike or a.

April 18, 2023

The labour market situation in the UK is worrying. Claimant counts rose by 28.2K in March, following two months of falls by 21.5K and 18.8K, and forecasts for a fall of 2.5K last month. In a broader picture, the number.

April 18, 2023

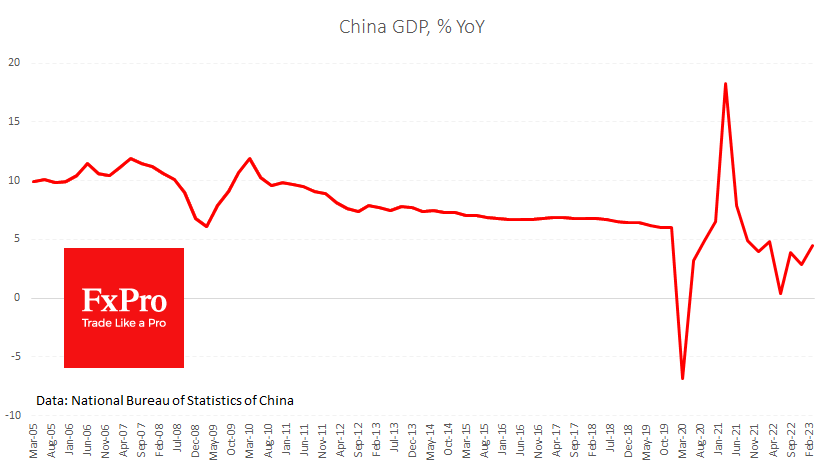

China released a large set of statistics this morning from which it’s difficult to draw clear conclusions, although GDP growth was stronger than expected. The Chinese economy grew by 2.2% in the first three months of the year and is.

April 17, 2023

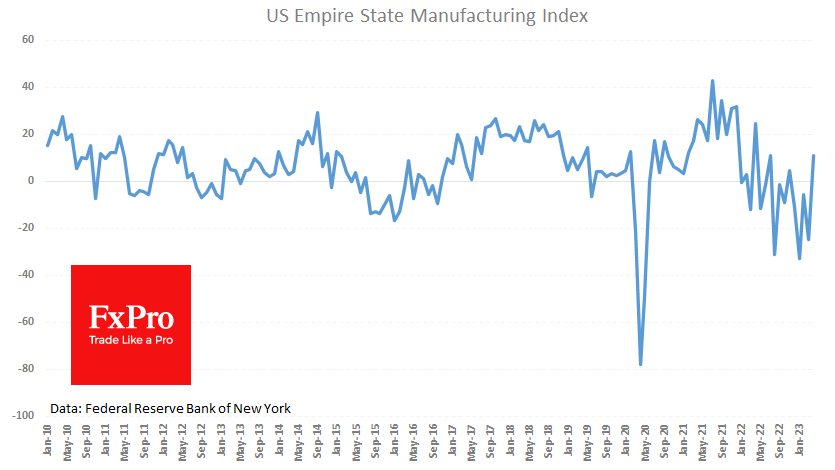

Today is not a day rich in economic data. The most important is the Empire State manufacturing index, which came in well above expectations for April. The New York Fed’s index rose to 10.8 from -24.6 the previous month, although.

April 17, 2023

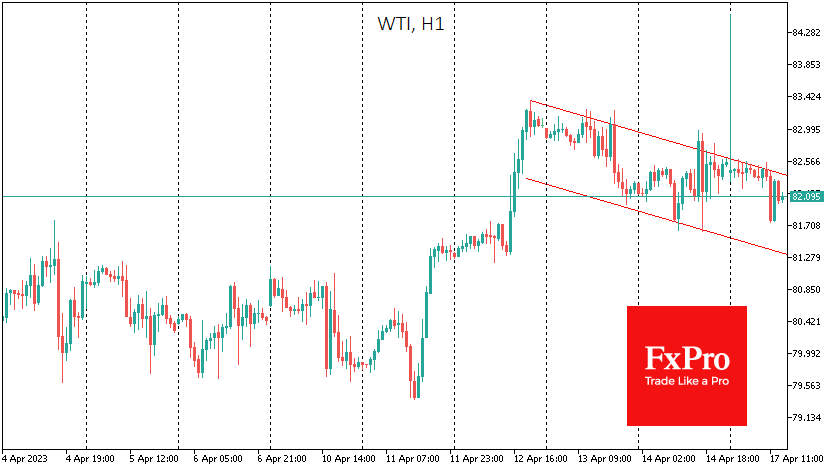

WTI Crude Oil is trading below $82 a barrel at the start of the new week and remains below its 200-day moving average. Crude oil was not allowed to break above this critical curve for the banks and big players,.

April 14, 2023

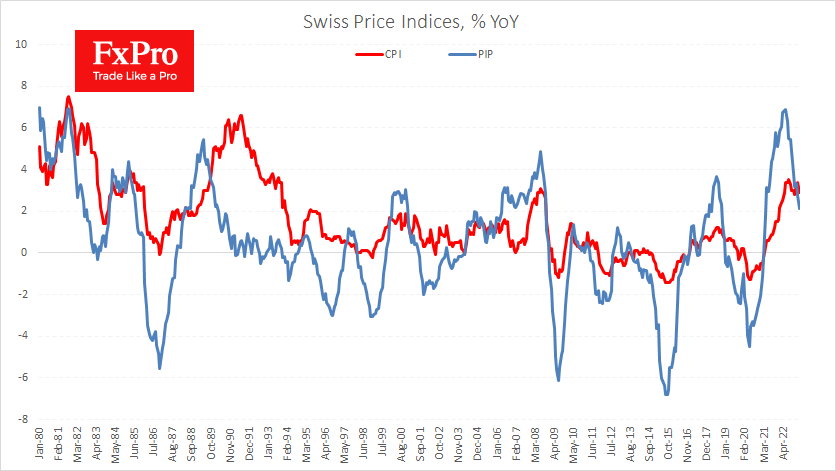

The Swiss Producer and Import Price Index rose by 0.2% in March, slowing the annual growth rate to 2.1% from 2.7%. Producer price pressures are easing faster than expected (2.7% y/y expected). Easing inflation is a long-awaited signal for the.

April 14, 2023

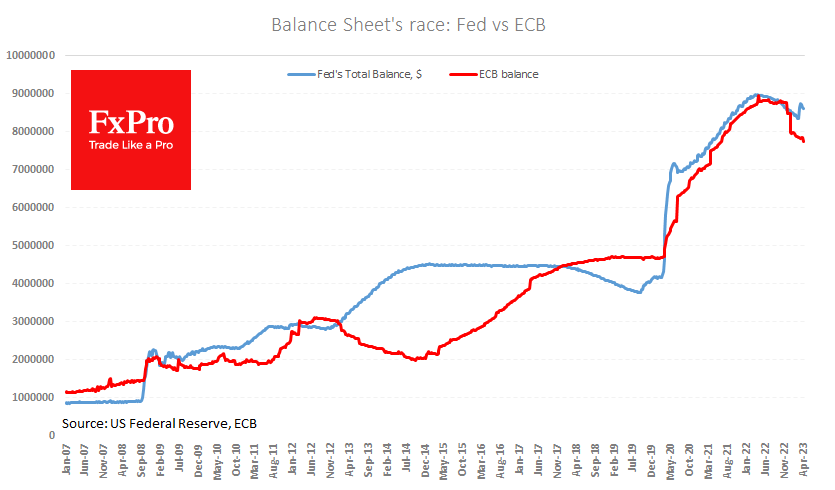

The Fed’s balance sheet shrank by 17.6 bn last week to 8,615 bn. Down 119bn over three weeks, the balance sheet is still 275bn higher than at the start of March. Pumping liquidity into the financial system helps to support.

April 13, 2023

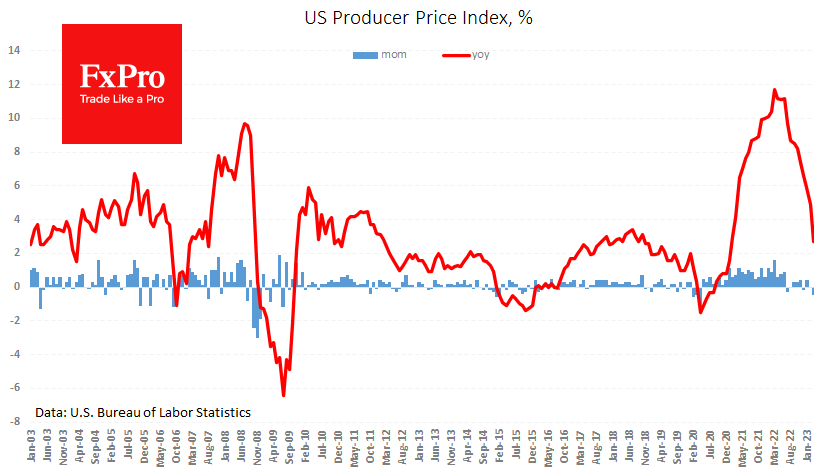

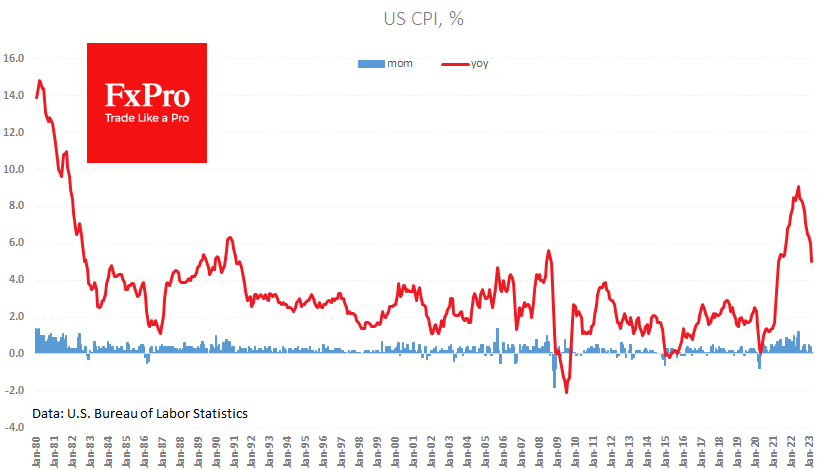

US producer prices are the real inflation surprise. A real shock followed yesterday’s mild disappointment in consumer inflation in producer prices. They fell by 0.5% in March, and the annual growth rate fell from 4.9% to 2.7%. This is the.