Canada’s success in chasing inflation is upbeat news for the CAD

July 20, 2022 @ 17:00 +03:00

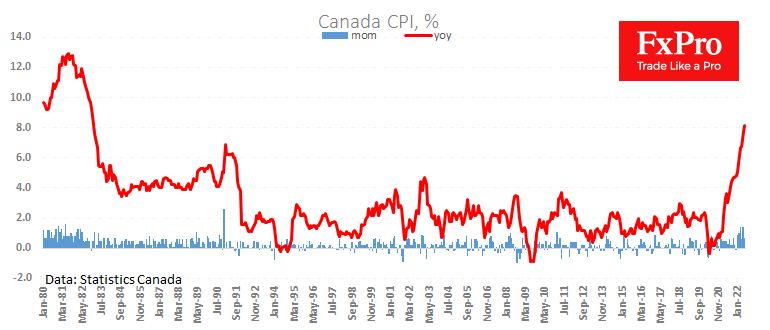

Canada took over the inflation marathon from the UK. The rate of consumer price growth accelerated from 7.7% to 8.1% y/y in June there, although it was lower than 8.4% as expected.

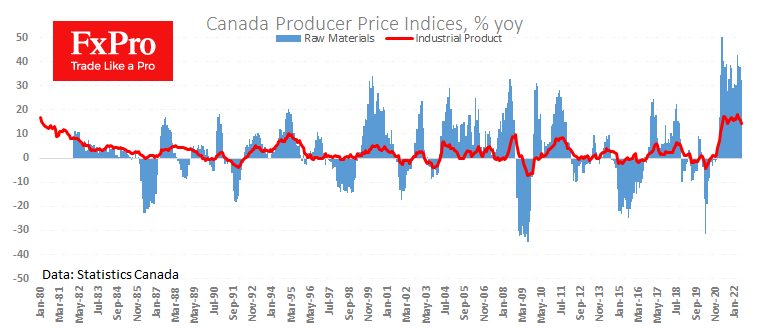

However, an even more critical signal came from producer prices, which fell by 1.1% in June. The annual growth rate has fallen for the third month in a row, reaching 14.3% in June after peaking at 18% in March.

The Commodity Price Index lost 0.1% over the month, contrasting with the forecast of 4.1% growth. The annual growth rate for this index fell to 32.4% against a peak of 42.6% in March.

Notably, price pressures are weakening markedly in this country, with the Bank of Canada imposing the most aggressive policy on developed nations last week by raising its key rate by half a percentage point.

Over the next few months, a sharp tightening of policy promises to translate into a sharper slowdown in inflation than in most other G7 countries. Also not to be overlooked is that Canadian exports benefit from rising commodity prices.

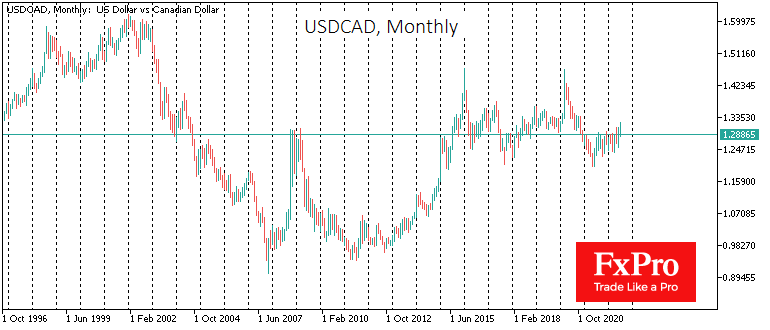

This combination of factors adds to Looney’s immunity against a rising US currency. Since June 2021, the CAD has lost 7% against the USD compared to a 16% decline in EUR and GBP and a 27% decline in JPY. Suppose the stance of the Canadian monetary authorities doesn’t change. In that case, it could make the Loonie one of the leaders in the rally against the USD, reviving memories of the super cycle of 20 years ago, when USDCAD lost 42% in five years.

The FxPro Analyst Team