Only US policymakers can stop the Dollar’s growth

July 21, 2022 @ 13:08 +03:00

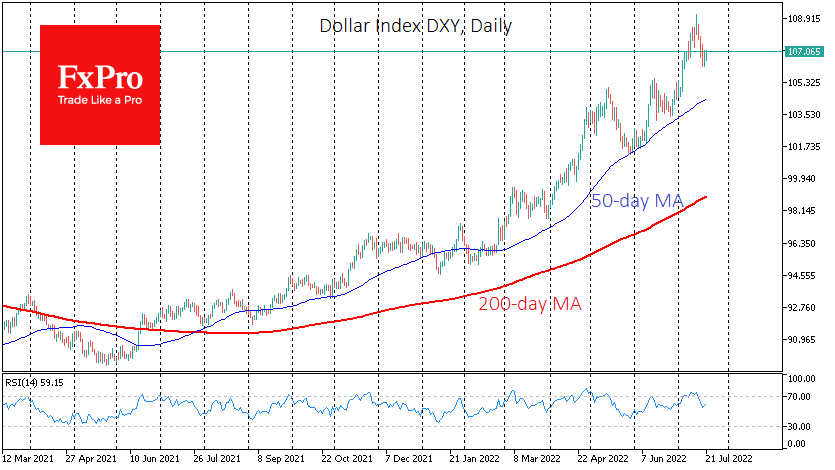

The differences between the actions of monetary authorities in various developed countries are becoming increasingly apparent. Until we see real work by the governments and central banks of the USA, Japan, or the Eurozone to change the trend, it is hardly prudent to bet on a peak in the USD.

In our view, governments’ ability to service their debts is an unspoken and indirect reason for this divergence. In the first instance, this depends on the level of the debt burden, and a more comprehensive set of measures also includes international investor confidence and the ability to raise money from the markets at an acceptable interest rate for the government.

From that point of view, the procrastination by the ECB, which is not expected to raise its rate until later Thursday, is understandable. Probably by as much as 50 points at once. For the ECB, it may look like a decisive move, but it is desperately lagging behind market conditions and the actions of its colleagues. Much of this has to do with questions about whether debt-ridden Italy and Greece can hold their own.

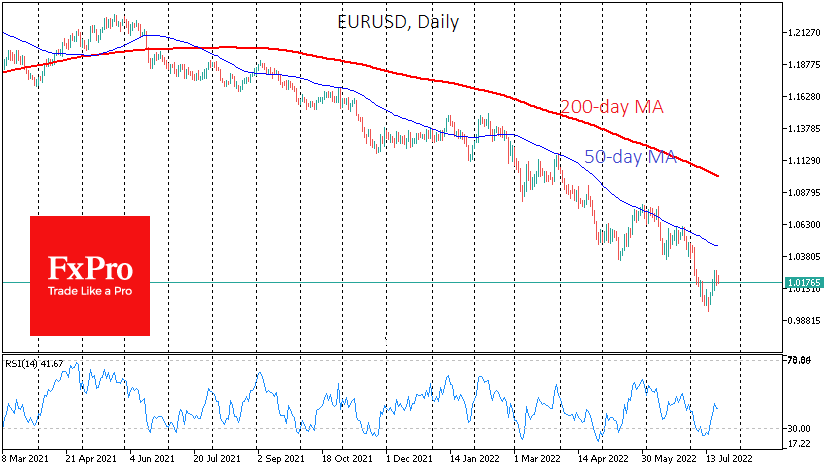

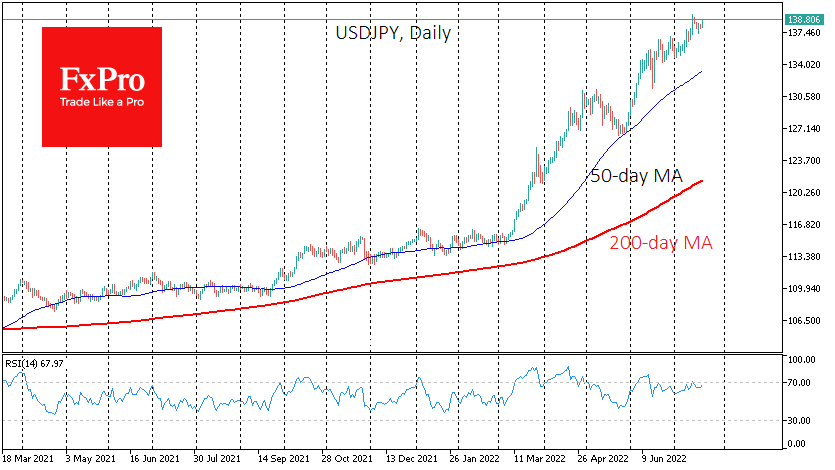

In Japan today, the central bank left Thursday’s rate unchanged at -0.1% and promised to increase QE if necessary. The debt-ridden Rising Sun Country cannot raise rates to protect against rising import prices., which has direct and obvious consequences for the currency. Since the start of 2021, the yen has lost 35% against the Dollar, about double the loss of the euro.

To investors and traders, the current euro and yen exchange rates may seem low after updating 20-year lows, but that is a dangerous approach. Rebalancing global monetary or currency policy is necessary to reverse the Dollar’s rising trend.

The ECB and the Bank of Japan allow a market devaluation of their currencies, ostentatiously delaying their policy tightening. Since they are significant reserve currencies, devaluation is proceeding smoothly despite economic problems and gloomy prospects due to dependence on energy imports.

Japan’s authorities appear to be only concerned about the pace of the yen’s decline, not its direction. The euro region’s monetary and financial authorities have made no discernible comments to defend the euro. Only the US authorities can stop the Dollar’s rise in such circumstances.

Right now, the appreciation against peers is working to lower inflation and cool the economy, as is the policy of the Fed. Furthermore, the current situation is working on the Dollar’s credibility, which has been shaken in 2020.

In our view, in the coming months, the Dollar’s rise will only be interrupted by occasional technical pullbacks. Only the US authorities can stop this trend. The Treasury could suddenly become alarmed by the appreciation of the Dollar. The Fed could also quickly reduce the rate hikes or talk about easing plans once it is convinced that inflation has turned around. But so far, we are not at that point.

The FxPro AnalystTeam