Pound cuts oversold against the dollar but must fight economic headwinds

July 19, 2022 @ 11:44 +03:00

The British pound is trying to return to levels above 1.2000. The pressure on the pound intensified on Monday evening, along with the reduced demand for risk assets after the US market. Today the pound will have to fight new headwinds in the form of local macroeconomic statistics on the UK labour market.

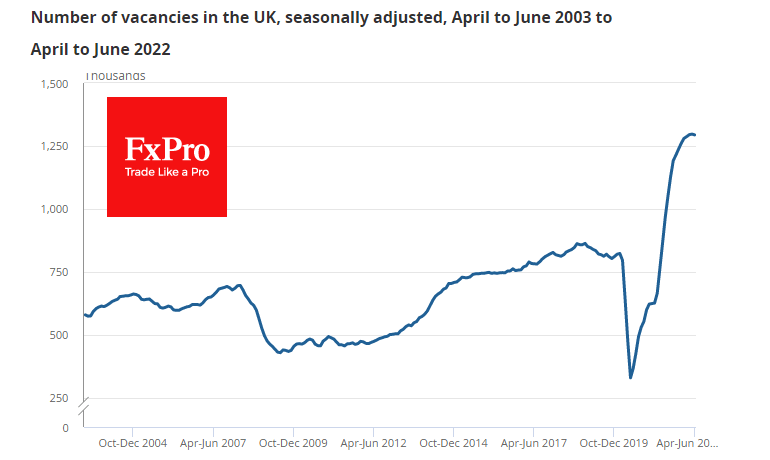

The number of people receiving unemployment benefits fell by 20k in June, half the number expected and 34.7k a month earlier. The number of job openings for the three months to June was 1,294k compared to 1,297k for March-May and 1,295k for February-April. The overheated labour market has begun to cool down.

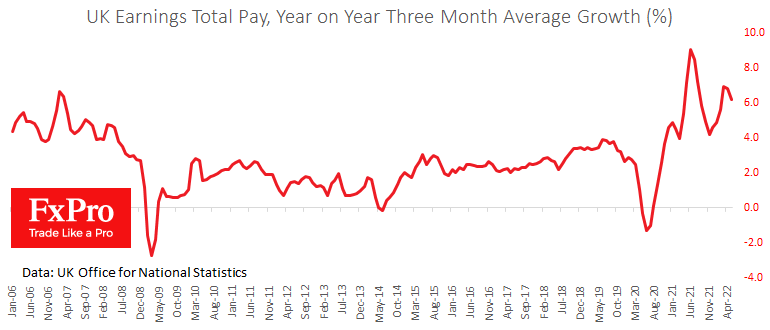

Wage figures also indicate this. Earnings including bonuses rose 6.2% in the three months through June compared to the same period a year earlier. Official inflation data showed a 9.1% YoY increase in May, while June’s data, released on Wednesday, is expected to accelerate to 9.3%, marking an acceleration of the fall in workers’ actual earnings. In addition, these statistics came out weaker than expected, which may additionally work to weaken the pound against its competitors.

Despite unimpressive labour market data, GBPUSD is gaining for the third trading session, which should be attributed to the market’s desire to take profits from the previous rally in the dollar.

The US currency rose too far too fast and is now subject to short-term technical pressures. Until the Fed meeting on July 27, we may see a corrective rebound capable of flattening market positioning and providing the potential for a two-way move at the outcome of the critical FOMC meeting.

Locally, despite weak data today and potentially worrisome inflation readings on Wednesday and retail sales on Friday, GBPUSD may not have significant headwinds for a rebound up to 1.2200 – a support area in May and a 76.4% Fibonacci retracement level from the February-July downtrend. This would relieve some of the pair’s oversold position but is hardly enough to break the pair’s medium-term downtrend as the UK economy is slowing more quickly than the US, suffering from high imported commodity and energy prices.

The FxPro Analyst Team