Market Overview - Page 472

August 16, 2019

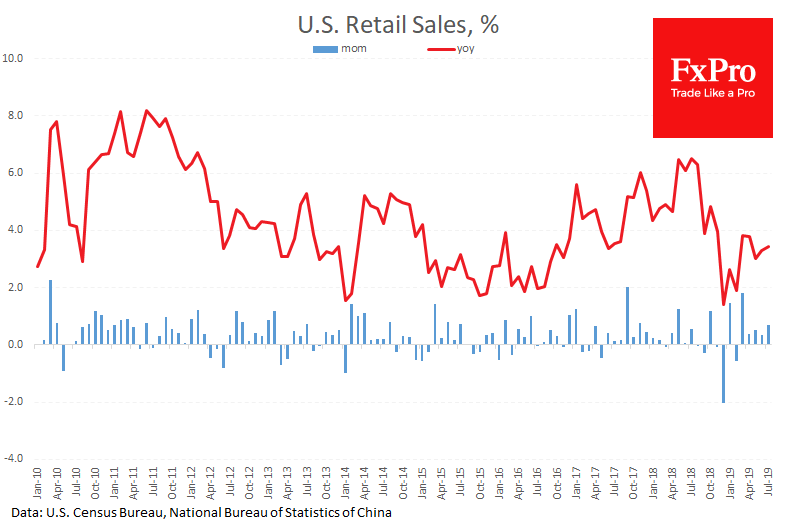

Asian stock markets grew on Friday morning due to hints of new stimulus from the Chinese government. The Asia Pacific MSCI added 0.2% on Friday morning, while the Shanghai Blue Chip Index China A50 increased by 0.8%. The promise of.

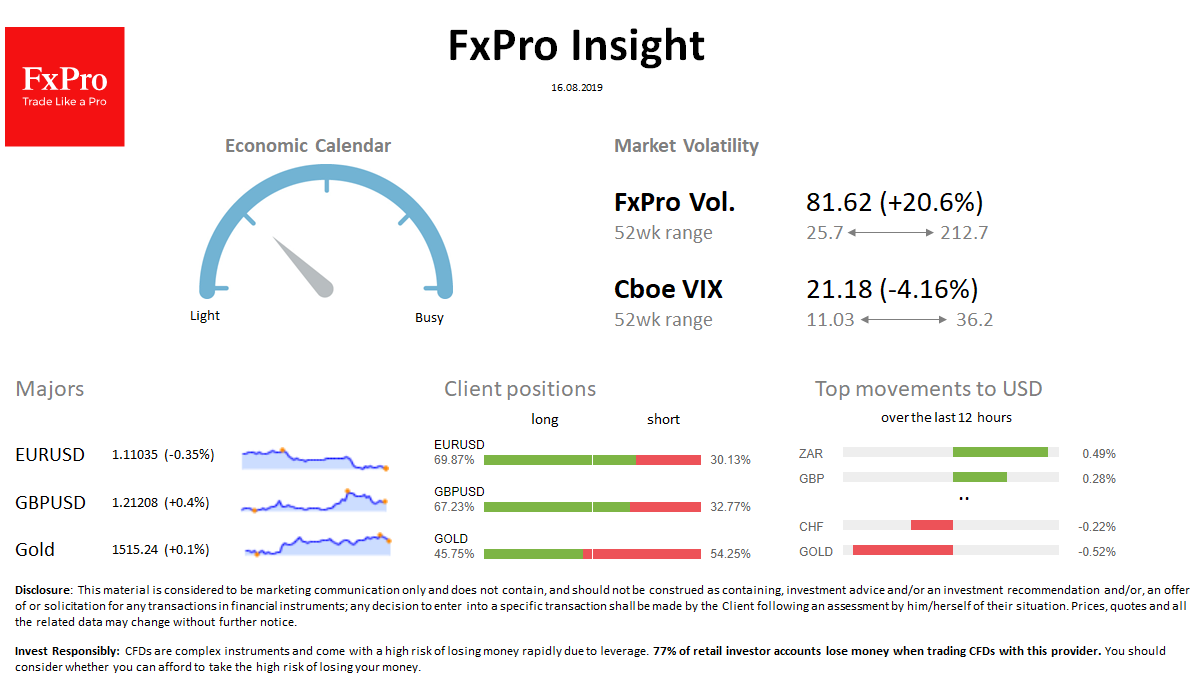

August 16, 2019

Market overview FX: Dollar index rises for 4-day high due to safe-haven demand. EURUSD fell under pressure on ECB’s hints to massive stimulus, that drags USDCHF higher. GBP and other risk-sensitivities increased, along with ZAR, AUD added 0.3% this morning..

August 15, 2019

Argentina’s historic market collapse has sparked fears that South America’s second-largest country is on track for yet another default. A stunning result in primary polls over the weekend set off a shockwave in financial markets, with the country’s stock market.

August 15, 2019

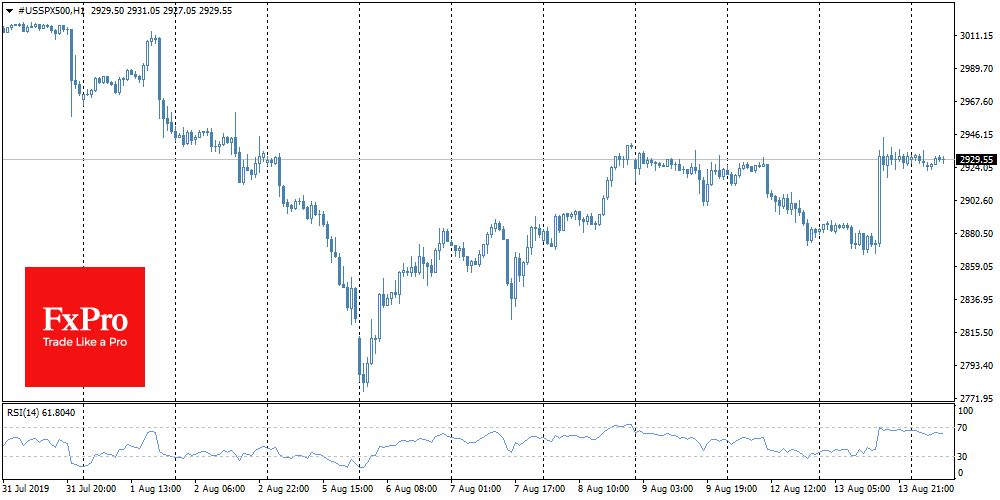

The world markets failed to maintain a positive attitude. The U.S. indices lost more than 3% on Wednesday. At the same time, the debt markets did not bounce back with the stocks on the news of the tariff delay. Moreover,.

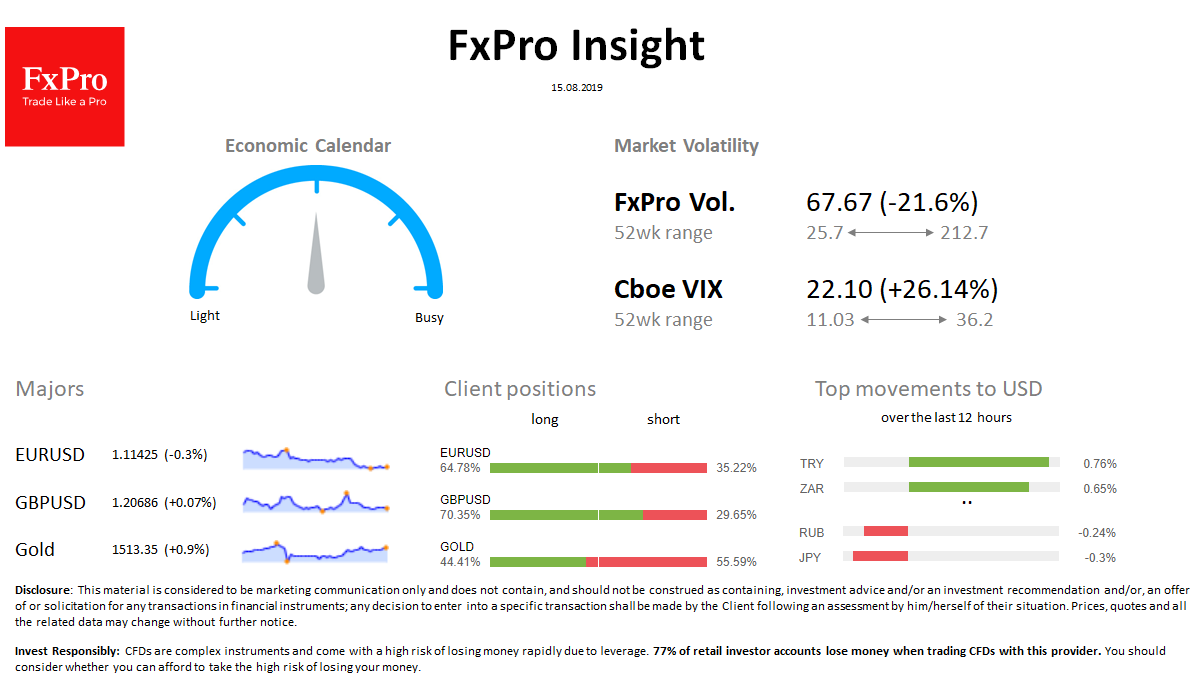

August 15, 2019

Market overview FX: The dollar index rose due to the demand for US protective government bonds. USDJPY, USDCHF again added on Thursday morning, Risk-sensitive TRY, ZAR, AUD add more than 0.6% this morning. Overall, volatility on FX has declined. Stocks:.

August 15, 2019

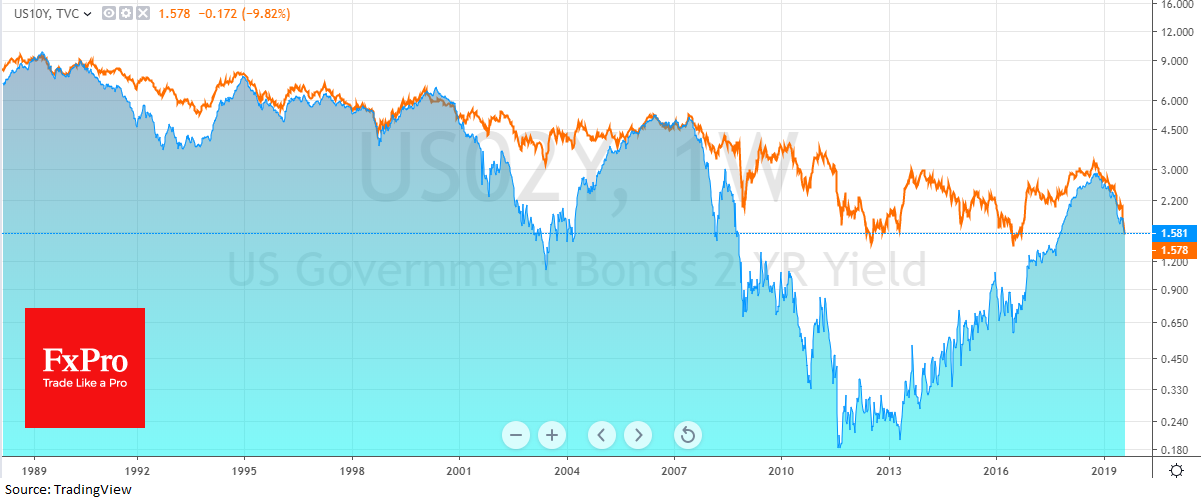

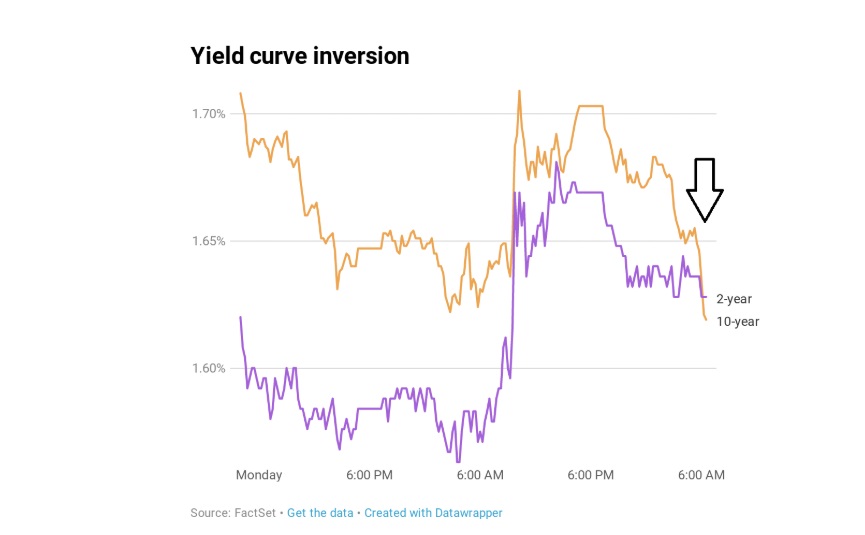

Fears are rising that a recession looms after a closely watched market metric flashed a warning signal, but one strategist told CNBC the supposed indicator “predicts absolutely nothing.” The yield on the 10-year U.S. Treasury briefly broke below the 2-year.

August 15, 2019

President Donald Trump in a tweet Wednesday suggested a “personal meeting” with China’s President Xi over the ongoing Hong Kong crisis, as investors remained on edge about the trade tensions between the U.S. and China. “I know President Xi of.

August 14, 2019

Stocks plunged on Wednesday, giving back Tuesday’s solid gains, after the U.S. bond market flashed a troubling signal about the U.S. economy. The Dow Jones Industrial Average dropped 800.49 points or 3.05% to 2,5479.42, its biggest point decline of the.

August 14, 2019

The yield on the benchmark 10-year Treasury note on Wednesday broke below the 2-year rate, an odd bond market phenomenon that has been a reliable, albeit early, indicator for economic recessions. The yield on U.S. 30-year bond fell to a.

August 14, 2019

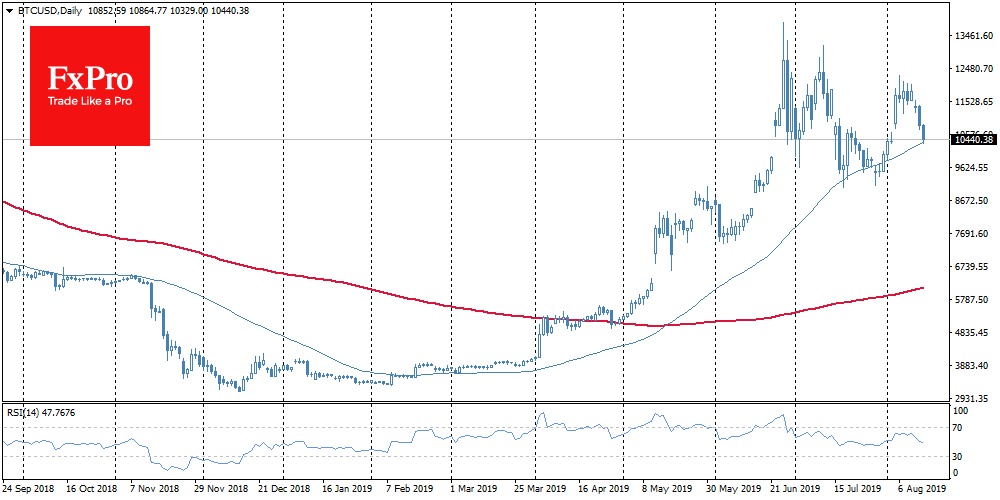

The BTC has fallen by almost $800 or 7% per day and trades on Wednesday morning for $10,600. What does not grow – it falls. A very actual phrase about Bitcoin at the moment. The inability to develop the growth.

August 14, 2019

The privacy-focused cryptocurrency Zcash has fallen by nearly 15 percent this week as Bitcoin’s dominance approaches 70 percent. According to CoinMarketCap, Zcash was trading at slightly over $66 seven days ago but is now just under $56, a decline of.