Market Overview - Page 440

November 25, 2019

Bitcoin has just plunged to a new six month low under $6,700 which opens up a new range of lows in the short term. The chances of a ‘santa rally’ are dwindling as crypto markets continue to crash back towards.

November 22, 2019

Kelly Loeffler, the CEO of bitcoin futures trading exchange Bakkt, is gunning to be appointed Georgia’s new U.S. Senator by the state’s governor. The only problem: President Trump has other ideas. According to the Atlanta Journal-Constitution, Trump is pushing Georgia’s.

November 22, 2019

Cryptocurrency exchanges operating illegally in China face a new threat after the central bank announced it would take new steps to uphold its trading ban. In a statement on Nov. 21, the People’s Bank of China (PBoC) warned it was.

November 22, 2019

With three rate cuts this year, there remains “not as much scope as I would like to see for the Fed to be able to respond to that. So there is good reason to worry.” One particular area she cited.

November 22, 2019

As the hype over self-driving vehicles begins to wear a bit thin, it looks like the technology will come to trucks more quickly than passenger cars. Chinese autonomous driving company Pony.ai, which also has an office in California, has focused.

November 22, 2019

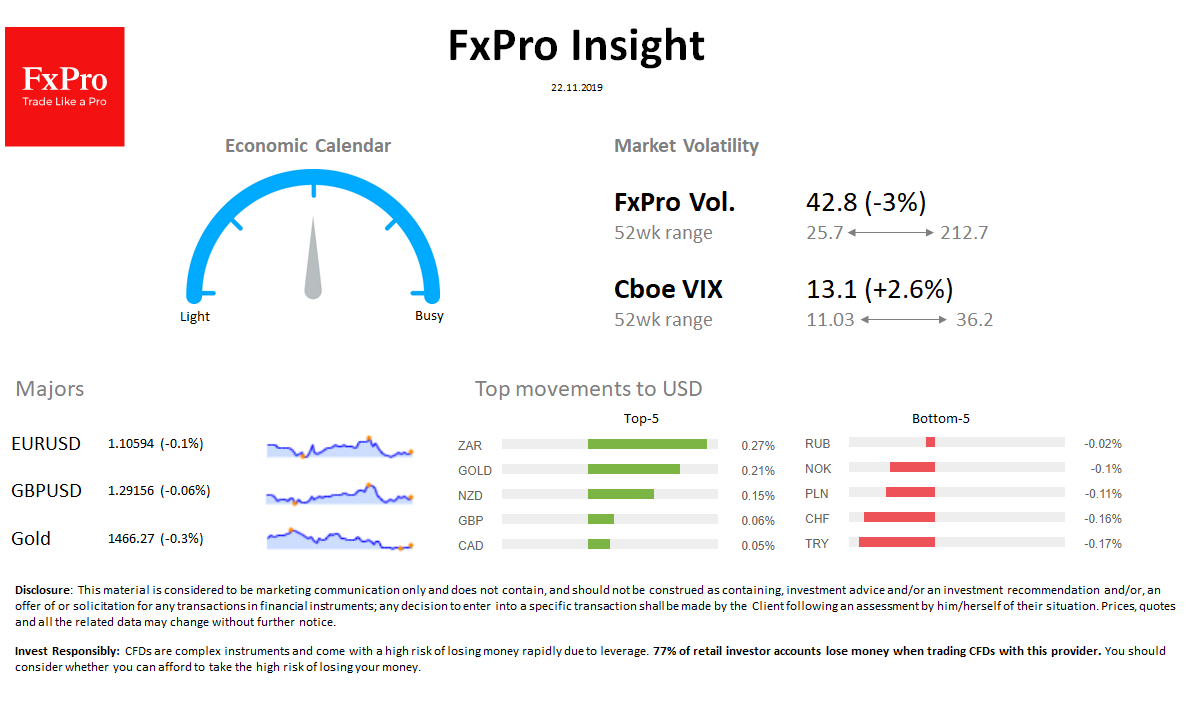

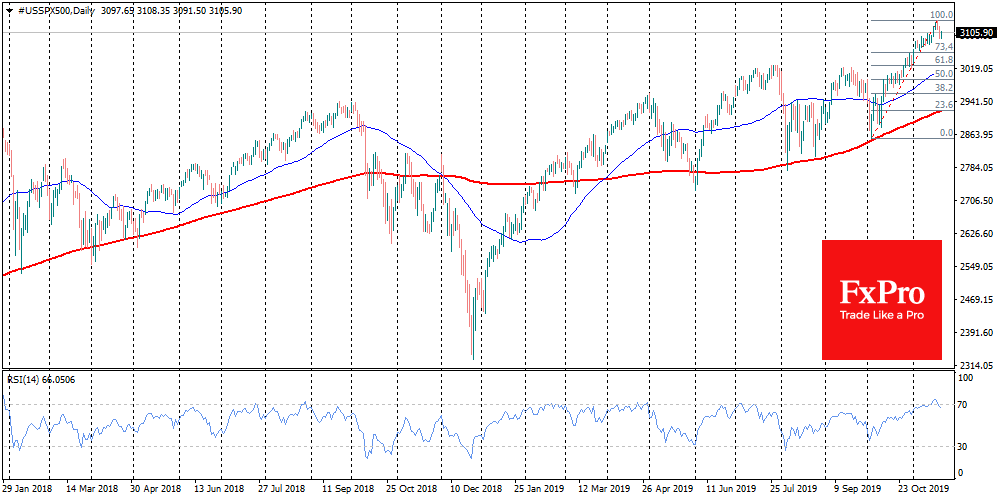

Financial markets bounced from recent local lows. The American S&P500 returned to the region above 3100. Hong Kong’s and Shanghai’s markets started the day with a positive following their US colleagues. However, by the end of the Asian trading session,.

November 22, 2019

Market overview Forex: The dollar index little changed for the day. EURUSD stood near 1.1070 before European opening. GBPUSD pushed lower after another attempt to growth. Stocks: S&P500 managed to turn to growth at the end of the day on.

November 21, 2019

Late last month, Bitcoin (BTC) saw a jaw-dropping trading session, with the cryptocurrency’s price gaining 42% in a 24-hour time frame; this was BTC’s best daily performance in over six years. This move, which brought the asset from $7,300 to.

November 21, 2019

The situation around the trade continues to get more complicated. US lawmakers passed two bills in support of protesters in Hong Kong. Markets have taken this information negatively as China is almost sure to saw it as interference in its.

November 21, 2019

Market overview FX: The dollar index changed only slightly over the last 24h, remained at 97.8. Commodities CAD and AUD, as well as Chinese CNH, are losing ground following concerns over progress in US-China trade negotiations. EURUSD almost unchanged at.

November 21, 2019

Dan Schulman, CEO of payment processor PayPal, revealed during an interview that he does indeed own Bitcoin (BTC). On Nov. 20, Fortune reported that PayPal CEO Dan Schulman stopped by its offices where he discussed a variety of topics, including.