Market Overview - Page 85

December 19, 2022

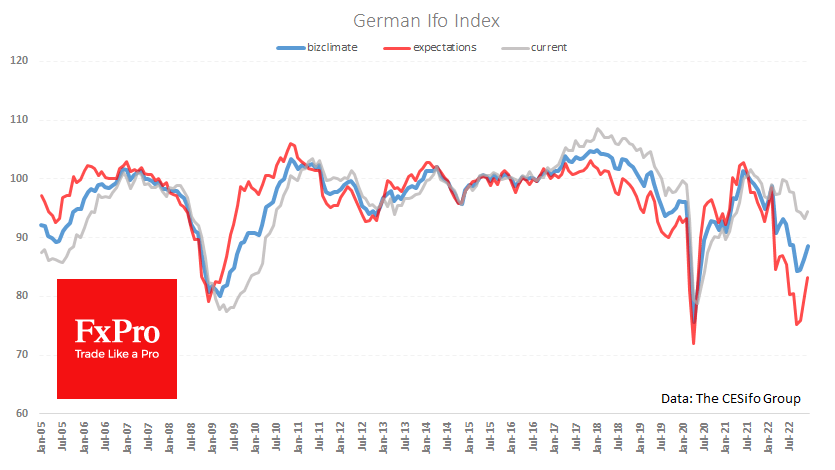

Germany’s business sentiment index rose in December for the third month, returning to August levels on the back of more optimistic expectations, while assessment of the current situation has improved just slightly. Ifo Business Climate Index for Germany jumped from.

December 16, 2022

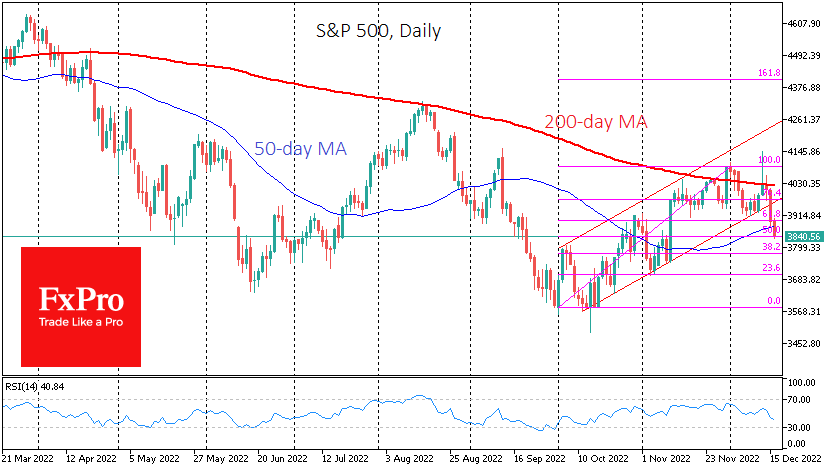

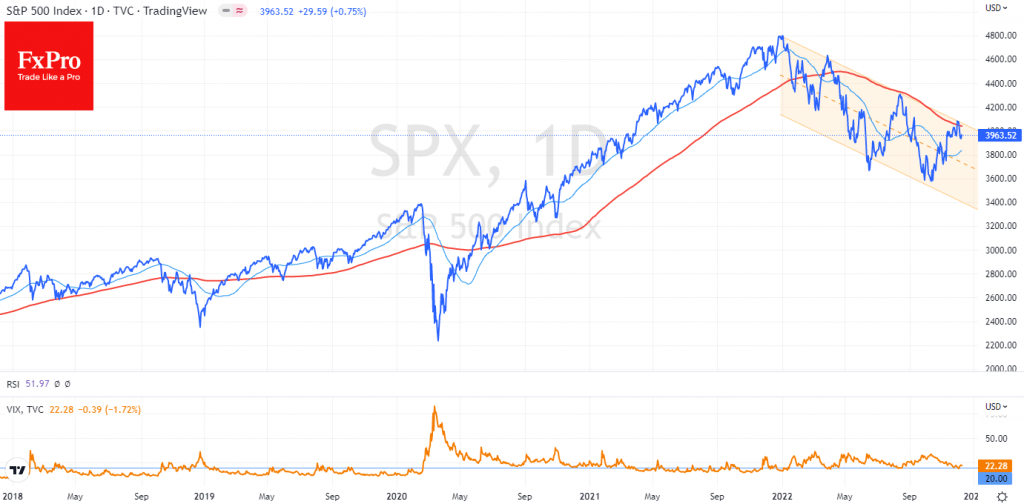

For the third time since April, the S&P500 index faces a sharp sell-off from the 200-day average. And all times, the fundamental reason is a more hawkish Fed policy than the markets had hoped for. In June-August and October-December, the.

December 16, 2022

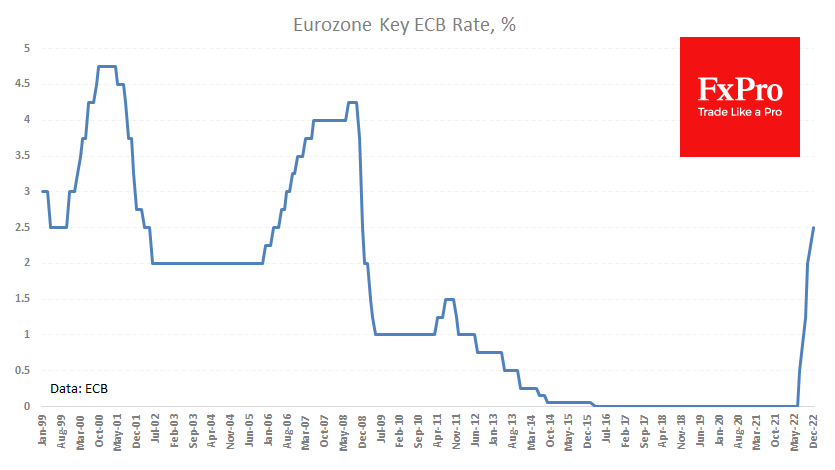

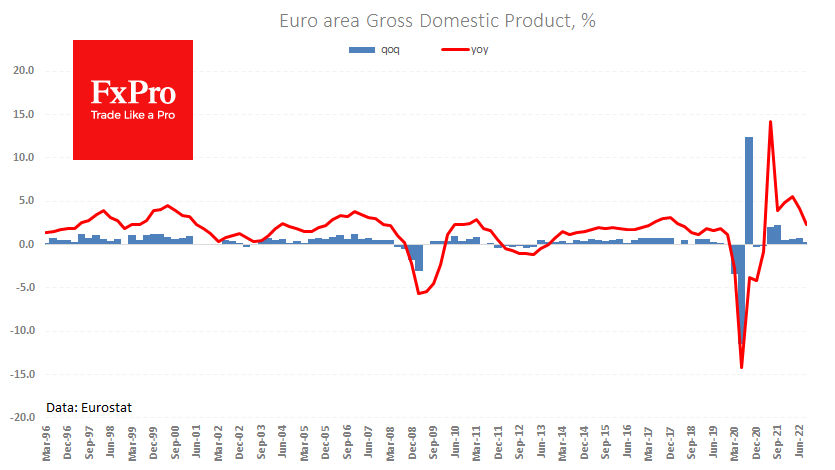

The ECB raised key rates by 50 points, bringing the key rate to 2.5% – the highest in 14 years, but promising not to stop there. In addition to the rate decision, the ECB will start selling assets off the.

December 15, 2022

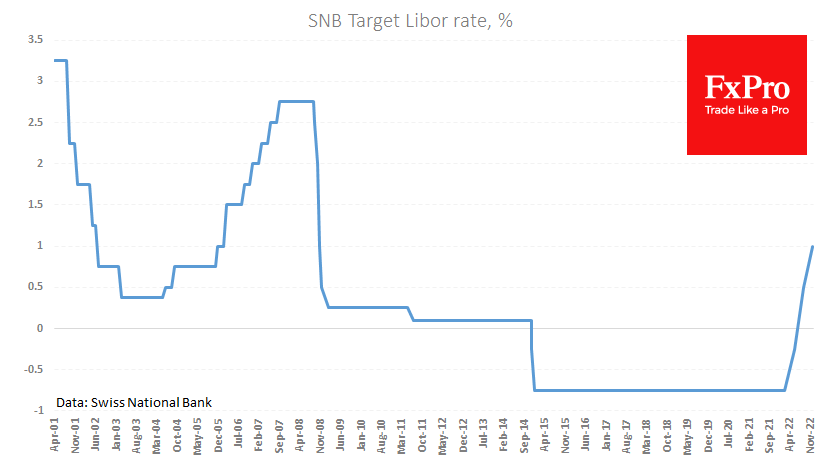

The Swiss National Bank raised its rate by 50 points to 1.0% after two hikes of 50 and 75 points at the previous two meetings. In an accompanying commentary, the NBS said it was countering rising inflationary pressures. In the.

December 14, 2022

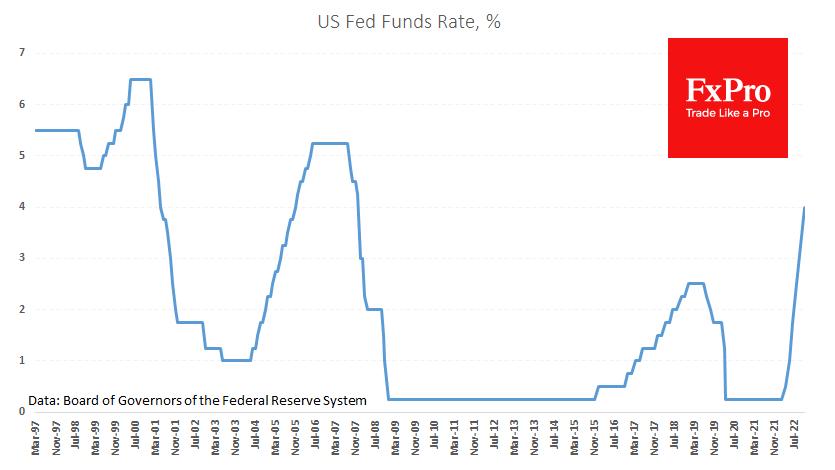

The Fed’s key rate meeting promises to be the last significant scheduled event for financial markets. Decisions and comments today have every chance of being decisive for the stock market over the next few weeks. The currency market has already.

December 13, 2022

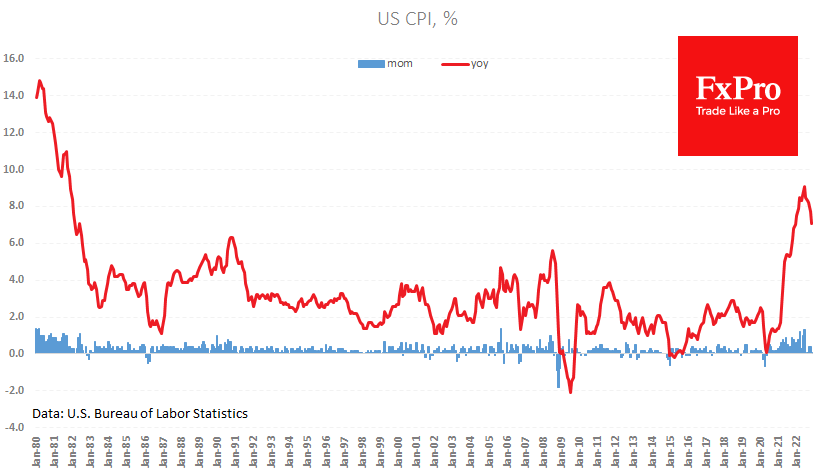

US consumer prices added 0.1% for November, significantly weaker than the expected 0.3%. The annual price growth rate slowed to 7.1% YoY against expectations of 7.3%, 7.7% a month earlier and two percentage points below the June peak. An important.

December 13, 2022

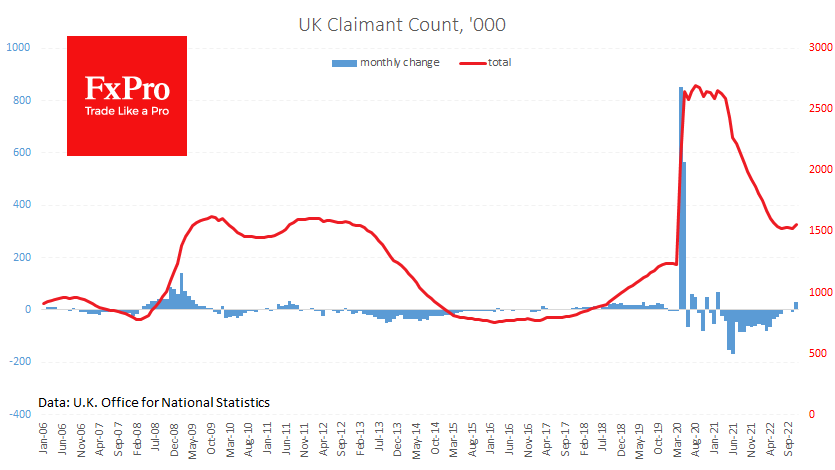

UK data released today marked a sharp rise in jobless claims, marking a turnaround in employment recovery after covid restrictions. The ONS reported a 30.5K increase in claimant count for November after a 6.5K decline a month earlier and a.

December 9, 2022

US stock indices have rallied impressively in October and November, but the start of December is still heavy. And now is the right time to figure out whether the previous two months were a bear market rally or the beginning.

December 7, 2022

The single currency edged against most of its peers on Wednesday and managed to return to territory above 1.05, helped in no small part by published economic data. In the morning, Germany surprised with a less sharp drop in industrial.

December 7, 2022

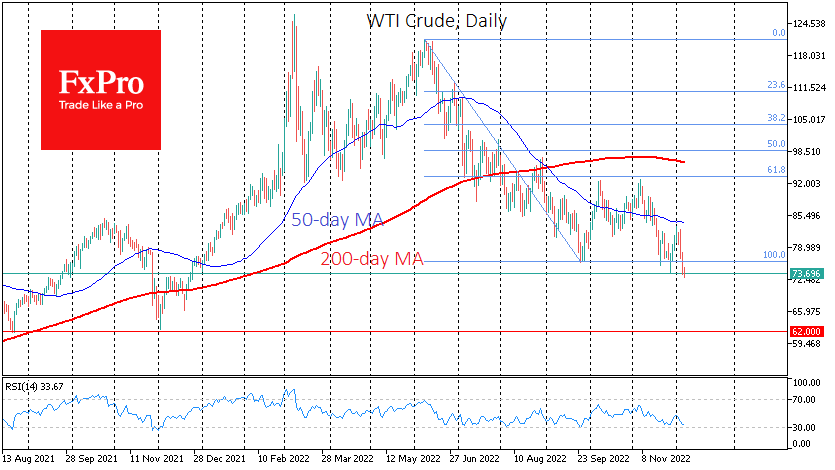

WTI crude is down to $73, while Brent is approaching $78, losing 2% since the start of the day and almost 10% since the beginning of the month. Despite rumours about possible quotas cut, OPEC+ keep them for another two.

December 7, 2022

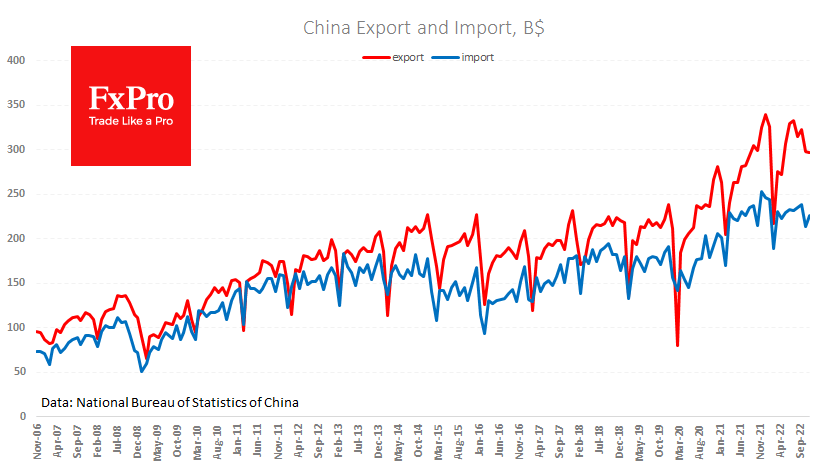

Last month, China’s harsh lockdown measures negatively impacted foreign trade. Exports fell by 8.7% YoY; imports lost 10.6% YoY. Economists, on average, were expecting half the rate of decline. Trade surplus shrank to $69.84B in November from $85.15B a month.