Pound hits ceiling

January 26, 2023 @ 15:13 +03:00

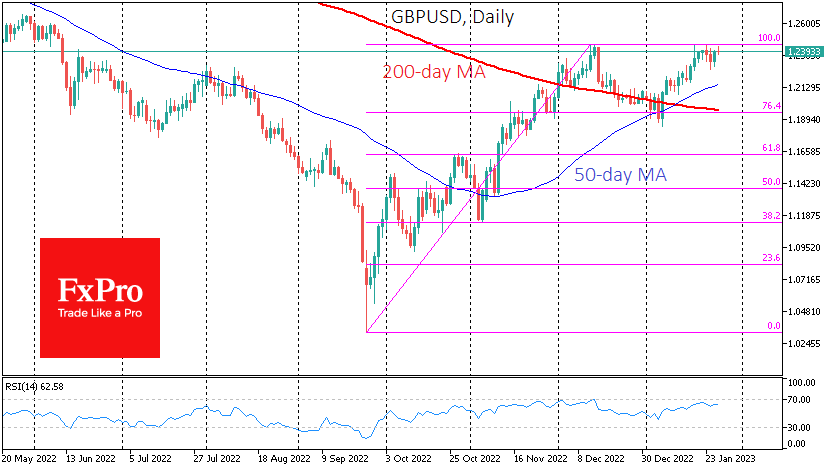

The British Pound is testing the $1.2400 level this week, above which it failed to consolidate in the middle of last month. The GBPUSD has yet to trade consistently higher since last June.

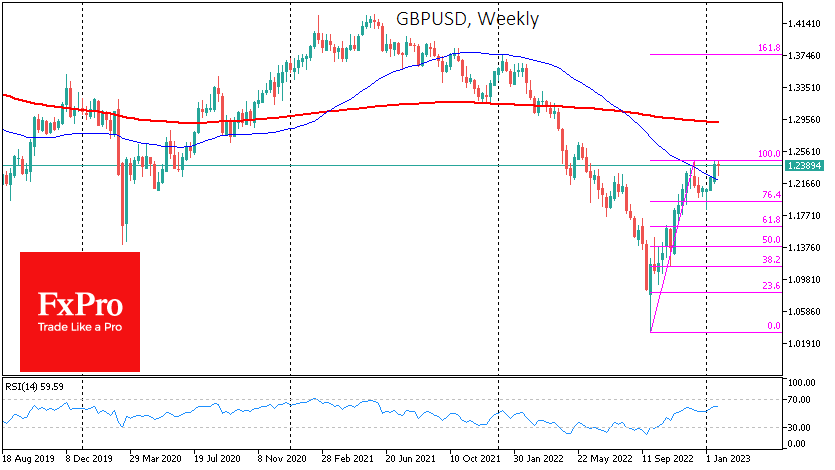

Looking at the entire rally from September’s historic lows at 1.0327, the retreat from December’s highs to 1.19 is a fairly common Fibonacci retracement to the 76.4% area of the original move, though not the classic 61.8%.

Technically, two important moving averages, the 50- and 200-day moving averages, acted as support in early January, preventing the pair from falling any further while allowing it to take some profits from the initial rally.

The pattern now suggests that GBPUSD has the potential to rise to 1.37-1.38, where the highs of last January and the 161.8% level of the first wave of the rally are concentrated. A move in this direction has every chance of becoming the main trend this year, although we expect a very significant battle for 1.3000 over the next few quarters.

However, the tactical stance is more cautious. The pound has been hitting a glass ceiling just above 1.2430 for over a week now. The inability to rewrite the previous highs is not a formal signal for further growth.

At the same time, a divergence with the Relative Strength Index is forming on the daily timeframe, as the price’s repeated highs are coming from the index’s lower local peaks, which is a bearish signal.

Without a strong rally above 1.2430, we should be prepared for a deeper local correction. The area of the January lows, also crossed by the 200 SMA, looks like a good target for another pullback.

A deeper correction towards 1.1630, where 61.8% of the recent rally and last October’s local peak are located, cannot be ruled out. Such a full-blown correction would fully recharge the pound bulls and pave the way for further growth.

The FxPro Analyst Team