Market Overview - Page 79

March 22, 2023

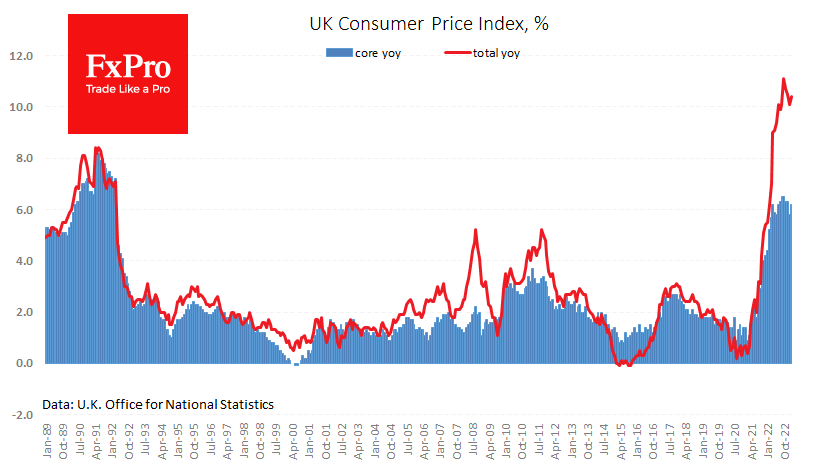

UK consumer prices rose by 1.1% in February. Instead of the expected slowdown in annual inflation from 10.1% to 9.9%, we saw an acceleration to 10.4%. The core CPI returned to 6.2% y/y. This is an essential signal of continuing.

March 21, 2023

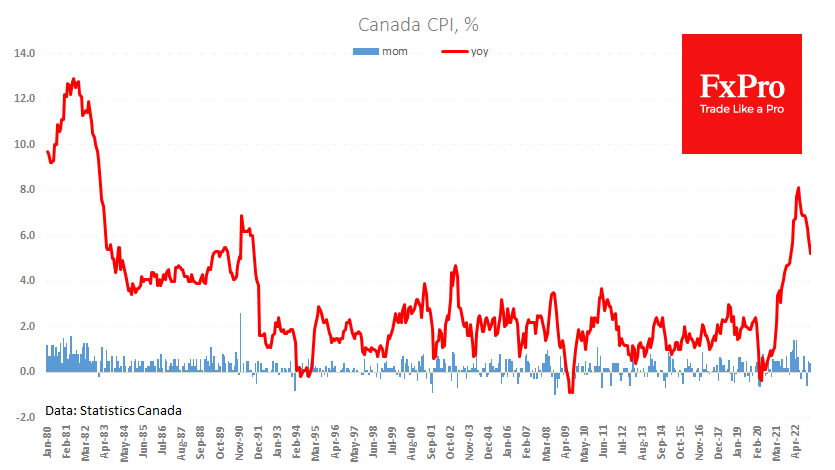

Canadian consumer prices rose 0.4% in February, with annual inflation slowing to 5.2% from 5.9%. Both figures were below expectations of 0.5% and 5.4%, respectively, reflecting a faster return to normality than economists had expected. Consumer inflation excluding fuel and.

March 21, 2023

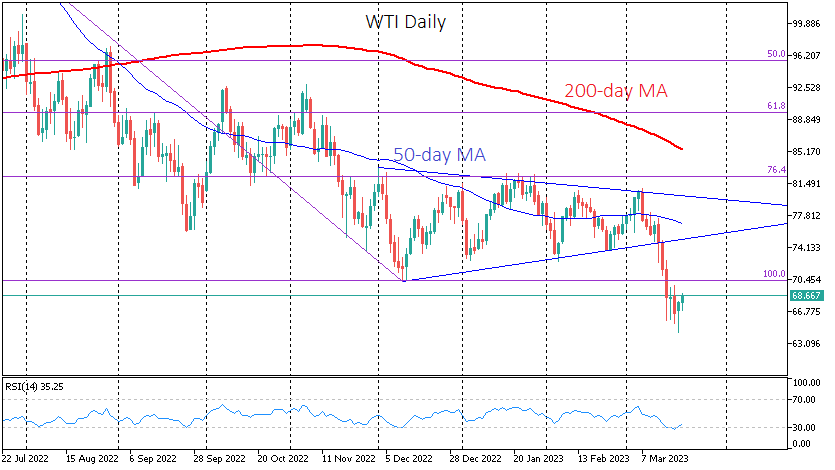

By the start of European trading on Monday, WTI had lost over 20% from its high of $80.96 on 7 March to a low of $64.36. The sell-off that intensified last week may well be giving way to a new.

March 20, 2023

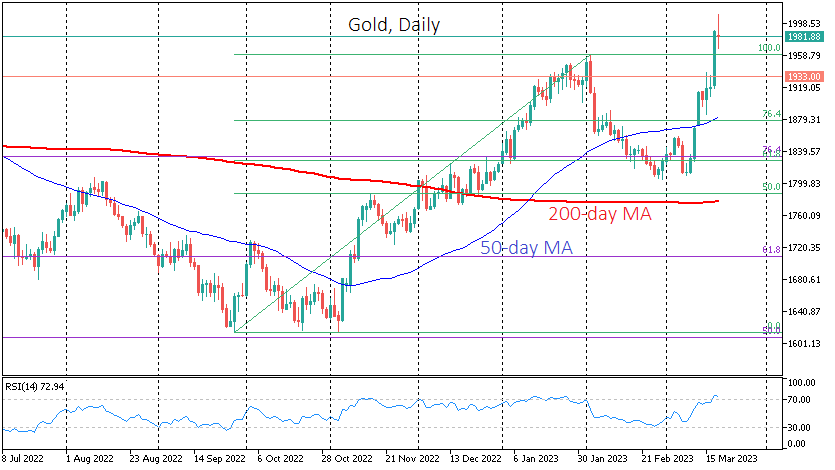

In just ten days, gold has risen by 11% or around $200. At the start of the day on Monday, the price was approaching $2010. Historically, this is thin-air territory for gold. Despite the threat of a short-term pullback to.

March 20, 2023

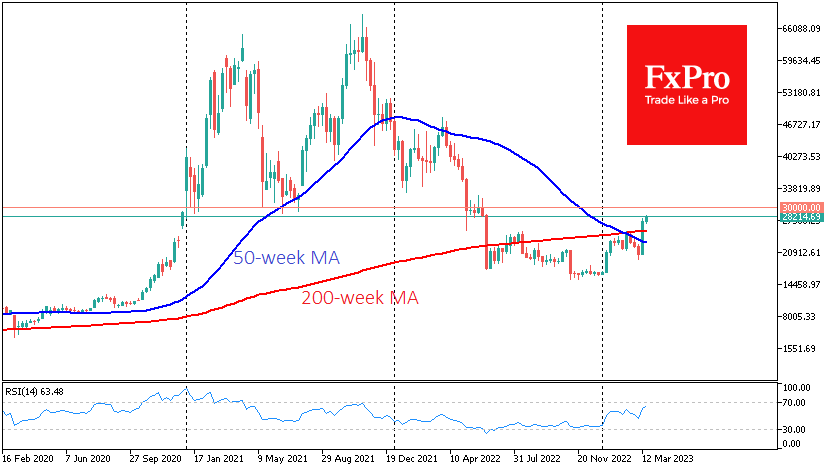

Market picture Bitcoin jumped 24% last week to close at $28K. Ethereum added 16.2% to $1800. Other leading altcoins in the top 10 gained between 6.6% (Polkadot) and 19.3% (BNB). The total capitalisation of the crypto market, according to CoinMarketCap,.

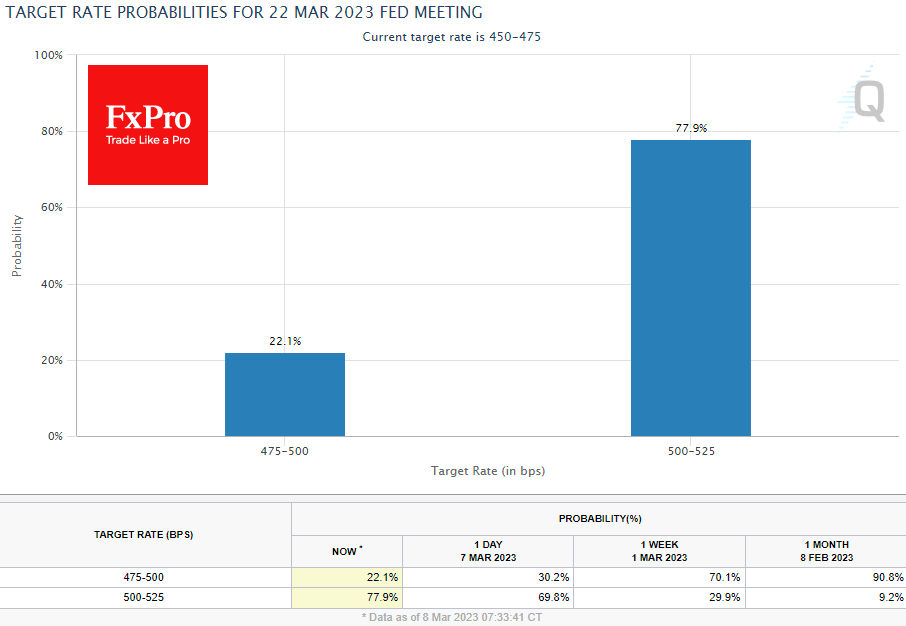

March 17, 2023

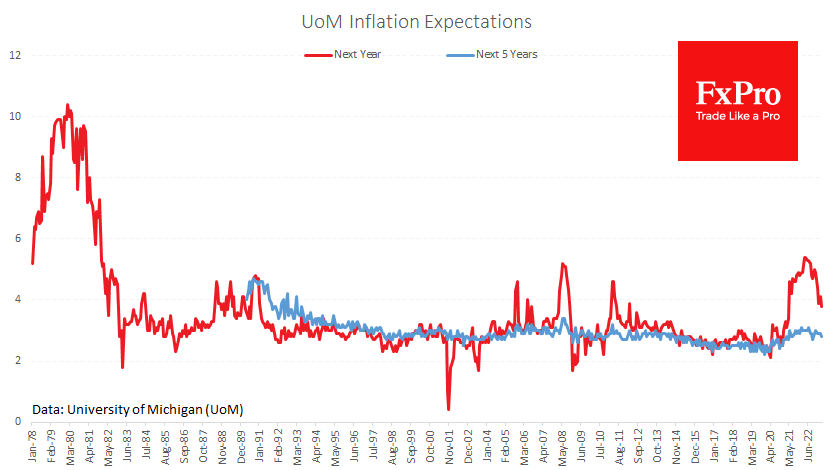

US inflation expectations are declining, which could be good news for the stock market, suggesting less pressure on the Fed to raise interest rates. The University of Michigan’s inflation expectations index for the year ahead fell to 3.8%, the lowest.

March 14, 2023

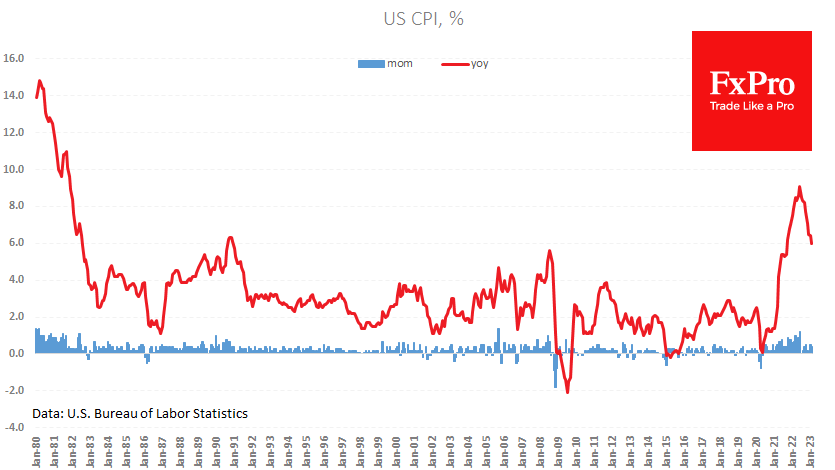

The US consumer price index rose 0.4% in February, slowing the annual rate to 6.0%, in line with economists’ expectations. The core price index, which excludes food and energy, rose 0.5% for the month (0.4% expected) and slowed slightly to.

March 14, 2023

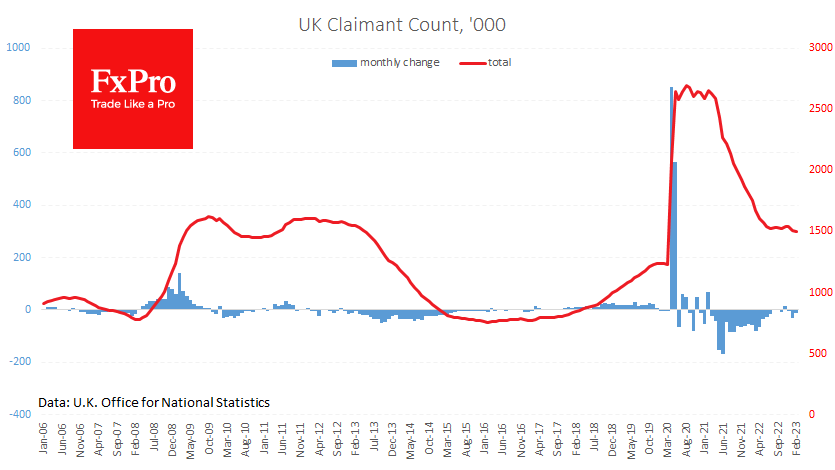

Unemployment claims in the UK fell by 11.2k in February, against analysts’ average forecast of a rise of 12.5K. Jobless claims have fallen by nearly 50K over the past three months after a sustained period of stabilisation, a sure sign.

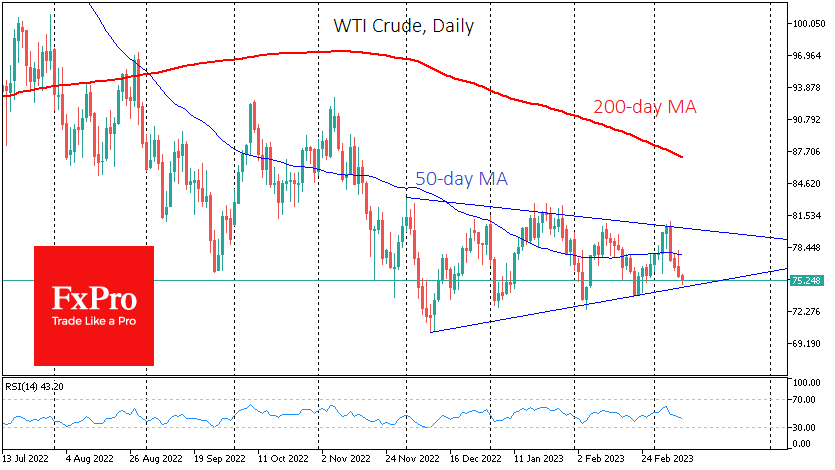

March 10, 2023

Oil reversed sharply from bullish to bearish on Tuesday, losing around 6.5% and below $75/bbl WTI. The reversal fits neatly into a tapered triangle pattern, with a setback from the upper boundary earlier in the week to the lower boundary..

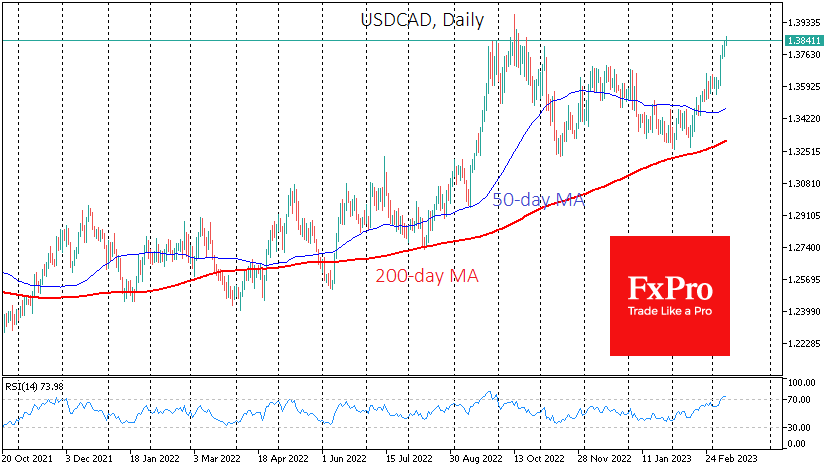

March 10, 2023

USDCAD has been rallying this week, gaining 1.7% since Tuesday and testing the five-month high of 1.3850. The pair looks vulnerable to both a short-term correction and the potential for a longer-term reversal. The US Dollar has enjoyed gains after.

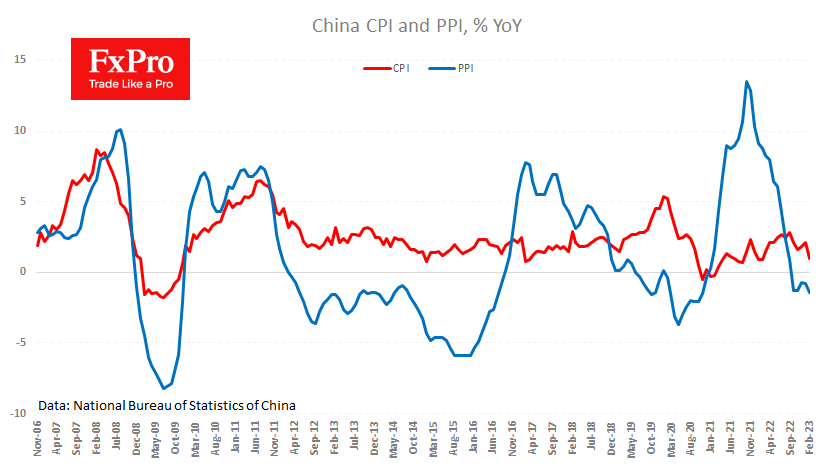

March 9, 2023

China’s consumer price growth fell to 1.0% y/y, a sharp slowdown from 2.1% y/y and against expectations of 1.9% y/y. Producer prices continued their deflationary slide in February, falling 1.4% y/y, versus -0.8% in the previous month and a slightly.