German inflation is slowing, but ECB wants to do more

May 10, 2023 @ 13:25 +03:00

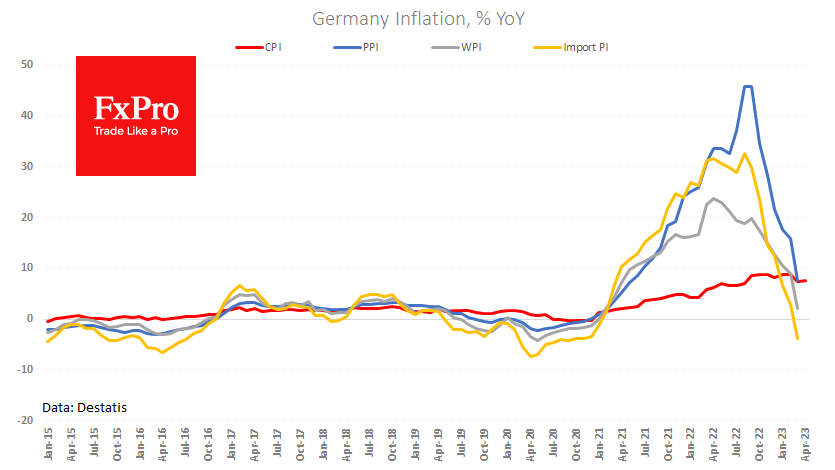

German consumer inflation slowed to 7.2% y/y in April, Destatis said in its final estimate. The trend of decelerating price increases continues, although it remains well above the ECB’s target.

March data for other price indicators point to further easing of pressure. For example, the wholesale price index rose by only 2% y/y in March, and import prices were 4.8% lower than 12 months earlier. Gas prices at the European hub continue to fall, reaching $403 per 1,000 units. This is the lowest level since July 2021 and the upper limit of the typical price range since 2011.

The slowdown in inflation allows the ECB to hold back and end the hiking cycle sooner, which is potentially negative for the euro. But now investors should pay more attention to how ECB officials assess the situation, as their job of taming inflation is not yet considered done.

In her speech today, Lagarde once again reminded us that more action needs to be taken to curb inflation, which implies further rate hikes. This stance is more hawkish than the Fed, hinting at a pause and an end to the tightening cycle.

The FxPro Analyst Team