Market Overview - Page 78

March 30, 2023

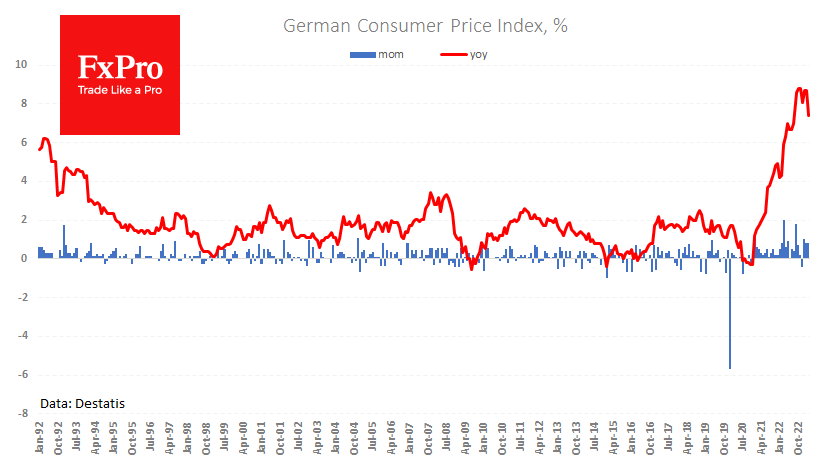

Preliminary estimates for Germany indicated an increase in consumer prices in March by 0.8% m/m and 7.4% y/y, which is higher than the average growth forecasts of 0.7% m/m and 7.3% y/y. In March last year, prices jumped by 2%.

March 30, 2023

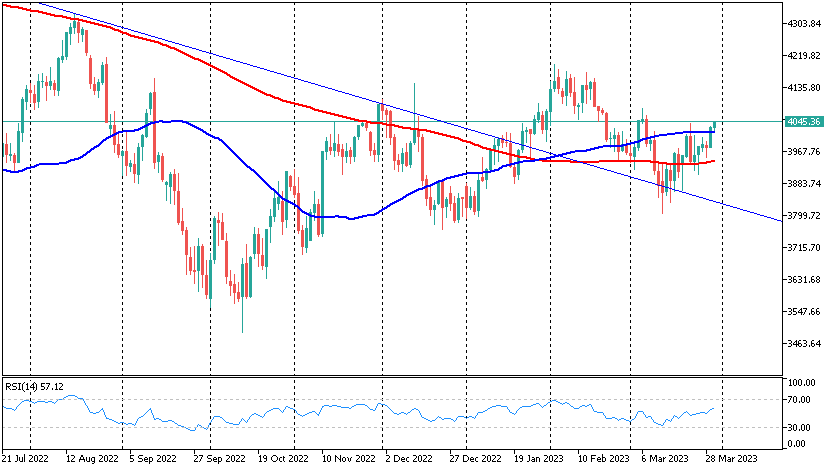

S&P500 futures are currently trading at a 3-week high. Returning to the territory above 4000 and exiting above the previous week’s highs set up optimism. Since March 13, the S&P500 daily candlesticks have been showing an uptrend. The index is.

March 29, 2023

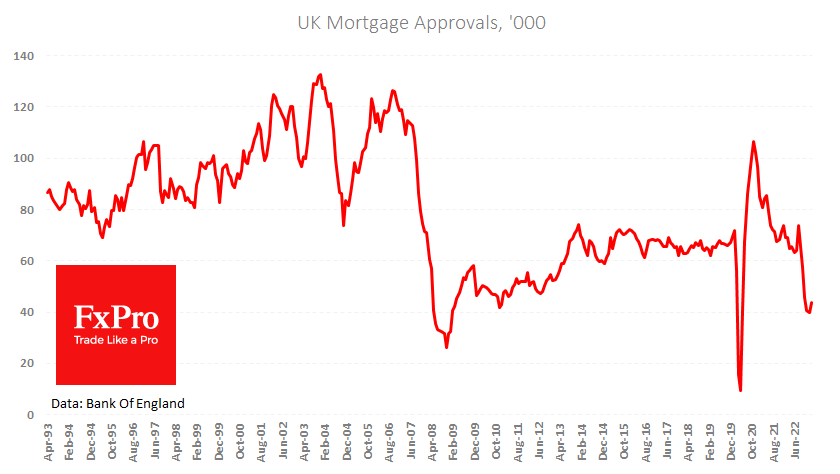

UK credit and money supply data published on Wednesday mostly came out weaker than expected, indicating a continued tightening of financial conditions. The unexpected exception was the number of approved mortgage applications. The M4 unit shrank by 0.4% m/m, contrary.

March 29, 2023

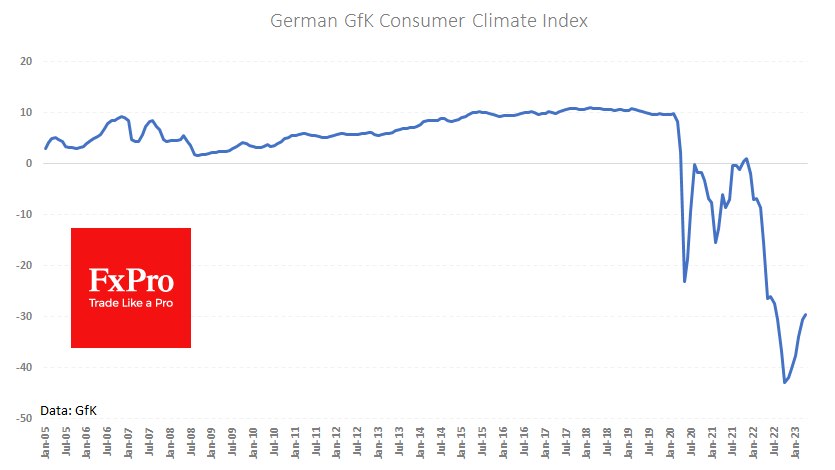

The GfK consumer climate index for Germany rose by 1.1 points to -29.5 in April, a very low level by historical standards and still below the lows of the pandemic in the year 2020. Sentiment has been improving since October,.

March 28, 2023

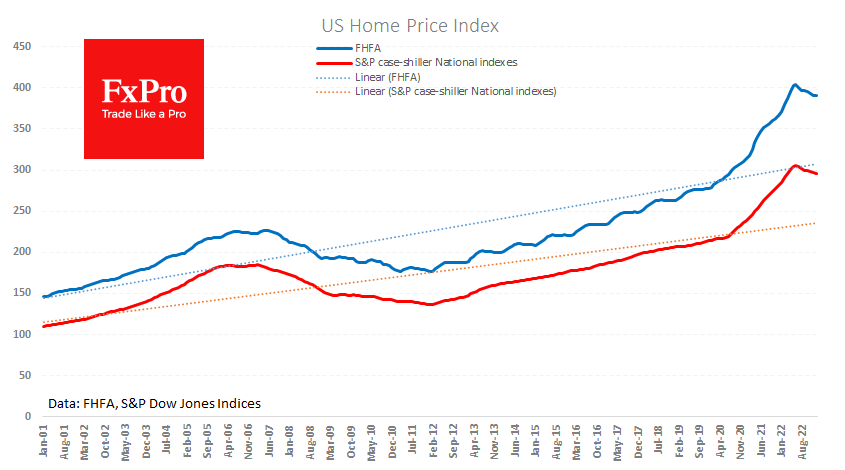

The S&P CoreLogic Case-Shiller house price index for the 20 largest US metropolitan areas fell for the seventh consecutive month in January. The index fell by 6.8% during this period, and the annual growth rate slowed to 2.6%. The annual.

March 28, 2023

Gold stormed $2000 twice last week, but both attempts failed to consolidate above this significant round level. The double correction since the previous week clears the way to the upside but does not signal that gold is in trouble. The.

March 27, 2023

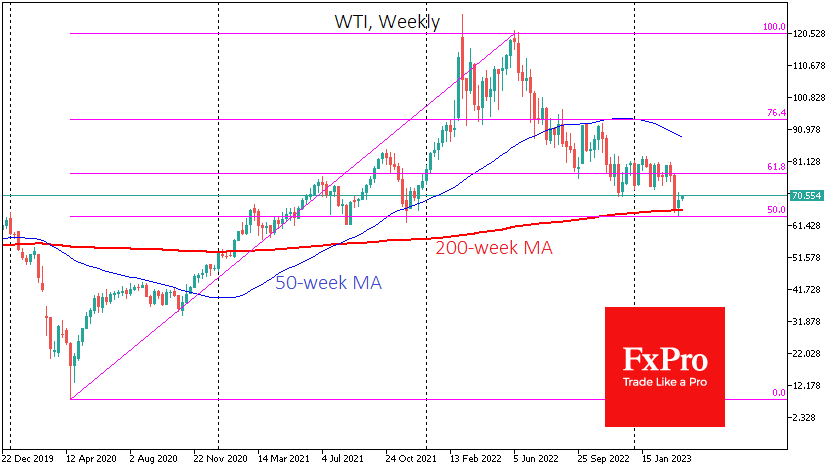

WTI oil is back above $70 on Monday, having gained more than 2% since the start of the day. Today’s short-term impulse is a halt in exports from Iraqi Kurdistan via Turkey. The latter move could be part of a.

March 24, 2023

US stock indices got a new impulse to decline on Friday on fears about the viability of Deutsche Bank. This is the recent momentum of the banking stress we have been in for the last three weeks. The technical signals.

March 24, 2023

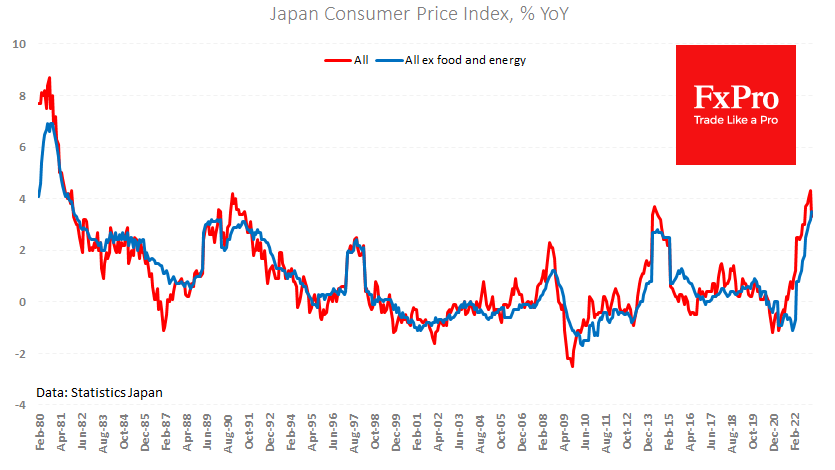

Japan’s headline inflation rate slowed from 4.3% to 3.3% in February. The point is that prices fell by 0.6% for the month, so the slowing annual inflation cannot simply be attributed to a high base effect. The core index (excluding.

March 23, 2023

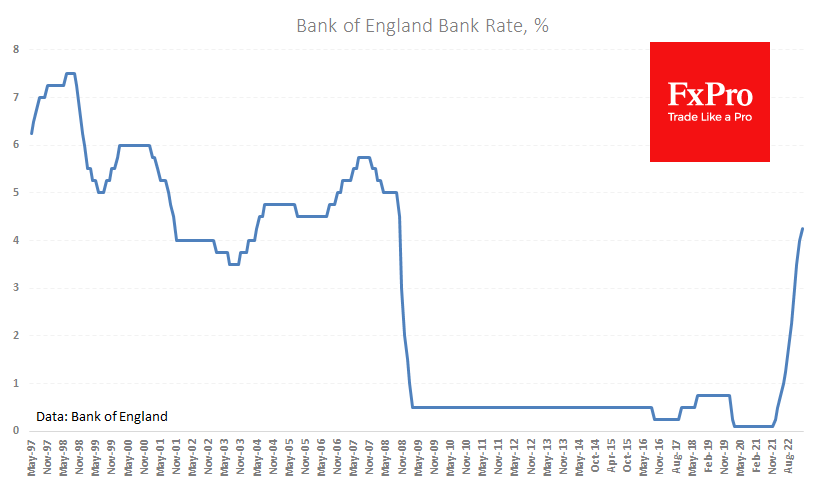

The Bank of England raised its interest rate by 25 points to 4.25%, in line with market expectations. Two members voted to keep rates on hold for the third meeting, while seven others voted against it. Commenting on the decision,.

March 23, 2023

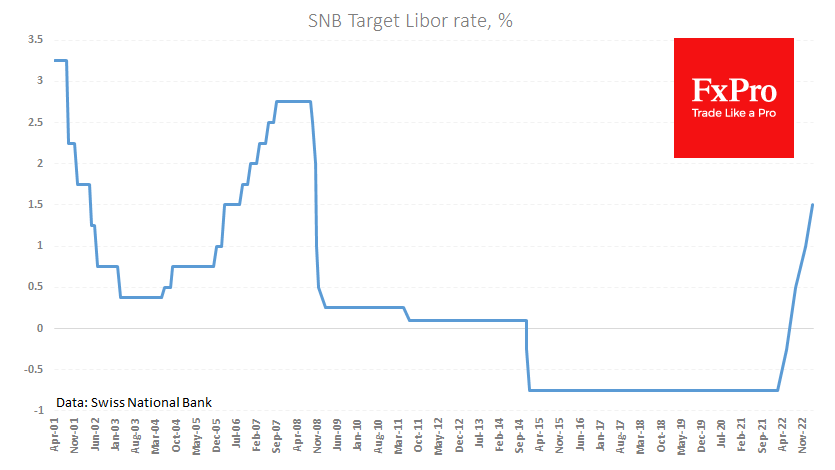

The Swiss National Bank continued to tighten its monetary policy by raising its key interest rate by 50 points to 1.5% today. This decision is broadly in line with the market expectations of economists prior to the Credit Suisse story..