G7’s ban on Russian gold may not stop its drop

June 27, 2022 @ 15:22 +03:00

G7 countries are discussing refusing to import gold from Russia – another attempt to limit the country’s export earnings. However, this news is more about headlines than the potential to become an actual market mover.

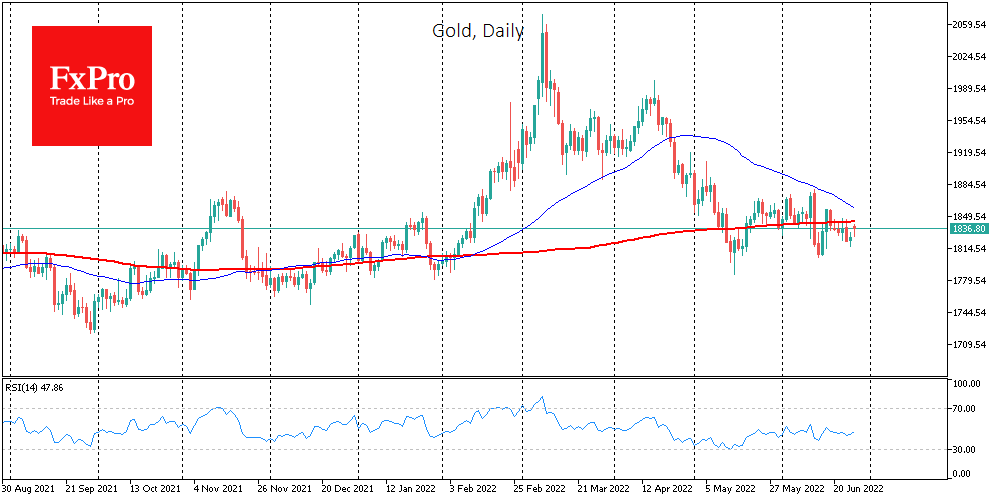

The price of the troy ounce rose by $12 to $1838 on Monday’s open and changed a little since. The 0.6% increase shows that commodity buyers are not so concerned about commodity shortages.

The G7 countries and most major economies in the EU have not been buying Russian gold for many months, so the announced measures will have little effect on current demand but will only document the status quo.

As with oil, we may see a temporary and time-limited supply shock due to a change in logistics, but not a loss in the share of gold that Russia supplies to the world market. However, gold was already winning back this shock at the beginning of March.

Potentially, this is good news for mining companies outside of Russia, as the competitiveness of their products in developed markets will be further enhanced.

It is worth paying attention to how Newmont, Barrick Gold or ETF funds that include gold or silver producers will trade. If we do not see a rise in prices or a surge in volumes today, we should not expect this news to affect the market any further.

A glance at the gold chart from the tech analysis side is not bullish just yet, either. Gold is traded under the 200 SMA, and it has not been able to break out of this line for the last month and a half.

Meanwhile, the 50-day average is moving towards the 200-day, promising a death cross early next month. In the last two periods (February and August 2021), gold has lost about 7% after the occurrence of this bearish signal. It is well worth expecting that this time too, we only see a consolidation before another round of declines into the $1730 area before the end of September.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks