Market Overview - Page 77

April 12, 2023

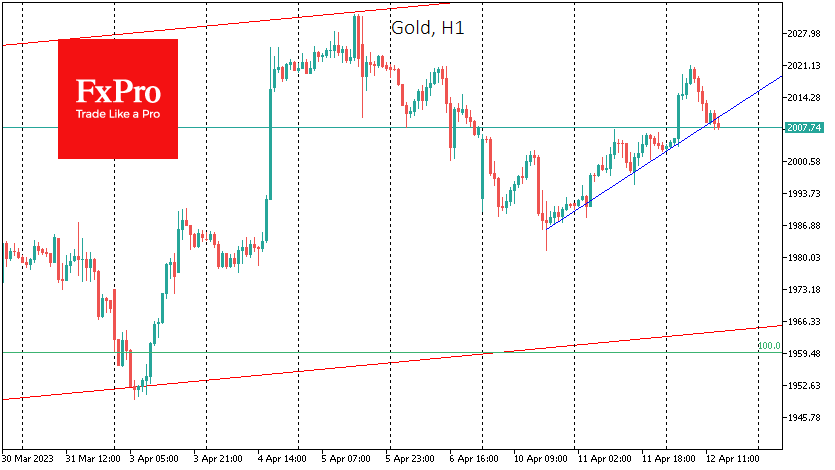

Despite its proximity to historical highs, the short-term momentum suggests that buying will intensify even on minor pullbacks. A week earlier, gold made a local high of $2030 and then corrected by 2.25%. The intraday chart on Monday afternoon clearly.

April 12, 2023

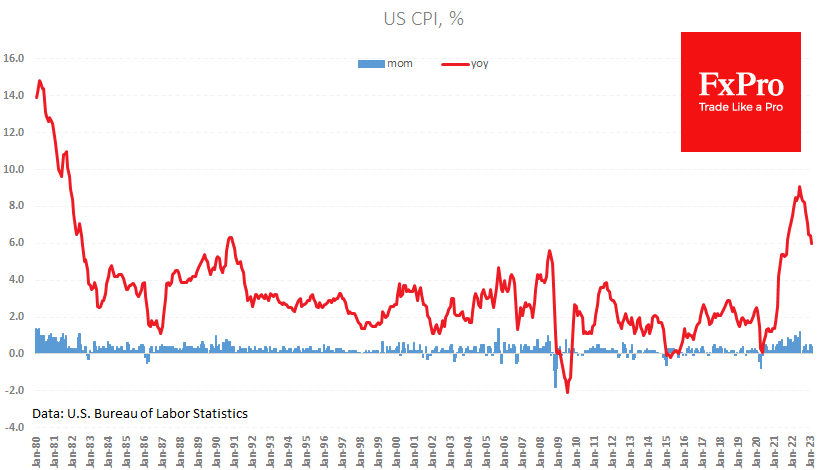

The currency market has moved little over the past week, waiting for significant drivers. The Easter lull is likely to end today, as inflation data and the Fed’s March meeting minutes are expected to be released. US inflation reports have.

April 11, 2023

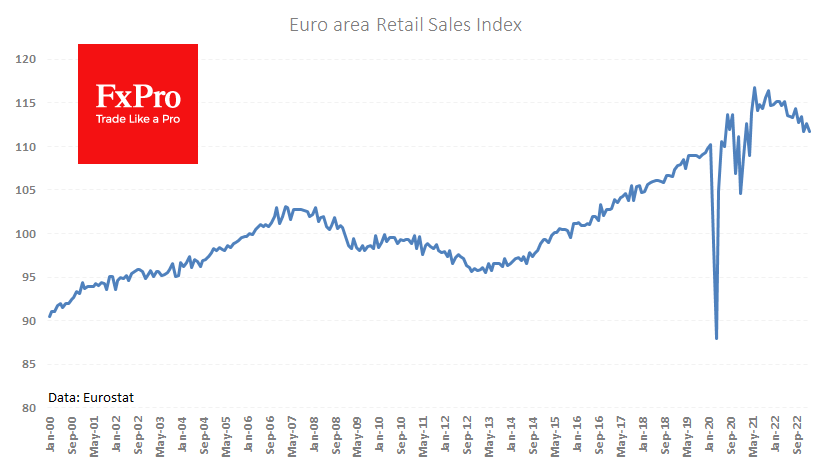

Investor confidence and retail sales data released on Tuesday beat average market forecasts but showed no improvement over recent months. The Sentix investor confidence index rose from -11.1 to -8.7 in April. This is roughly where the index was in.

April 11, 2023

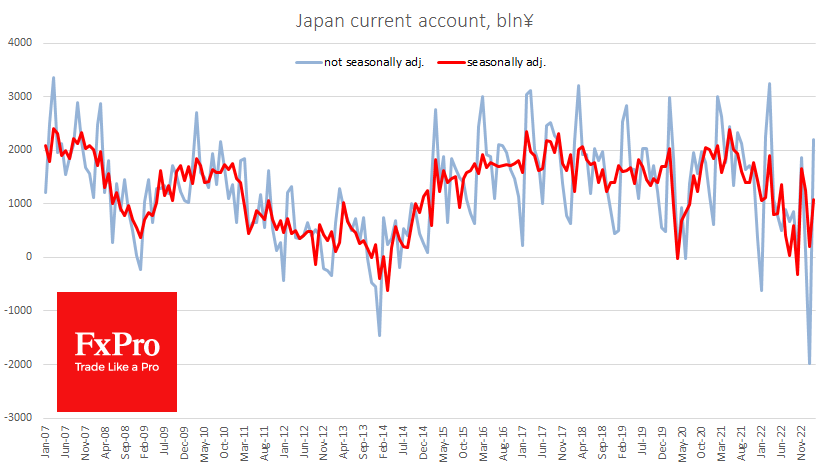

After last year’s shock, Japan’s economic indicators are slowly returning to normal. But conditions are still unsuitable for raising interest rates for the Bank of Japan. This is not good news for the Yen. The interest rate differential, which has.

April 11, 2023

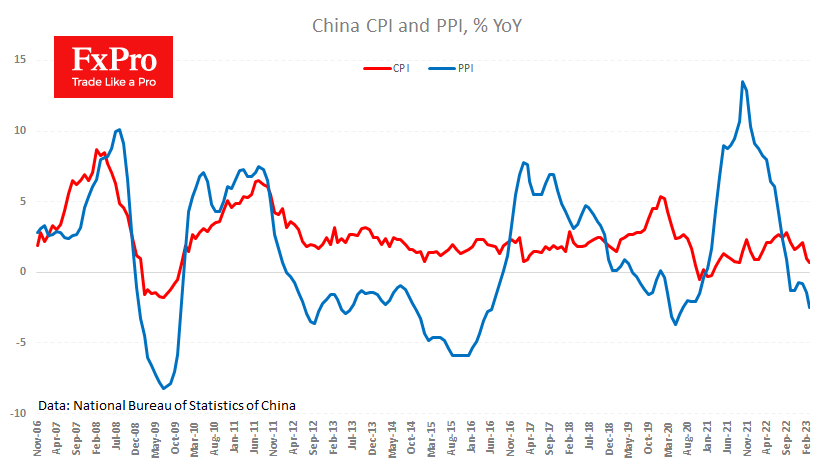

Consumer inflation in China fell to 0.7% YoY in March from 1.0% in the previous month. Last month’s producer price index was 2.5% lower than a year earlier, accelerating its decline from 1.4% in February. The hypothesis that China’s move.

April 7, 2023

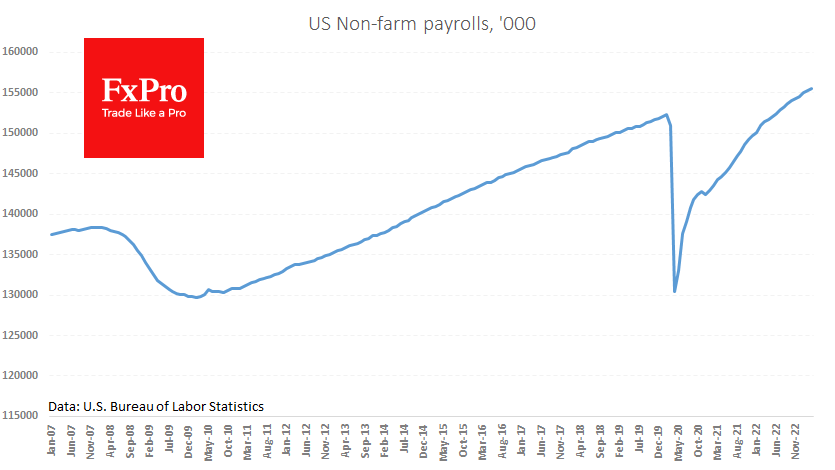

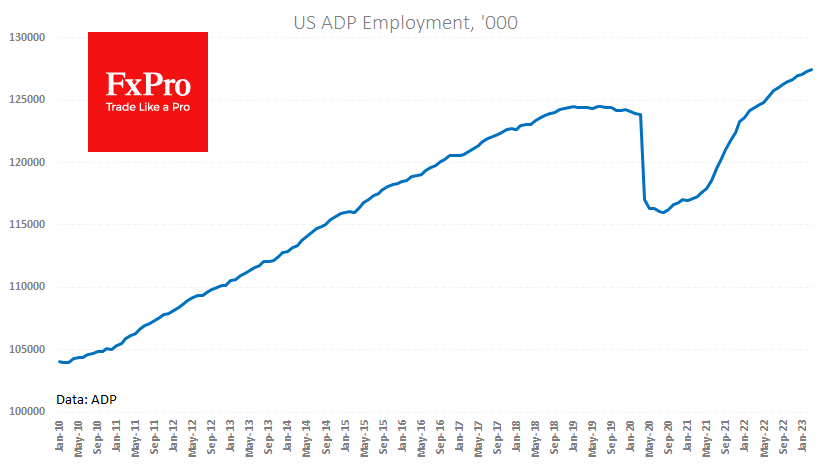

The US economy added 236K jobs in March, very close to the average forecast. The unemployment rate fell 0.1 percentage point to 3.5%, while the labour force participation rate rose from 62.5% to 62.6%, vs the expected fall to 62.4%..

April 7, 2023

One of the most timely and unpredictable economic reports, the US Nonfarm Payrolls report for March, will be released on Friday. Market participants will look to other publications to shed light on the situation. The average forecast among market participants.

April 6, 2023

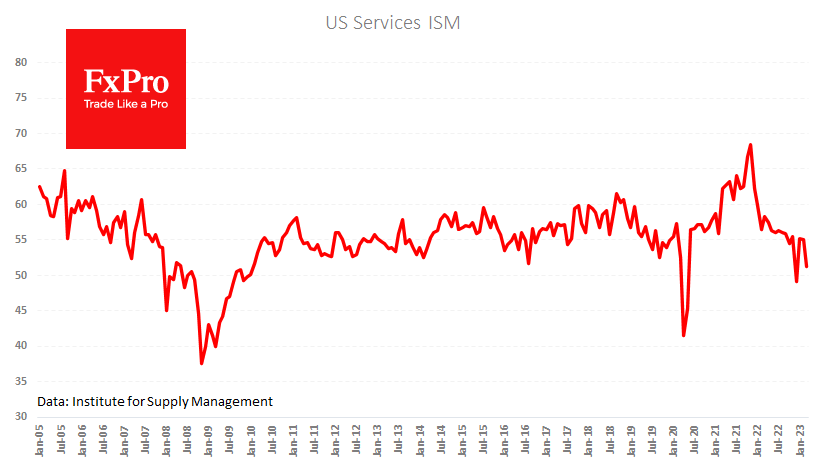

This week’s PMI business activity figures were much weaker than expected, reflecting the impact of the sharpest monetary tightening in more than 40 years on the economy. The ISM’s service sector data attracts the most interest from market participants as.

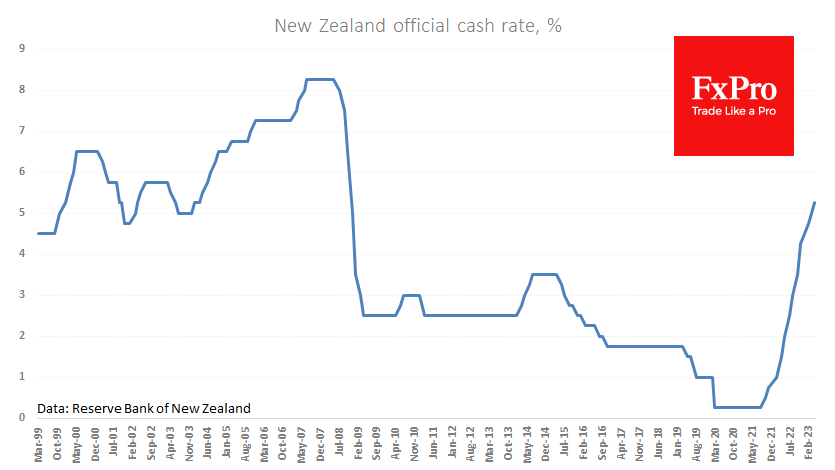

April 5, 2023

The Reserve Bank of New Zealand made another rate hike of 50 points to 5.25%. Contrary to forecasts of a 25-point rate hike and the global trend towards a slowdown in policy tightening, the RBNZ has not slowed down a.

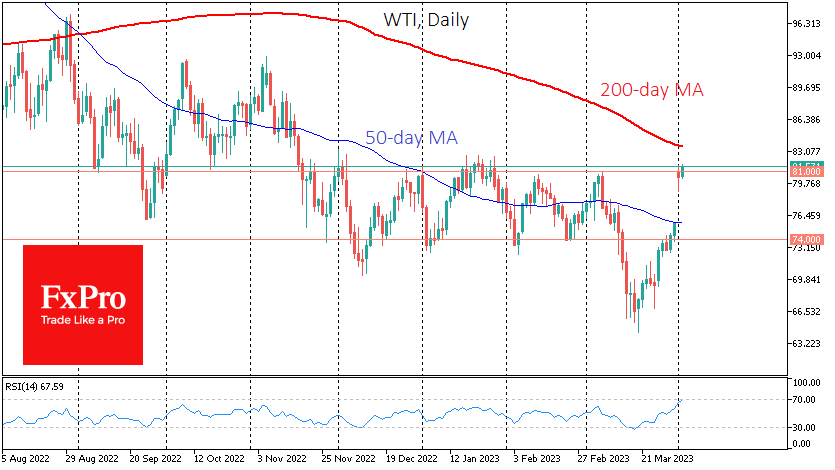

April 4, 2023

Over the weekend, OPEC+ unexpectedly announced a production cut of 1.16 million bpd. Separately, Russia extended its voluntary cut by 0.5 million barrels from March to the end of the year. The unexpected decision caused oil to jump at the.

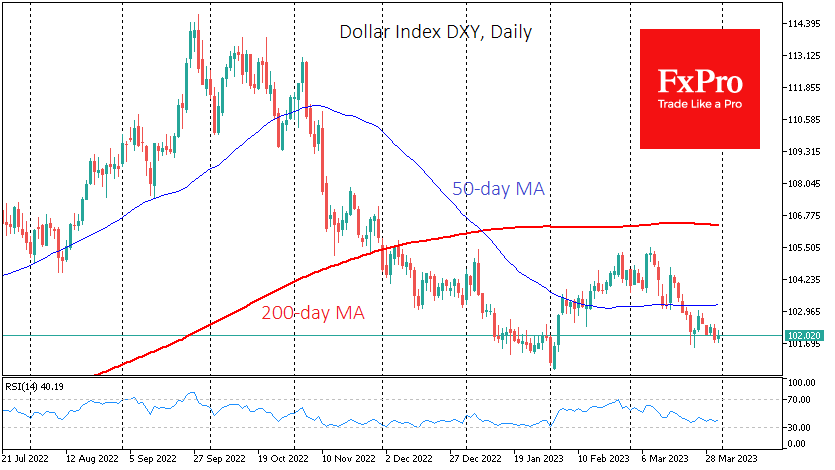

March 31, 2023

The dollar index is ending with a decline for the fourth of the last five weeks, almost completely erasing the gains from February’s rise. Although it cannot be ruled out that the quarterly portfolio shakeout will create traction in the.