Oil completes its short-term rebound

July 11, 2022 @ 17:20 +03:00

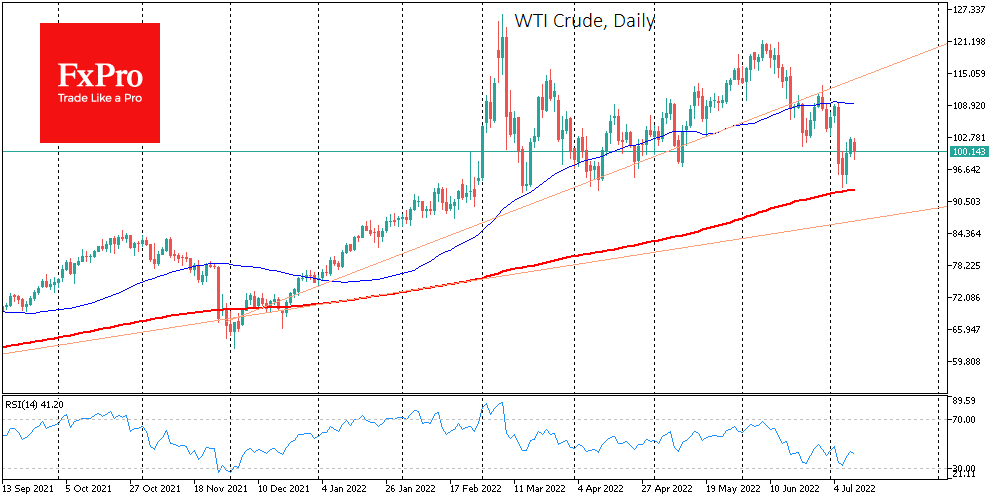

WTI crude oil has been losing 3.5% since trading on Monday, bouncing back below $100 after rebounding late last week. A stronger dollar and the return of a cautious tone to financial markets as the week begins indicate that downside risks continue to prevail for oil.

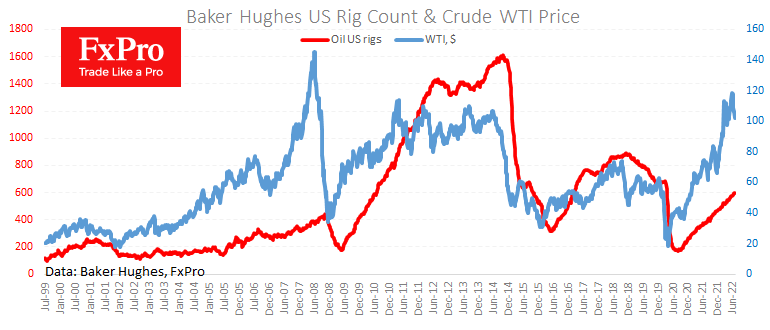

Baker Hughes’ weekly statistics released late last week showed another rise in the number of rigs in operation from 595 to 597. The creep continued despite a jump in commercial crude inventories (+8.2m for the week) and oil falling by more than 20% in less than a month to July 6.

The rise in oil at the end of last week looks like a technical rebound after a 15% decline in five trading sessions. Notably, oil went up amid the rising dollar environment, which looked like a sell-off reload followed by an even more substantial sell-off.

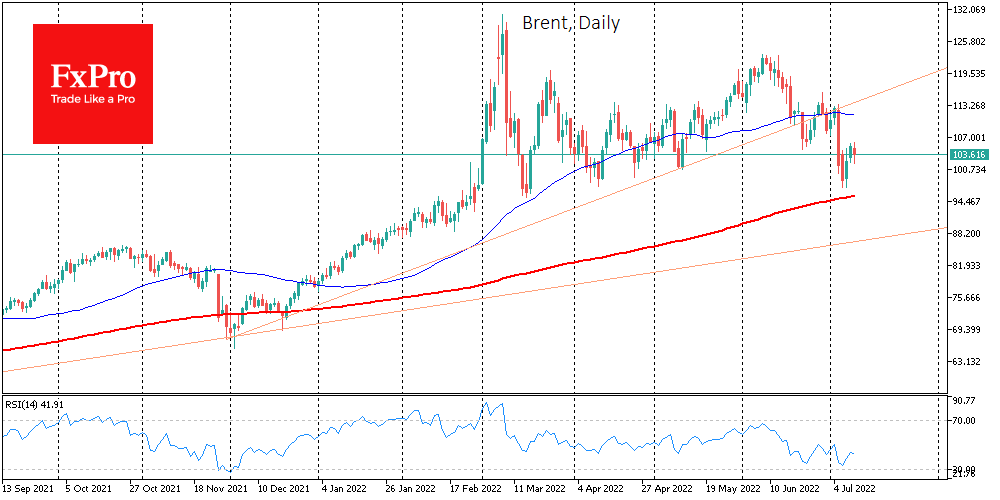

Oil was locally oversold on approaching the 200-day moving average early last week. However, before that, we saw a breakdown of the uptrend from last December, an intensified sell-off from the 50-day moving average. In addition, the upward trend breakdown was confirmed when WTI fell below the previous local lows from April last week.

Oil could slide rather quickly into the $92.70 area for barrel WTI Crude on a retest of the 200-day moving average and the area of local lows since the war outbreak in Ukraine. For Brent Crude, these are values near $96.

A decisive move below these lines could force a broader layer of buyers to capitulate, triggering an avalanche of stop orders and sending quotations to an actual peak.

Should WTI’s $92.7 and Brent’s $96 fail, the next significant stop could be the $80-85 area, taking oil back to the October 2021 highs.

While the news backdrop and gas station price observations are not conducive to pessimism in oil, investors and traders should still pay attention to the slowing global economy and falling demand. Separately, the increasing supply of oil, which is holding back the growth of futures and is already putting pressure on spot prices, should not be forgotten.

The FxPro Analyst Team