Oil set to erase the rally since Dec 2021

July 06, 2022 @ 17:31 +03:00

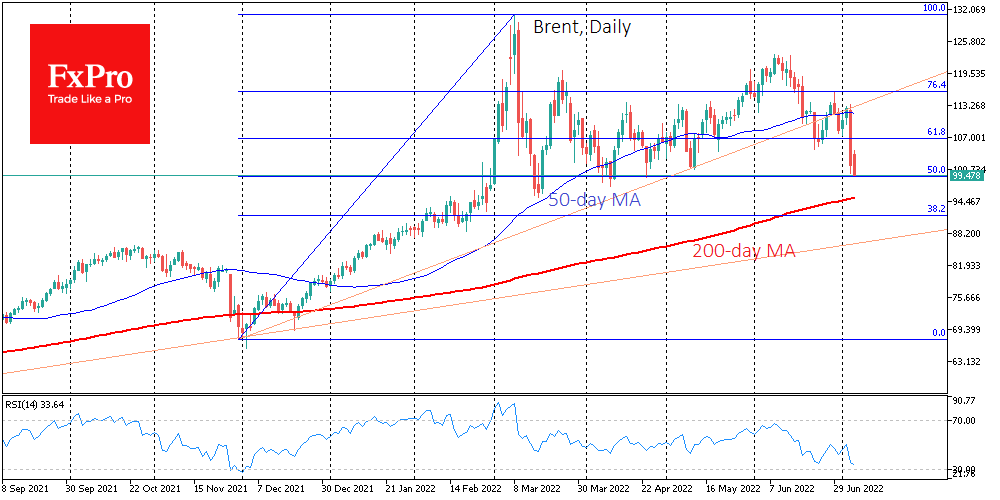

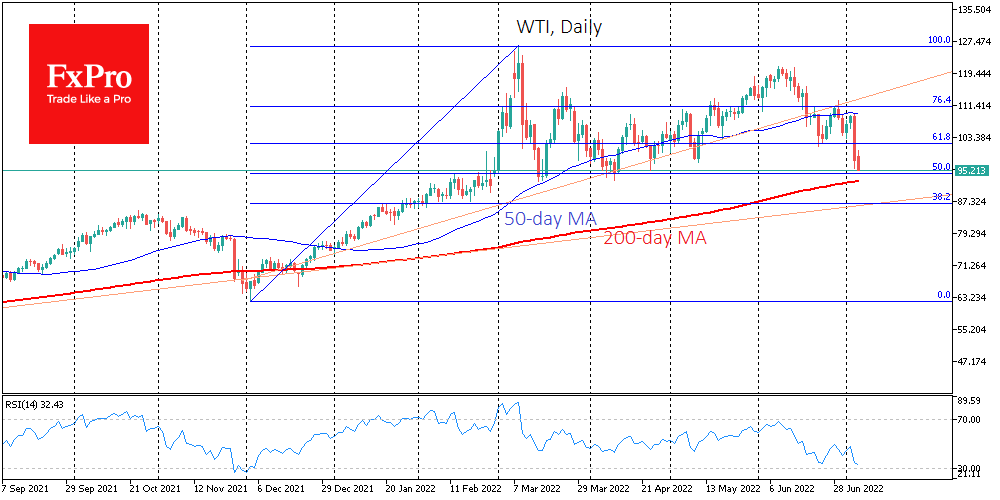

Brent crude is losing more than 10% in just over a day to $100, repeating the lows of early May and raising the question of breaking the uptrend since last December.

In our view, the trend break occurred when the price moved below the 50-day moving average and was confirmed yesterday after a failed attempt to return above it.

Additionally, the latest downside momentum sent the price below the 61.8% Fibonacci retracement level of the mentioned rally, an important indication that we see more than a corrective pullback.

Apart from technical factors, there are also enough fundamental reasons for market participants to tune in for a decline in the price.

For example, the starting point for the rally late last year was evidence that the more contagious COVID-19 strain was not causing an increase in hospitalisations and countries continued to lift coronavirus restrictions. But Europe is now facing a significant surge, gradually reinstating some restrictions.

The other factor – demand growing faster than supply recovery – is also running out of steam amid signs of falling consumption and slowing growth.

History is also on the side of the bears. The most significant reversals in oil over the last decade and a half have occurred precisely in the middle of the year, with the most notable examples in 2008 and 2014. This is also what we are seeing now.

Again, it would not be surprising if the nearest stop on the way down for oil is the start of the last step of the rally in February, around $95 per barrel for Brent and $92 for WTI. The 200-day moving averages for those instruments also pass near those levels. A fall below would signal an actual market collapse, opening the way quickly for another 15-25% decline.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks