The dollar index seems unstoppable now

July 11, 2022 @ 13:04 +03:00

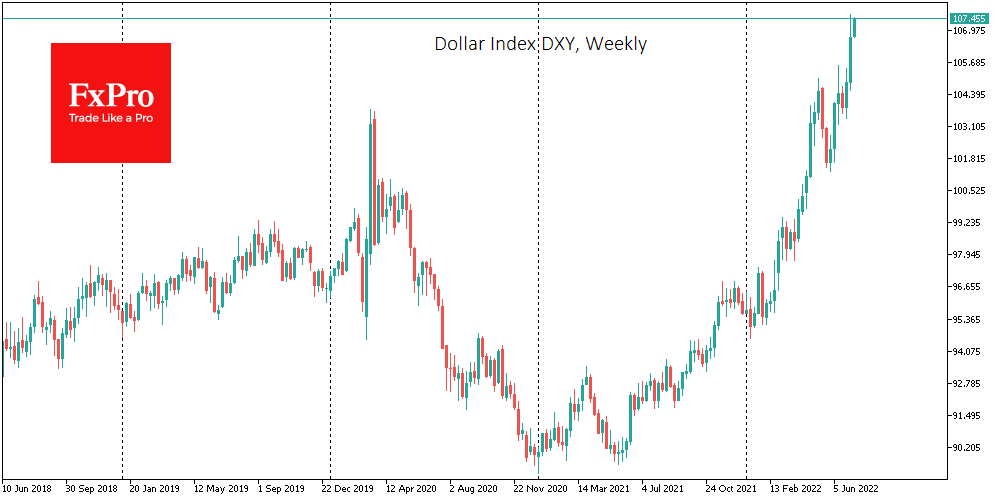

The dollar index is making new highs, rising to 107.6 on Friday afternoon, and by the start of active trading in Europe, trading at 107.45. This is the highest rate since October 2002. The dollar index has added about 20% to its 2021 low.

The strengthening dollar carries positive secondary effects for the US, from reducing inflationary pressures through imports to ending the talk of dollar weakness that has been prevalent since late 2020.

Nevertheless, central bankers are not welcome too sharp currency fluctuations in either direction, although they blatantly ignore the absolute value of the exchange rate against another currency or trade-weighted basket.

So far, the Fed has paid little attention to dollar appreciation, but it is worth being prepared that this approach would change in the coming days and weeks to avoid causing an uncontrolled rise in the dollar that could prove devastating.

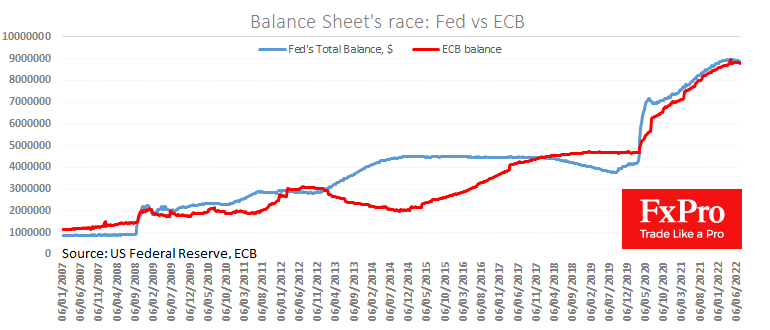

In the past fortnight, the Fed has begun selling assets off its balance sheet, reducing it by $42.5B. The ECB stopped net buying in July, but active Fed-like selling is a matter of uncertainty.

Other key central banks are also a step or two behind the Fed, or moving slower, from full-blown QE from the Bank of Japan to the Reserve Bank of Australia, which raised its rate by 50 points against +75 from the Fed last month and forecasts another such hike at the end of July.

The dollar’s strengthening so far looks controlled. Still, after last week’s substantial rise to multi-year highs, the markets could start a wave of an exodus from Europe and Asia, underpinned by the news and macroeconomic backdrop and current exchange rate movements.

In our view, the currency market has reached the point where it can become a one-way street, and we are witnessing a massive capitulation on one side. In such cases, it is hard to say which levels could be the real turning point. Suffice it to recall the negative oil prices in April 2020 and the EURCHF dip from 1.20 to 0.78 in January 2015.

Such a point could be a EURUSD drop below parity if it occurs in the next couple of weeks. To sustainably turn the euro upwards or stop further dangerous dollar appreciation, it may take the resolve of monetary and government officials, which we lack now.

Perhaps only the Fed is now able to stop the dollar by starting to mention a slowdown in the pace of policy tightening, a potential rate hike limit in this cycle and a rate cut condition. And all this may not be as distant a prospect as the markets now seem to think.

The FxPro Analyst Team