Market Overview - Page 67

August 25, 2023

It was a very telling performance from the US equity market on Thursday, as three major indices – the S&P500, Nasdaq-100 and Dow Jones 30 – confirmed the dominance of the bearish trend. At least in the medium term. The.

August 24, 2023

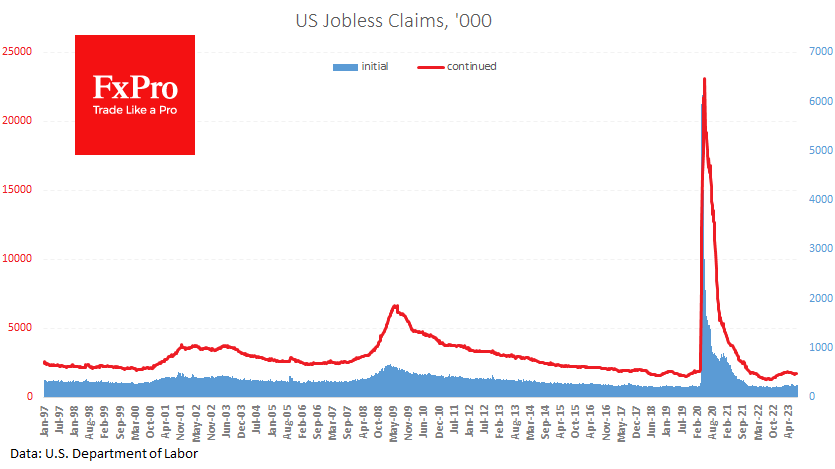

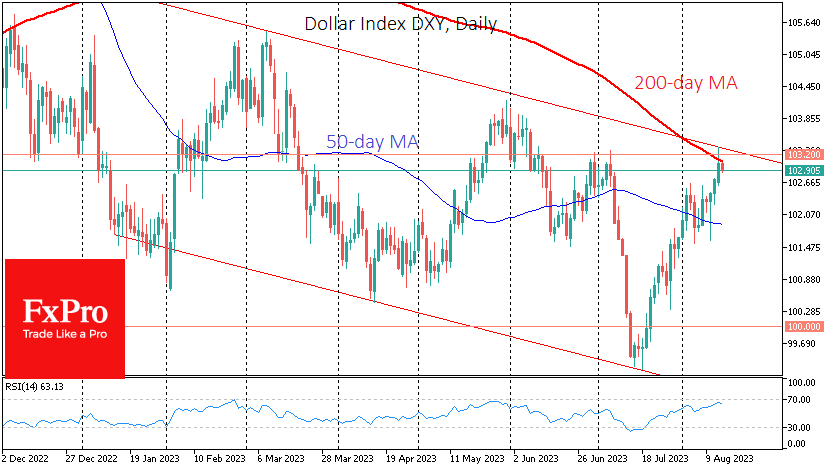

Data out of the US pointed to a further build-up of pro-inflationary risks from the labour market, giving the Dollar a fresh boost intraday. Fresh data showed weekly jobless claims fell to 230K, down from 240K and 250K in the.

August 24, 2023

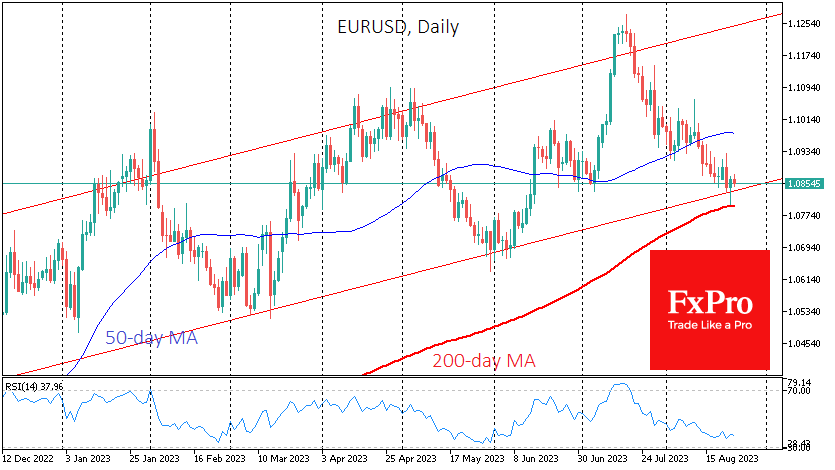

There is an important battle for the long-term trend in the euro-dollar pair. The central bank speeches in Jackson Hole on Friday have enough potential to break or reinforce the direction of the past 11 months. EURUSD is trading near.

August 22, 2023

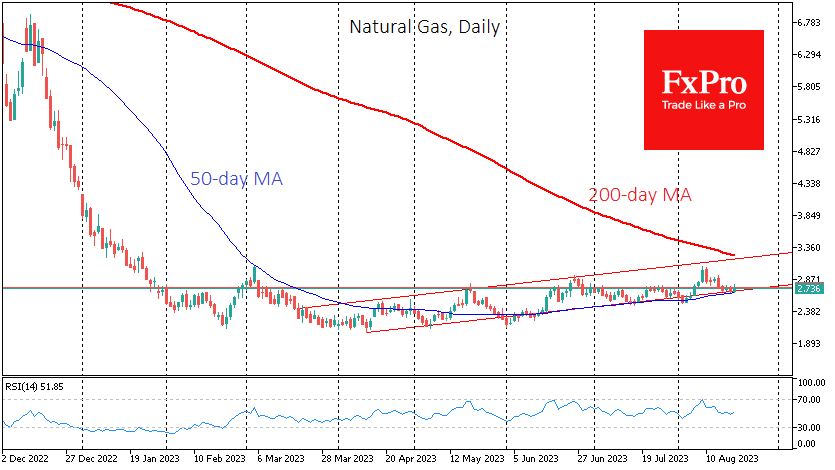

New York traded Natural gas is up 3% on Monday, having managed to break away from support again. Gas has formed an uptrend from the April lows but has not yet switched to an acceleration phase. Gas prices formed a.

August 21, 2023

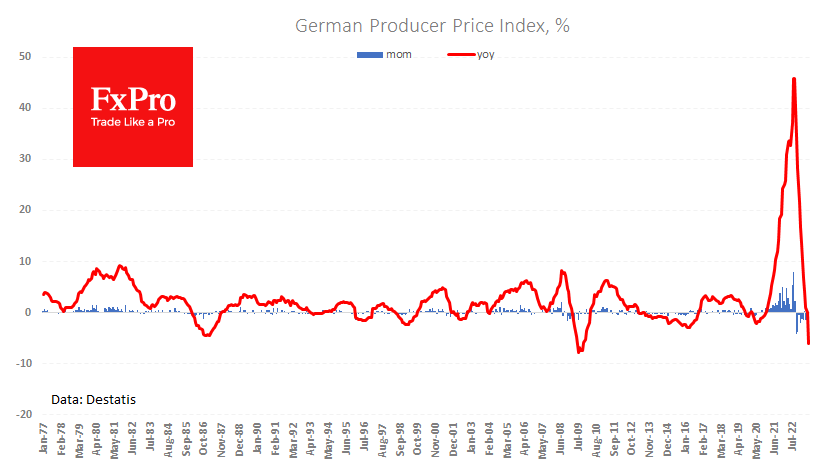

The sharp fall in German producer prices is both a signal of easing inflationary pressures and a warning of a sharp slowdown in demand. The German producer price index fell by 1.1% in July, dwarfing the expected correction of 0.1%..

August 18, 2023

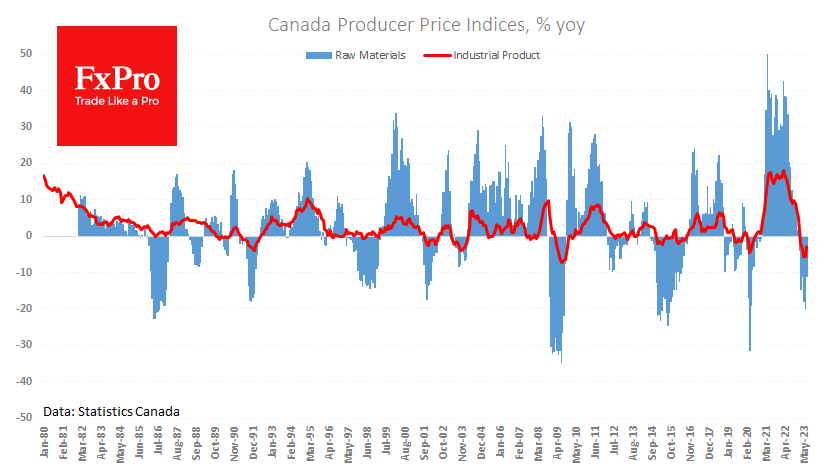

Canadian producer prices rose more than expected in July, reviving concerns that the active phase of the fight against inflation may not be over. The Producer Price Index rose 0.4% in July, more than the 0.2% expected. The year-on-year decline.

August 18, 2023

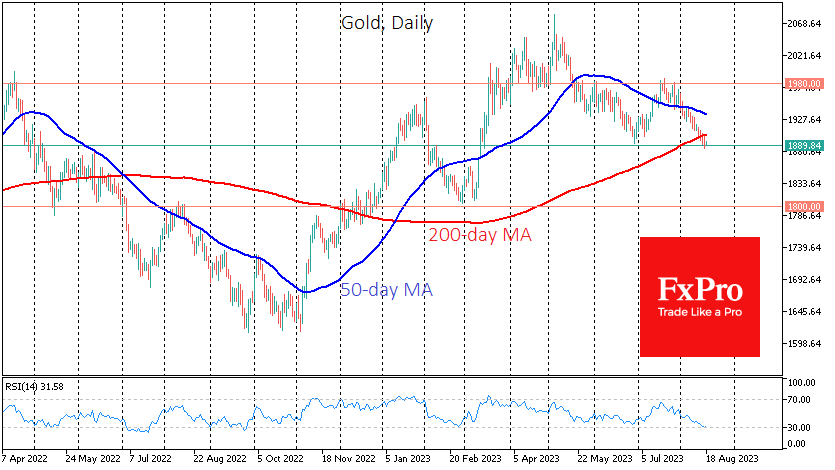

Gold has gained 0.3% since the start of the day on Friday, marking only its third session of gains since the beginning of August. Despite signs of local oversold conditions suggesting a bounce, the ultimate downside target looks to be.

August 17, 2023

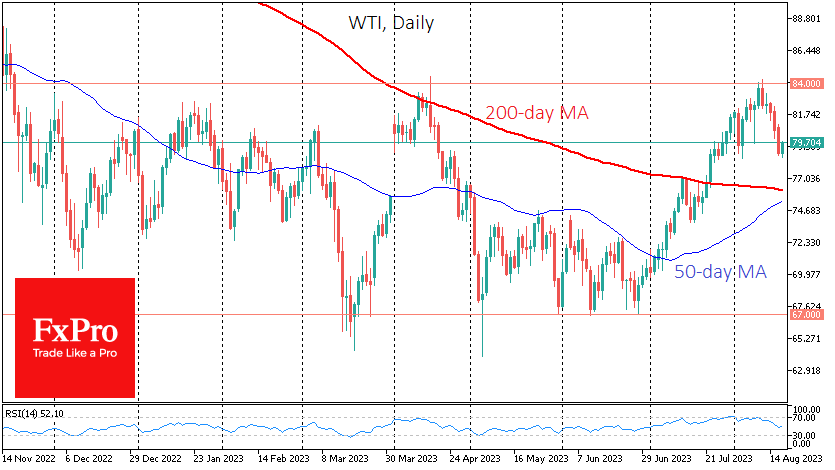

WTI crude oil is down almost 7%, having fallen for the last seven days. The sell-off intensified as the price touched levels above $84. As has happened several times this year, this reversal could be a precursor to a fall.

August 16, 2023

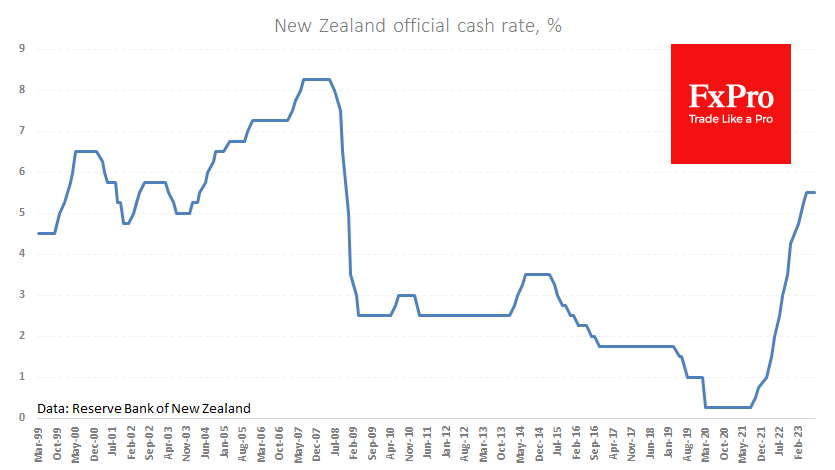

The Reserve Bank of New Zealand left its key rate unchanged for the second time at 5.5%. Most analysts predicted this decision, but it created positive momentum in the NZDUSD, which at one point added about 1% to the day’s.

August 16, 2023

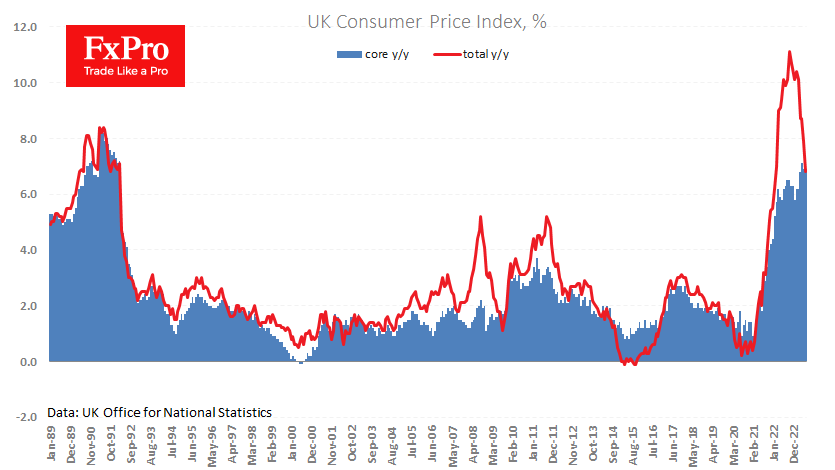

Inflationary pressures in the UK are easing, although they remain the highest among the G7 countries, as sellers are in no hurry to cut prices. UK CPI fell 0.4% in July (-0.5% expected), the first decline since January. The year-over-year.

August 15, 2023

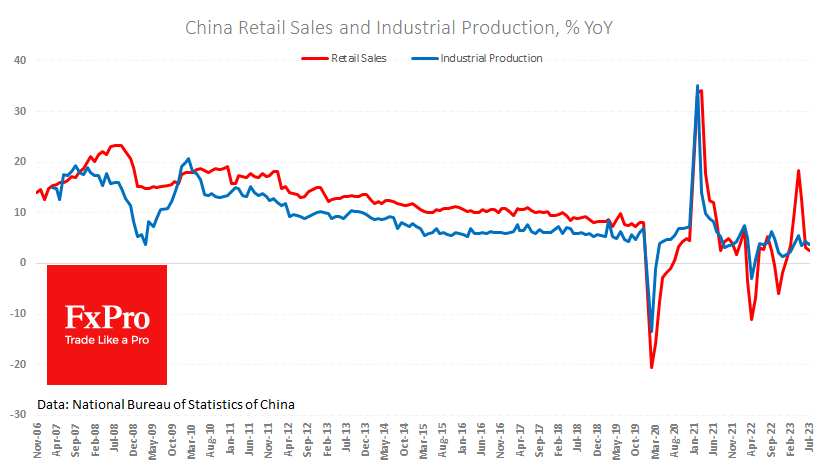

Another set of statistics from China has added to the wave of disappointment over the momentum of the world’s second-largest economy, prompting a dichotomic response from regulators. Retail sales in July were only 2.5% y/y, down from 3.1% y/y in.