Market Overview - Page 61

November 29, 2023

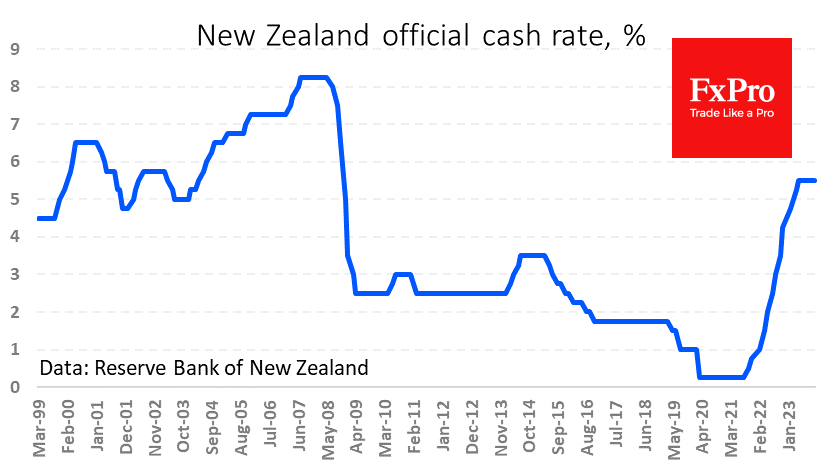

The Reserve Bank of New Zealand left its key rate unchanged at 5.5%, the highest in 15 years, but on hold for six months now. The decision was in line with market expectations. However, the NZDUSD rallied, adding over 1.2%.

November 28, 2023

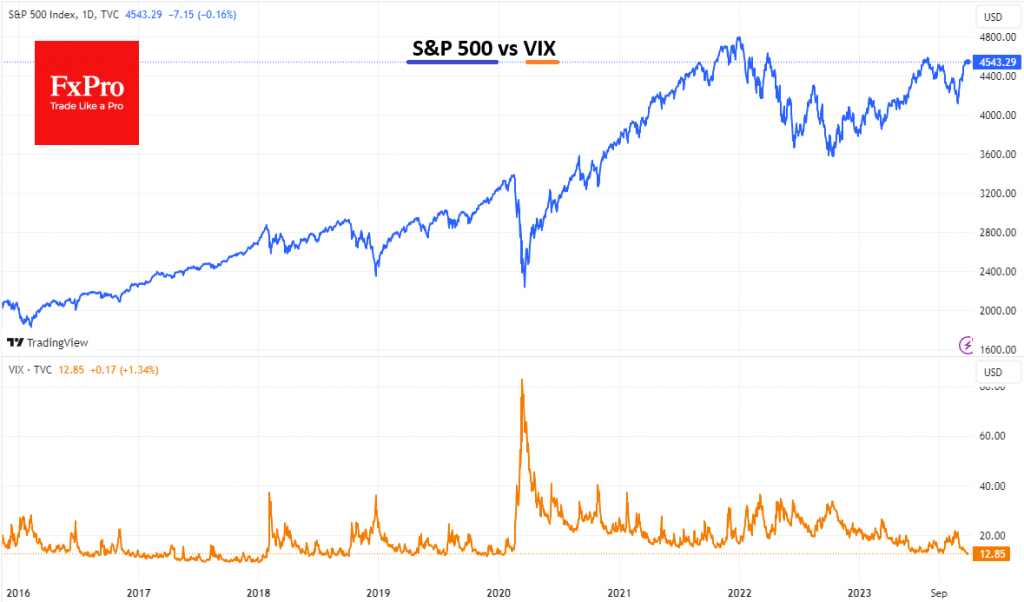

Financial market volatility has plunged to its lowest level in almost four years, according to the VIX index. This so-called “fear index” fell to 12.45 on Friday, the lowest level since January 2020. Such low levels could be both a.

November 28, 2023

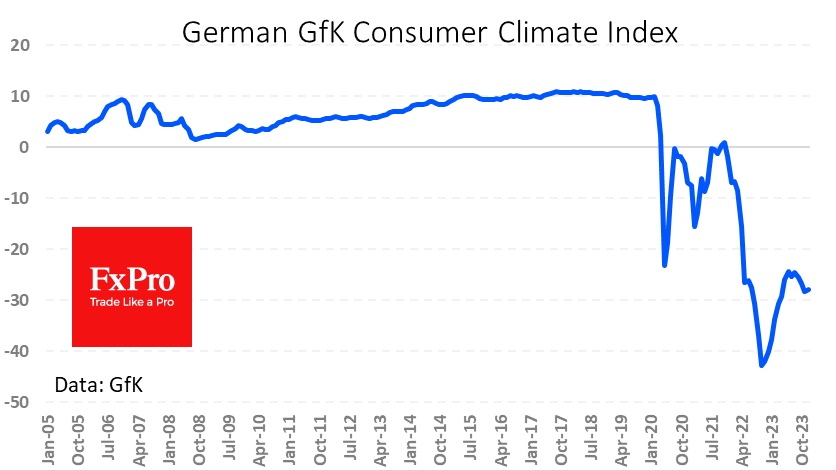

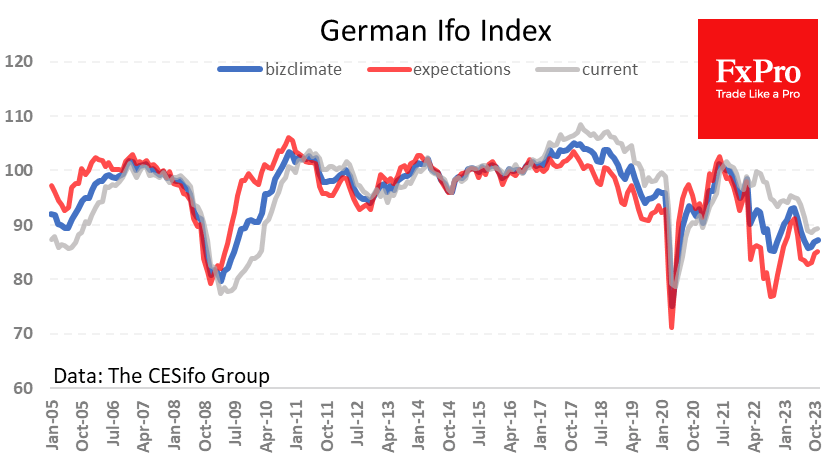

Worrying news on the Eurozone economy continues to come in, although this is not hurting the single currency so far, which is trading at fifteen-week highs at 1.0950. Germany’s business climate index rose from -28.3 to -27.8 in December but.

November 28, 2023

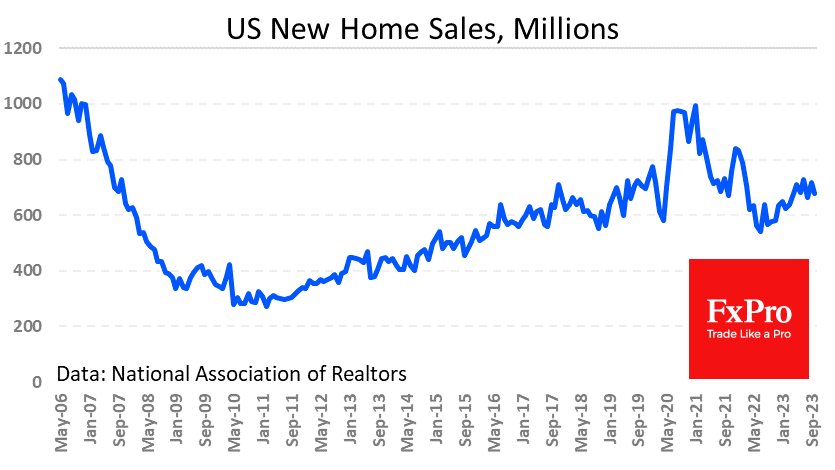

The US new home sales report came out weak on several key aspects. Sales fell 5.6% m/m to 679K vs 719K a month earlier (revised from 759K). The median price of a home sold in October was 409.3K, down 3%.

November 27, 2023

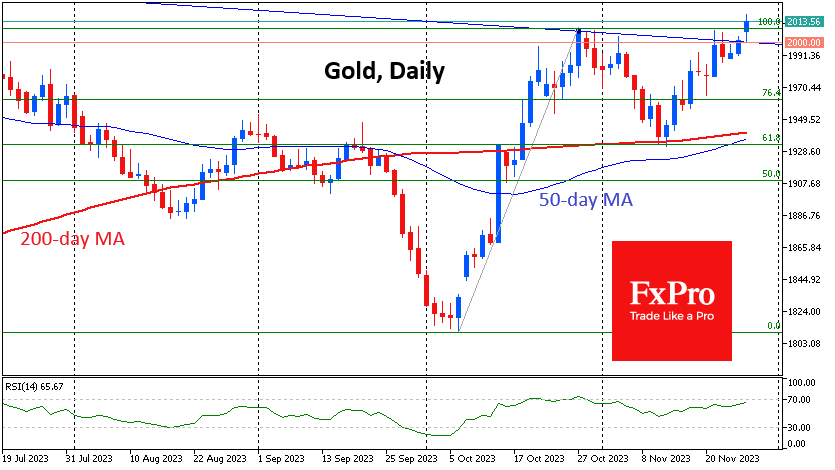

Gold touched six-month highs, moving into territory above $2010 at the start of the new week. Over the past three years, the price has climbed above $2000 several times but failed to hold there for a long. Technically, gold started the week.

November 25, 2023

German Ifo Business Climate Index rose for the third consecutive month. Still, this recovery is weaker than expected, putting the Euro in a more vulnerable position against the Pound and Canadian Dollar, where the latest data exceeded expectations. Germany’s business.

November 23, 2023

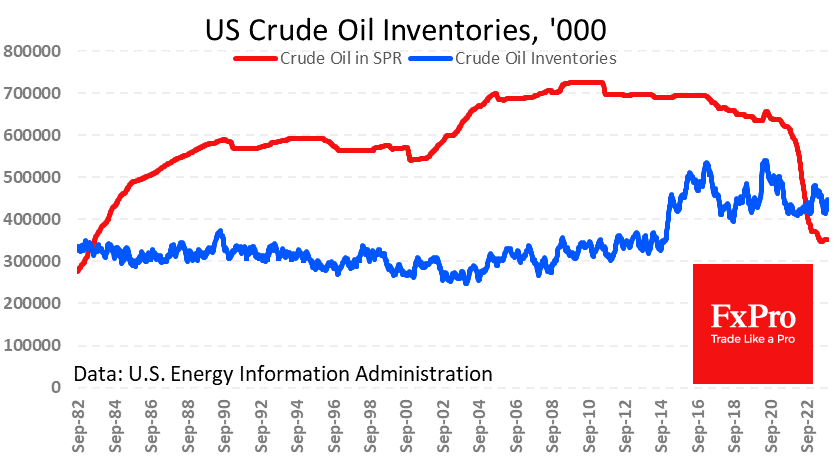

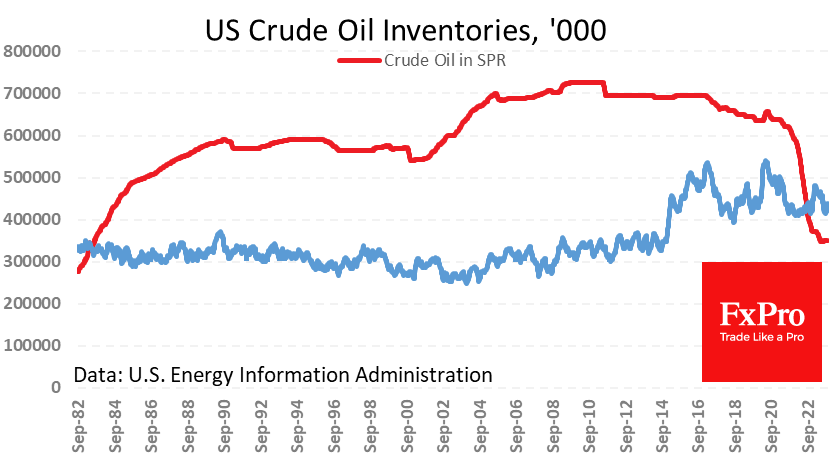

The last two weeks have been hectic for oil traders, who have had a rich extract of news and data from many directions, fuelling volatility but leaving the price at the same level as a fortnight ago. The fresh weekly.

November 22, 2023

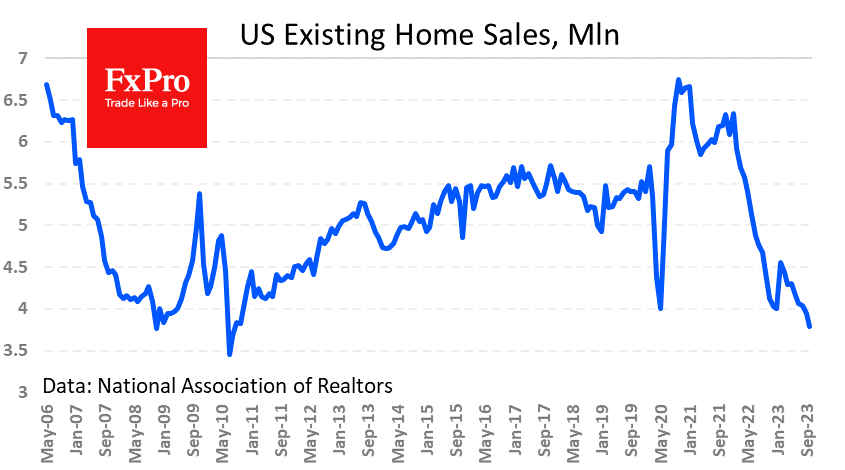

US Existing Home Sales have continued to fall under the pressure of high interest rates despite prices retreating from their highs. It is well known that the housing market is a leading indicator of the economic cycle. This was the.

November 21, 2023

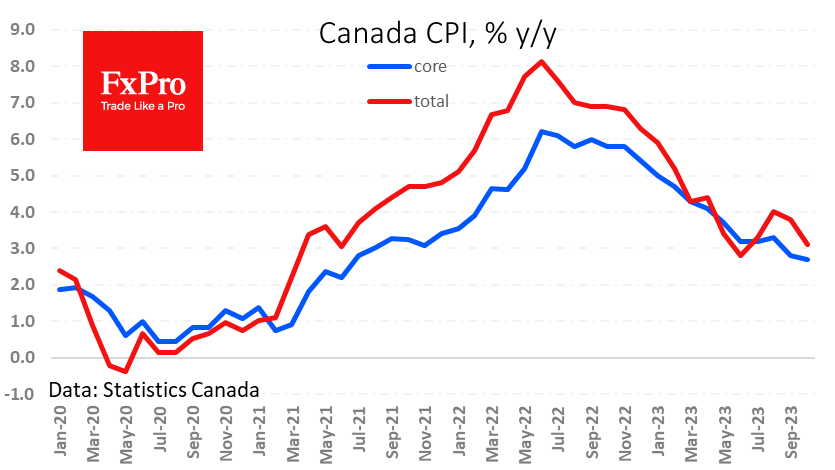

Overall inflation slowed from 3.8% to 3.1% y/y in October versus an expected 3.2%. On the other hand, core inflation came in above expectations, ticking up 0.3% y/y in October, albeit lowering the annual rate of increase from 2.8% to.

November 21, 2023

Palladium is showing signs of recovery after a recent sell-off, which could be a reversal of the metal’s long-term trend. Palladium has lost almost half its value since the start of the year to lows of $936 on the 10th.

November 20, 2023

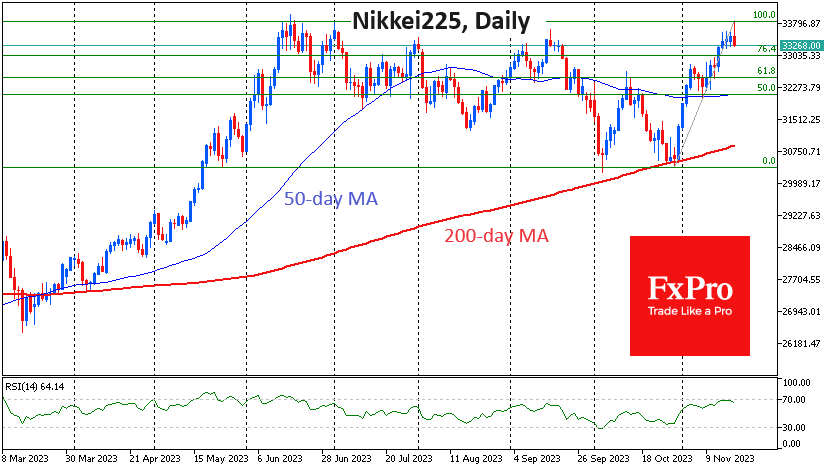

There are significant moves in the Japanese markets today. The Japanese stock market started the day with a rise of over 1%, taking the Nikkei225 to 33850. It was the second brief climb to this height since June, last seen.