The strength of the US economy spooks markets

December 07, 2022 @ 10:06 +03:00

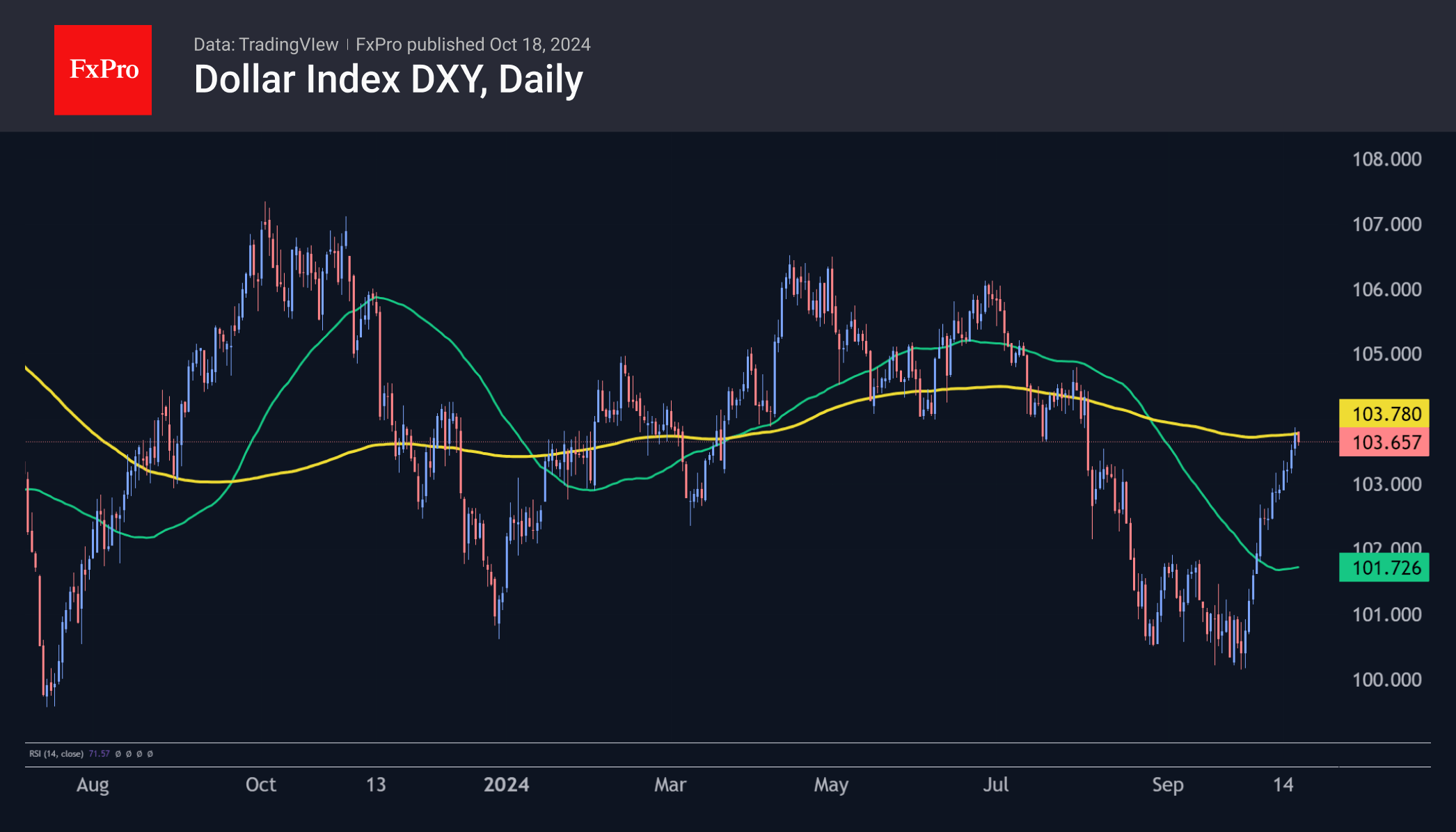

Since the end of last month, the inverse dependence of major stock indices on US data has become more pronounced. Following the positive surprise of the November employment report (so-called ‘hard data’), markets received a better-than-expected ‘soft data’ batch.

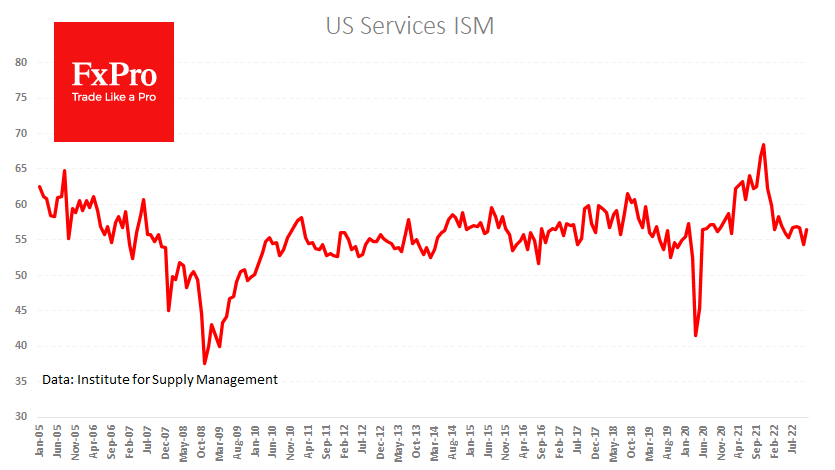

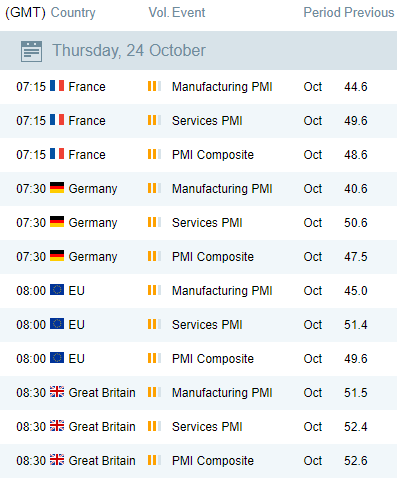

ISM Non-Manufacturing Index rose from 54.4 to 56.5, against expectations of an average decline to 53.5. Markit Services PMI for November was upgraded from 46.1 to 46.2 in the final reading. The positive difference between expectation and fact explains the strength of the move.

But we also draw attention to the low nominal levels of the indices above. The services PMI has been in decline territory for the last five months. The non-manufacturing ISM is near its lowest levels since late 2019 if we exclude the dip on the first lockdown caused by covid-19. The employment component of the ISM index has been hovering near 50 for the last ten months, also setting up caution.

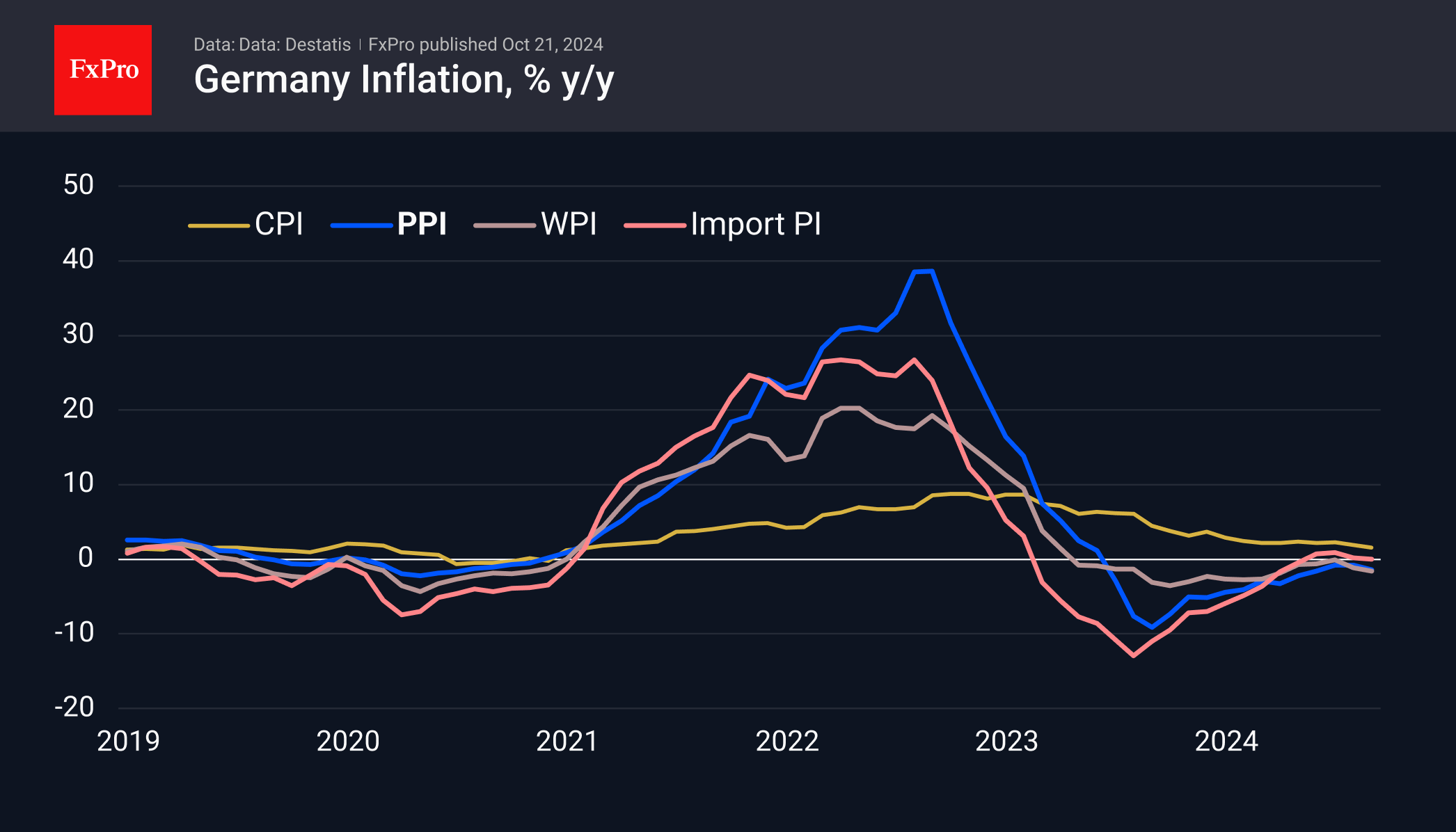

While a “the worse, the better” trade might make sense in the short term, a strong economy is a boon for markets in the longer term. This is especially true if we see inflation fading in parallel. And that is precisely the case now in the US, where petrol prices have returned to levels of the beginning of the year.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks