S&P 500 clings to bear trend until last

December 14, 2022 @ 18:53 +03:00

The Fed’s key rate meeting promises to be the last significant scheduled event for financial markets. Decisions and comments today have every chance of being decisive for the stock market over the next few weeks. The currency market has already picked its trend earlier this month.

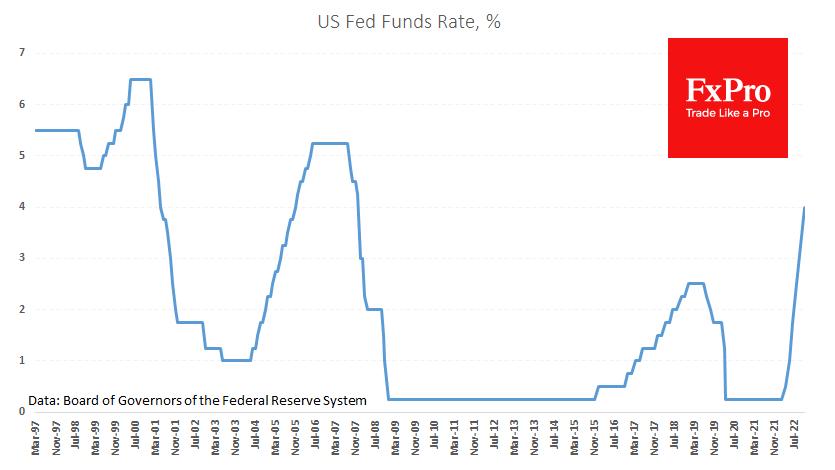

The Fed will almost certainly raise rates by 50 points, slowing down after four hikes of 75 points earlier this year. The Fed has long hinted at such a move and is unlikely to want to surprise markets today with unexpected moves, preferring the tactic of managing expectations.

A sharper-than-expected slowdown in inflation has affected rate expectations. The market is now pricing in just one or two more hikes of 25 points after today’s move. And here, the Fed has a lot to manage. Previously, some Fed officials have persisted that rates could rise higher than the market is setting and (even more importantly) hold high for longer than expected.

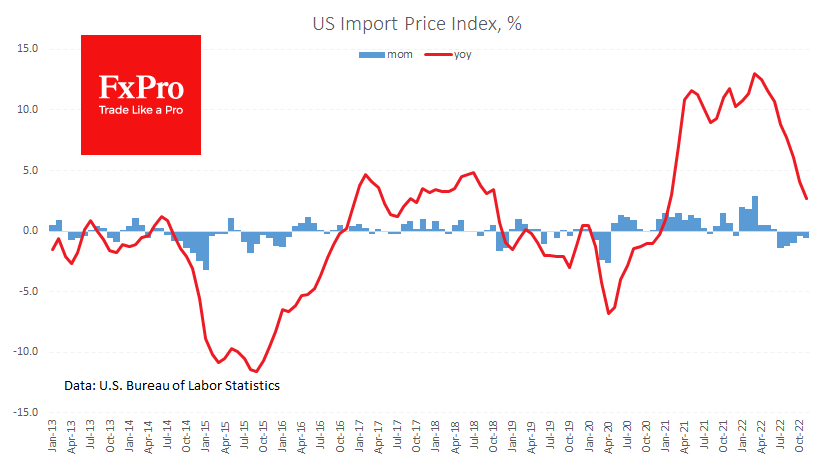

However, markets continue to argue with such predictions, reacting with notable purchases of risky assets on lower-than-expected inflation releases. Earlier today, another such report came out – on import prices. This index is losing for the fifth month, falling by 4.6%. The annual growth rate has fallen to 2.7%, the lowest since January 2021. This is a significant anti-inflationary factor considering the huge US foreign trade deficit. Added to this is the impressive pullback in commodity prices in recent months.

As a result, the Fed can afford to slow down policy tightening and soon take a pause drastically. If we are right, Powell will clear the way for such an opportunity.

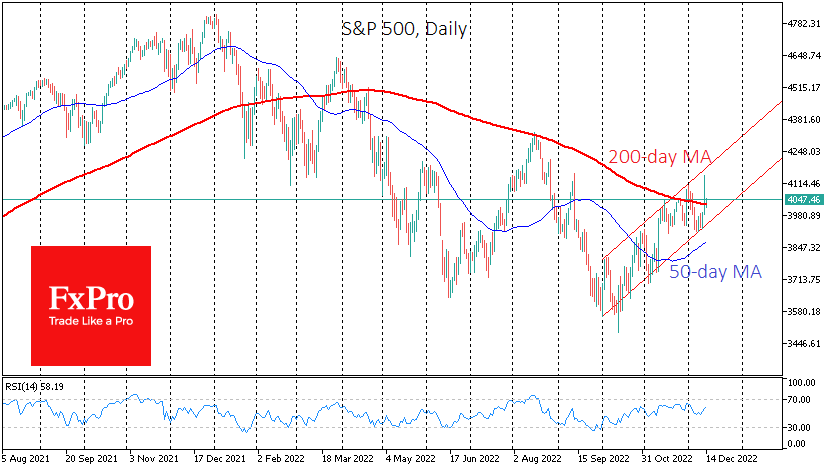

Meanwhile, the stock market is in no hurry to get ahead of the game. The S&P500’s more than 3% surge after the CPI release was more than nullified in the following couple of hours. The index failed to close the day above the 200-day MA, clinging to the bearish trend with all its might.

It has yet to cling above this line since April. But now the situation is different as the Fed has gone from an increasingly harsh tone, each time in the last two months, to an increasingly softer one, which feeds the bounce in equities.

A consolidation above 4050 for the S&P500 promises to be a meaningful bullish signal for the market, triggering a rally right up to Christmas or even the end of the year. An additional supporting sign could be a sharp rise above 4100, triggering a short squeeze.

At the same time, a sharp reversal downwards from those levels would be a very unpleasant surprise to the markets, capable of triggering a new wave of sell-offs comparable to the more than 15% declines that started in April and August. Recall that the Fed’s actions were the fundamental reason for the reversal in both cases.

The FxPro Analyst Team