Market Overview - Page 598

July 24, 2018

In Norway, where plug-in hybrid and electric vehicles made up more than half of new car sales last year, Tesla is the lowest-ranked automaker on a list of brands for quality of service, and fourth-worst among companies in all sectors..

July 24, 2018

According to sources who are analysing the current situation regarding the bitcoin price consistently, it appears that the cryptocurrency may be in line for a major breakout. An analysis from Telegram groups and recent comments on Discord channels have also.

July 24, 2018

Oil prices extended declines into a second session on Tuesday as attention shifted to the risk of oversupply, with market participants shrugging off escalating tensions between the United States and Iran. Brent crude oil was down 19 cents, or 0.3.

July 23, 2018

If Karl Marx could see Russia today, he might revise his view of religion’s role in oppressive regimes. In the country’s capital, urbanism has become the new opium of the people. Authoritarian leaders have long seen cities as a stage.

July 23, 2018

The Bitcoin price rose by nearly 5% overnight on Sunday to touch the $7700 level after having had a relatively quiet Sunday trading between the $7400 and $7500 mark. This unexplained boost could probably be due to more investors taking.

July 23, 2018

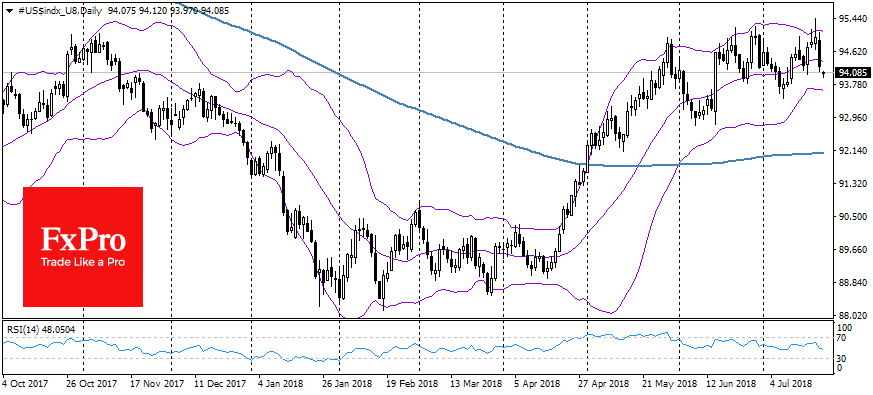

The dollar remained under pressure after the Trump’s criticism about the strengthening of the national currency. Despite doubts that the influence of the president’s comments will be long, tactically they came out at an opportune moment, not allowing the growing.

July 23, 2018

The recent decline in cryptocurrency mining has eroded demand for graphics cards, with card suppliers planning to slash prices to clean out their inventories. The softening market has snagged demand for ASIC mining equipment, supply chain sources have indicated. Graphics.

July 23, 2018

Distribution territories: $270.00, $300.00, $330.00. Accumulation territories: $140.00, $110.00, $80.00. As many digital currencies witnessed a great voluminous increase in their market capitalization last week, so also ZCash did. The bullish engulfing Japanese that emerged on July 13 has been.

July 20, 2018

The dominance of BTC started to bounce back, first reaching 40 percent, and ultimately recovering up to 45 percent, which it had not been able to secure since November, 2017, when its dominance index was at 58.67 percent. Over the.

July 20, 2018

As many people accept, cryptocurrencies are on a different level to PayPal and other traditional payment methods. They differ because they are on there on their own unit of account and payment systems. These systems allow for peer to peer.

July 20, 2018

The first-ever crypto investment report released July 18 by digital asset management fund Grayscale Investments reveals that the majority of capital inflow this year is coming from institutional investors. Grayscale has been overseeing investments into crypto for five years, launching.