Market Overview - Page 58

January 24, 2024

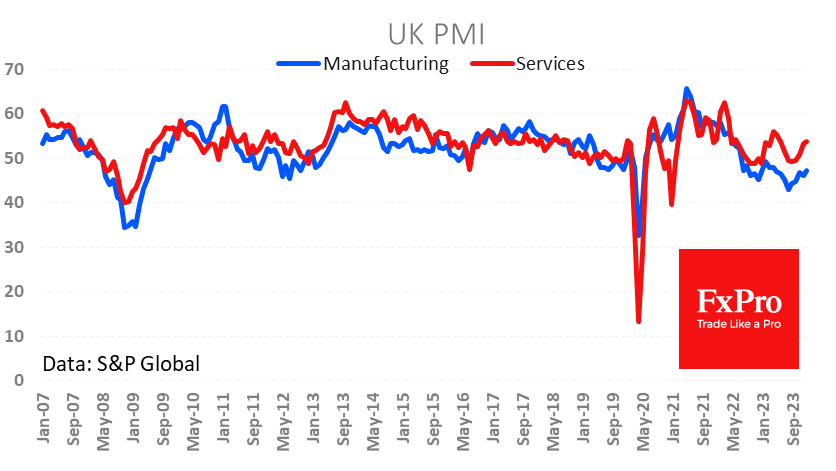

In contrast to mainland Europe, UK PMIs markedly exceeded expectations, noting an overall increase in business activity. The manufacturing PMI rose to 47.3 in January from 46.2, noticeably above the expected 46.7. This is the highest reading of the index.

January 24, 2024

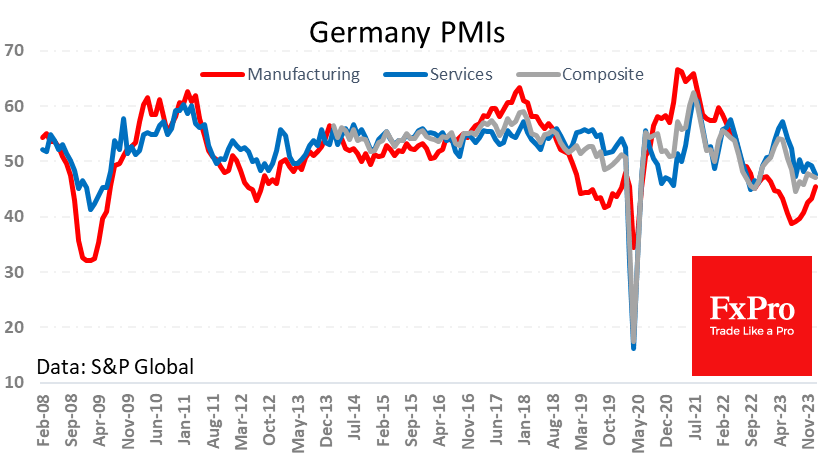

Preliminary January PMIs for Germany showed a worsening of the situation contrary to the expected improvement. The composite PMI in January was at 47.1 against 47.4 a month earlier, and there are forecasts of an increase to 47.8. The reason.

January 23, 2024

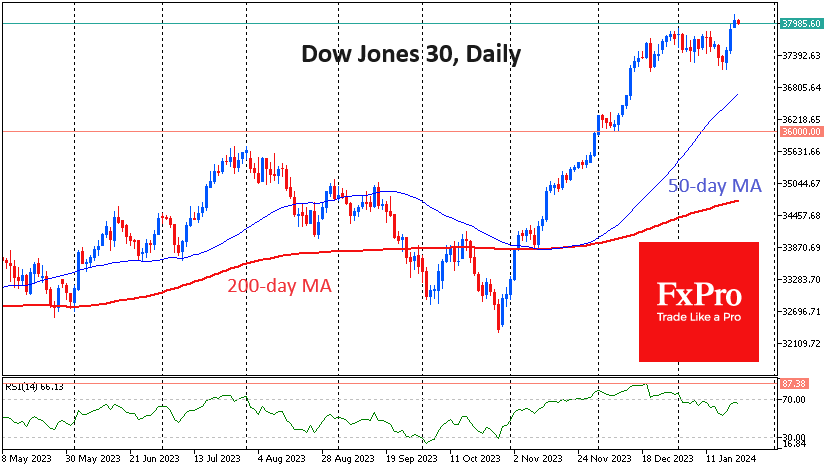

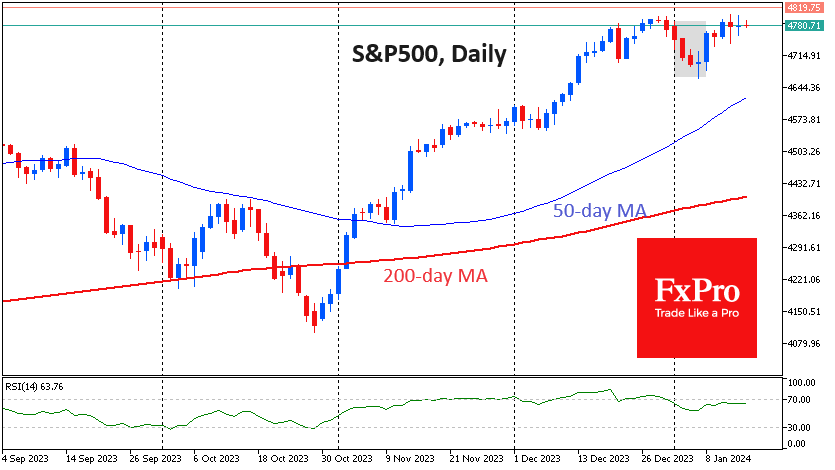

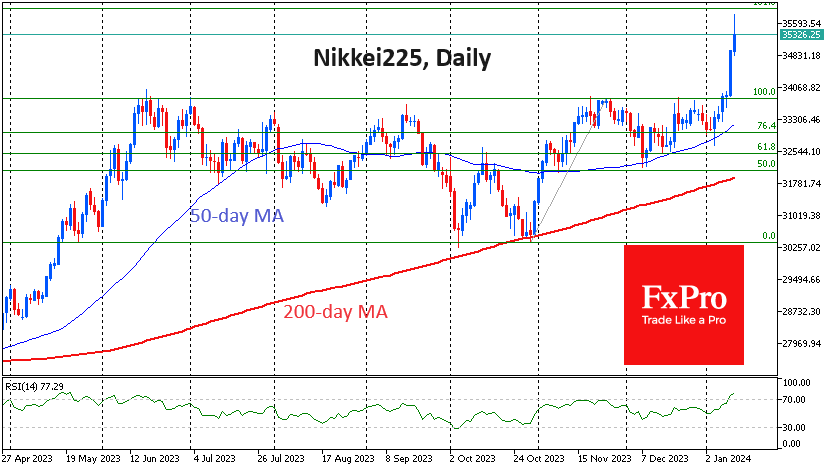

US indices rewrote all-time closing highs on Monday, with the Dow Jones taking the next round level of 38,000 among them, while a day earlier, the Nasdaq100 climbed above 17,000 in a powerful 2% gain for the day. Japan’s Nikkei225.

January 17, 2024

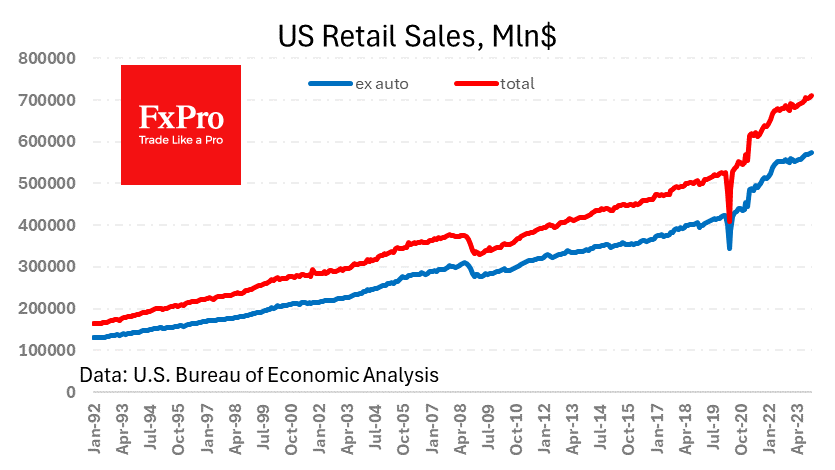

The US economy continues to surprise economists by beating retail sales forecasts for the sixth consecutive month. Reportedly, for December, the increase was 0.6%, compared to 0.3% in November and 0.4% expected. Sales excluding autos rose 0.4%, up from 0.2%.

January 17, 2024

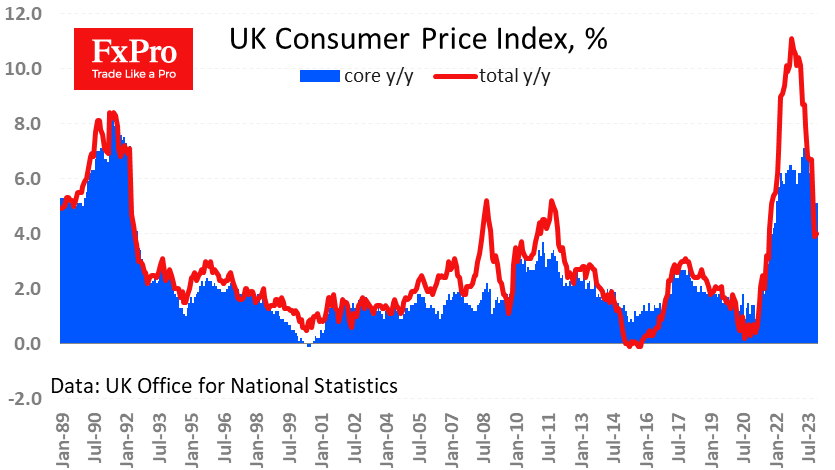

UK inflation statistics sparked a 0.8% rally in the pound on Wednesday morning, supporting GBPUSD gains against a general pull from risk assets. According to data released on Wednesday morning, the General Price Index rose by 0.4% for December against.

January 16, 2024

Gold lost 0.8% on Tuesday to $2037 due to the impact of a rising dollar after policymakers in Davos flagged overly optimistic expectations for an interest rate easing cycle. Commentators are trying to find a link between hawkish comments from.

January 16, 2024

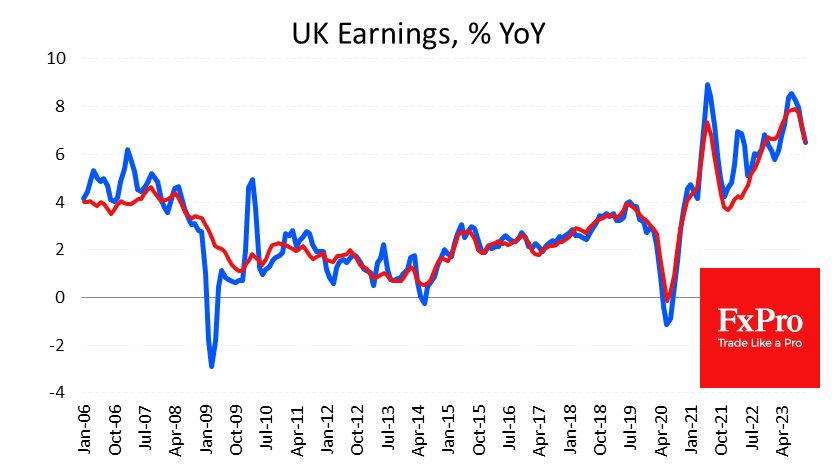

The British Pound has lost around 0.5% against the Dollar since the start of the day on Tuesday, falling to 1.2660. Markets have eased expectations for aggressive US interest rate cuts. In addition, UK employment data was released that provided.

January 16, 2024

US equity indices declined in the first five trading sessions of January. This dynamic promises a challenging year for the stock market, according to the old “first five days” rule. Identifying a defining trend would have been an easy task.

January 12, 2024

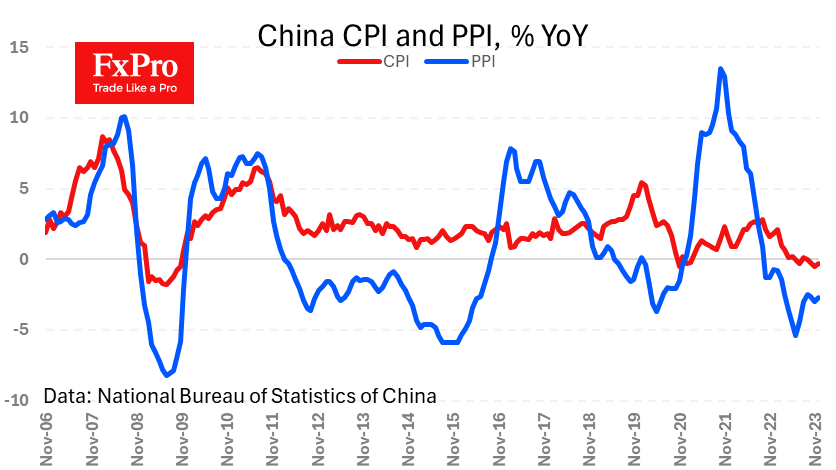

Inflation is still on the agenda, and global markets are playing up signs that it is easing. Chinese inflation and US PPI were the focus of traders on Friday. Consumer prices in China fell 0.3% y/y versus -0.5% in the.

January 12, 2024

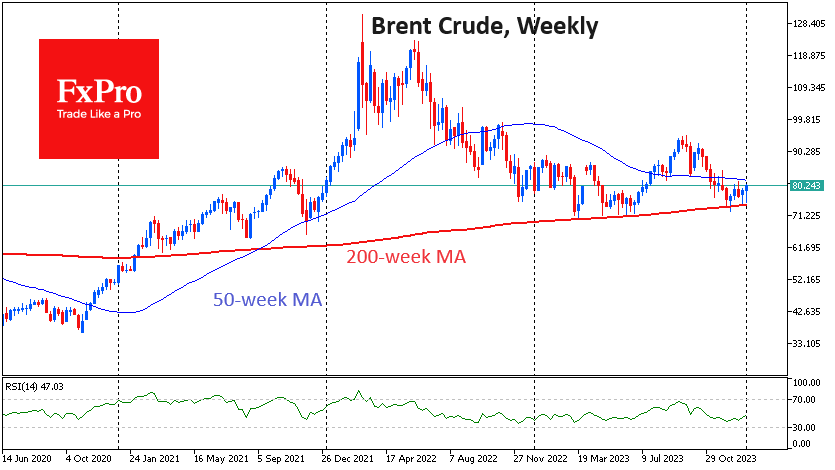

Oil is up 2.8% since the start of the day on Friday following a new round of escalation in the Middle East. The price of Brent rose above $80, while a barrel of WTI traded above $75. The US and.

January 11, 2024

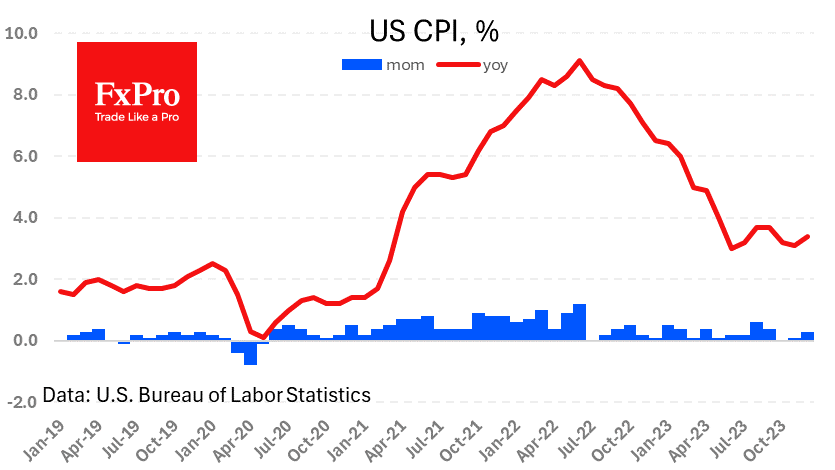

US consumer inflation exceeded expectations, adding 0.3% m/m and accelerating the annual pace from 3.1% to 3.4% in December, above the expected 3.2%. The core CPI also added 0.3% m/m, while its year-on-year gain slowed from 4.0% to 3.9% but.