Australian inflation surprise

January 25, 2023 @ 16:22 +03:00

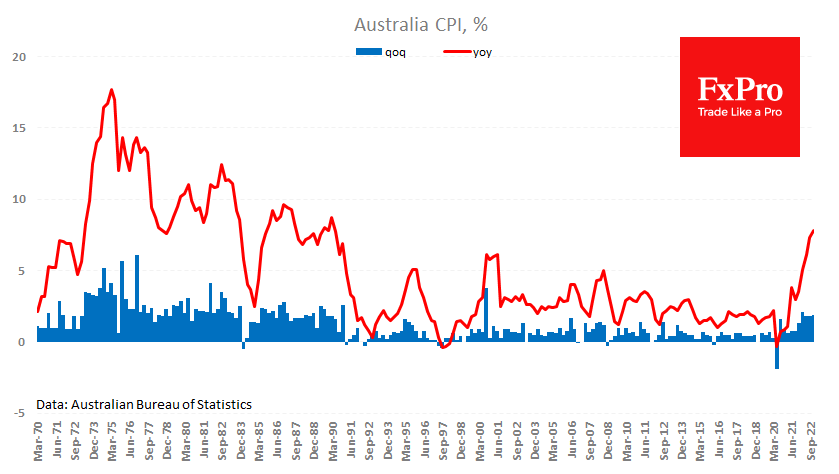

Inflation data continues to be the main driver of the markets. This morning the currency market focused on a surprise out of Australia, where the annual CPI growth rate for the fourth quarter accelerated from 7.3% to 7.8%, against expectations of only 7.5%. Inflation hit its highest level since 1990. Moreover, a 1.9% rise in prices in the final three months of last year shows that inflationary pressures have stayed the same.

The significant outperformance of the data compared to expectations triggered a wave of Aussie buying. AUDUSD climbed to 0.7120 by the start of the European session as traders reassessed the outlook for policy tightening, suggesting a higher interest rate.

From a broader perspective, the Australian data and today’s stronger-than-expected numbers from New Zealand and earlier from Japan should remind the market that inflation is sticky and there is a long fight ahead. This is true now that employment levels in the developed world have been near their highest for decades. If high inflation is a global phenomenon, it has the potential to regain some of the traction the dollar has lost since October.

The FxPro Analyst Team