Market Overview - Page 465

September 6, 2019

This week brought a small reprisal for bitcoin price and the broader cryptocurrency market as it witnessed $20 billion added to its total market cap by late Tuesday. This was also reflected by an approximate 10% gain for BTC alone;.

September 6, 2019

The world’s two largest economies are “already in the early stages” of a second Cold War, according to Niall Ferguson, a senior fellow at the Hoover Institution at Stanford University. Speaking to CNBC’s Steve Sedgwick at the Ambrosetti Forum in.

September 6, 2019

Progress in China-US Talks New hopes for easing the trade war are having a very positive effect on all markets at once. The Chinese side is going to fly to Washington in early October. However, up to this point, a.

September 5, 2019

The bitcoin price has stabilized around $10,500 following a spectacular 13 percent rally. As BTC continues to hover around this critical level, here’s where crypto traders believe the dominant asset is headed next. Earlier this week, technical analyst DonAlt revealed.

September 5, 2019

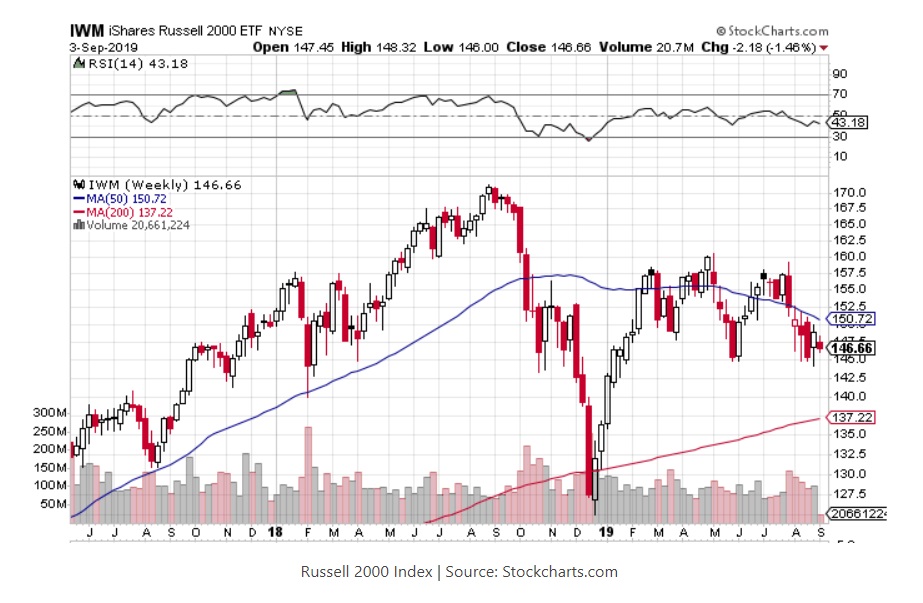

Many instruments – whether its stocks, futures, forex or cryptocurrencies – can experience similar price trends and behaviors during certain months. It is worth reviewing how prices respond given certain months, especially months that involve seasonal changes. September is one.

September 5, 2019

Pound (GBP) to Euro (EUR), Dollar (USD) exchange rates were trading close to fresh highs posted on Wednesday as Thursday’s European session got underway with Sterling riding a wave of positive sentiment as opponents to no-deal Brexit trounced the government.

September 5, 2019

OPEC is under intensifying pressure to show it still has the power to reverse a slide in oil prices, according to RBC Capital Market’s Helima Croft. The Middle East-dominated producer group has struggled to shore up crude futures this year,.

September 5, 2019

Tug of war by the two largest economies in the world again brings the parties to the negotiating table: the Chinese and US authorities have already approved a plan for a high-level meeting to be held in early October in.

September 4, 2019

The price of bitcoin surged by $5,000 on April 2, a 23 percent jump that many believe was sparked by an article published on April Fool’s Day. Its title was “SEC drops the Bomb: Approves Bitcoin ETFs.” ETFs, a backronym.

September 4, 2019

Last week, Bitcoin price fell below $10,000 yet again, and with the break of support, much of the market turned bearish and began calling for lows around $8,000 to be tested. However, before the long Labor Day weekend concluded, Bitcoin.

September 4, 2019

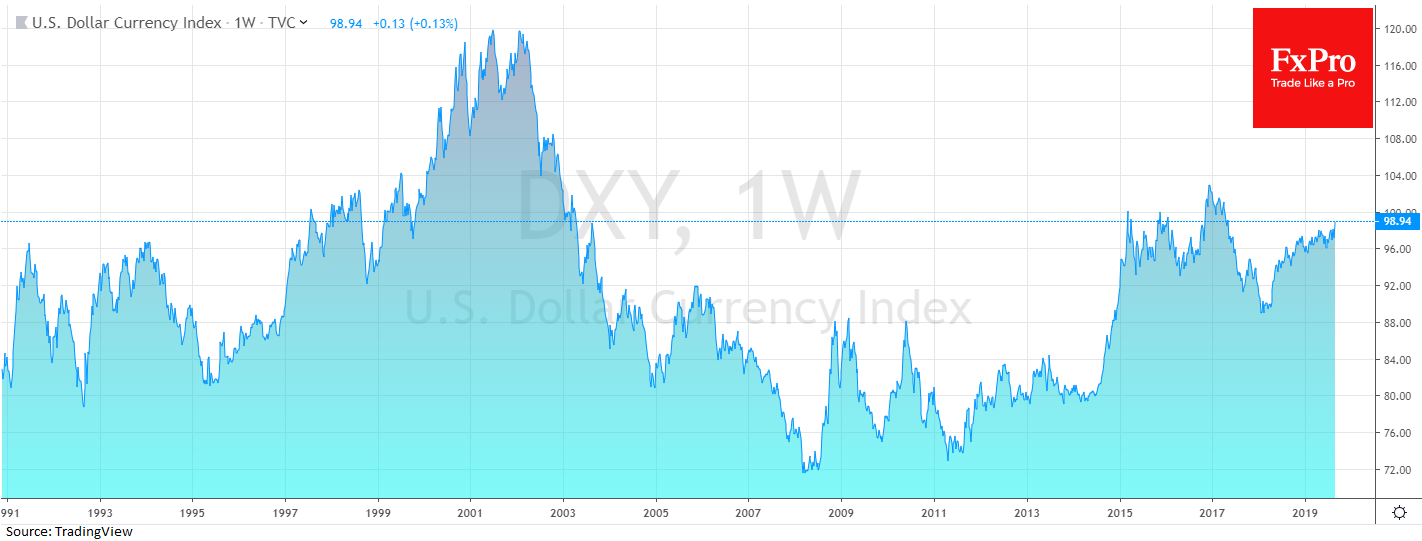

The seven-day dollar rally broke off on Tuesday afternoon. In Europe, the U.S. currency lost its momentum for growth, and following the worrying news from the U.S., traders began to take profits from previous growth. Despite this, it will not.