Market Overview - Page 449

October 28, 2019

As President Xi Jinping called on his countrymen to seize opportunities in distributed ledger technology, China’s industry heavyweights were already leading hundreds of enterprise blockchain projects. In total, the identities of 506 such projects have been published by the Cyberspace.

October 28, 2019

The crypto markets boomed this week, exhibiting their trademark volatility once again. In meteoric fashion, the bitcoin price jumped from a 5-month low of around $7,300 to a monthly high well above $10,000. Much of the cryptocurrency market followed, with.

October 25, 2019

Oil prices fell on Friday but were on track for strong weekly gains as support from a surprise draw in U.S. inventories and possible action from OPEC and its allies to trim production further outweighed broader economic concerns. Brent crude.

October 25, 2019

The Chinese yuan is expected to show some near-term weakness against the U.S. dollar, according to investment bank Goldman Sachs. On Friday afternoon, the onshore yuan changed hands at 7.0663 at 2:28 p.m. HK/SIN after the People’s Bank of China.

October 25, 2019

The cryptocurrency market entered a modest recovery on Thursday, though bitcoin lagged its altcoin peers following a major technical breakdown earlier in the week. At just over 65%, the bitcoin dominance rate has fallen to its lowest level since July..

October 25, 2019

The Federal Reserve likely will cut interest rates next week, but in doing so will make a pair of adjustments aimed at signaling that the current easing cycle could be over, according to a Goldman Sachs forecast. Markets widely expect.

October 24, 2019

A zoomed out version of the bitcoin chart shows it would take the cryptocurrency another 365 days to achieve a full-fledged upside breakout. Brought to notice by Teddy Cleps, a prominent cryptocurrency analyst, the weekly Bitcoin chart shows the possibility.

October 24, 2019

Investors in Telegram’s blockchain project have opted to stick with the firm despite the U.S. Securities and Exchange Commission’s recent injunction against the messaging platform’s token offering. Both groups of investors in Telegram’s twin $850 million funding rounds have now.

October 24, 2019

In case you are baffled by the latest Bitcoin price move, you are definitely not alone. Gemini co-founder Cameron Winklevoss has shared his take on Twitter, alleging that the price of the top coin is actually supposed to go up,.

October 24, 2019

His legacy will form around three words — “whatever it takes” — but as President Mario Draghi prepares to leave the helm of the European Central Bank (ECB), questions are emerging about the success of the policy tools he helped.

October 24, 2019

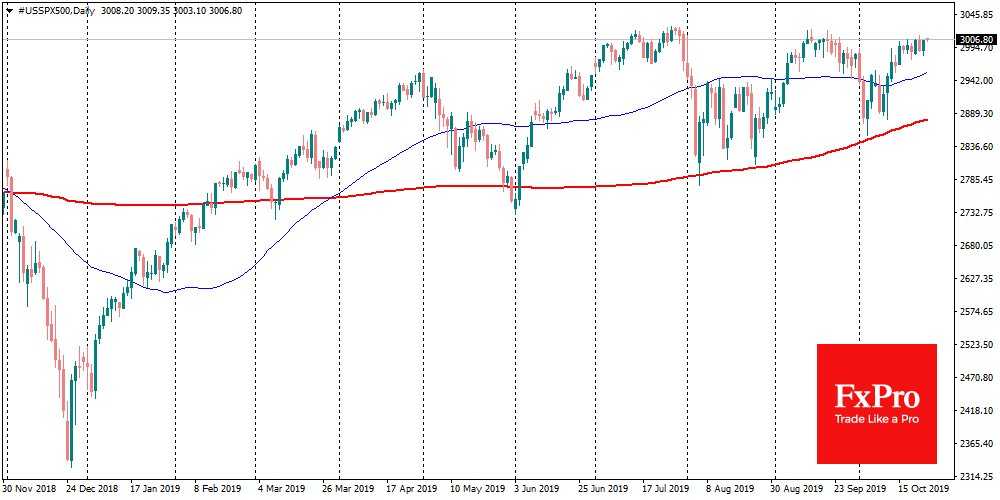

The stock markets show growth on Thursday morning, supported by a slight decrease in uncertainty around Brexit and Sino-US trade negotiations progress, as well as the ceasefire in Syria. However, the current increase in stock purchases also should be seen.