Market Overview - Page 11

October 10, 2025

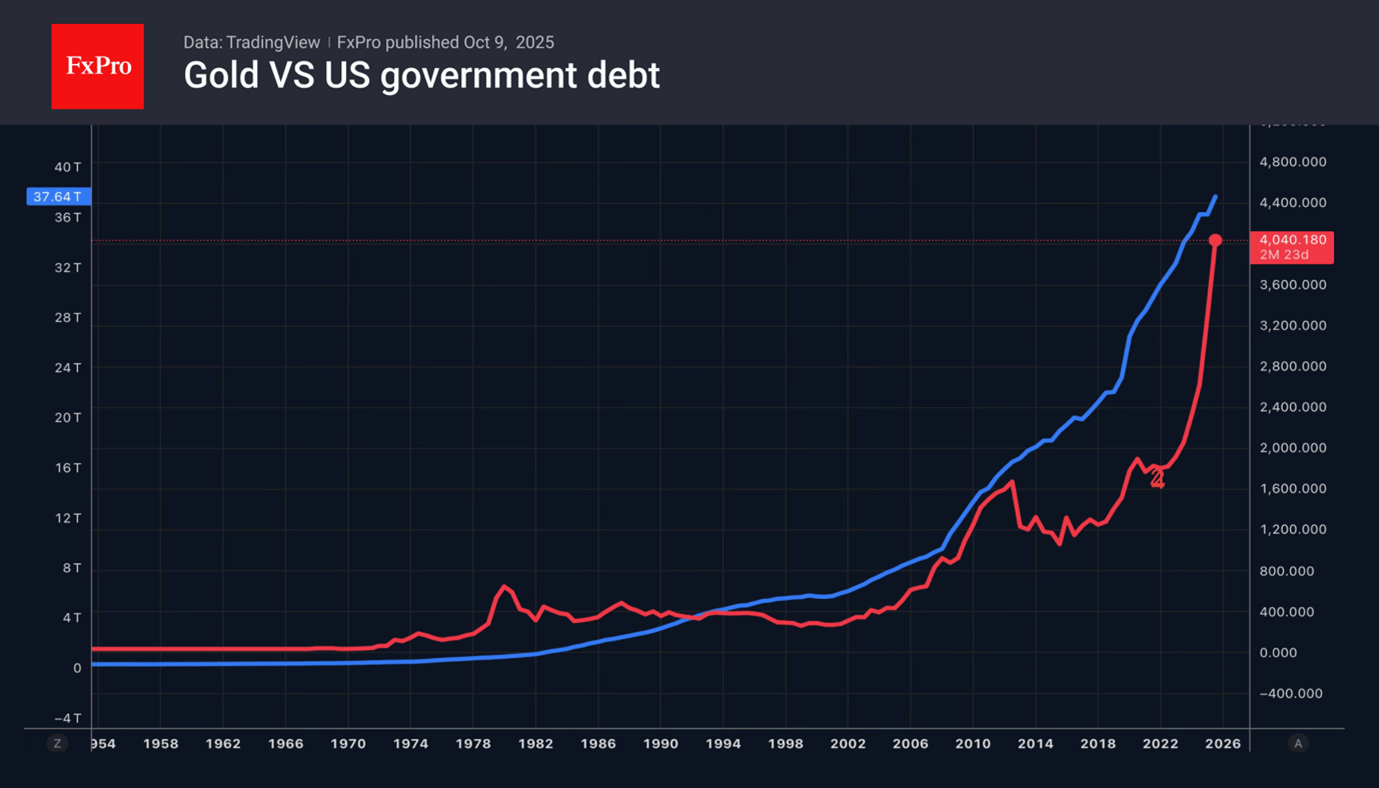

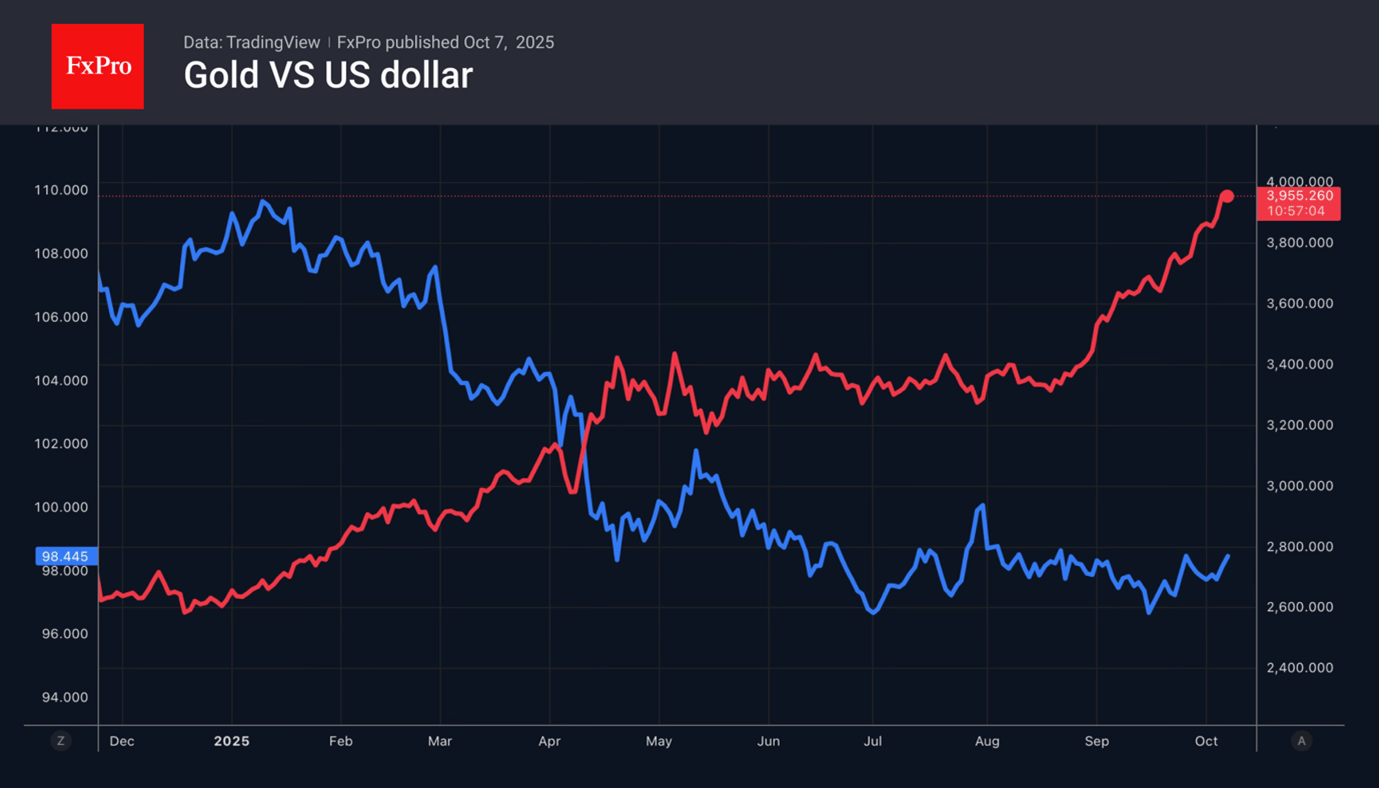

Gold is outside the realm of politics. While currencies and securities depend on the actions of presidents and governments, precious metals do not. Therefore, political turmoil forces investors to use them as safe-haven assets. The impressive 52% rally in gold.

October 10, 2025

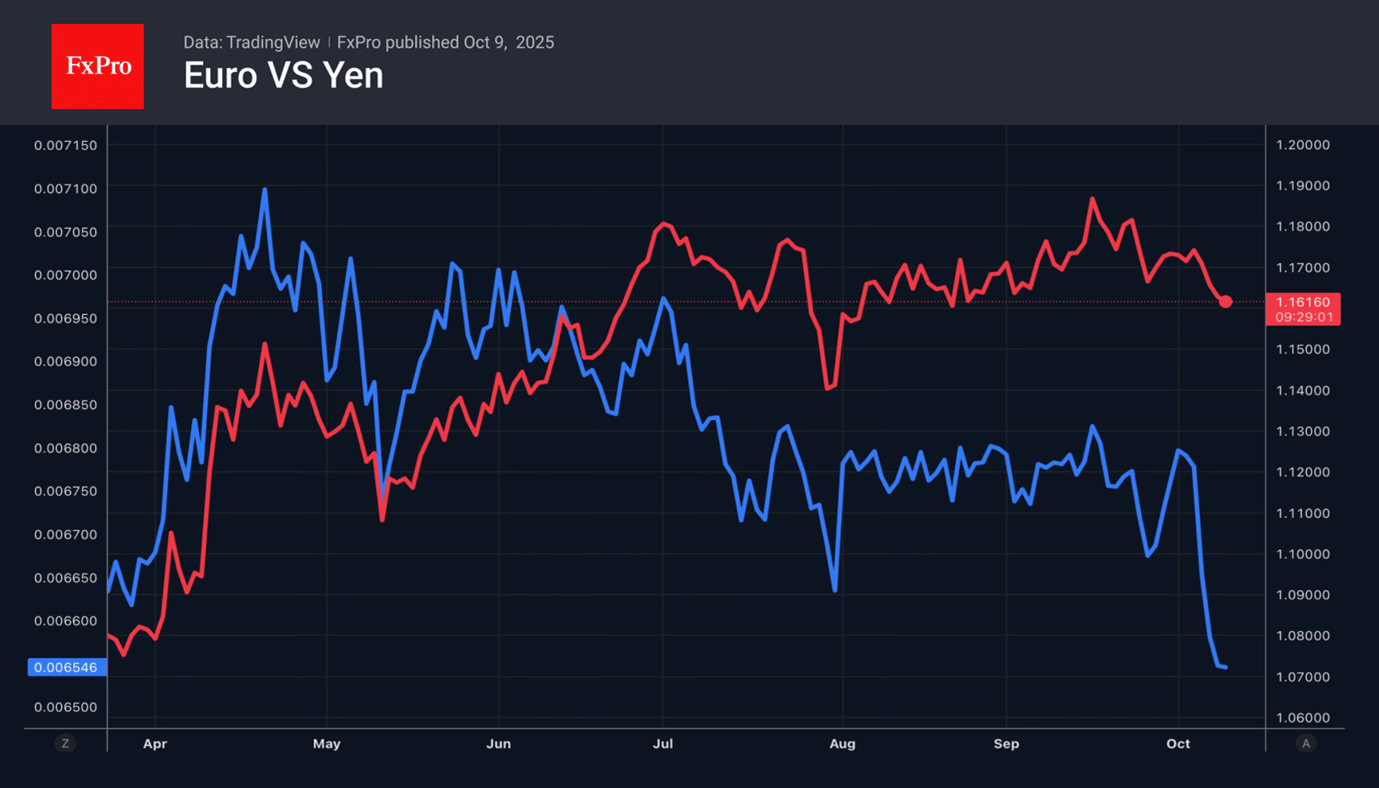

USD rises on euro, yen weakness; S&P 500 hits record highs amid low volatility and investor optimism for Q3 earnings growth.

October 9, 2025

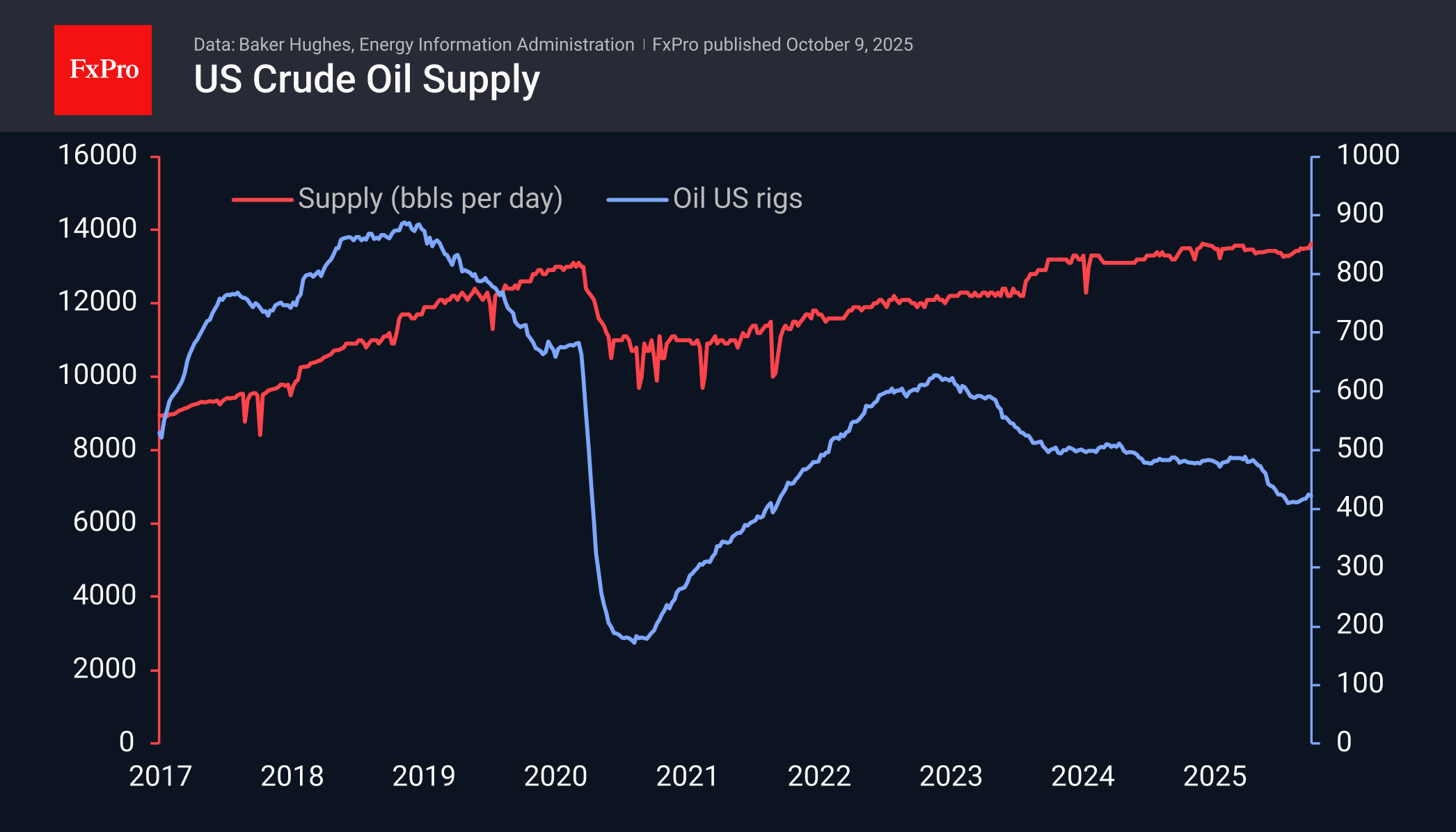

Oil remains resilient, holding near $60 despite rising US production, inventories, and bearish fundamentals.

October 8, 2025

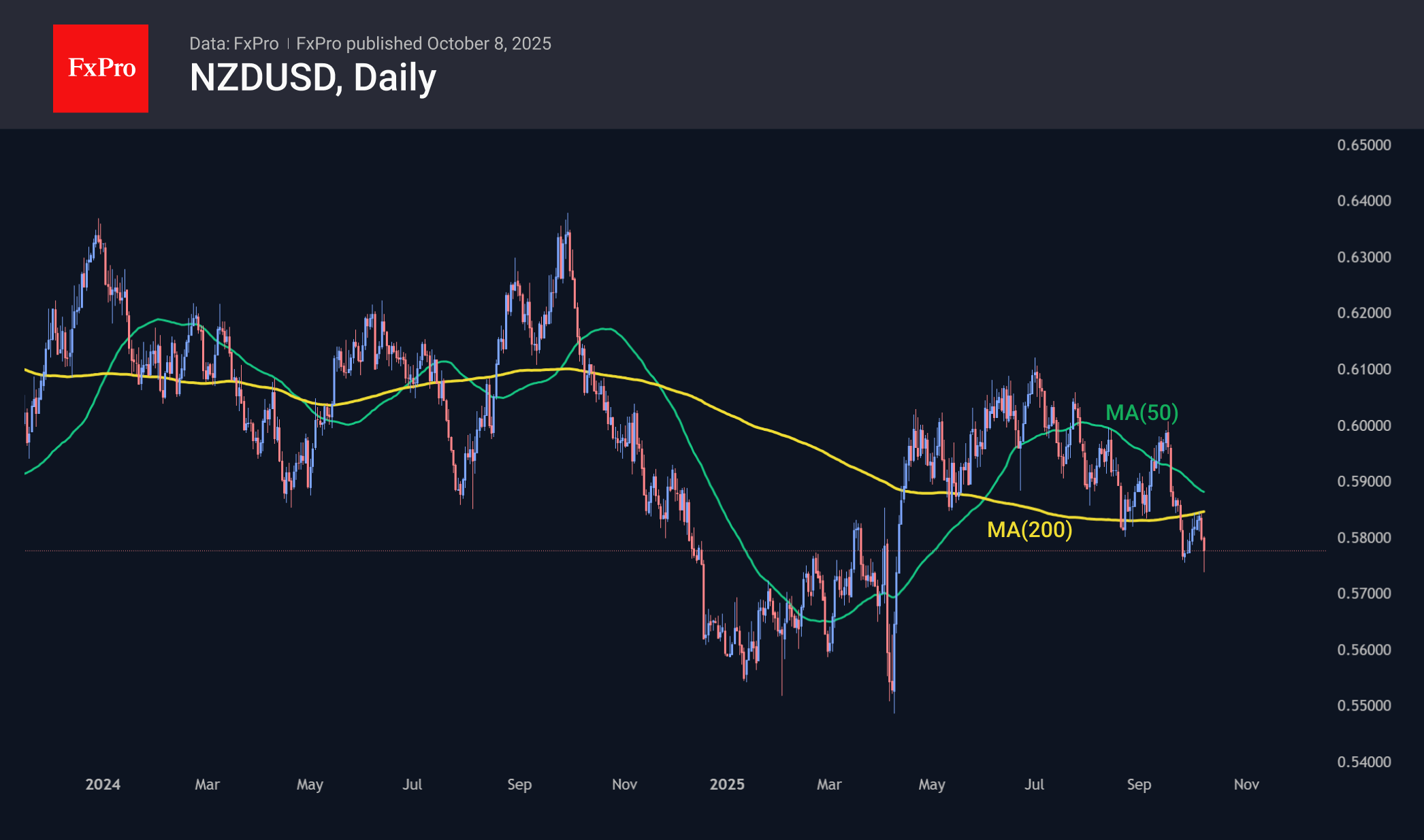

The dollar rises as other major currencies weaken due to rate cuts, political changes, and economic troubles, making it a safer choice for investors.

October 7, 2025

Gold hits record highs as distrust in fiat currencies grows. Political turmoil in France, US, and Japan fuels demand for gold, ETFs, and Bitcoin as safe havens.

October 7, 2025

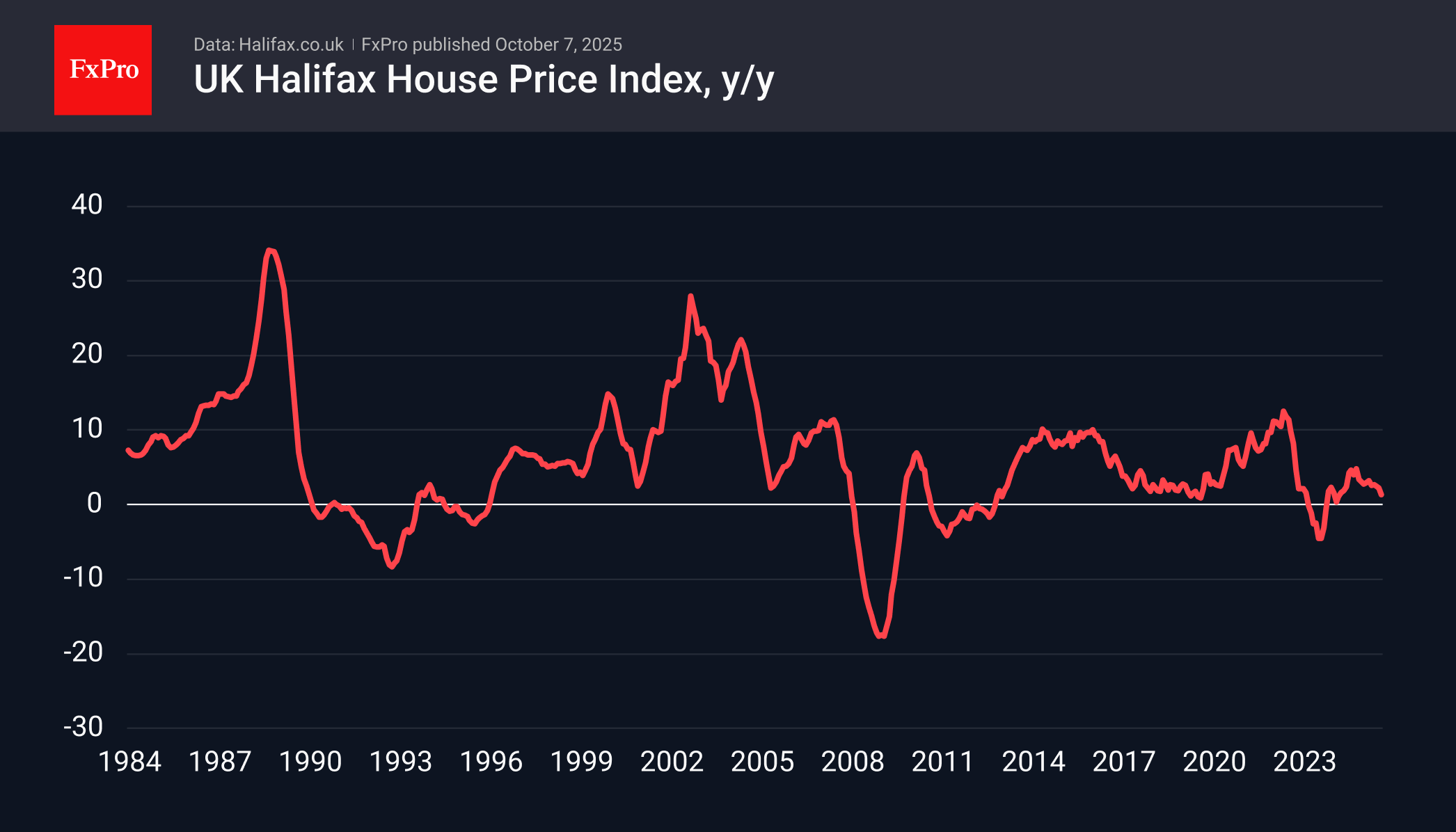

UK house prices lag behind inflation, rising just 0.3% YTD vs. 2.7% CPI. Market weakness pressures GBP and signals no economic overheating.

October 6, 2025

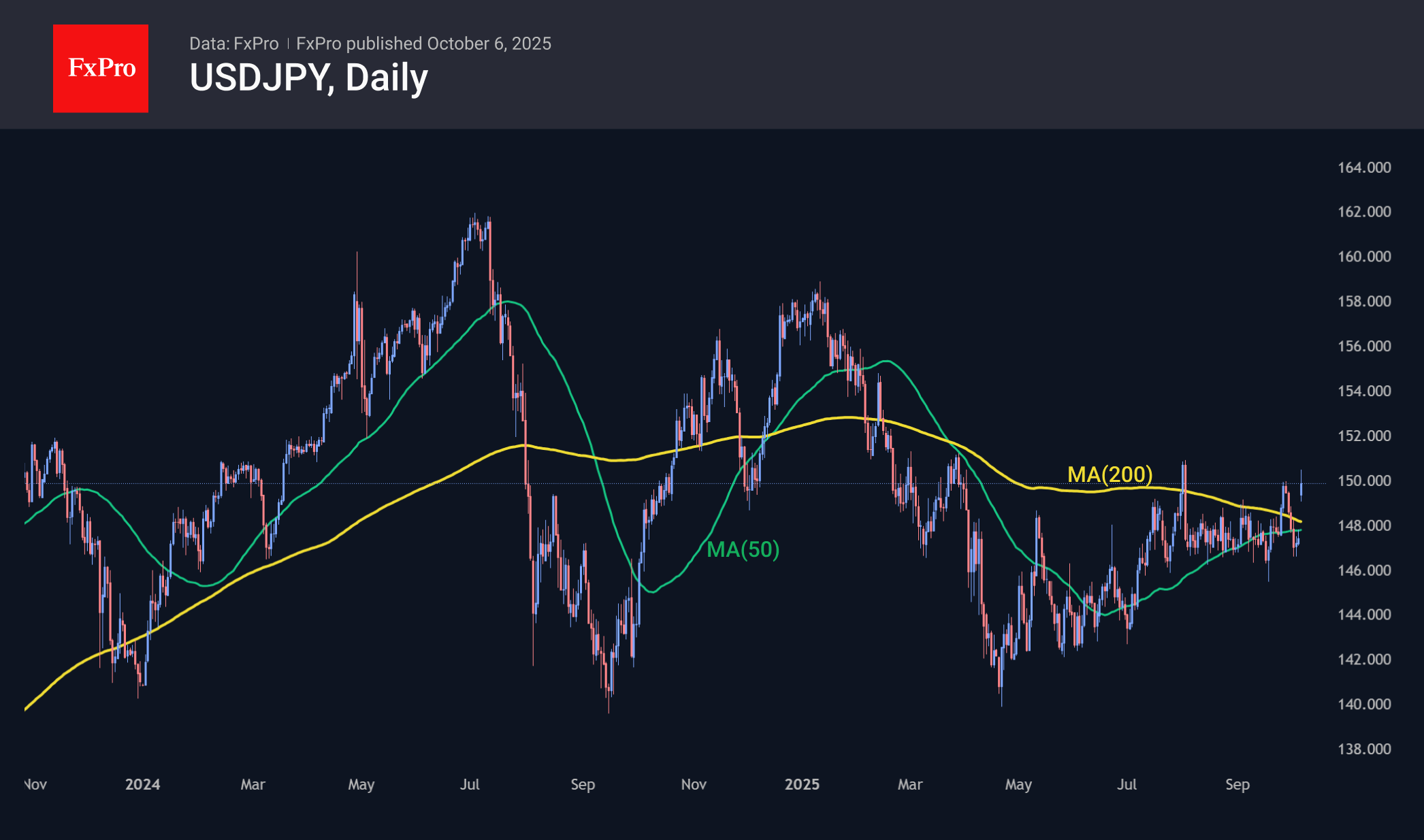

Political shifts in Japan and France caused major FX market moves, with the yen weakening and the euro under pressure, highlighting politics as a key FX driver.

October 6, 2025

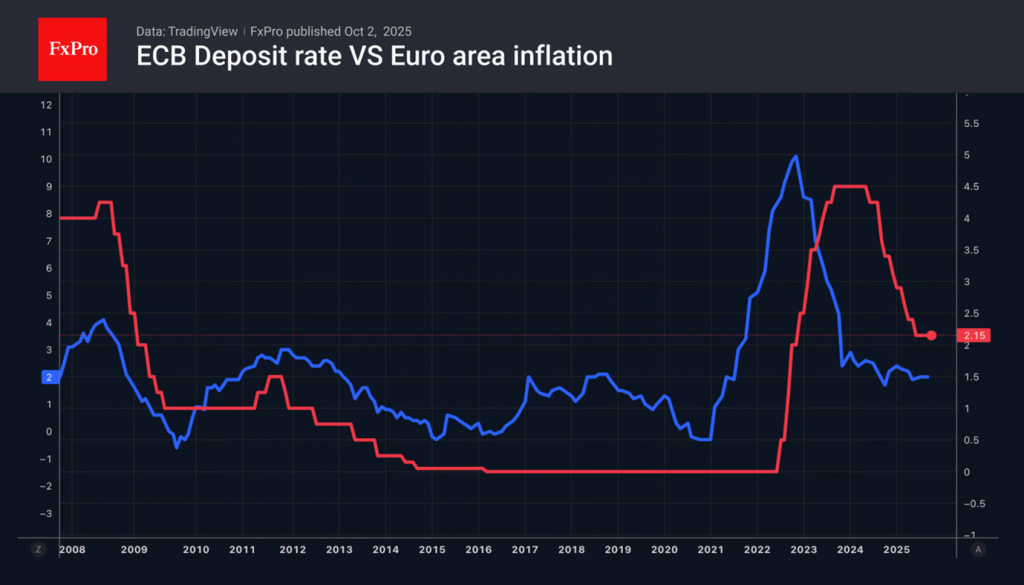

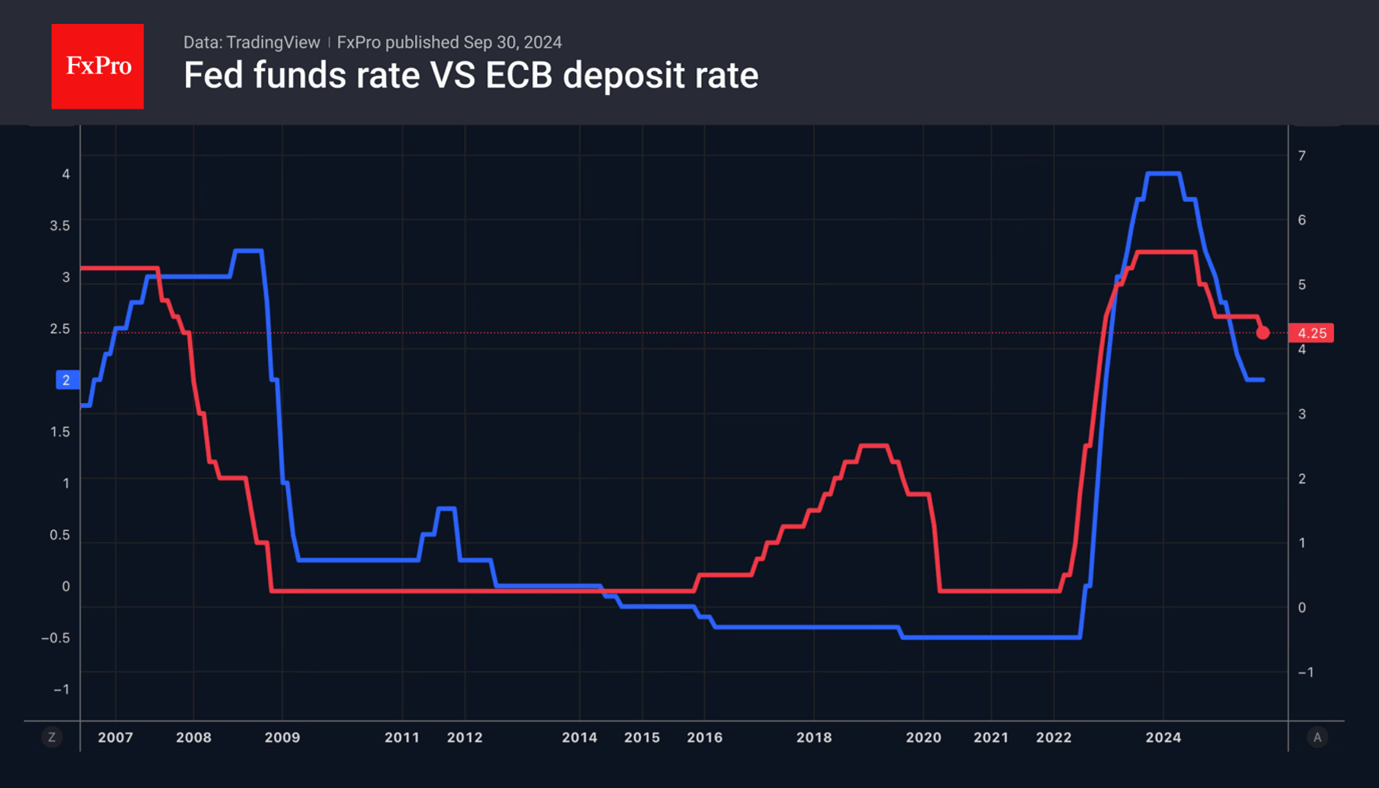

The economic calendar for the week ending 10 October includes Jerome Powell’s speech, the US Government shutdown, postponed statistical releases, and the publication of the FOMC and ECB meetings minutes. Weak private sector employment data paint a bleak picture and.

October 3, 2025

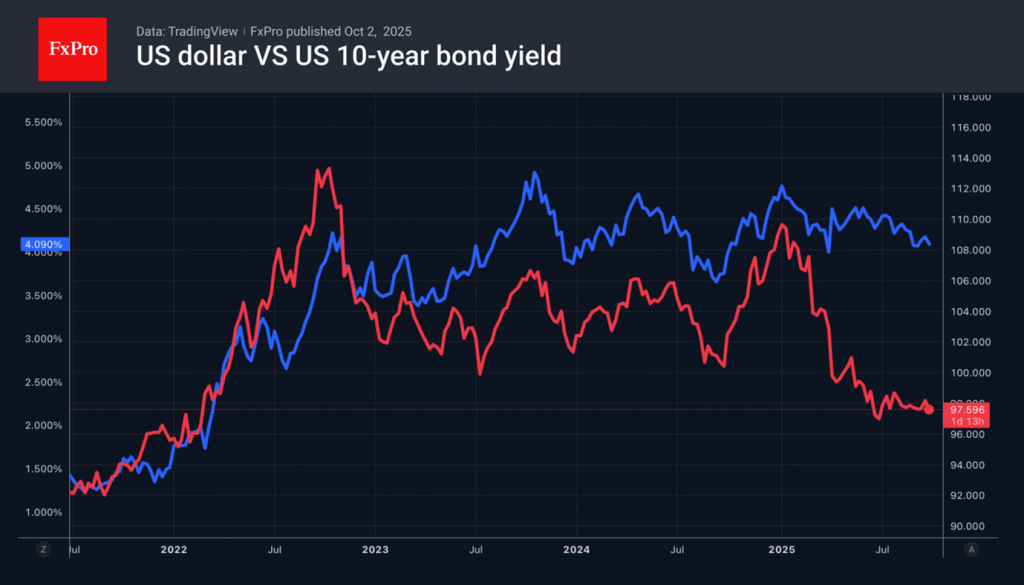

The shutdown came as a bolt from the blue for the US dollar. The greenback was confident that Democrats and Republicans would reach a last-minute agreement. That did not happen. During previous government shutdowns, the dollar index typically fell on.

October 2, 2025

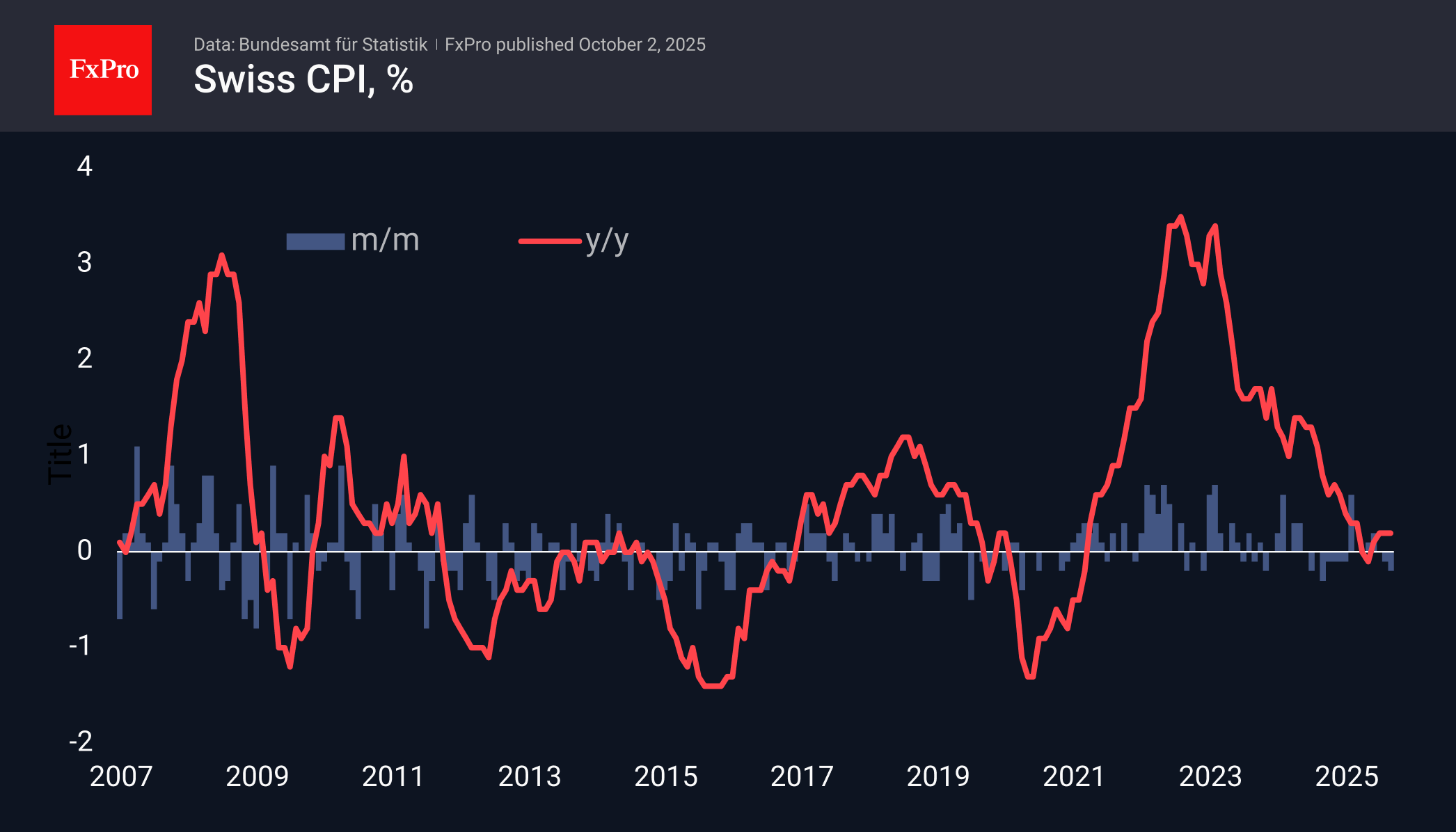

Consumer prices in Switzerland fell by 0.2% in September. Annual price growth was 0.2%, remaining at this level for the last three months and slightly below the average forecast of 0.3%. The decline was due to the strengthening of the.

October 1, 2025

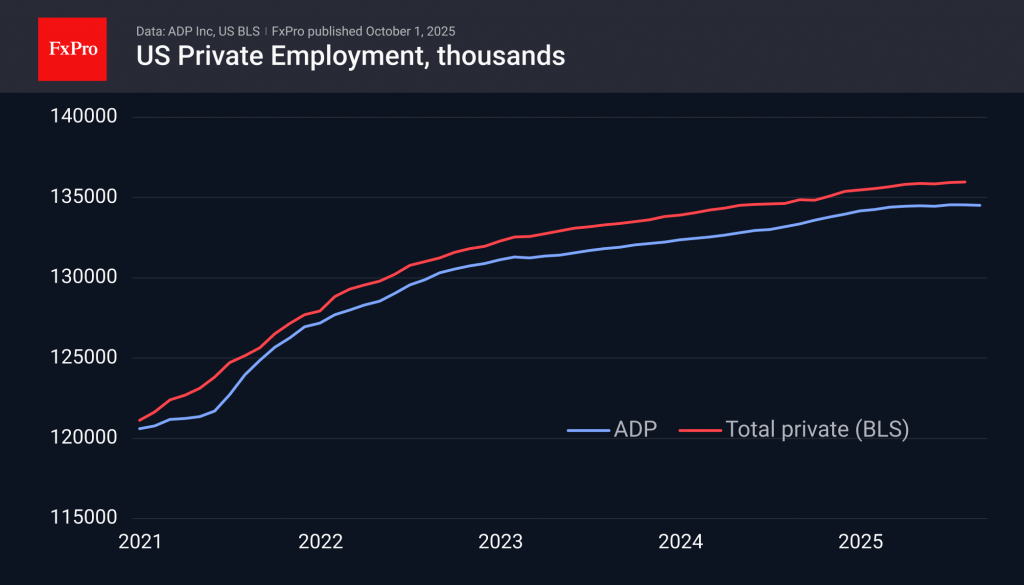

ADP reports job losses, raising Fed rate cut chances, market impact uncertain due to weak data and US government shutdown risk.