Market Overview - Page 105

June 7, 2022

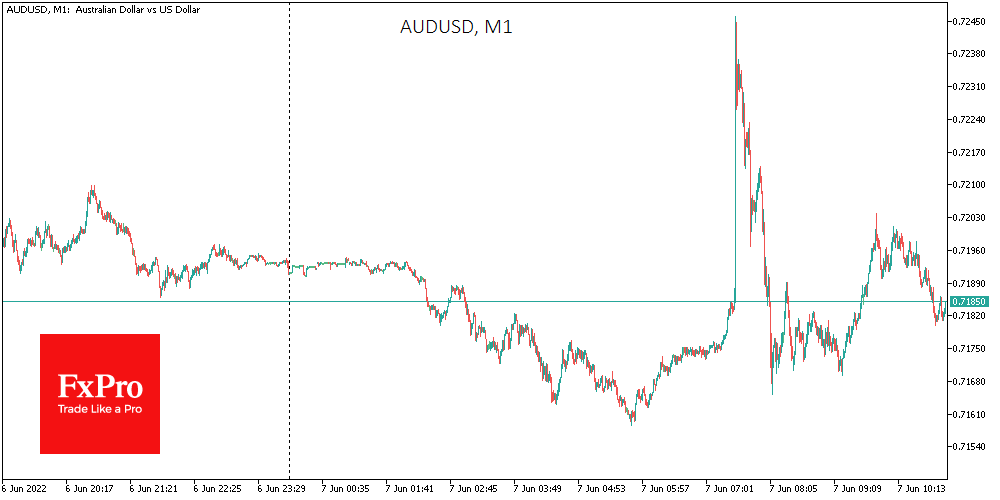

The Reserve Bank of Australia delivered a hawkish surprise momentarily undervalued by the markets. The RBA raised the rate to 0.85%, immediately 50 points after a 0.25% hike last month and expectations for a repeat this time. A big hike.

June 6, 2022

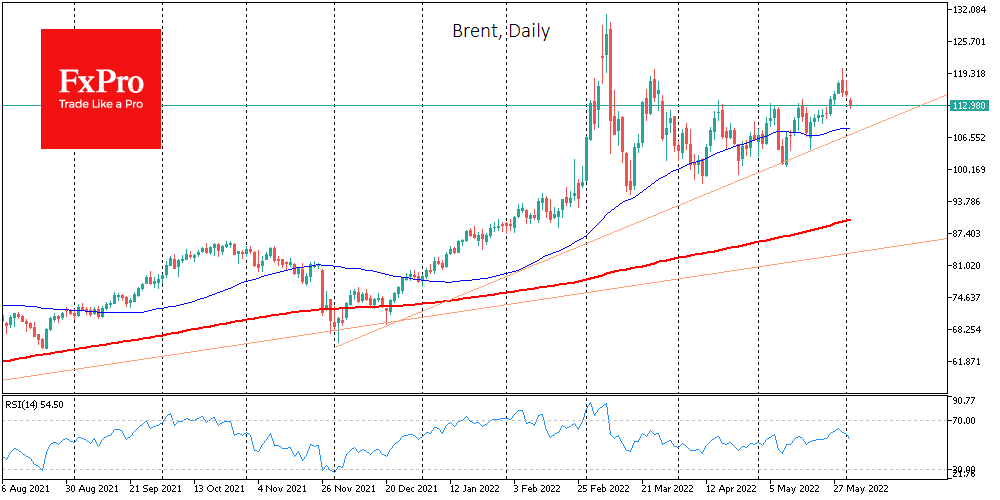

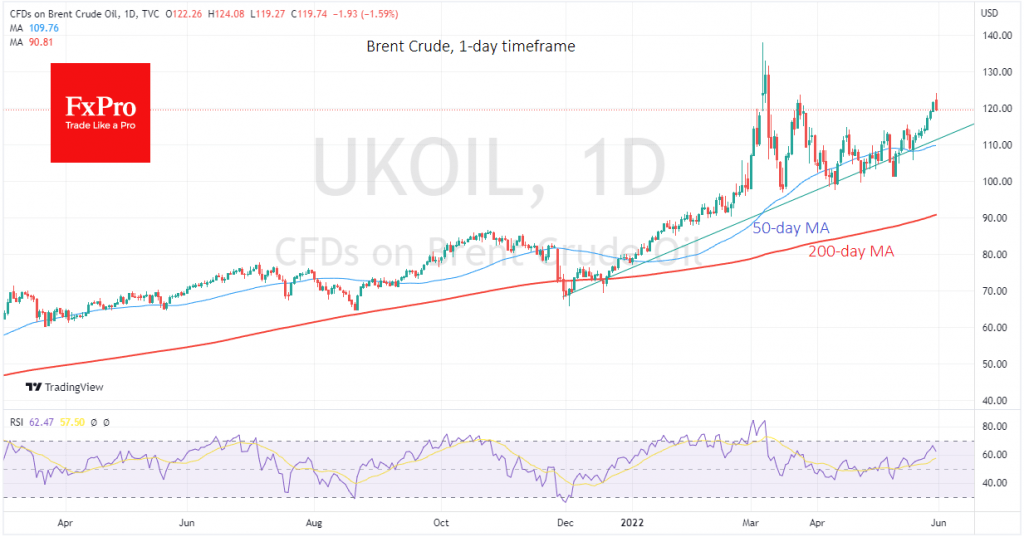

Oil was bought during the downturns on Thursday and Friday, with most buying activity during the US trading session. On Thursday and Friday, buying in US trading took the price out of the initial drawdown, closing the day near intraday.

June 6, 2022

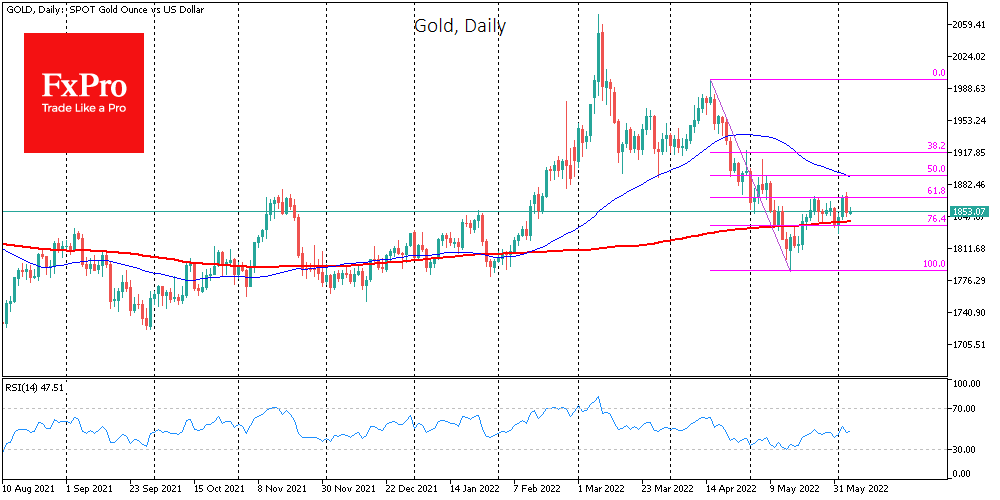

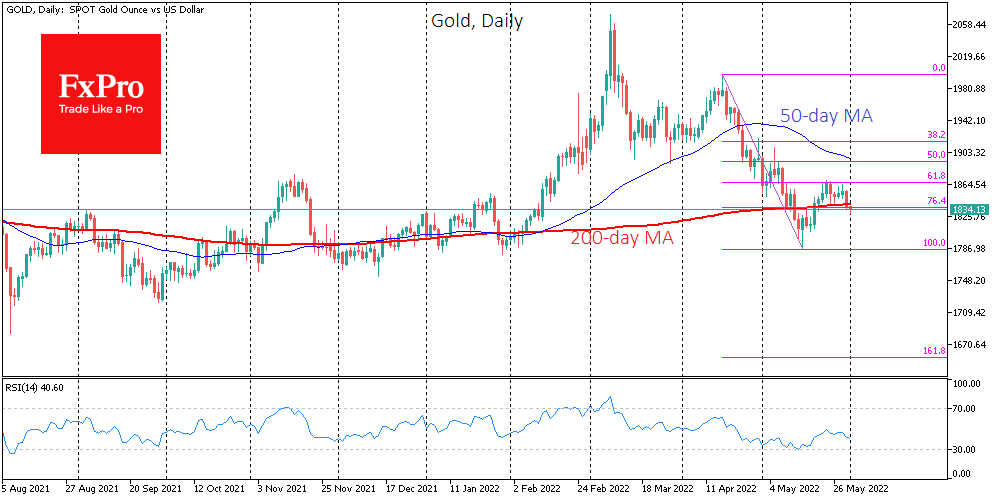

Gold lost 1% to $1850 on Friday, declining under pressure from the overall pull from risky assets. For short-term traders, it is also telling that this decline mostly erased the gains of the first few days of the month and.

June 6, 2022

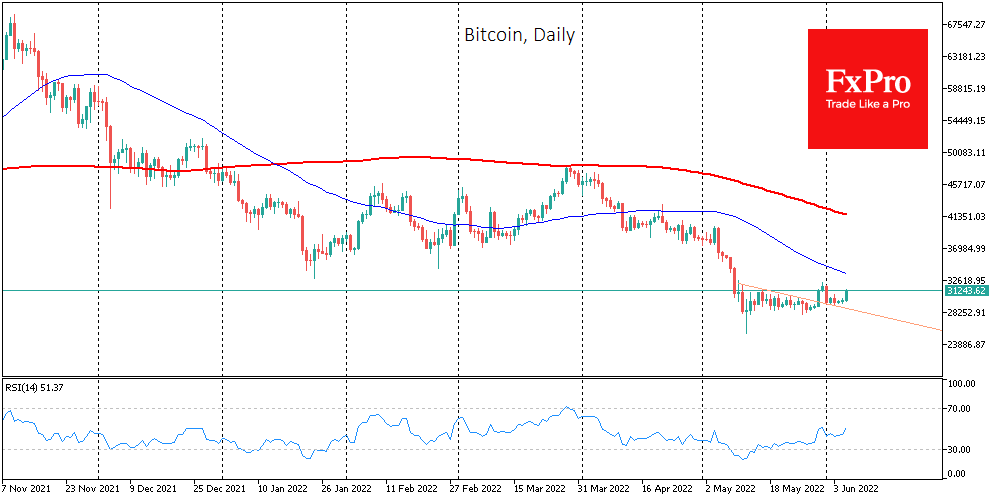

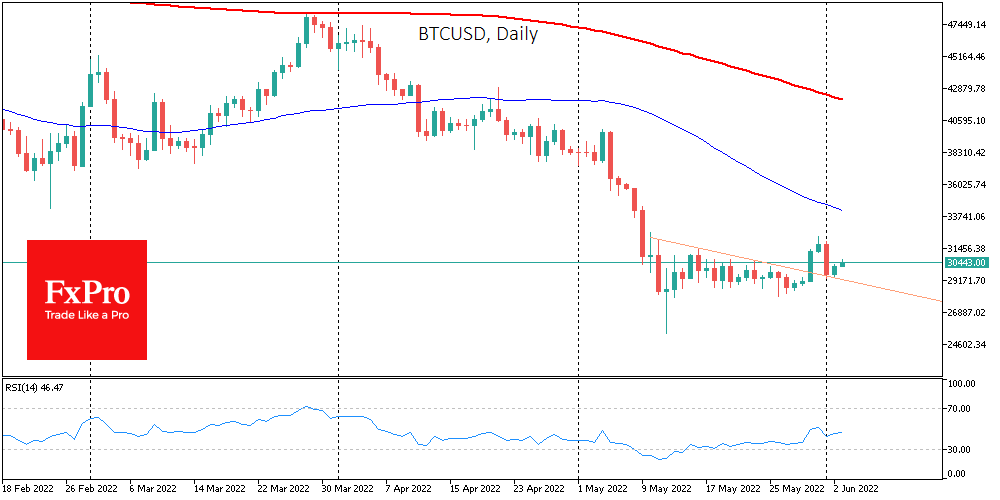

Bitcoin rose 3.1% over the past week, finishing near $30,000. Ethereum added 0.9%, while other leading altcoins in the top 10 showed mixed dynamics, ranging from a 10.7% decline (Solana) to a 23.2% rise (Cardano). The new week is off.

June 3, 2022

• Citibank reversed from resistance level 54.00• Likely to fall to support level 50.00 Citibank recently reversed down from the key resistance level 54.00 (the former monthly low from March and the monthly high from April). The resistance zone near.

June 3, 2022

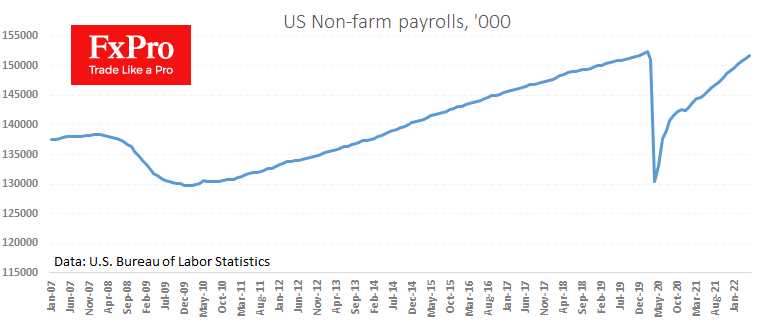

The US economy increased the number of jobs by 390k in May, the fresh NFP showed, better than average expectations (325k) but worse than April’s figures (436k). Total employment is only at 822k highs before the pandemic hit, and the.

June 3, 2022

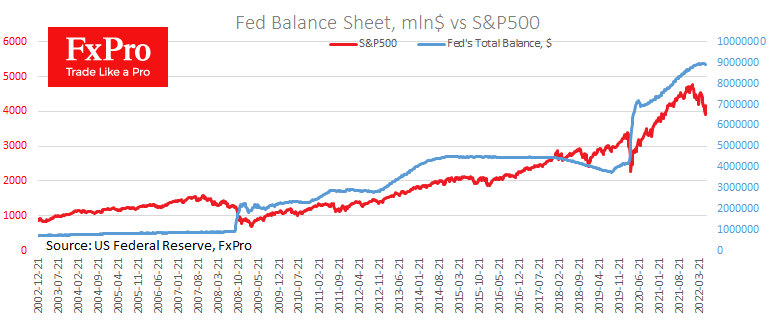

With the start of June, the Fed was due to start selling assets off the balance sheet. However, balance sheet values peaked at the beginning of April when they were 50 billion higher than the latest figures. The S&P500 had.

June 3, 2022

In May, US companies added 128K new jobs, the ADP showed in its monthly report, indicating a fading recovery. Market analysts, on average, expected a more than double increase. A look inside the report is even more alarming. Very small.

June 2, 2022

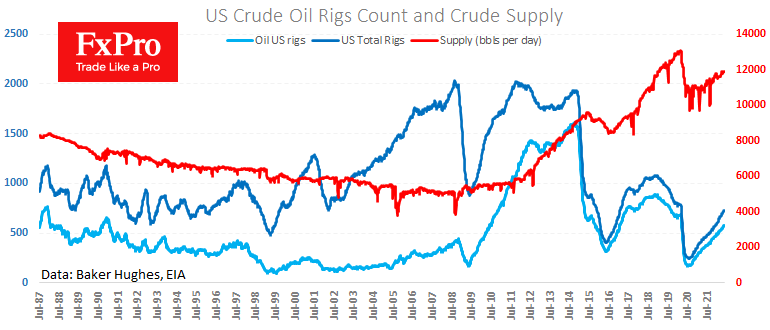

Crude oil is down for a third consecutive day, having lost more than 2% earlier on Biden’s comments that the West might agree to buy Russian oil at a discount instead of an embargo. In addition, the US media is.

June 1, 2022

Gold has shed its position for the second day in a row, losing more than 1% during that time, and that might be just the beginning of a new downside wave, which will potentially take the price down to $1650..

May 31, 2022

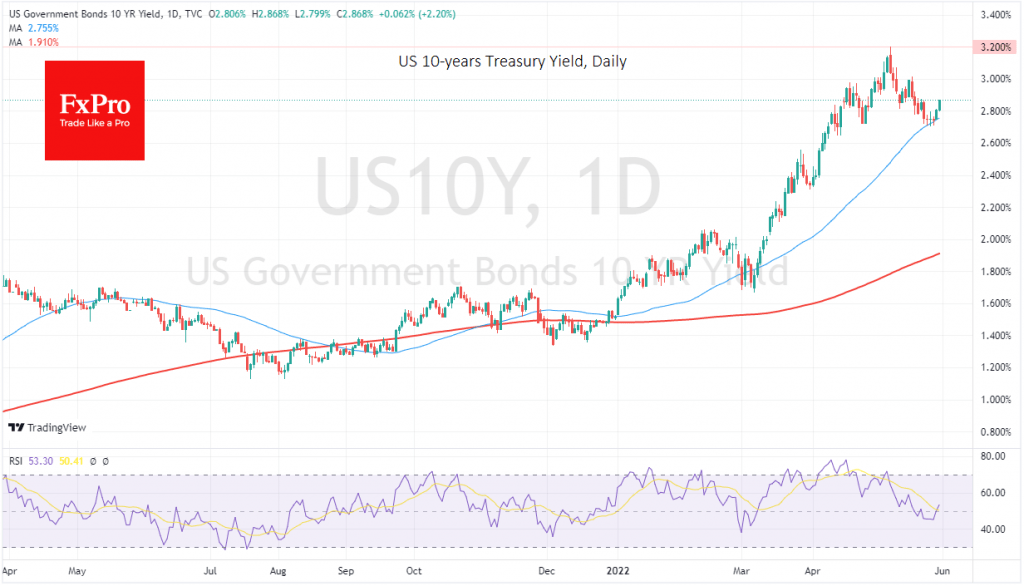

In the US debt market, 10-year Treasury yields have exceeded 2.8% after floundering around 2.7% last week. This small move for bonds is having severe consequences for almost all markets. The dollar index is almost in sync with long-term bond.