Market Overview - Page 99

August 1, 2022

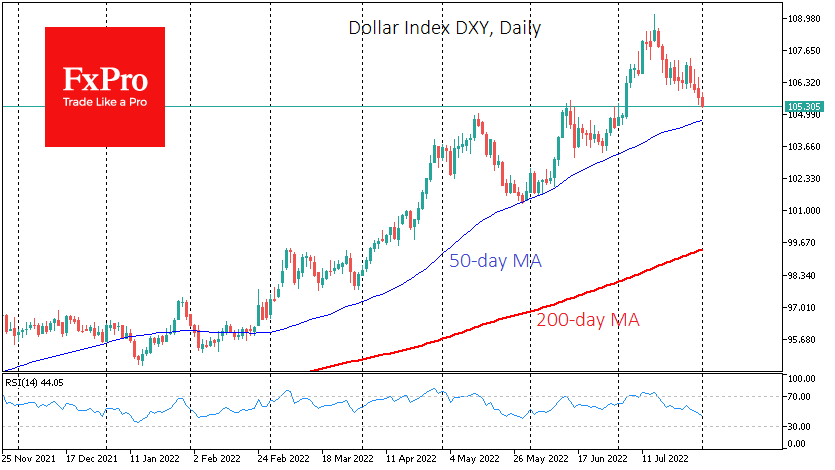

The last two weeks of July have seen a pullback in the markets towards risky assets, with the dollar retreating from multi-year highs against major currencies. Over the past two weeks, signs of an economic slowdown in the US have.

July 29, 2022

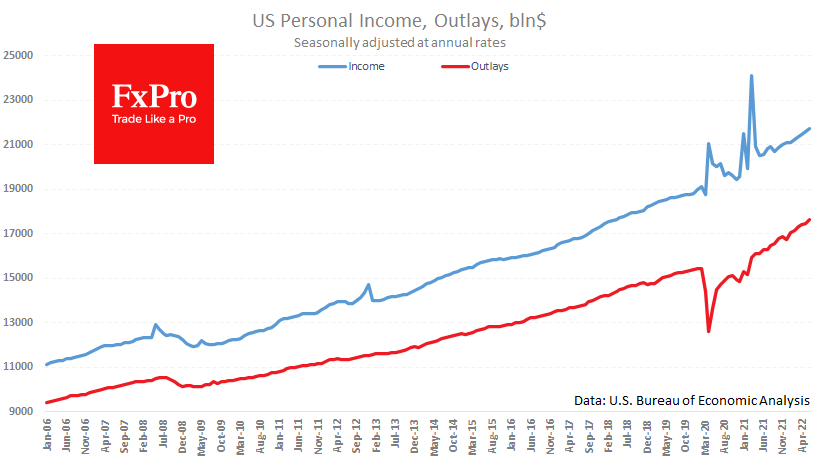

Americans increased spending (+1.1%) faster than income (+0.6%) in June. Both figures exceeded expectations, which is a bullish signal for the markets and the dollar as it shows buying is in good shape. But this may only be a good.

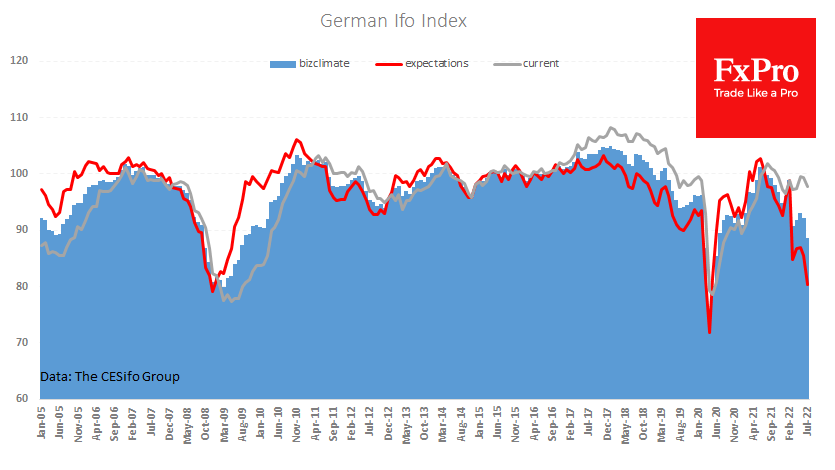

July 29, 2022

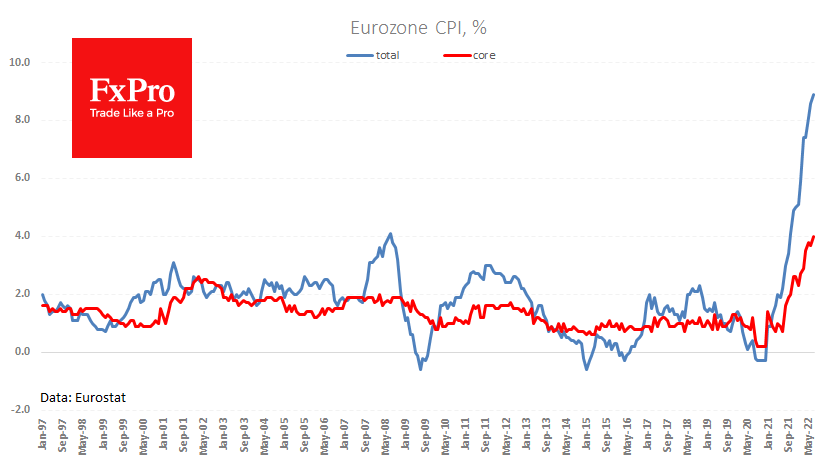

Inflation in the eurozone continues to speed up. Preliminary data for July showed a price increase of 8.9% against 8.6% a month earlier and the expected 8.7%. The core price index (which excludes energy and food) rose 4% y/y vs.

July 29, 2022

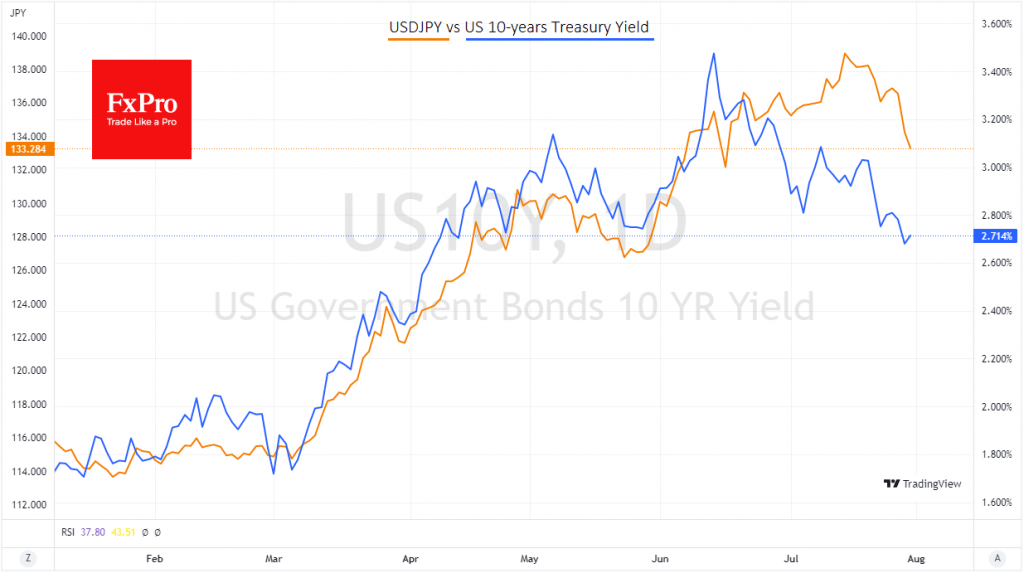

The Japanese yen has gained 3.4% against the dollar in less than 48 hours, recovering to 132.7 from a month and a half ago. Before that, from early March to mid-July, USDJPY soared by more than 20% on diverging monetary.

July 29, 2022

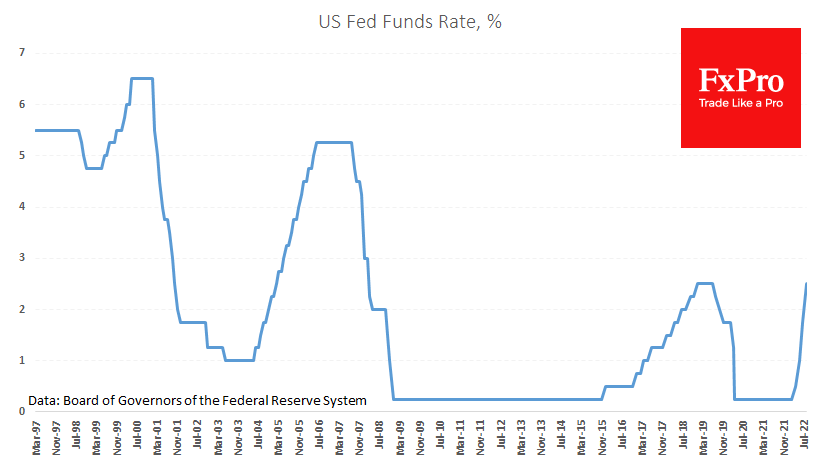

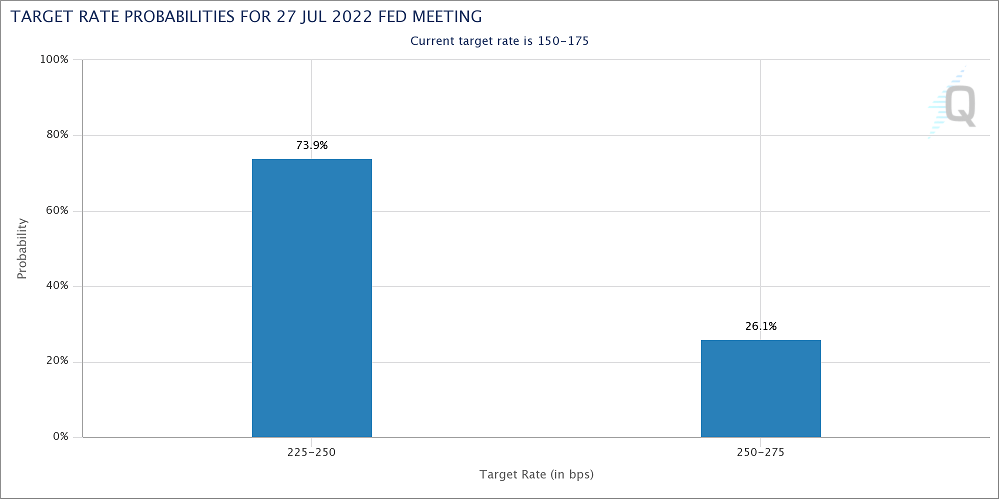

The Fed raised the rate by 75 points as expected by most, but this caused a relief rally in risk-sensitive assets. Powell also expressed his willingness to increase the rate further. Nor did he rule out further abnormal steps if.

July 28, 2022

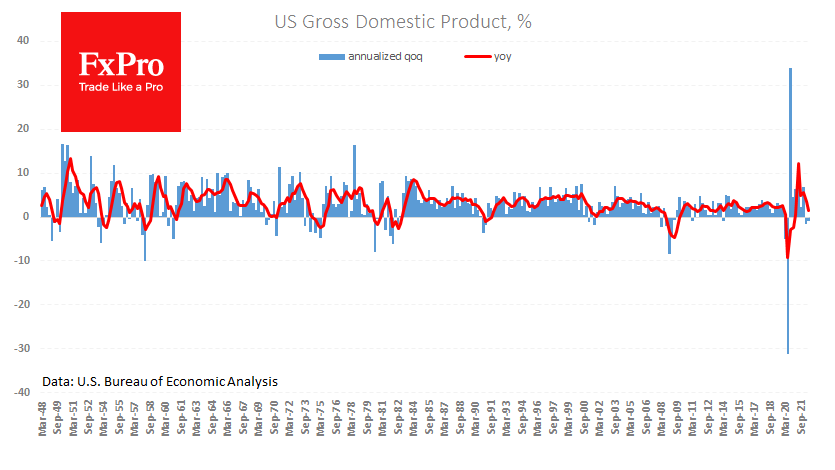

The US economy slipped into a technical recession. Preliminary estimates for the second quarter recorded a fall of 0.9% after a decline of 1.6% (seasonally adjusted data annulled). Despite the frightening figures in the headline, the US economy has lost.

July 27, 2022

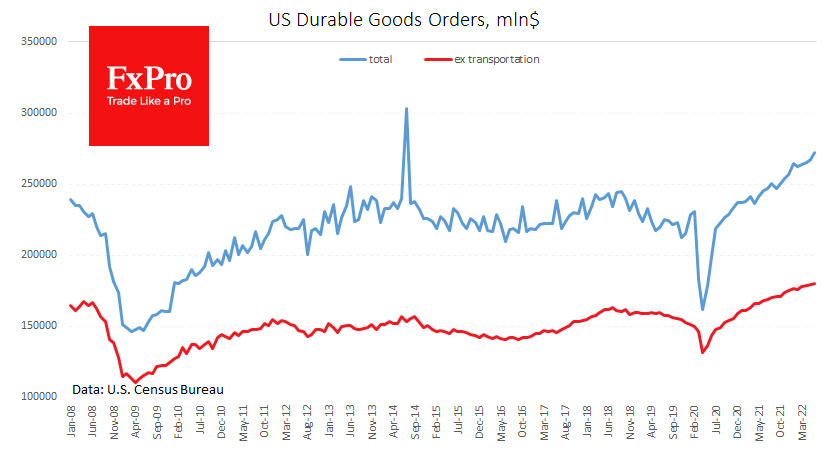

A new set of US economic data has dispelled worries after yesterday’s new home sales figures. Preliminary estimates showed that orders for durable goods, instead of the expected 0.5% decline, rose by 1.9% in June after rising by 0.8% a.

July 27, 2022

On Wednesday, 27th of July, at 18:00 GMT, the Fed will release its monetary policy decision, including the interest rate and the QE programme. The news is expected to cause a surge of volatility in the USD and across the.

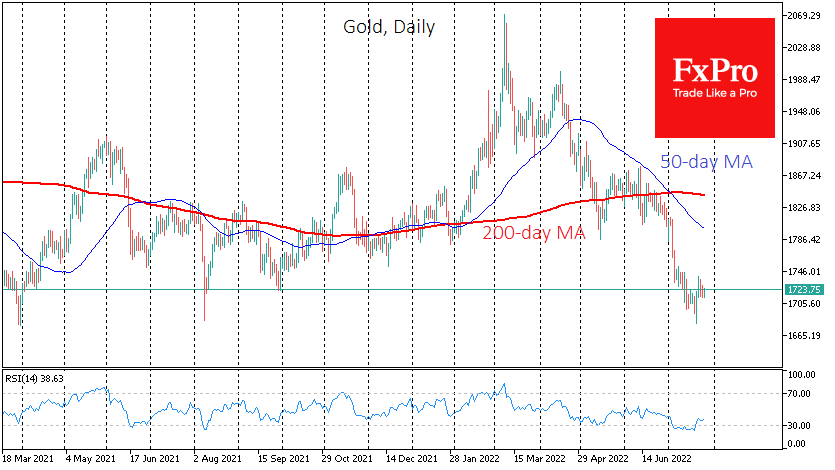

July 27, 2022

Gold is holding steady ahead of the FOMC rate decision. Such a lull is often the prologue to a good move. Gold has been moving in a broad sideways loop of $1680-$2070 after solid gains for almost two years. At.

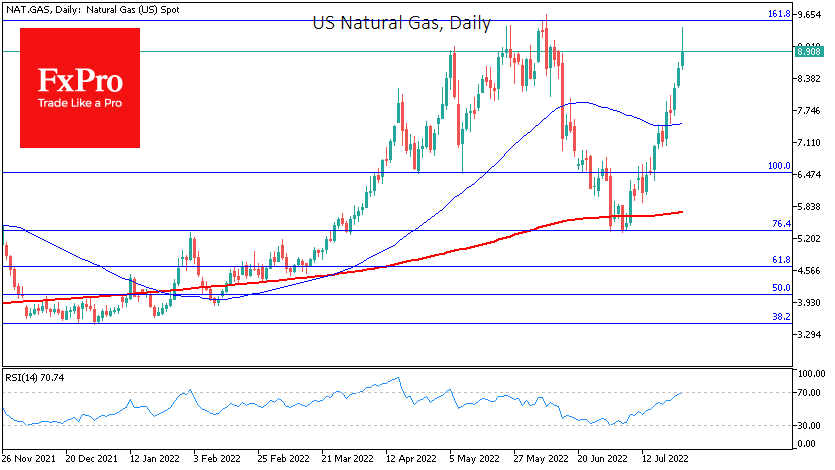

July 26, 2022

The gas story is in no hurry to leave the news headlines, and prices for the energy sector are behaving accordingly. In Tuesday’s trading in Europe, prices returned to the psychologically crucial round level of $2,000 per 1,000 cubic metres.

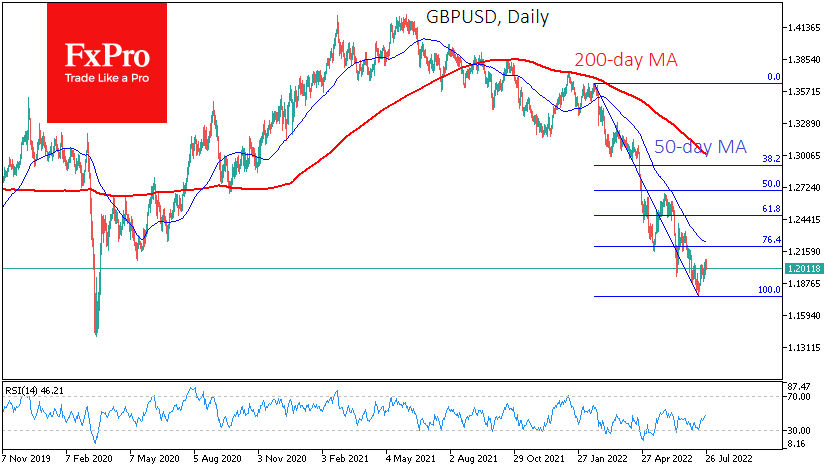

July 26, 2022

The British Pound is back above $1.2000, while FTSE100 is knocking on its 200-day moving average from below, testing the 1.5-month high area. The combination of a rising Pound and FTSE deserves attention, as this is often a sign of.