Yen could fall to as low as 150

September 06, 2022 @ 13:14 +03:00

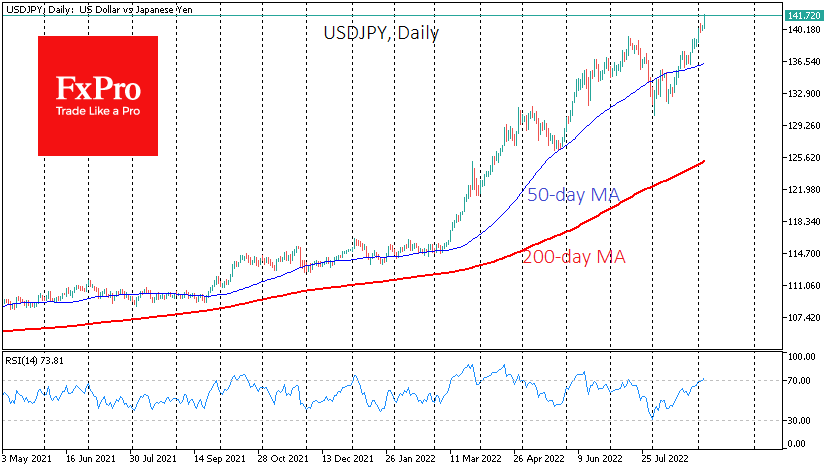

The Japanese yen is renewing 24-year lows against the dollar, and so far, policymakers have no safe tools to stop this decline.

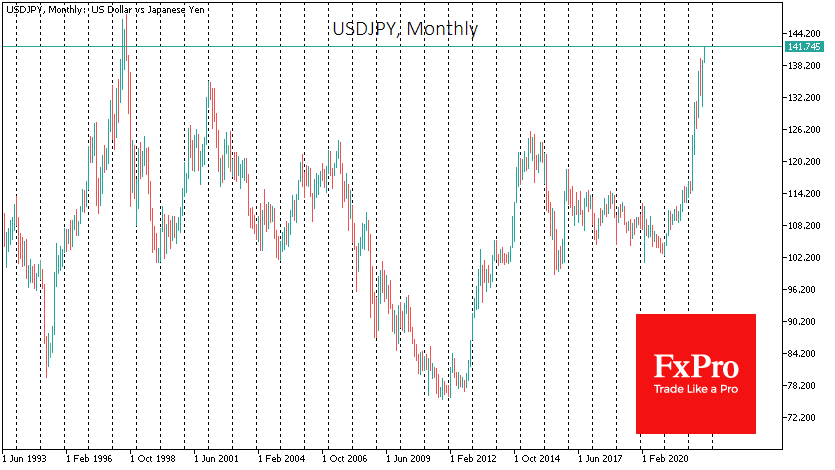

The USDJPY was above 141 on Tuesday morning, last seen in the first half of 1998. At the time near these levels, the Japanese Ministry of Finance intervened in the FX market to stop the collapse of the national currency in a few months. In 1990 it took the USDJPY about three quarters to move above 140 and was a corrective rebound. The pair have not traded consistently above current levels since 1987.

The current pair’s values are almost twice as high as the lows of 2011, which underlines the historical reversal in several directions.

The USDJPY have a tight correlation with the spread between the US and Japan bond yields. As Japan targets yields on its debt market curve, US bond yields are the only variable in the equation. The latter is rising at an unprecedented rate. The Fed only adds fuel to the fire to suppress inflation as quickly as possible and not let inflationary expectations take root.

That said, there are no signs yet that inflation in Japan is recovering. It might sound surprising, but the latest data shows that the rate of wage growth in July has slowed to 1.8% compared to 2.0%. Household spending rose by 3.4% YoY, but this is a weak result compared to 3.5% a month earlier and the expected 4.5%.

Sluggish economic growth and the need to service government debt of roughly 200% of GDP reduces the room for manoeuvre for the Bank of Japan, as a high key rate would multiply the government debt service costs. Sluggish inflation and consumer spending figures also remove the need for tightening monetary policy.

The USDJPY has likely crossed the informal line near 135, entering a deeper decline phase. Suppose the weakening of the yen continues in a relatively calm regime. There may not be any significant stops and turns before 150 (the psychologically important round level) or even 160 (near peak in 1990).

The FxPro Analyst Team