Market Overview - Page 93

October 5, 2022

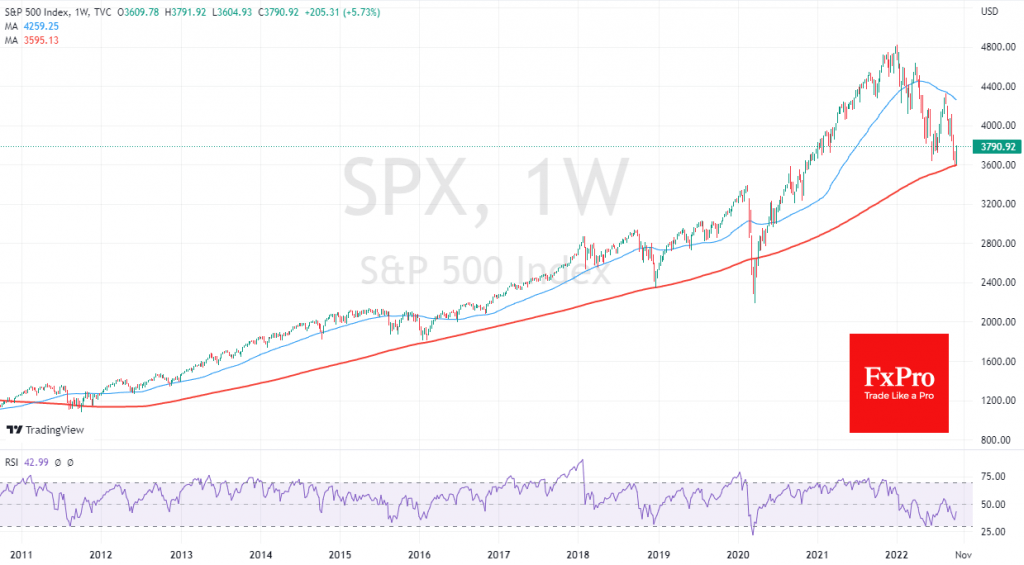

S&P500 index futures are trading 6% above the lows set at Monday’s start of the day. Such a solid start for the new month, quarter and financial year in the US is helped in no small part by the low.

October 4, 2022

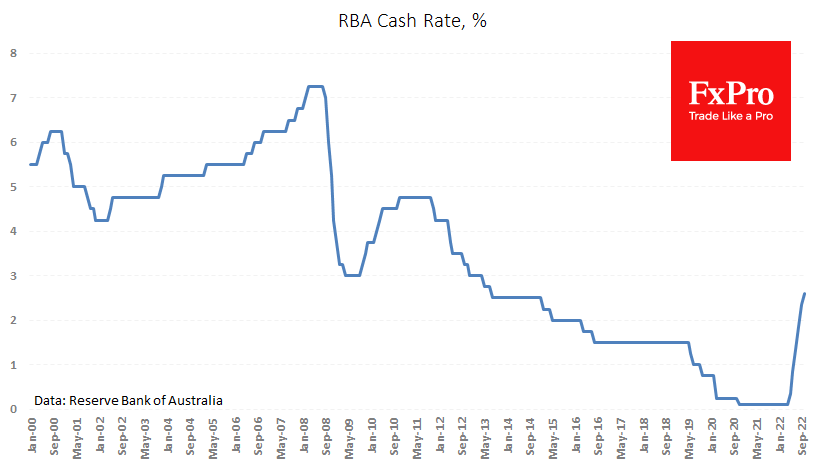

The Reserve Bank of Australia raised its rate by 25 points to 2.6%, against an expected increase to 2.85%. Previously, the rate had been hiked by 50 points four times since June. The same decision was also predicted by the.

October 4, 2022

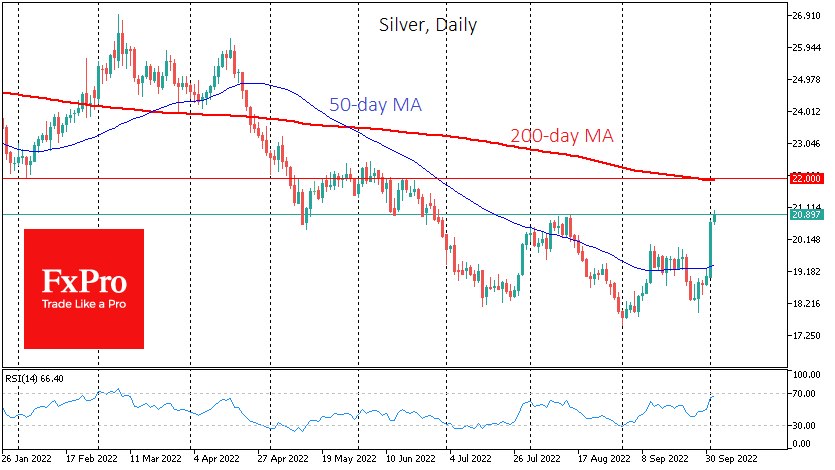

The precious metals have shone again in the last seven days. Gold has gained over 5% in that time, while Silver gained 18% from last Wednesday’s low, including yesterday’s 8% surge. Such a powerful uptrend encourages thoughts of a reversal.

October 3, 2022

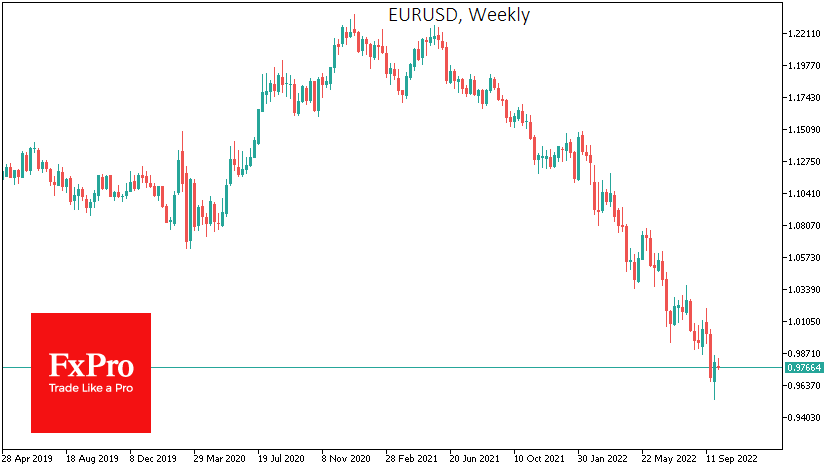

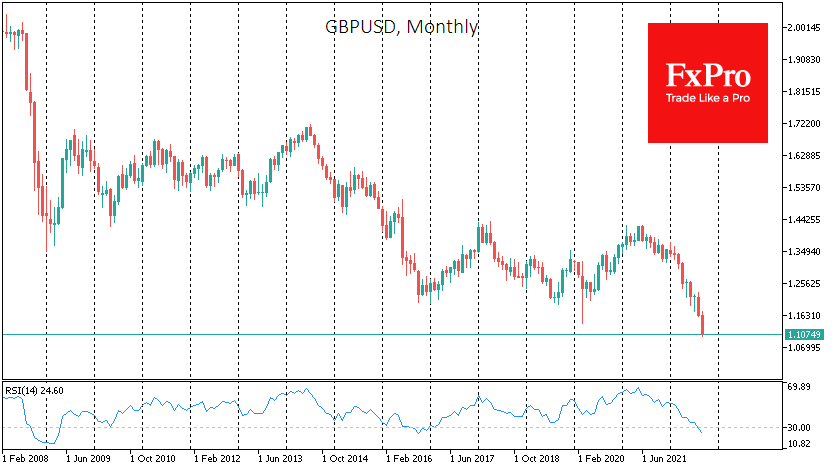

EURUSD, the world’s most liquid currency market pair, ended September down 2.5%, having consolidated below parity. A combination of technical and fundamental factors raises the chances of a rebound in the pair, potentially translating into long-term growth. Last week ended.

September 30, 2022

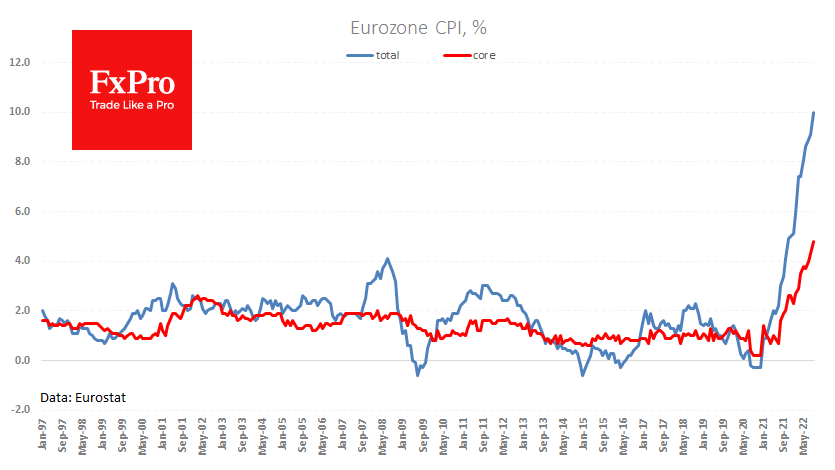

According to a preliminary Eurostat estimate, overall inflation in the euro area reached 10% y/y in September. The growth rate accelerated sharply from 9.1% a month earlier and is notably above the forecast 9.7%. An additional concern for the ECB.

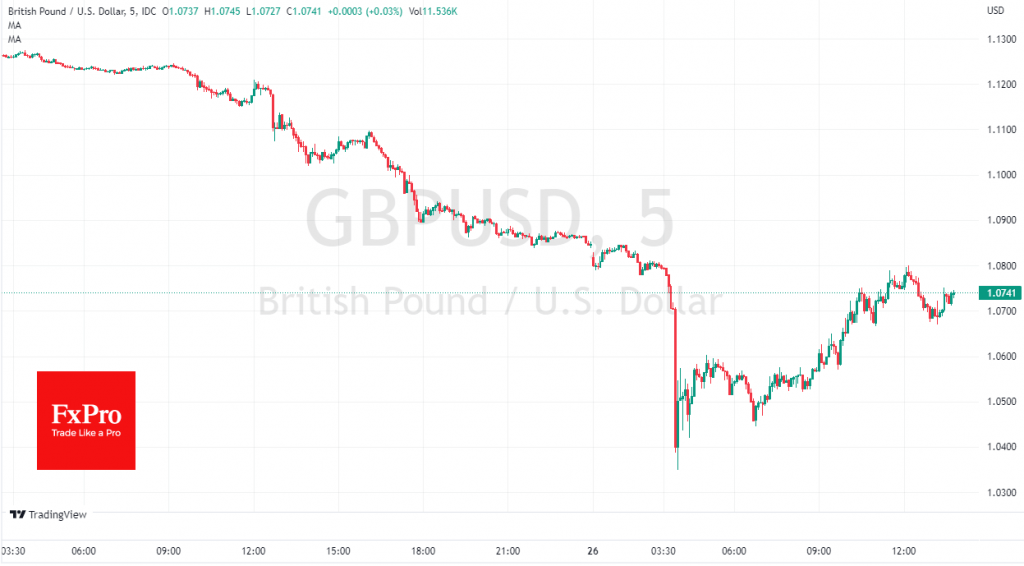

September 30, 2022

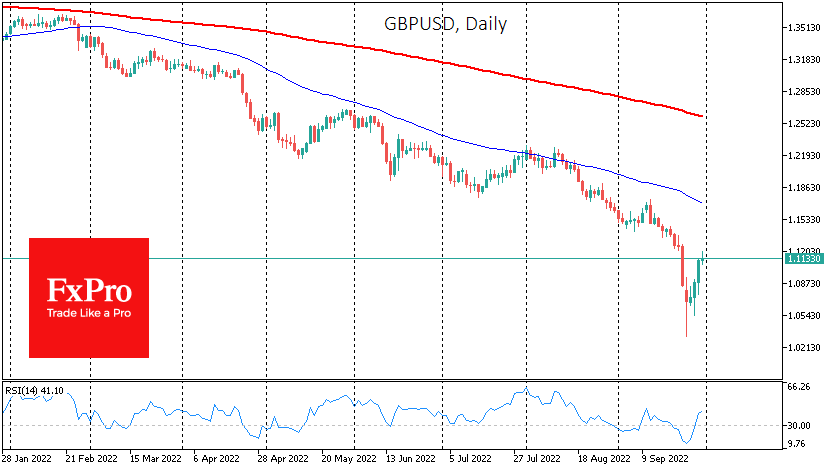

While some berated the UK government for collapsing the Pound on the government’s plans to cut taxes, others were buying the British currency. The Pound’s movement on Friday and Monday looks like a classic capitulation, often a precursor of a.

September 27, 2022

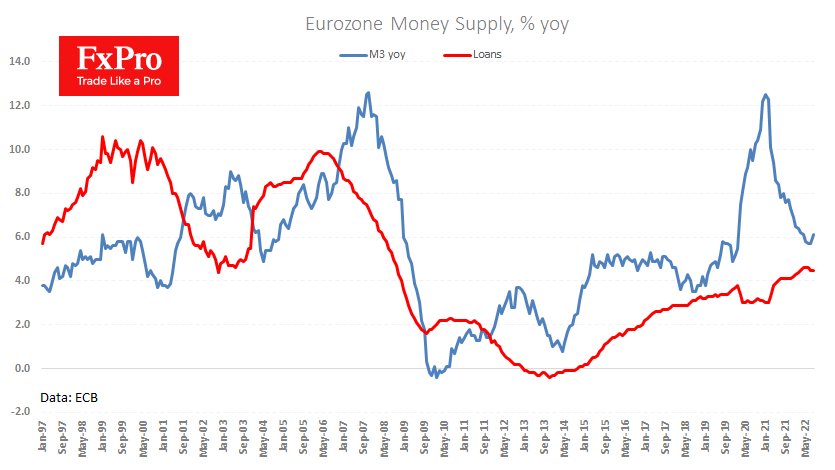

The trend of relentless sliding economic indicators in the eurozone paused today with the publication of money supply and private lending indicators. Monetary aggregate M3 showed a 6.1% y/y increase in August compared to 5.7% a month earlier and the.

September 27, 2022

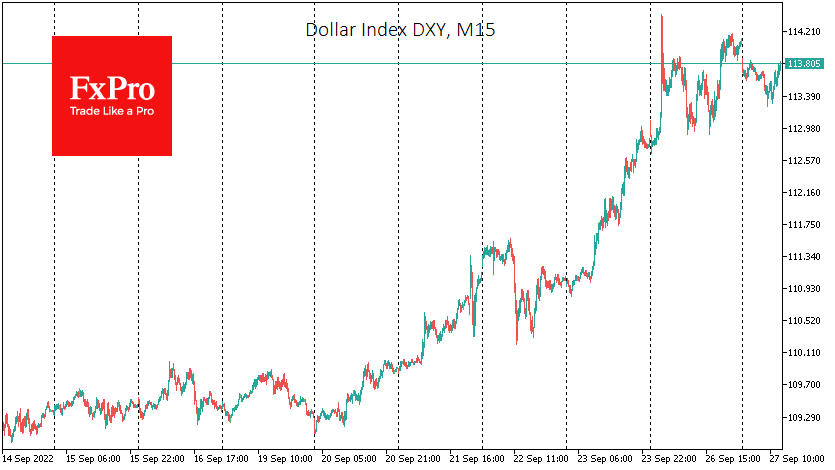

The US dollar is under some pressure on Tuesday morning, which can be attributed to the dollar’s local profit-taking after substantial gains on previous days. European equities and US index futures are also getting some relief, pulling back from lows..

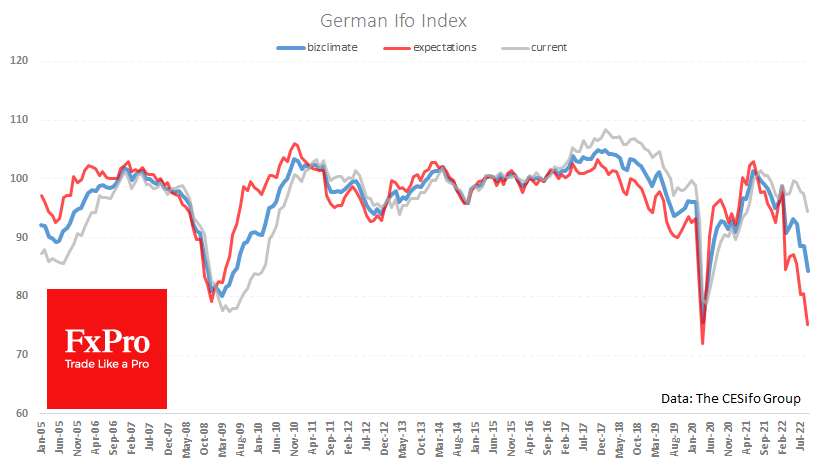

September 26, 2022

Business sentiment in Germany continued its substantial deterioration in September. The Ifo says the business climate index fell from 88.6 to 84.3 this month. The index has only been lower for two months in its history – in April and.

September 26, 2022

Last week, we said there has not yet been a final capitulation in many markets. However, we have seen such a capitulation in the pound, often followed by global market reversals. We could see both the interest of long-term investors.

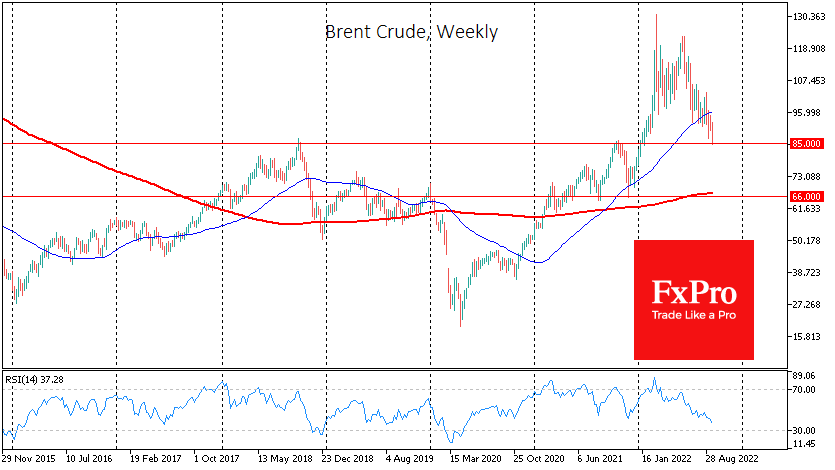

September 23, 2022

The dollar index surged more than 1% on Friday, putting marked pressure on oil prices, which are losing around 5% since the start of the day. A barrel of WTI is trading below $79, and Brent has fallen back to.