Market Overview - Page 92

October 13, 2022

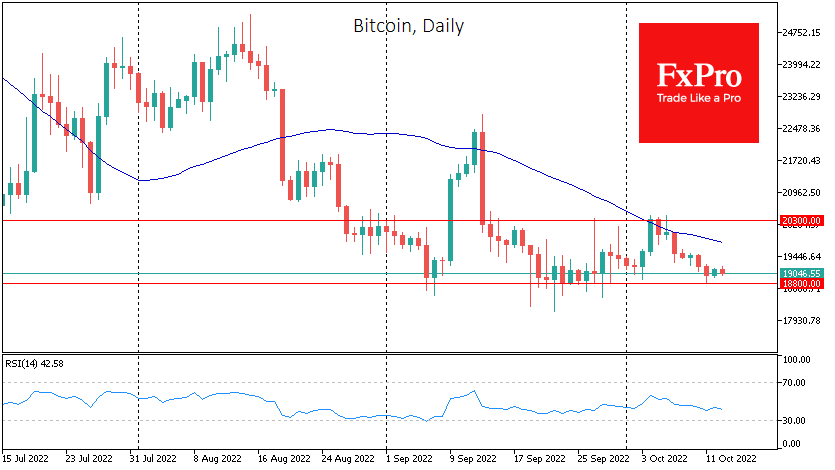

Market picture Bitcoin changed little over the day, remaining near $19.1K as the external outlook turned bleak, but there was no positive change either. Ethereum is trading near $1300, but the top altcoins are mostly down, losing between 0.2% (Tron).

October 13, 2022

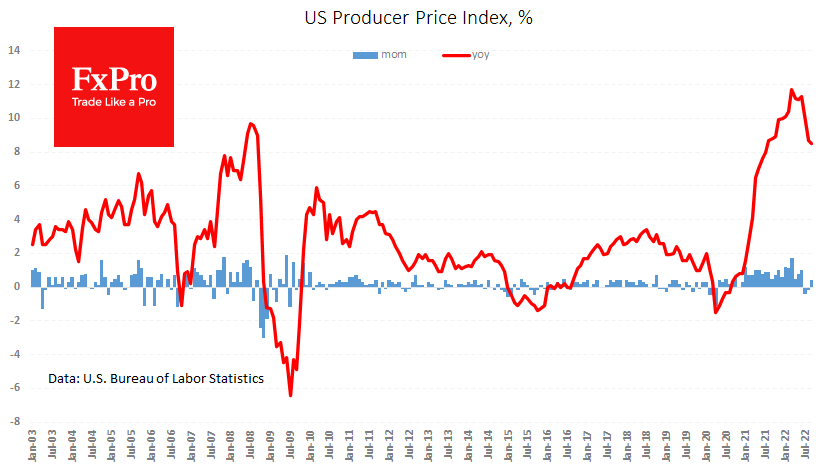

US producer prices rose 0.4% m/m, stronger than 0.2% as expected. The annual inflation rate remains on a slowing trend at 8.5% in September compared to 8.7% a month earlier. The core price index slowed from 7.3% y/y to 7.2%,.

October 12, 2022

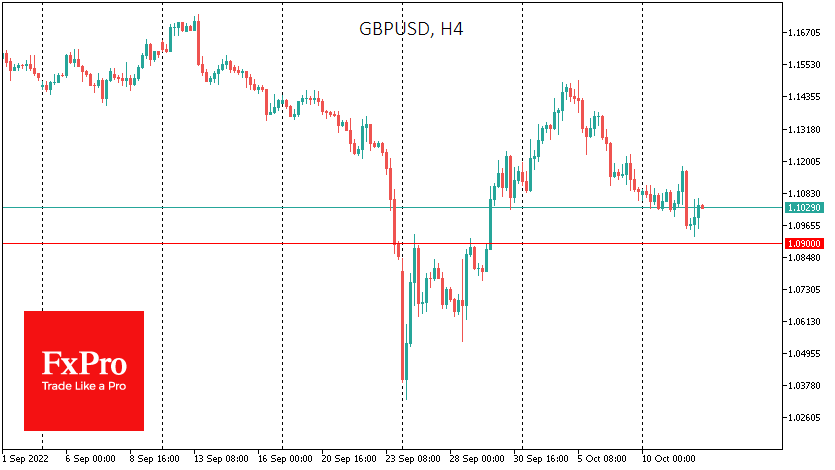

The Bank of England’s frenzy of emergency bond market support is rocking the currency market boat, leaving GBPUSD as one of the protagonists on FX. The Bank of England extended emergency support to the debt market yesterday to include inflation-linked.

October 11, 2022

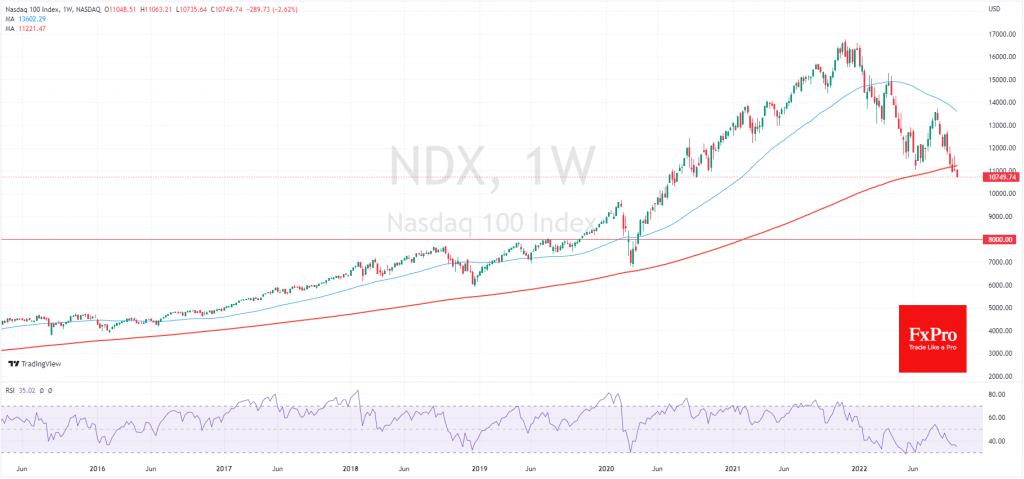

Nasdaq100 has a very similar pattern to what happened in the early 2000s, and the Fed’s behaviour adds to the story. In a decisive move downwards, the Nasdaq100 closed the third quarter (and the fiscal year in the USA) below.

October 11, 2022

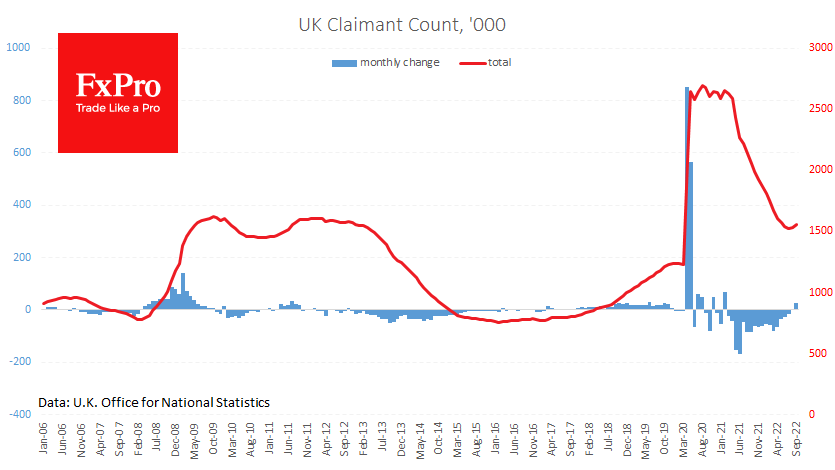

A fresh batch of UK labour market data points to a turn for the worse, foreshadowing an economic slowdown sooner than in Europe or the USA. The claimant count in September rose by 25.5k after a nominal increase of 1.1k.

October 10, 2022

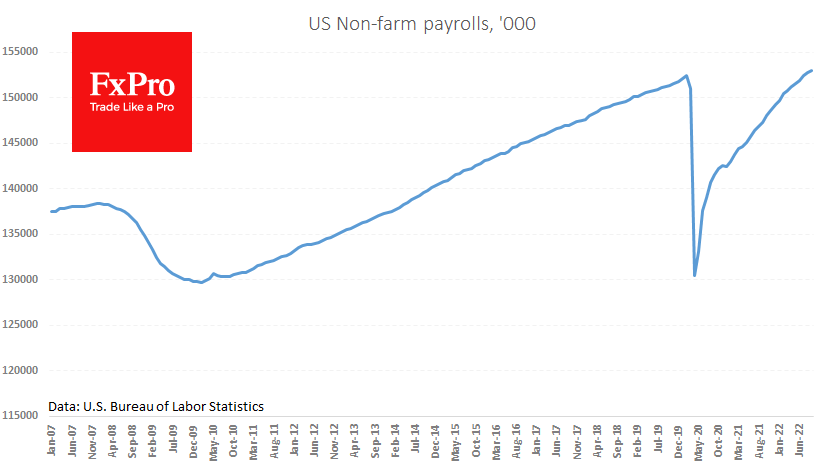

The US economy added 263K jobs in September – slightly above forecasts for growth of 250K-255K. The unemployment rate has returned to 3.5% after 3.7%, reversing concerns that there was already a sustained upward trend in the rate. We recall.

October 7, 2022

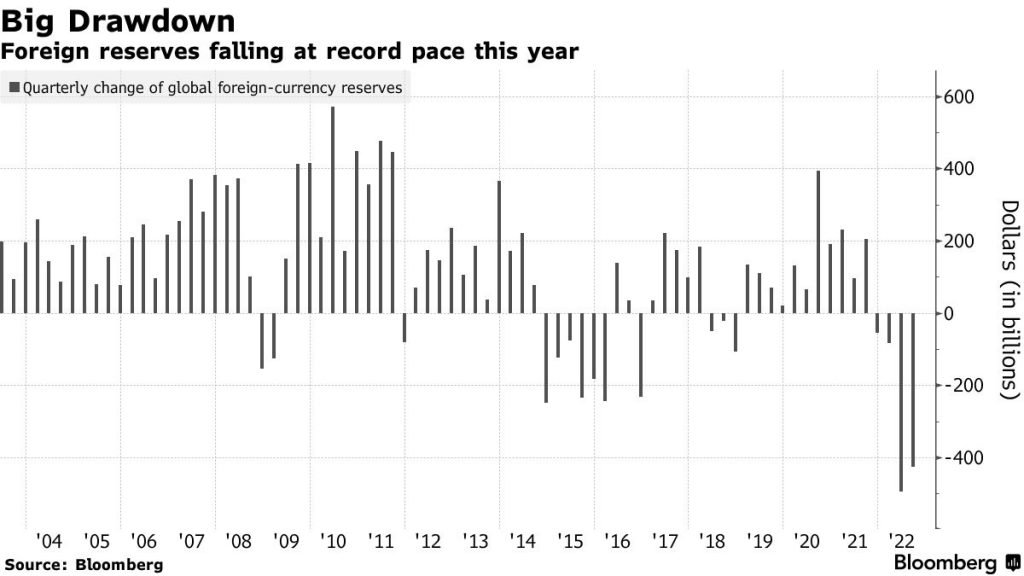

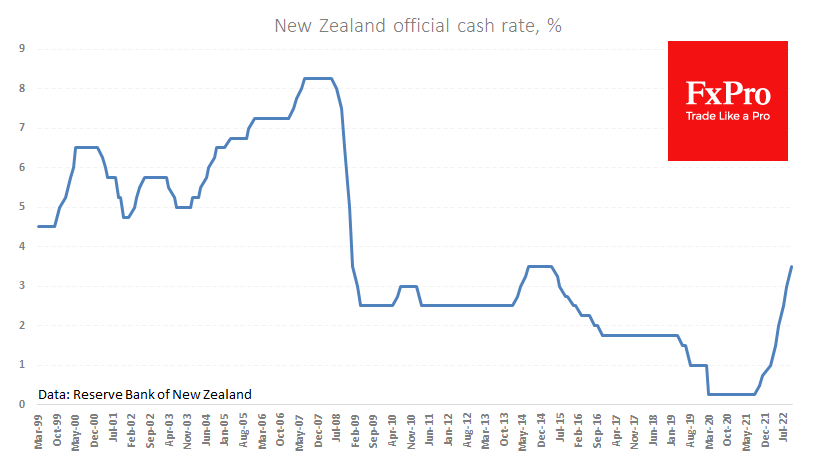

More and more of the world’s central banks are turning to currency interventions to keep their currencies from weakening. While each central bank is saving its currency, they are all working together to undermine the Dollar’s value by increasing its.

October 7, 2022

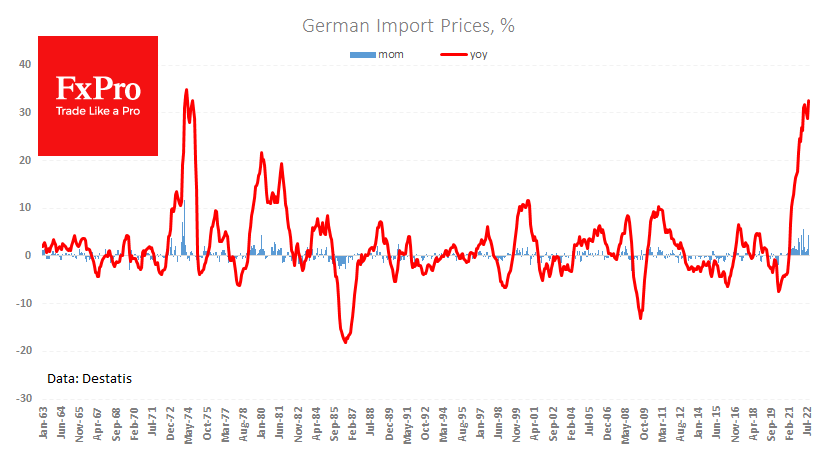

Import prices in Germany jumped by 4.3% in August, dashing hopes of waning inflationary pressures. The year-on-year growth rate has accelerated from 28.9% to 32.7%, marking a new record since 1974 – another consequence of the single currency’s weakness. Retail.

October 6, 2022

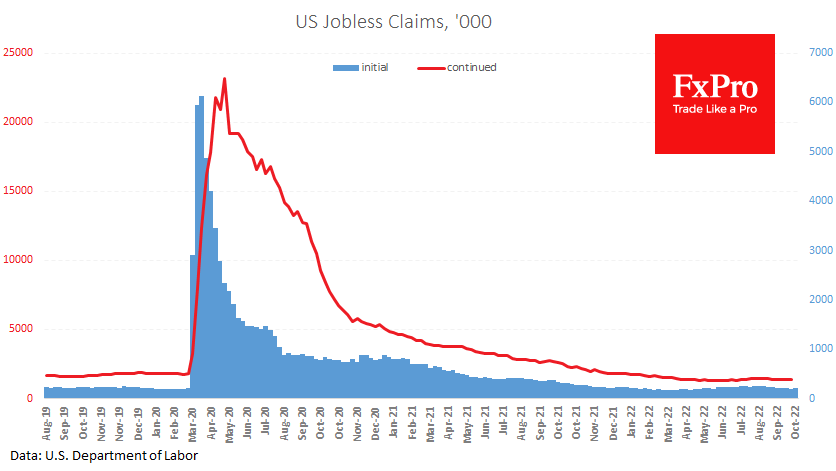

Weekly US jobless claims data is attracting the most interest from investors and traders when it precedes the publication of the monthly payroll report. Today’s released data came in below expectations, showing 219K Initial Claims for the previous week against.

October 6, 2022

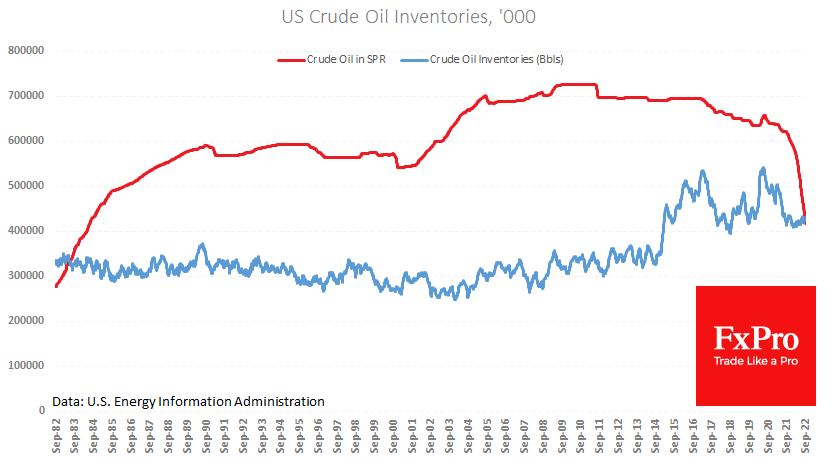

Oil has been in a downward trend since the beginning of June, but in the last two weeks, we have seen excessive efforts by politicians working in favour of oil in the short term, setting up a rebound. OPEC+ unexpectedly.

October 5, 2022

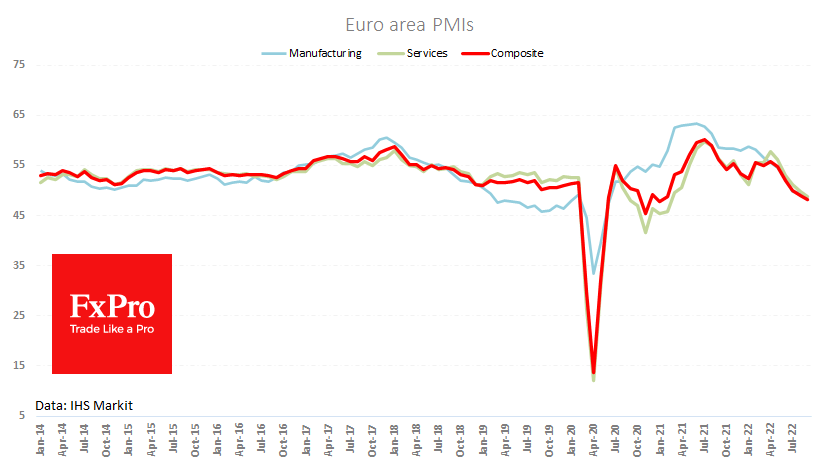

The final estimates of business activity in the euro region were weaker than expected and indicated a further business activity drop. The composite index fell to 48.1 in September from 48.9 a month earlier. Values below 50 indicate the eurozone.