Market Overview - Page 91

October 24, 2022

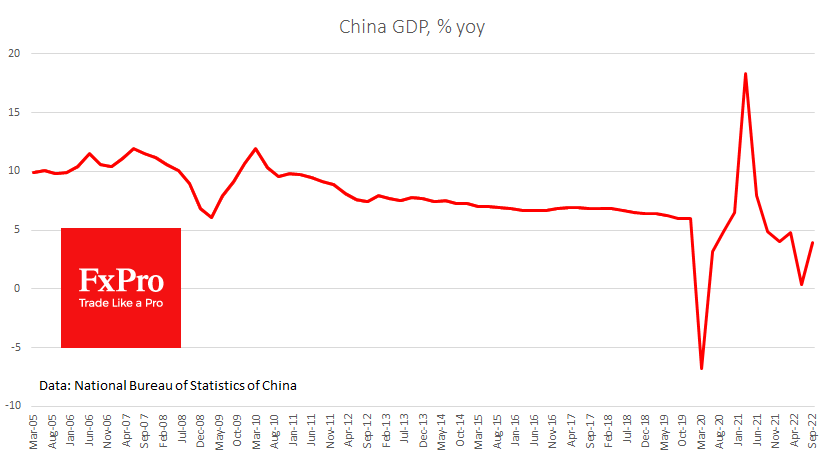

After a delay related to the Communist Party congress, China published a batch of monthly and quarterly statistics, which caused mainly disappointing reactions from analysts. GDP added 3.9% in the third quarter compared to a year earlier against expectations of.

October 21, 2022

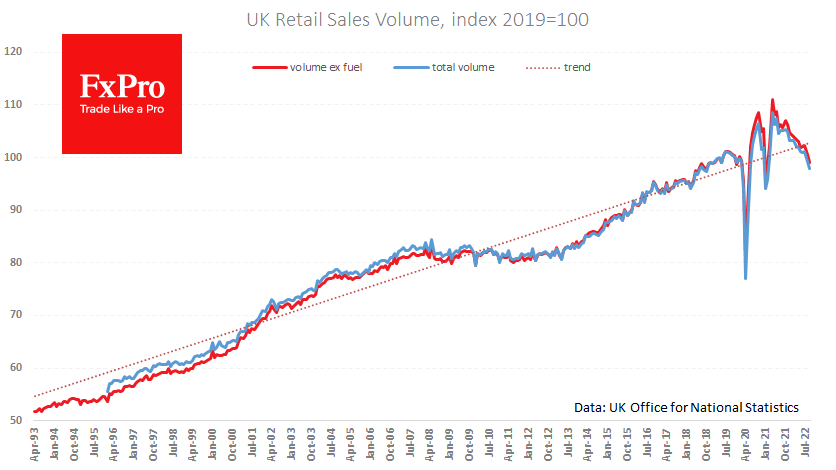

As if the political storm hitting the UK was not enough, macroeconomic data is also not encouraging markets, adding pressure to the country’s assets. GBPUSD is losing more than 1.4% since the start of the day on Friday, back below.

October 21, 2022

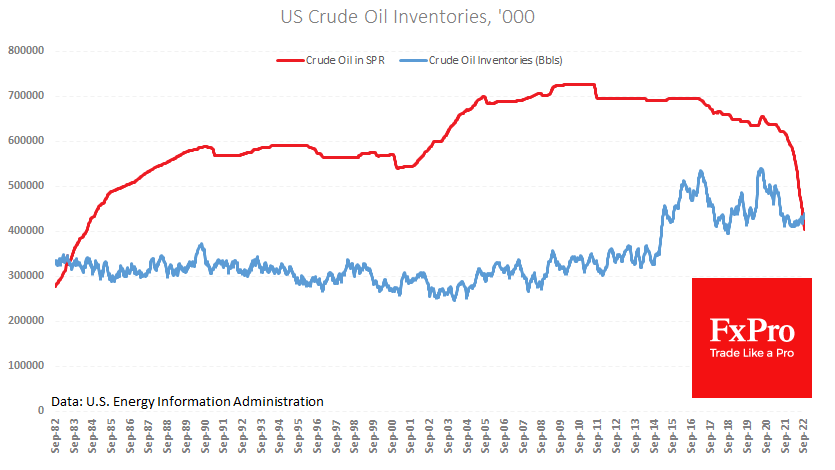

Oil failed on Thursday in another attempt to return to an upward trend. Overall sales wiped out the surge in the first half of the day at the end of the day. This market dynamic is a clear sign that.

October 19, 2022

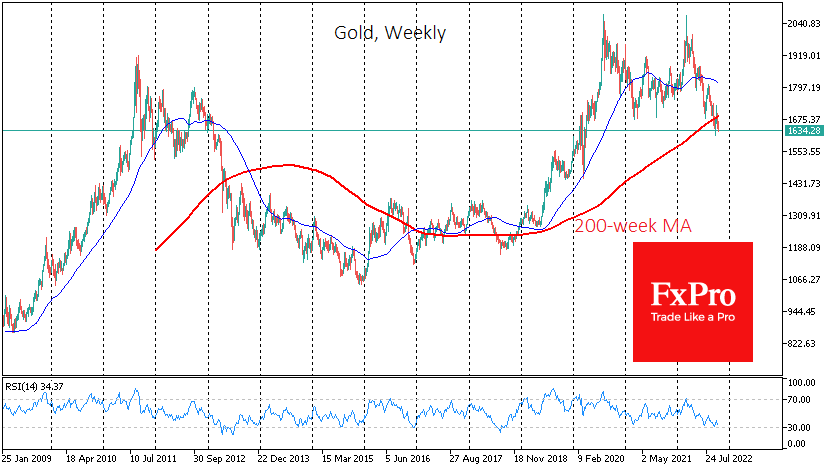

Gold is down more than 1% on Wednesday and 5.5% in the last two weeks, failing to find any firm buying support after taking off at the end of September. Declining almost daily over the previous two weeks, it wiped.

October 19, 2022

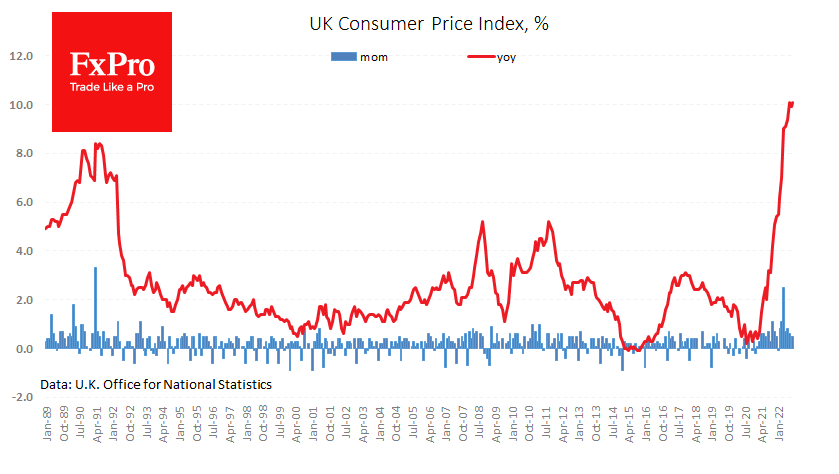

The portion of the UK inflation data showed that the problem is in no hurry to recede. The consumer price index returned to 10.1% y/y, changing hopes that the trend had already reversed. The retail price index is climbing further.

October 18, 2022

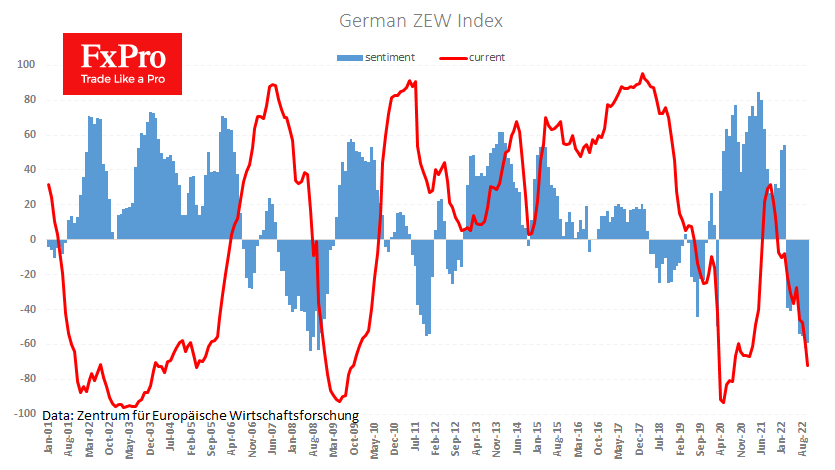

The German ZEW Economic Sentiment index unexpectedly improved in October, marking an increase from -61.9 to -59.2, whereas it had been expected to dip even deeper to -66.7. The index shows some signs of stabilisation, dropping to the same territory.

October 18, 2022

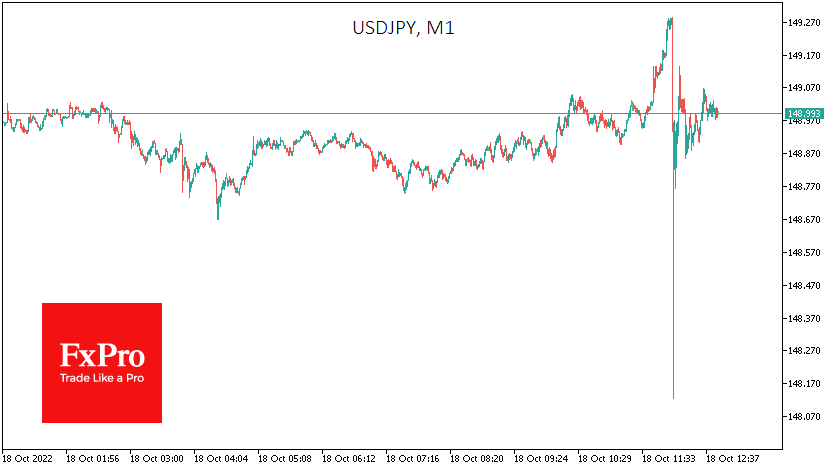

The exchange rate of the Japanese yen to the dollar is renewing its 32-year lows since the beginning of the week, and there is no end to the move. The USDJPY has touched and exceeded 149 and has gained about.

October 17, 2022

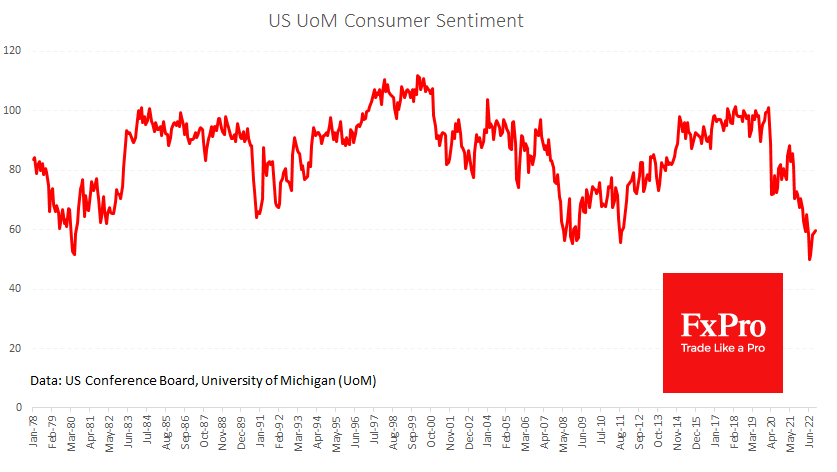

Last week brought two inflation surprises to the US markets. The first was the sensational CPI data for September. But on Friday evening, we turned our attention to another equally important indicator, inflation expectations. The University of Michigan Consumer Sentiment.

October 17, 2022

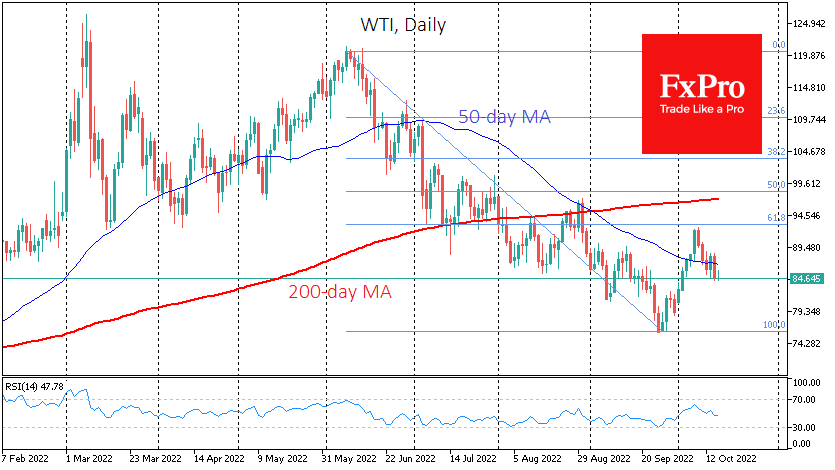

Three weeks ago, oil started a 22% rally due to OPEC+ production cuts and bounced back after being technically oversold. However, the 8% drop in quotations last week showed that bears still dominate this market, which several technical factors can.

October 14, 2022

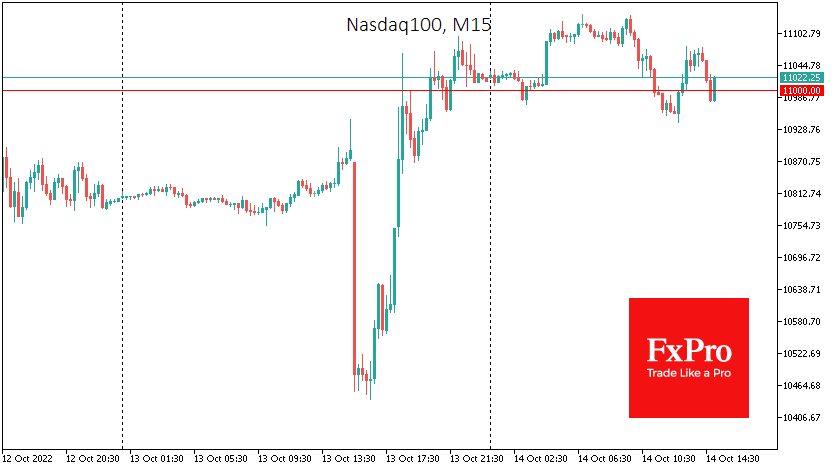

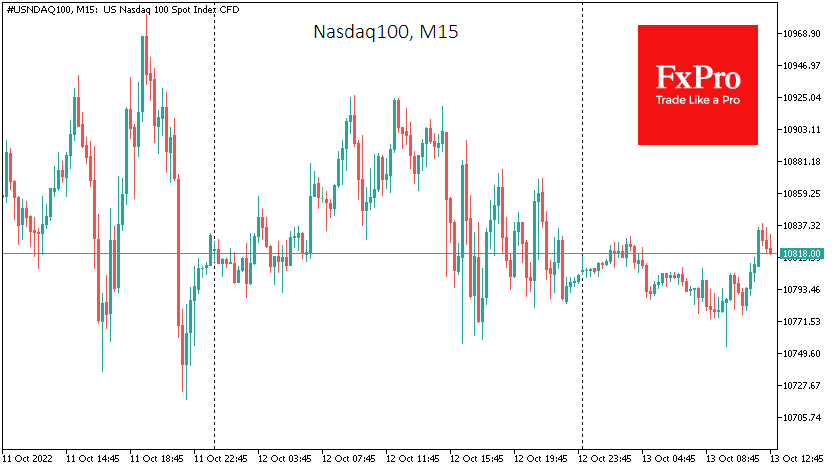

Thursday’s performance in crucial US equity indices appeared to be the long-awaited reversal pattern: a long decline, final capitulation on bad news, and strong reversal for no apparent reason. The Nasdaq100 index is up more than 6.5% from its intraday.

October 13, 2022

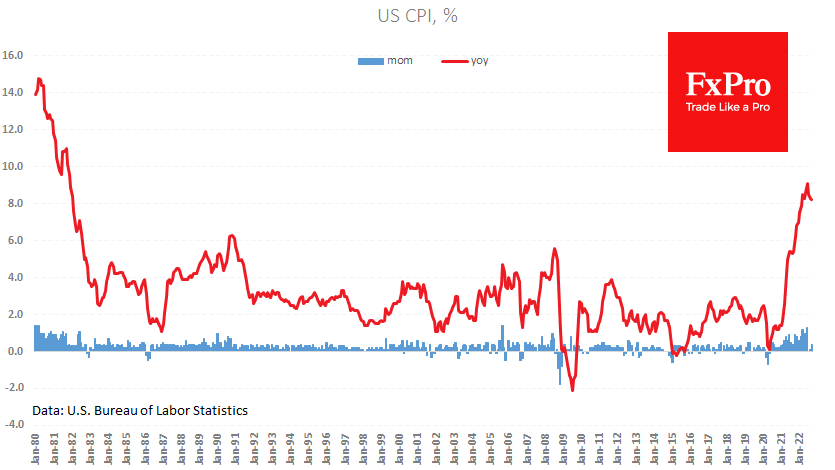

U.S. consumer prices added 0.4% in September, versus a forecast of 0.2% and an increase of 0.1% a month earlier. Annual inflation slowed from 8.3% to 8.2% versus the expected 8.1%. Yesterday’s more vital producer price readings suggested the possibility.