Cooling US housing market

November 17, 2022 @ 18:22 +03:00

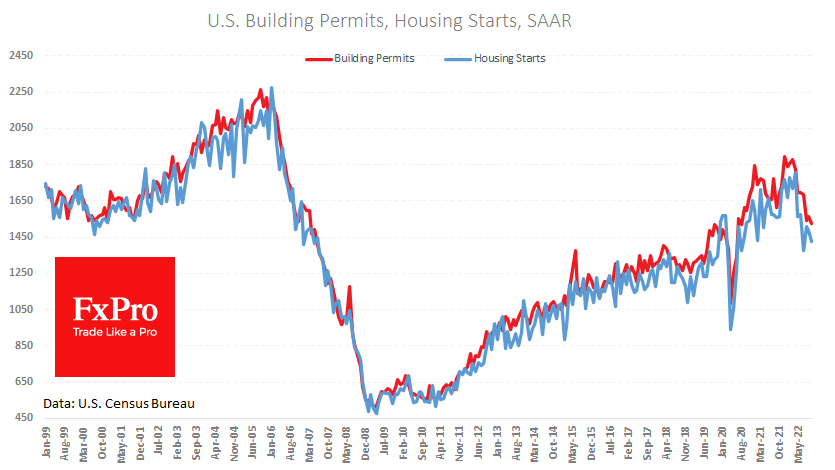

The number of building permits in the US fell by 2.4% to 1,526K, the lowest since June 2020, and is almost 20% below the peak a year ago. Housing starts fell by 4.2% to 1,425k.

During the pandemic, the housing market first collapsed due to lockdowns but then took flight, inflated by monetary and fiscal stimulus. This year, in addition to the halting of financial support programmes and another budgetary stimulus, Americans are dealing with the fastest rate of monetary tightening in 40 years, returning mortgage rates close to their 2007 peaks.

The market is pretty good, considering such meaningful fundamental shifts. But we note that the market is deflating at a pace comparable to the mortgage crisis, which began in 2006 and continued through 2009. Then it took about a year and a half of declines before the banking industry collapsed, and the Fed went from raising rates to lowering them.

October’s reading looks slightly better than expected and has briefly boosted demand for the dollar and renewed the momentum of the declining stock markets. It slightly increases the chances that the Fed, although slowing the rate hike, is still far from stopping.

The FxPro Analyst Team