Market Overview - Page 90

October 31, 2022

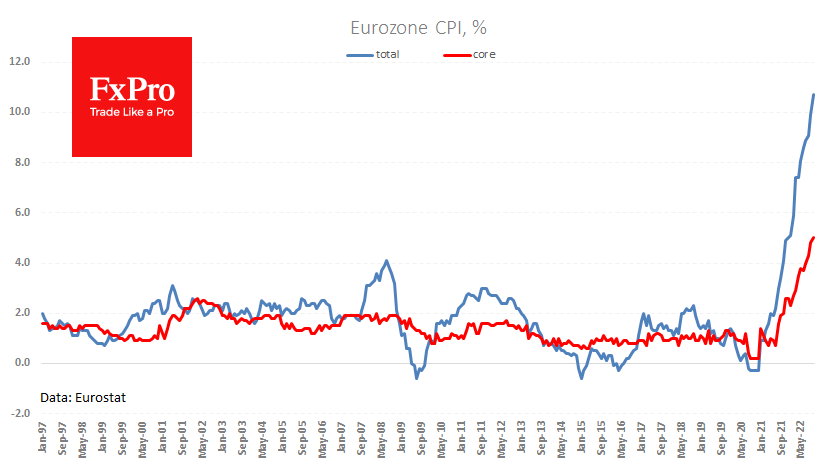

Eurostat’s preliminary estimate indicated an acceleration of annual inflation in the euro region from 9.9% immediately to 10.7%. Economists, on average, expected no change, and this difference of 0.8 percentage points is one of the most prominent indicators economists predict.

October 31, 2022

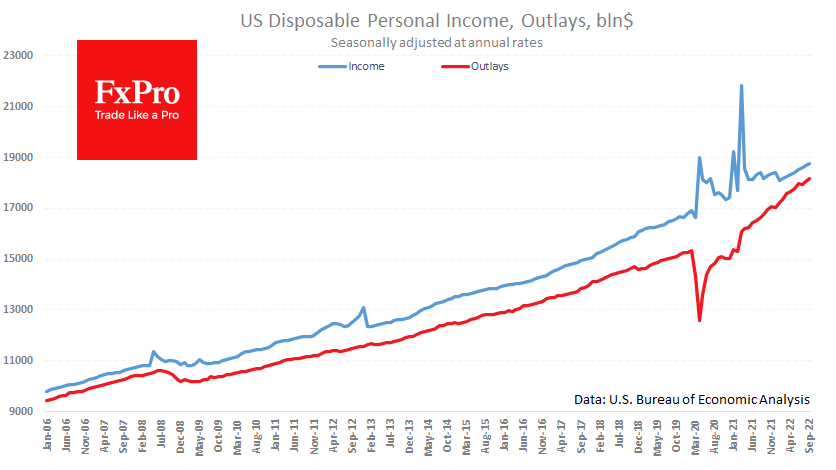

Americans’ Personal spending rose 0.6% in September, the same as a month earlier, while income growth was up 0.4% in each of the two months. Total earnings grew 5.2% YoY, as did earnings, whereas due to a cutback in tax.

October 28, 2022

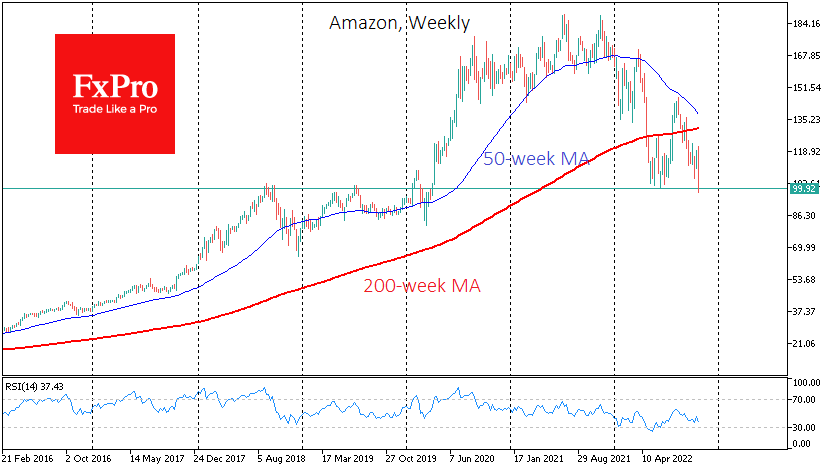

Markets will likely remember this week as uncrowning of Techs. On Friday, the failures of Meta, Google, Alphabet and Microsoft were joined by Amazon, whose shares lost more than 20% at one point after the quarterly report. The only bright.

October 28, 2022

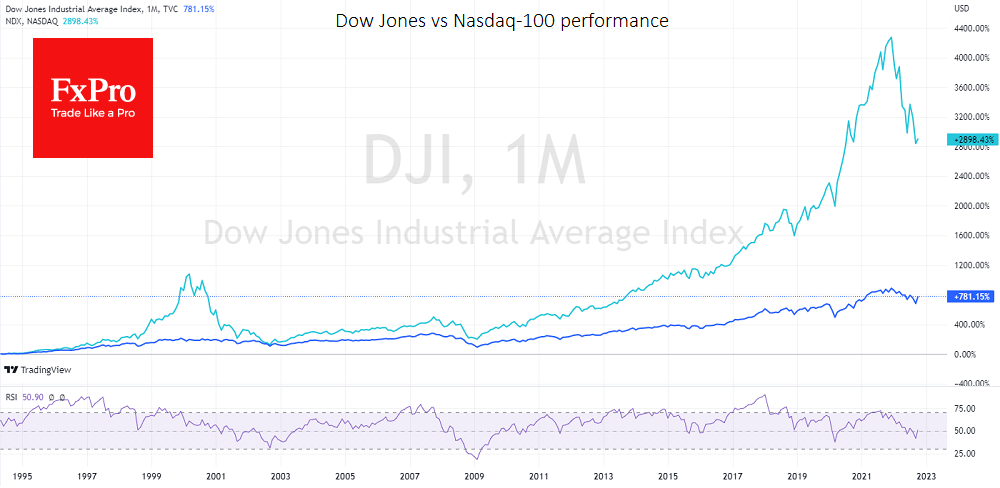

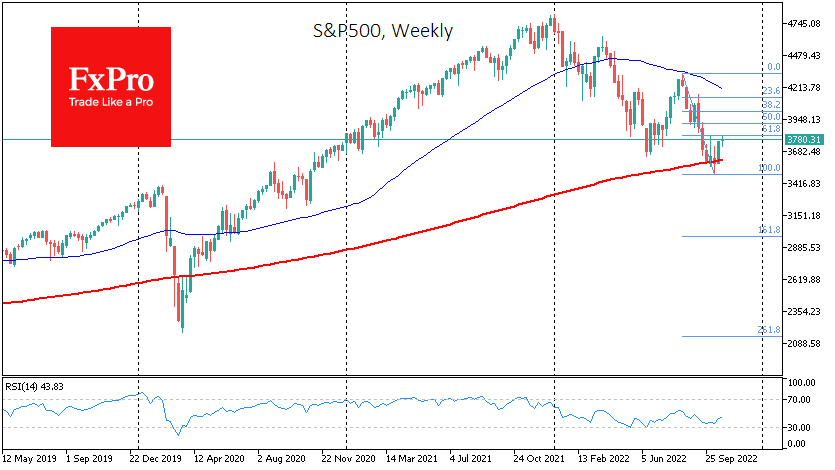

The Dow Jones is up 4.6% in the past five days versus 0.7% for the Nasdaq-100. And this divergence in momentum may continue as long as monetary authorities remain in the regime of containing inflation rather than pushing it up.

October 27, 2022

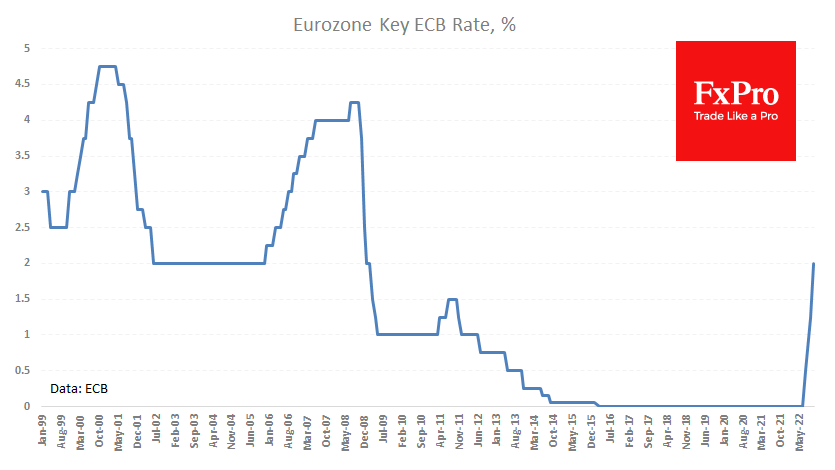

As most observers assumed, the ECB raised its key rate by 75 points to 2.0%. These are low rates by modern standards, but the eurozone last saw such rates 14 years ago. Furthermore, the central bank indicated its intention to.

October 27, 2022

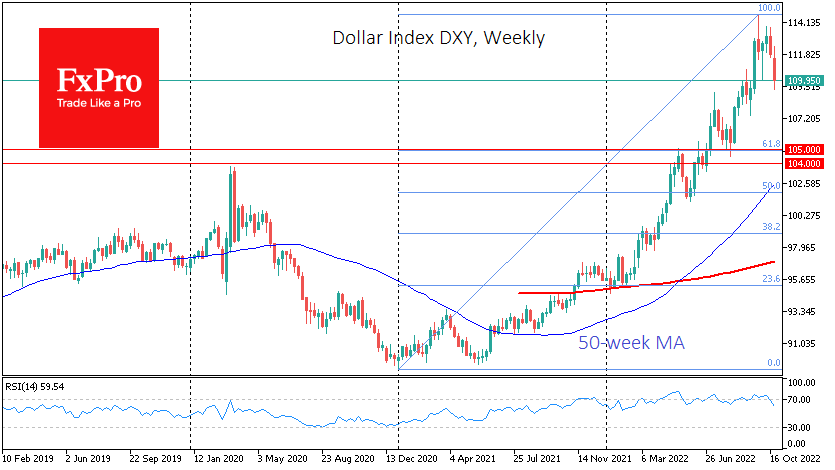

As we previously warned, major central banks worldwide that hold massive amounts of dollar securities are stepping up interventions to support their national currencies. On Wednesday, China, Japan, and Switzerland resorted to such measures. The UK and India used earlier.

October 26, 2022

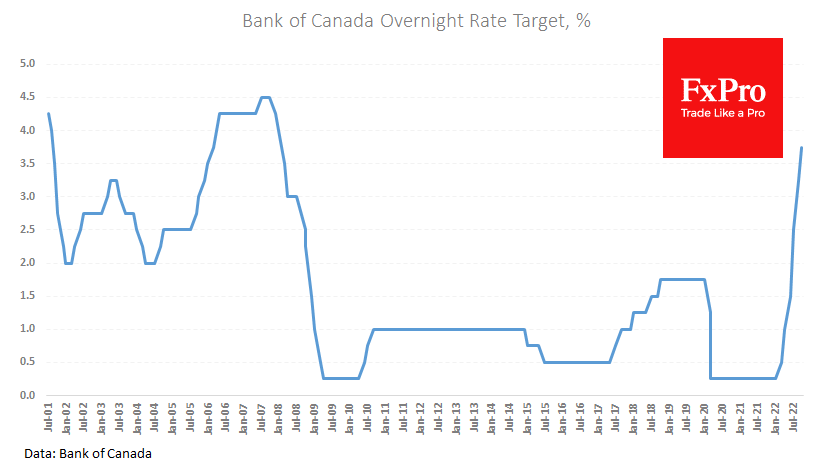

There was an important signal today that monetary authorities in North America are ready to ease the pace of policy tightening faster than the market expects. The Bank of Canada raised the rate by 50 points to 3.75%, although analysts,.

October 26, 2022

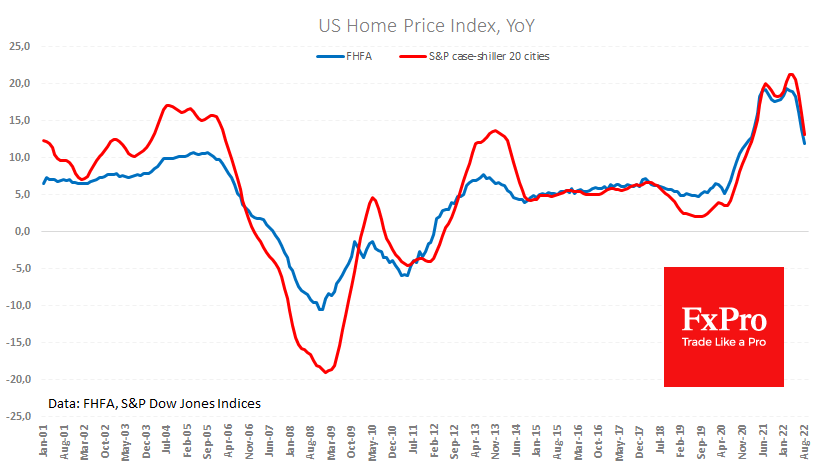

The US housing sector has entered a cooling down phase, giving rise to sometimes very alarmist comments that this is the beginning of a significant collapse, comparable to the failure during the global financial crisis. But we don’t tend to.

October 26, 2022

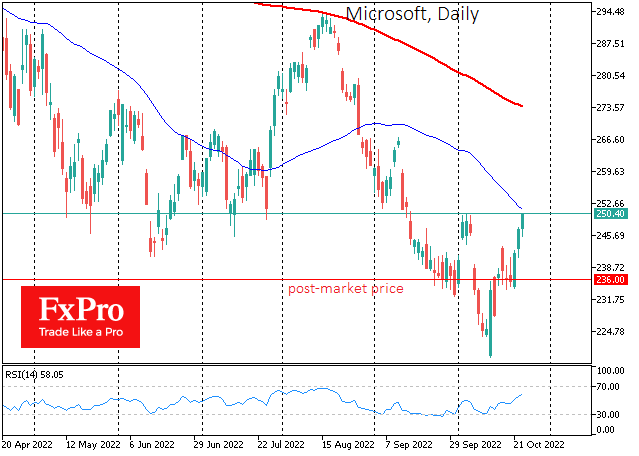

The technology companies that have acted as growth drivers for stock markets in recent years are increasingly losing their leading positions. Although it would be too naive to talk about the “beginning of the end” for the IT giants, the.

October 25, 2022

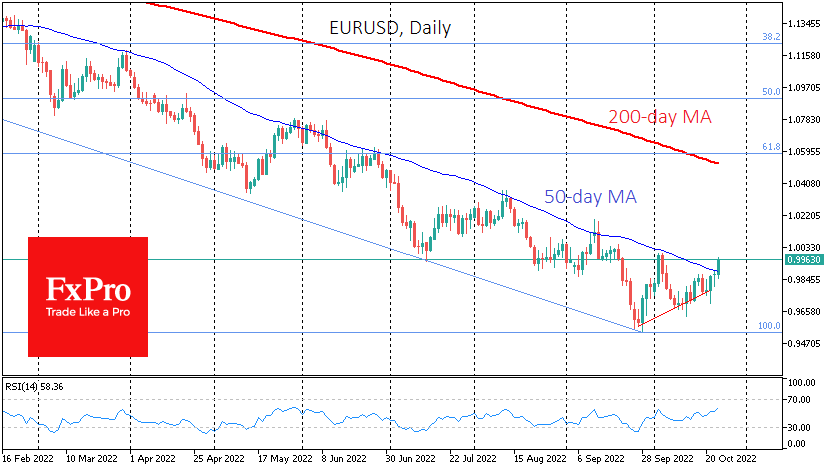

EURUSD continues to draw an almost perfect downward trend. Since the end of February, the 50-day moving average has repeatedly acted as resistance. This week we see another test of this line, which has fallen to the area of 0.9900..

October 25, 2022

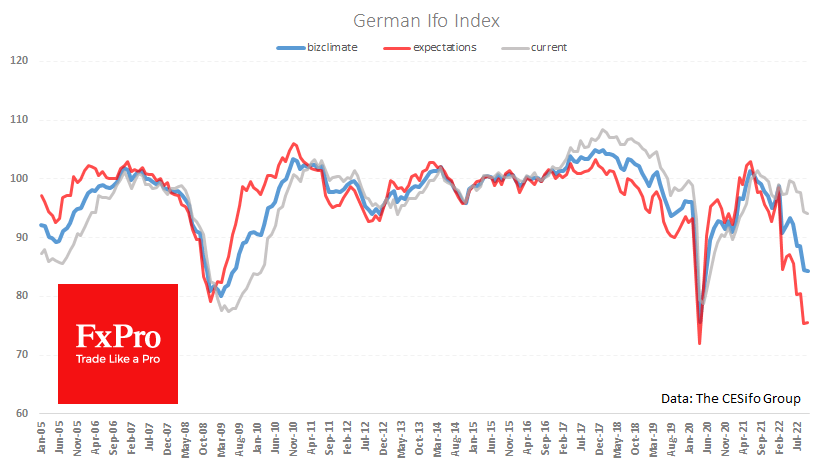

The Ifo Business Climate Index from Germany was above expectations in October – slightly down from 84.4 a month earlier to 84.3. The index components’ current situation and business expectations also marginally changed. But the overall level shows that the.