Market Overview - Page 9

November 6, 2025

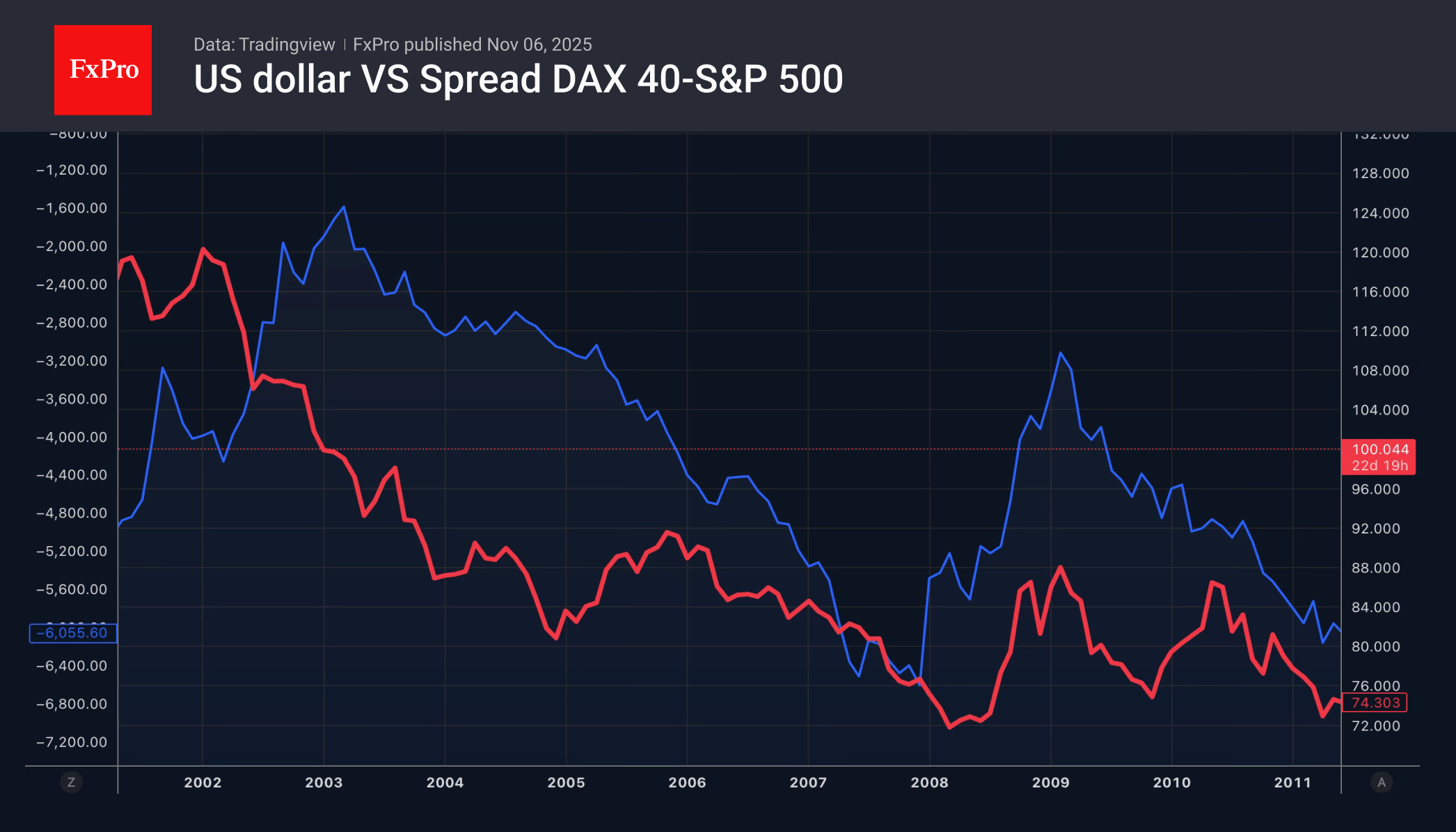

The dollar risks weakening due to the stock market. The pound fears a reduction in the repo rate. Wage data does not help the yen.

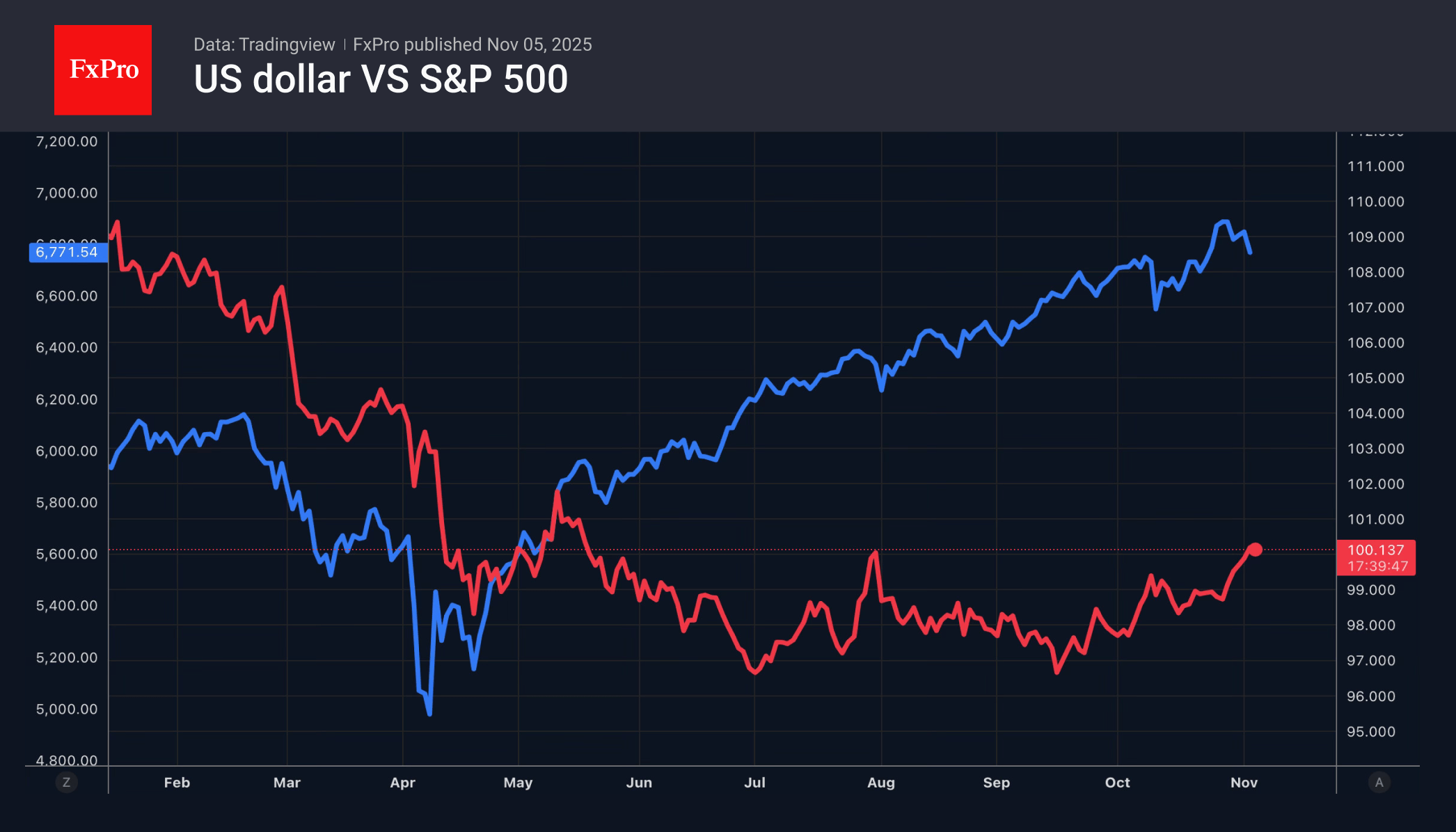

November 5, 2025

Progress in negotiations between Democrats and Republicans on resuming government operations has cooled the enthusiasm for the US dollar among bulls. The dollar index has taken a step back from its local high, as the record-long shutdown may soon come.

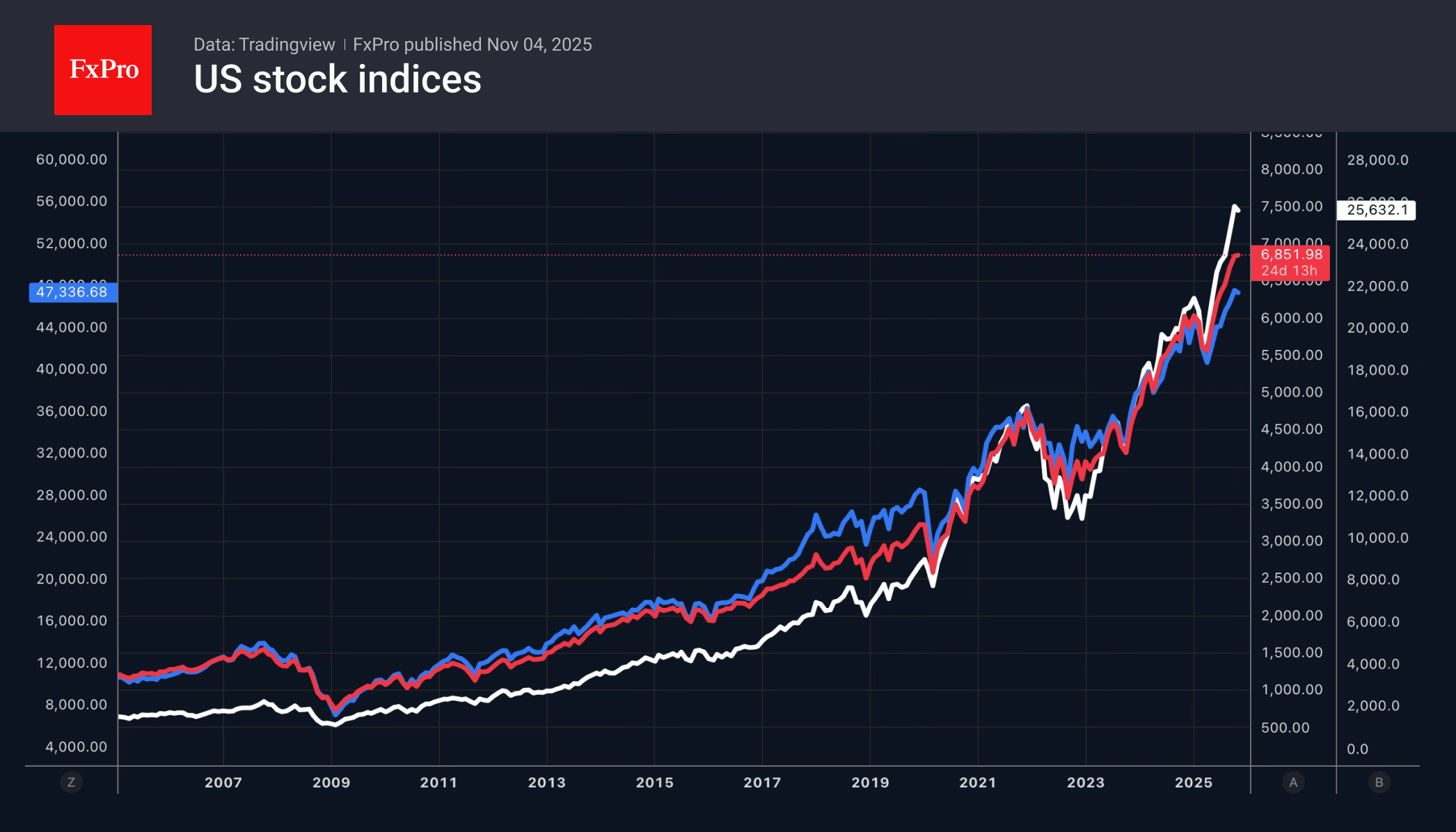

November 4, 2025

AI drives S&P 500 gains as tech giants exceed earnings forecasts but rising costs and Fed uncertainty add caution.

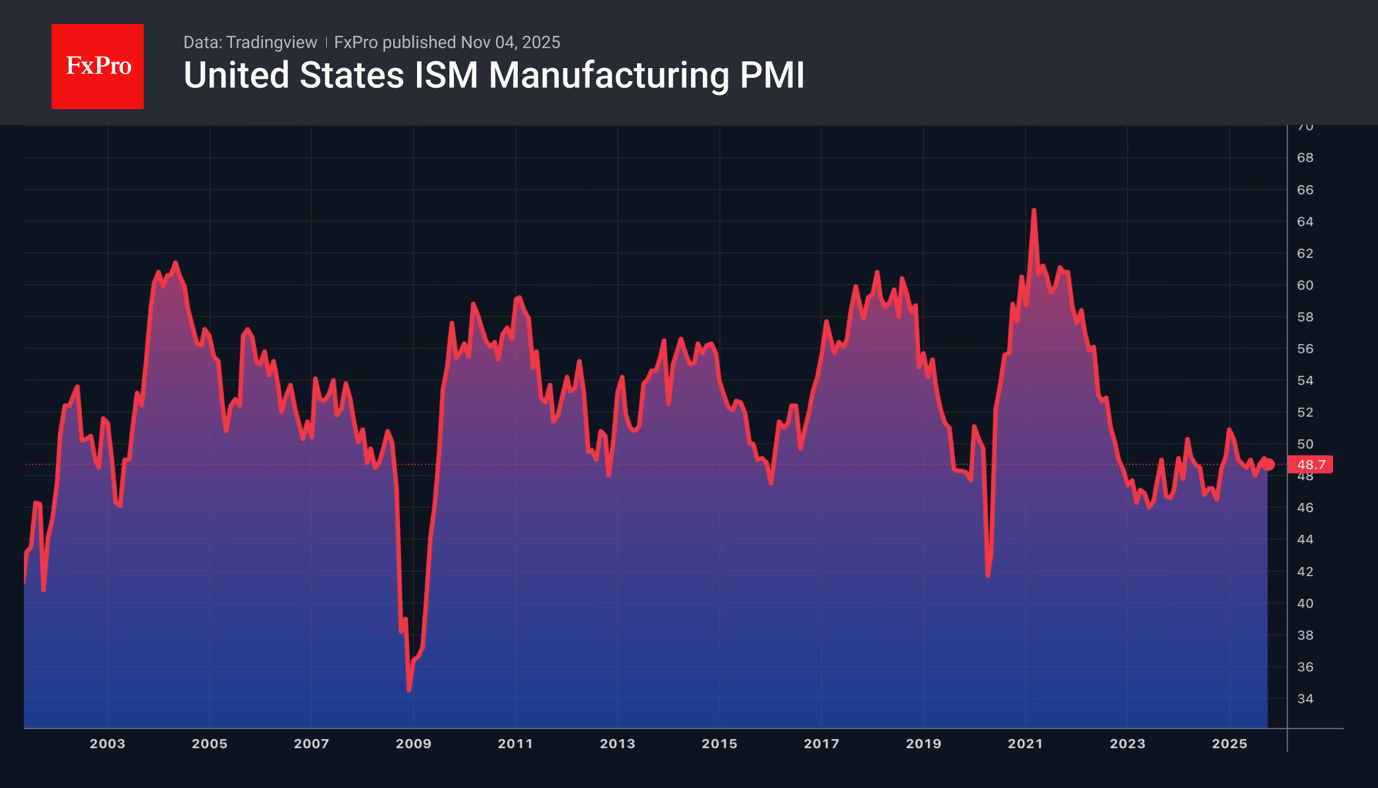

November 4, 2025

The US is poised for a record shutdown while weak PMI data halted the dollar. Rumours of intervention strengthened the yen, and RBA calls monetary policy tight that hurts AUD.

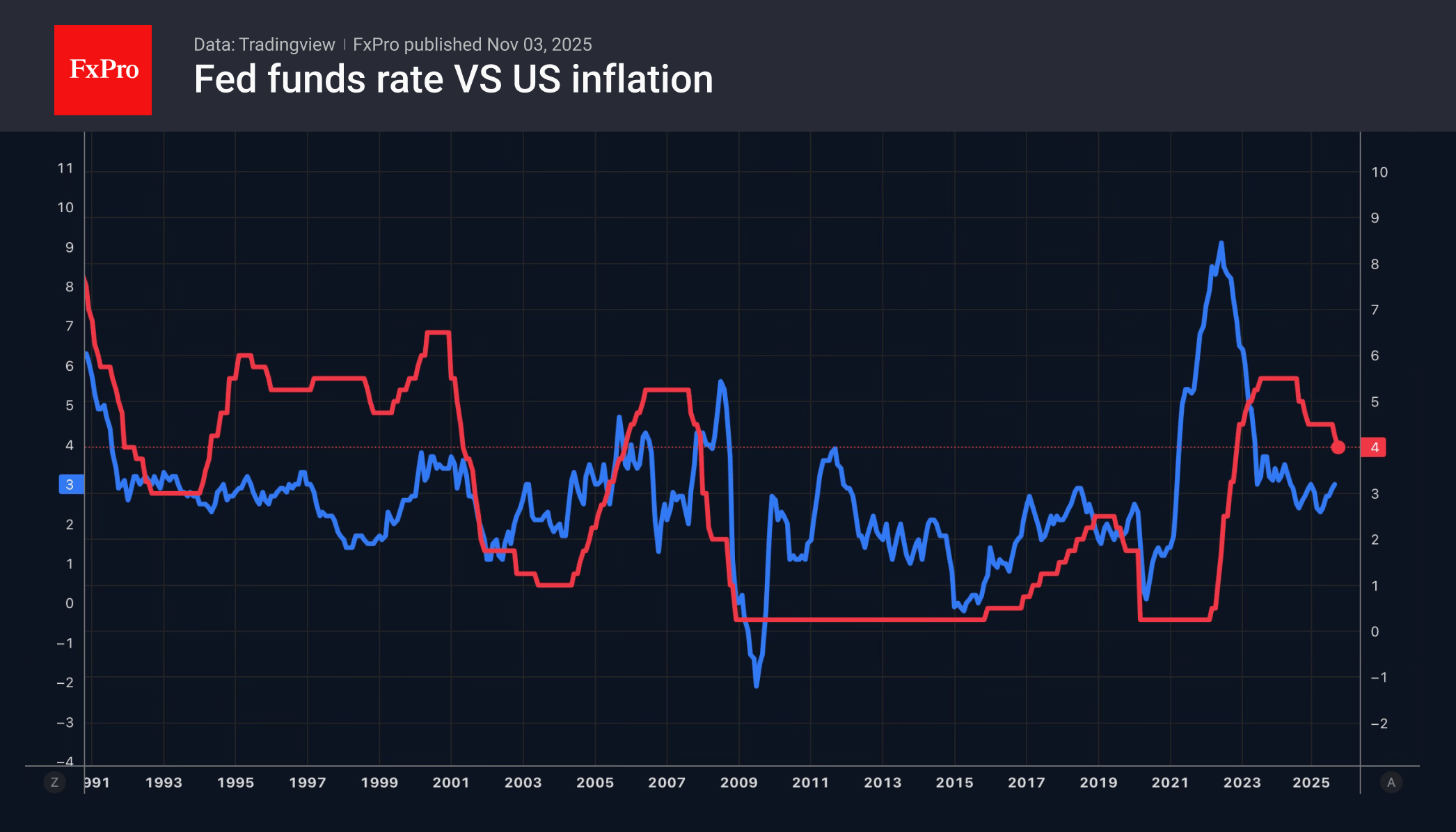

November 3, 2025

The shutdown helps the US dollar. Yen and Pound were losers in October as BoJ and BoE soften their monetary policy stance.

October 31, 2025

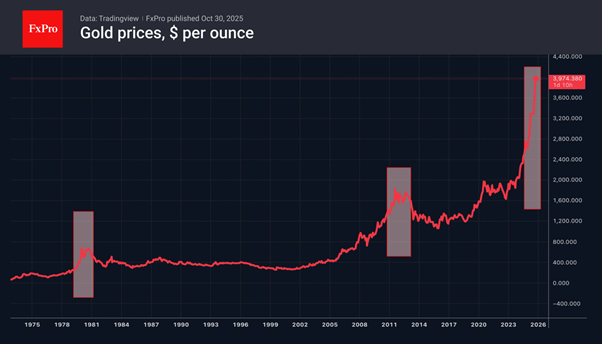

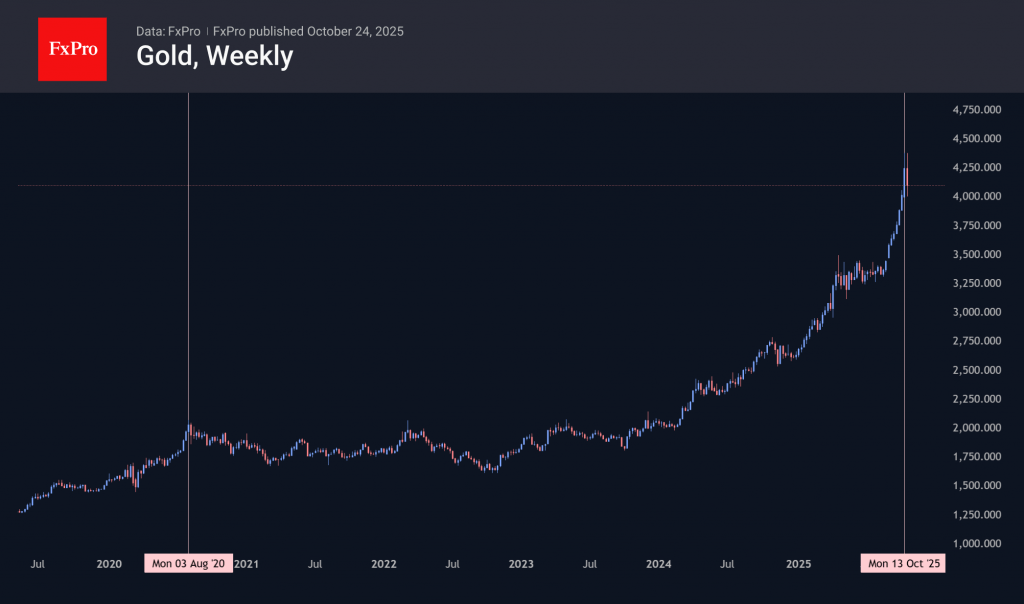

The strengthening of the US dollar and higher Treasury yields have pushed the gold price back below $ 4,000. Yellow metal is gradually losing its wild cards. It managed to reach a record high thanks to devaluation trading, expectations of.

October 30, 2025

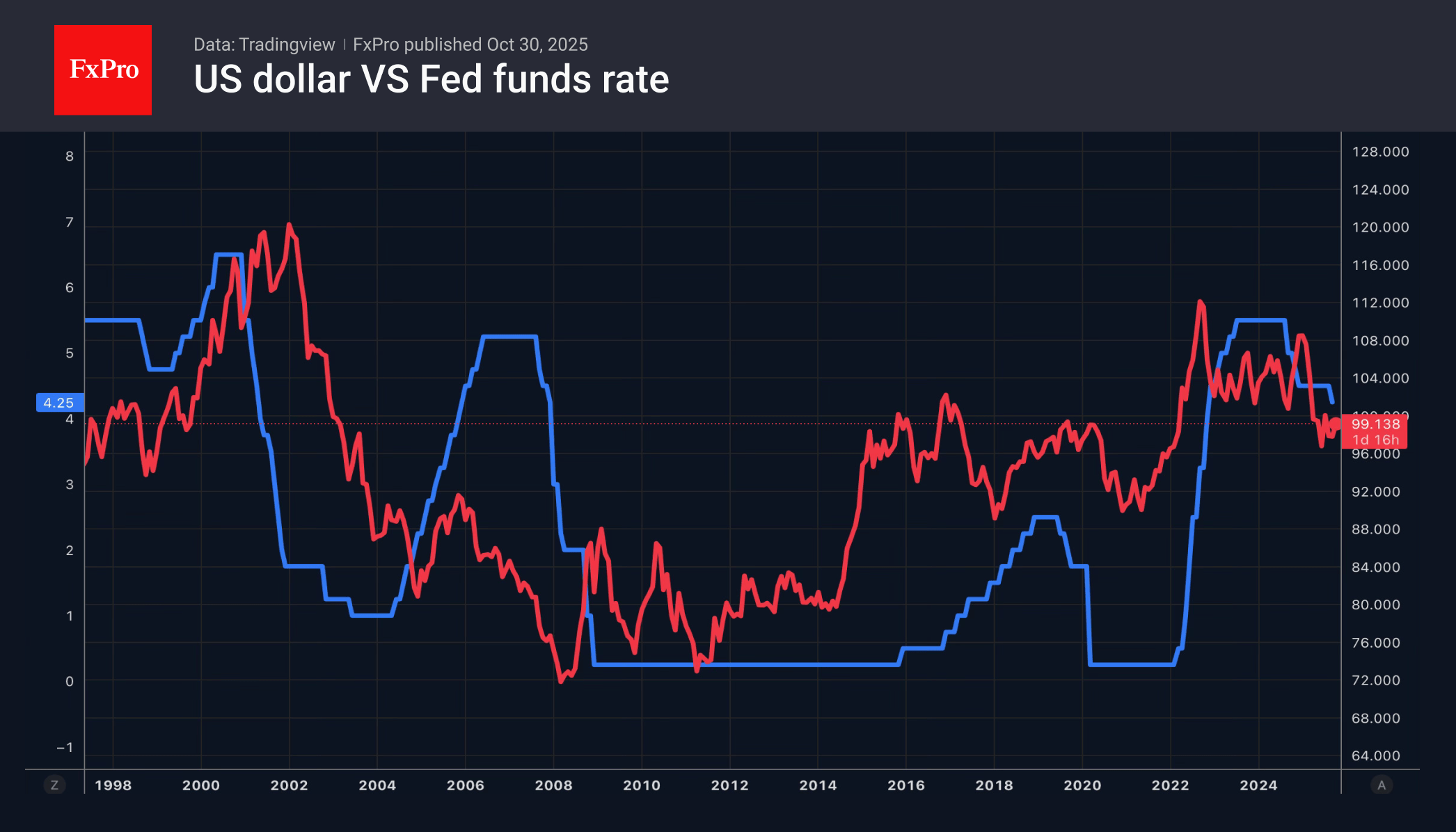

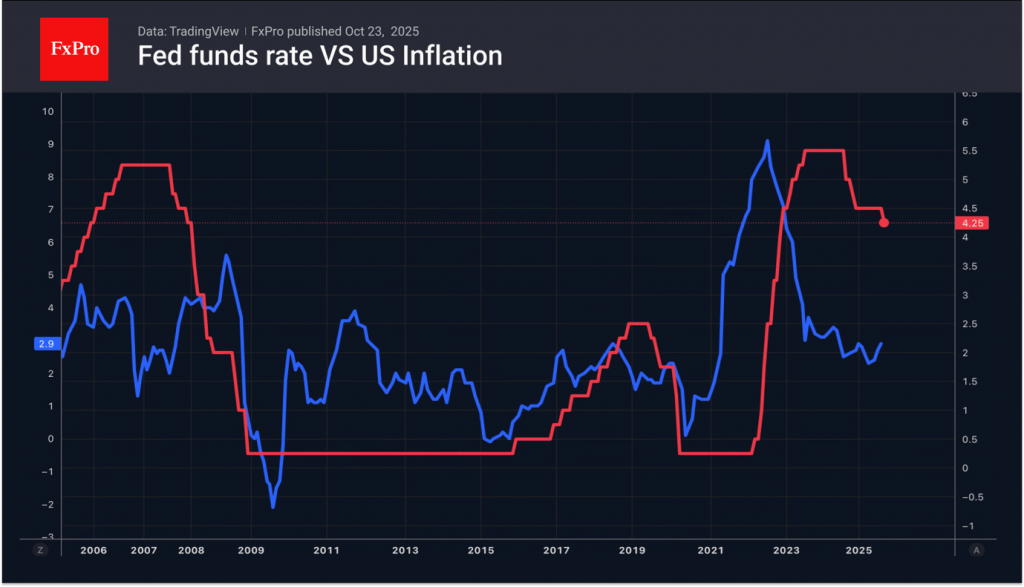

The second consecutive cut in the federal funds rate in 2025 has once again strengthened the US dollar. Since the September FOMC meeting, the USD index has risen by 3%. In both cases, the greenback benefited from a reassessment of.

October 29, 2025

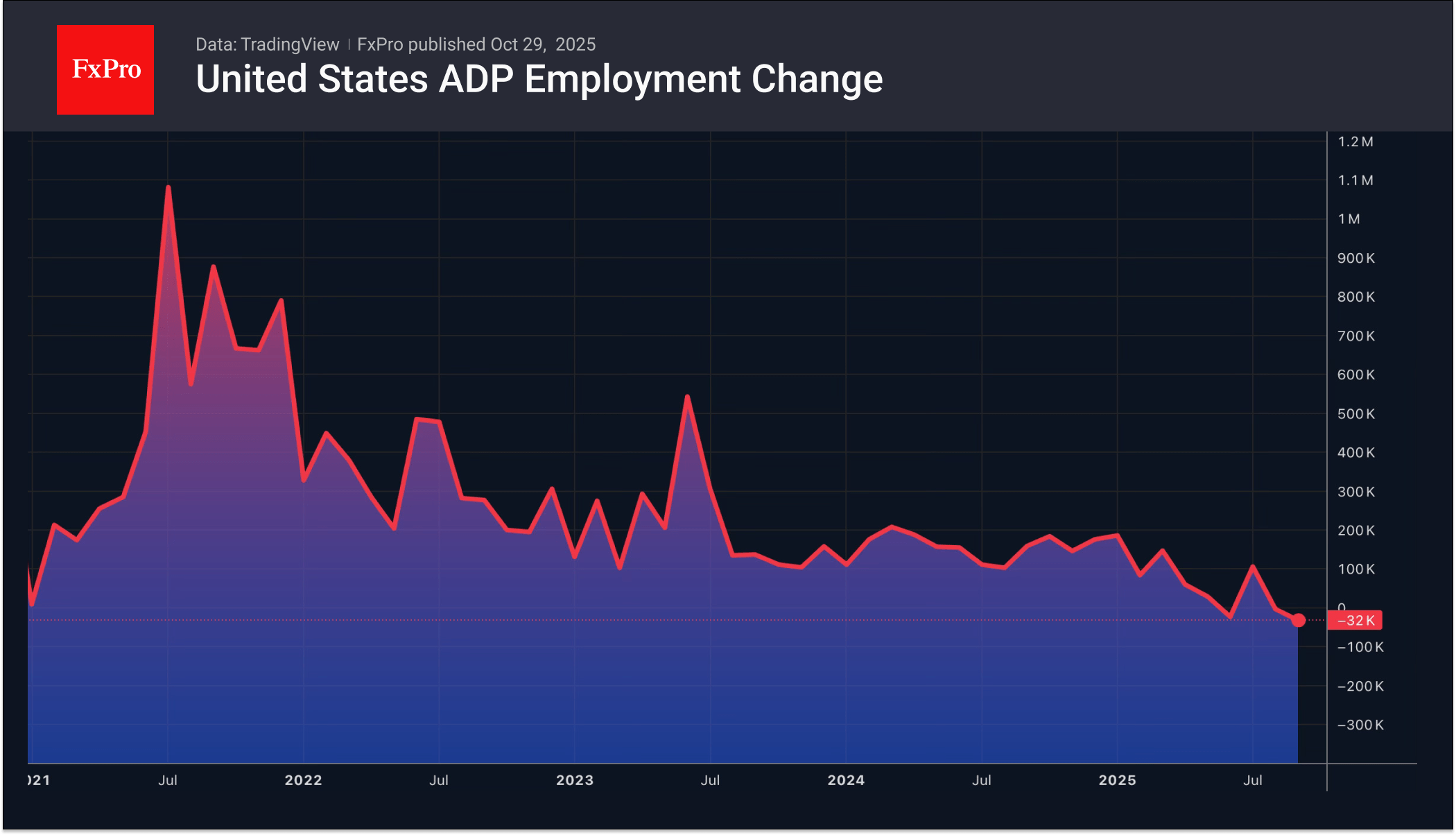

Strong US macroeconomic data and the closure of speculative positions on the US dollar ahead of the FOMC meeting announcement caused the EURUSD to retreat. ADP reported that private sector employment growth averaged 14,250 over the last four weeks to.

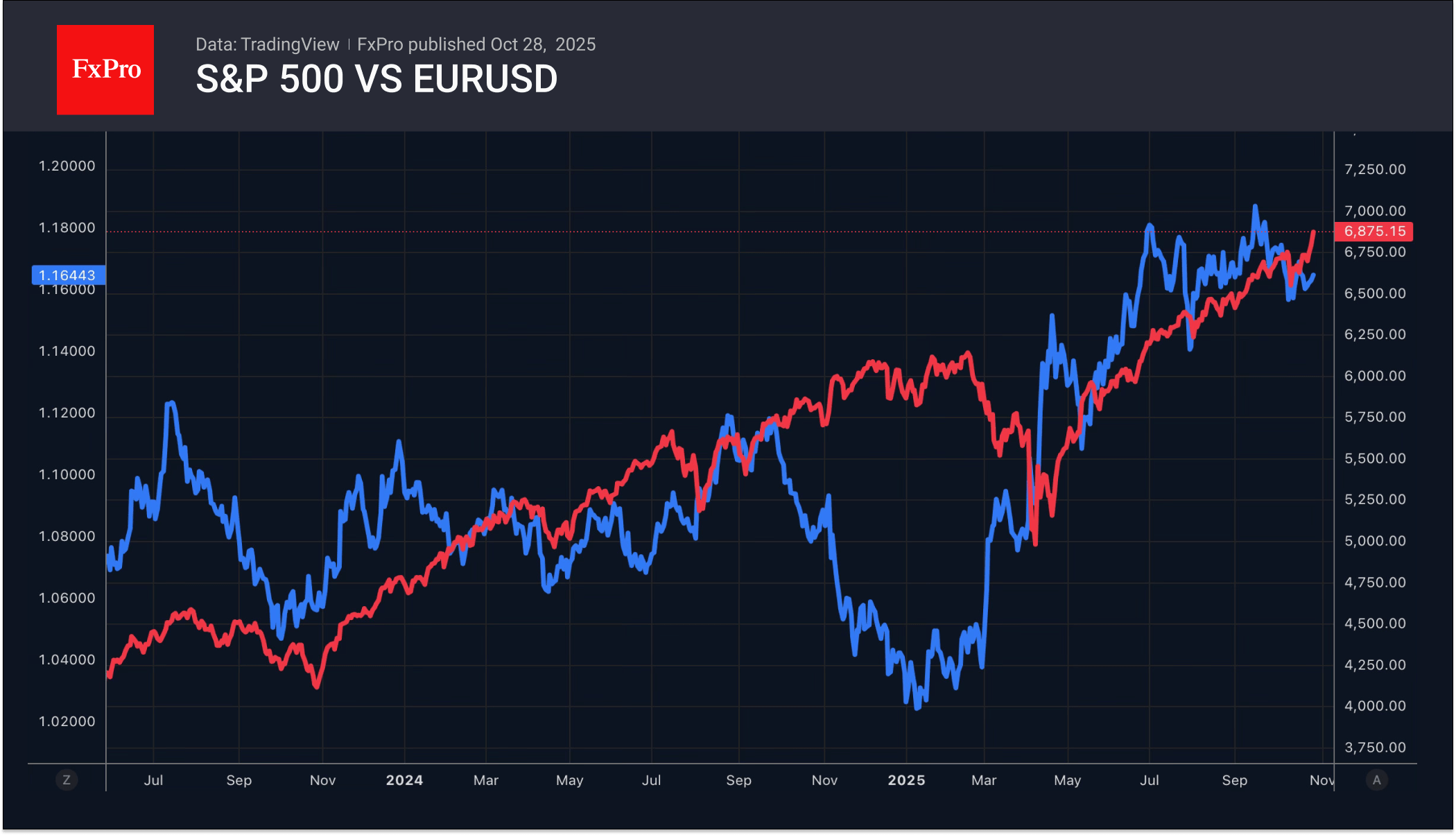

October 28, 2025

Trade war de-escalation and Fed’s probable rate cuts lifts euro, while politics is holding it back. Verbal interventions are helping the yen.

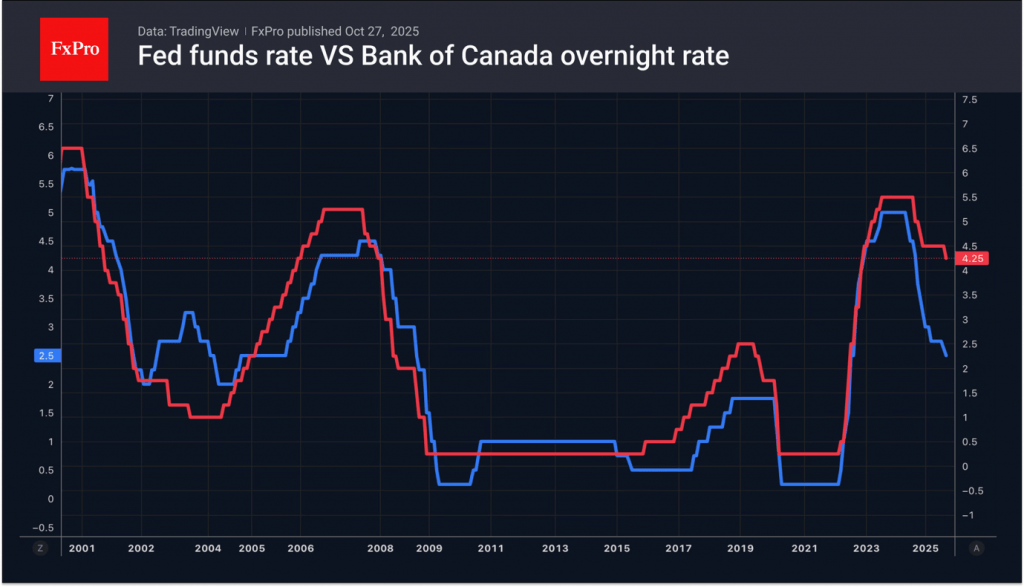

October 27, 2025

The Fed and Bank of Canada expected to lower rates while the ECB and BoJ have opted for a wait-and-see approach this week.

October 24, 2025

In the last week of October, investors will be focused on US-China trade negotiations and news surrounding Donald Trump’s visit to Asia. The main event on the economic calendar will be the Fed meeting. The futures market gives a 97%.