Market Overview - Page 83

January 19, 2023

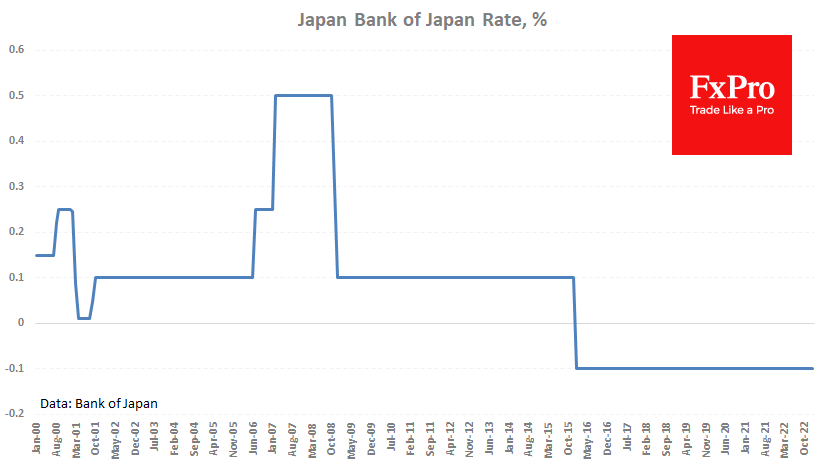

The Bank of Japan, which has not changed interest rates for the past six years and remains fully committed to QE, sparked a strong market reaction by leaving policy unchanged today. The Bank of Japan surprised markets at its last.

January 17, 2023

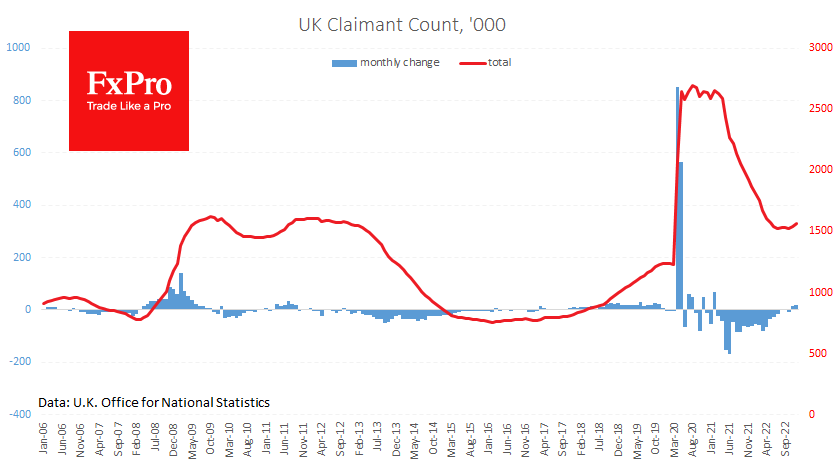

The UK market is showing further signs of a reversal in the labour market towards a fall in employment, but the increased pace of wage growth is keeping a close eye on the Bank of England’s actions and comments. Jobless.

January 17, 2023

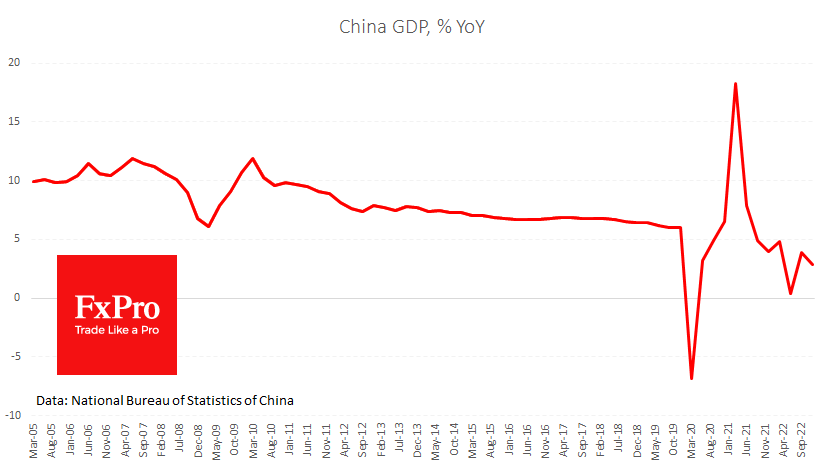

An extensive package of statistics from China showed a much better economy than the average analysts had expected. But this set of economic surprises failed to affect the renminbi, which is falling for a second day, having lost 1.4% in.

January 16, 2023

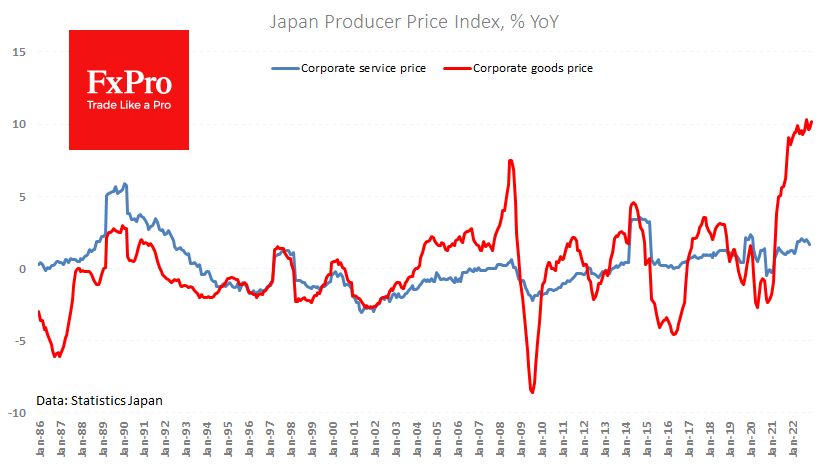

Japan’s Domestic Corporate Goods Price Index rose 0.5% m/m and 10.2% y/y in December after 0.8% m/m and 9.7% y/y. This is near the peak of 10.3% set in September. Despite lower commodity prices, prices are stubbornly reluctant to fall.

January 13, 2023

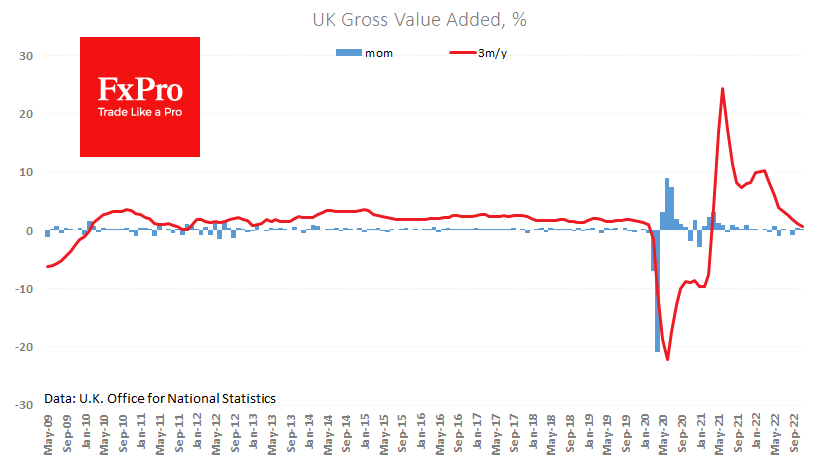

Britain, as previously with mainland Europe, is showing better than expected GDP performance, tempering expectations on the depth and duration of the looming recession. Monthly GDP estimates showed an unexpected growth of 0.1% in November after 0.5% in October, markedly.

January 13, 2023

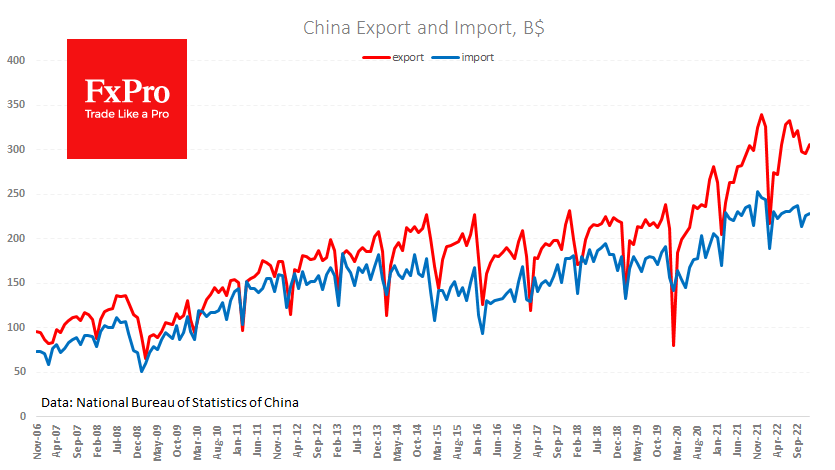

China’s foreign trade data for December was another demonstration of why the government went for a loosening of covid restrictions. Exports last month were 9.9% below levels a year earlier, accelerating the decline from November’s -8.7%. Imports lost 7.5% to.

January 12, 2023

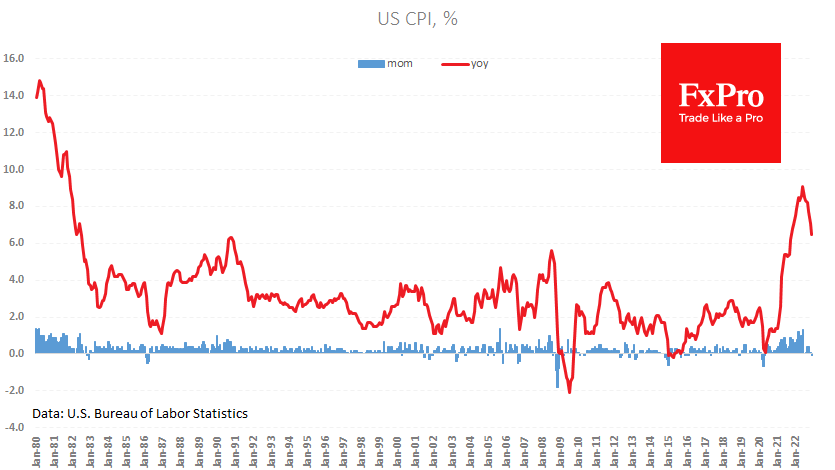

US consumer inflation data matched analysts’ average forecasts, but this did not prevent the markets from experiencing a spike in volatility. This mixed reaction to the economic report had previously only been seen in NFP reports or contradictory comments of.

January 12, 2023

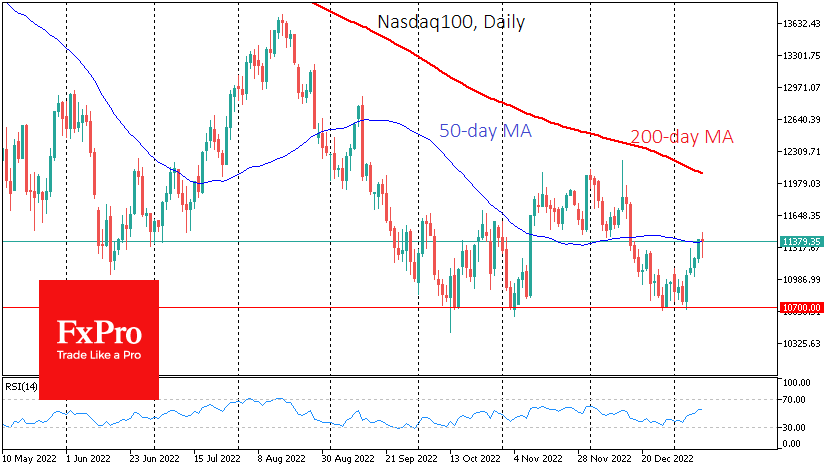

US inflation data promises to directly impact Fed policy, to which the Nasdaq100 is the most sensitive among key indices. The heavy reliance of the index on inflation and a set of significant key levels makes us watch the Nasdaq100.

January 12, 2023

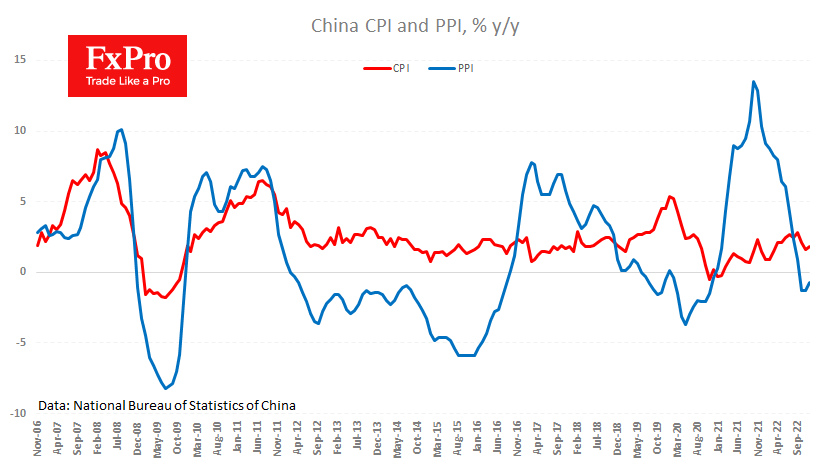

China picked up the torch this morning with the publication of national inflation data. In December, the consumer price index rose from 1.6% to 1.8% y/y. Producer prices, an important leading indicator for national and global inflation, are losing 0.7%.

January 11, 2023

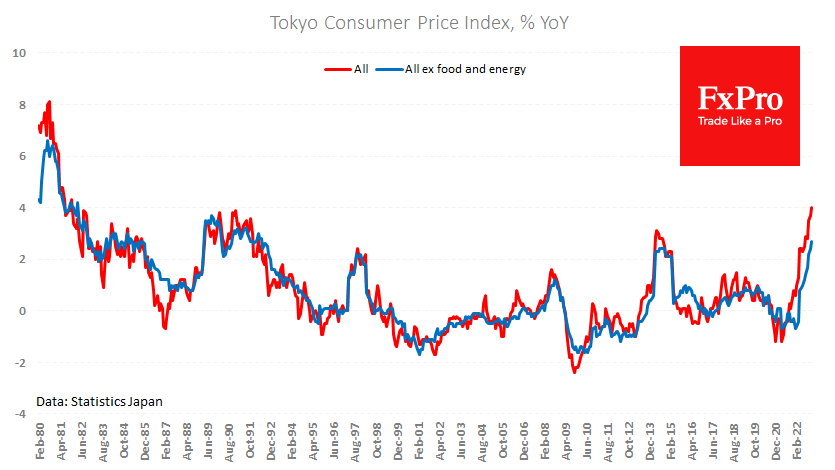

The deflationary days in Japan will become history for at least the next few years. The released advance data from Tokyo yesterday pointed to a further acceleration in the year-on-year price increase. The overall CPI rose from 3.7% to 4.0%.

January 10, 2023

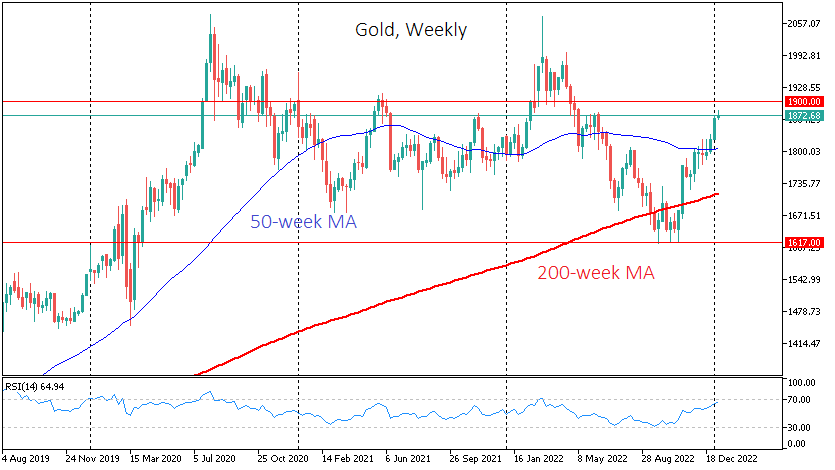

Gold is trading at $1875 per troy ounce – near the highs since last May. Having pushed back from the bottom in early November, the price has rallied by more than 15%, above $260, and so far, probably has yet.