Gold fails essential support, but the Bulls still have a chance

May 13, 2022 @ 12:42 +03:00

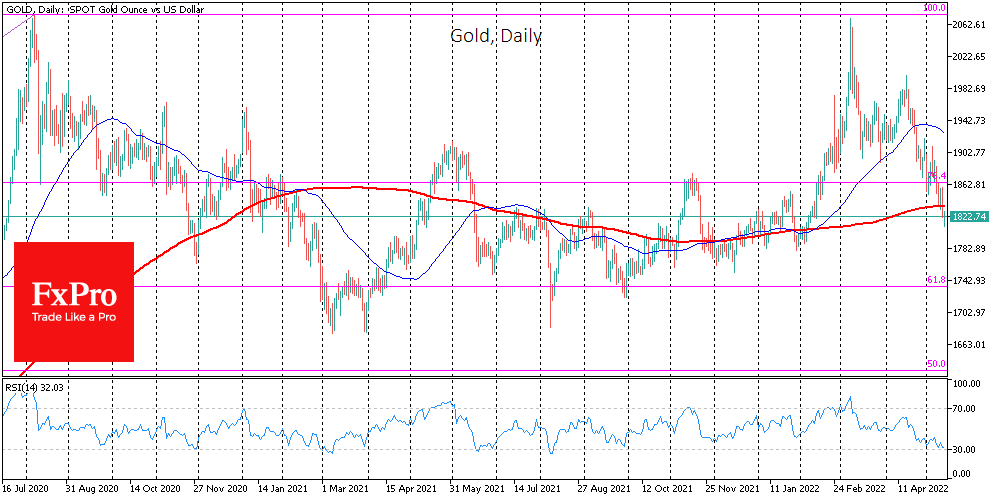

A sell-off in the equity market and a new wave of flight to the dollar on Thursday provided the perfect combination to knock out gold, which slipped to $1810 in thin trading on Friday morning, falling to its lowest level since early February.

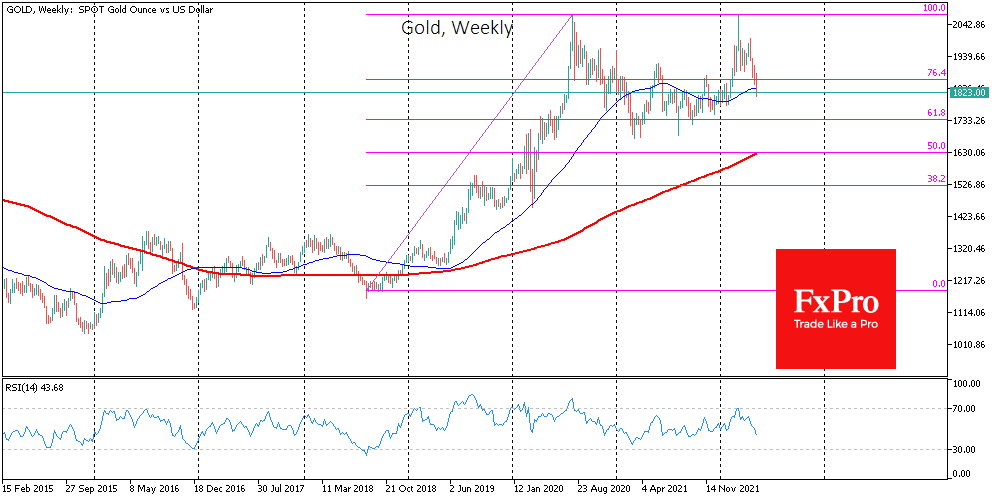

Right now, it’s up to gold to decide whether we see a double top formation or whether the bulls are gaining strength and liquidity ahead of a new multi-month rising momentum.

The current decline in the price makes us keep a close eye on further developments. Yesterday, gold took a sharp plunge under the 200 SMA, which is often a bearish factor for the instrument. A consolidation of the week under $1830 would reinforce that signal.

This would open the way for another roughly 25% drop into the $1350 area, the area of the 2015-2018 highs.

If we see an uptick in buyers’ in the hours and days ahead, we could say that gold is in a correction. Potentially, a reversal to the upside from these levels could signal the start of a new wave of long-term growth, the first impulse of which was in 2018-2020, followed by a prolonged wide side trend. A potential bull target, in this case, could be the $2500 area.

The FxPro Analyst Team