Market Overview - Page 80

March 7, 2023

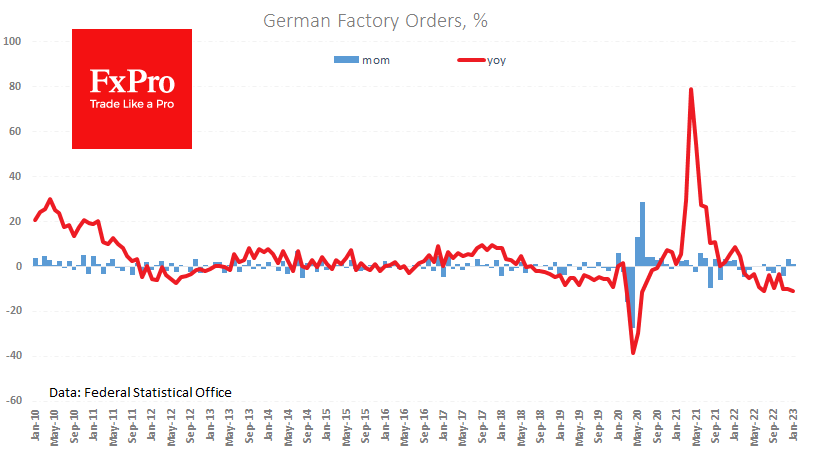

Europe continues to surprise with statistics, suggesting more room for a hawkish tone from the ECB next week. In addition to hawkish inflation readings, data from Germany today highlighted a continued recovery in industrial orders. Destatis reported a 1% rise.

March 7, 2023

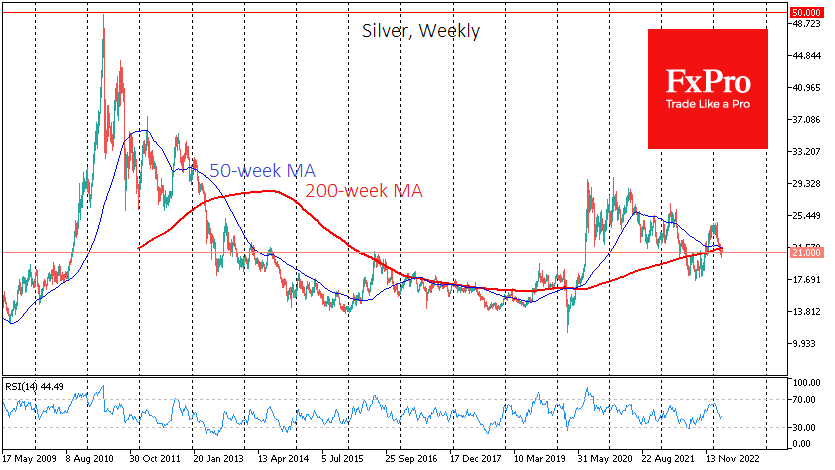

For the past six trading sessions, an ounce of silver has been trading above $21.0 in both directions. The price has been falling for most of February, losing more than 17% from its high ($24.62) to its low ($20.41). Last.

March 3, 2023

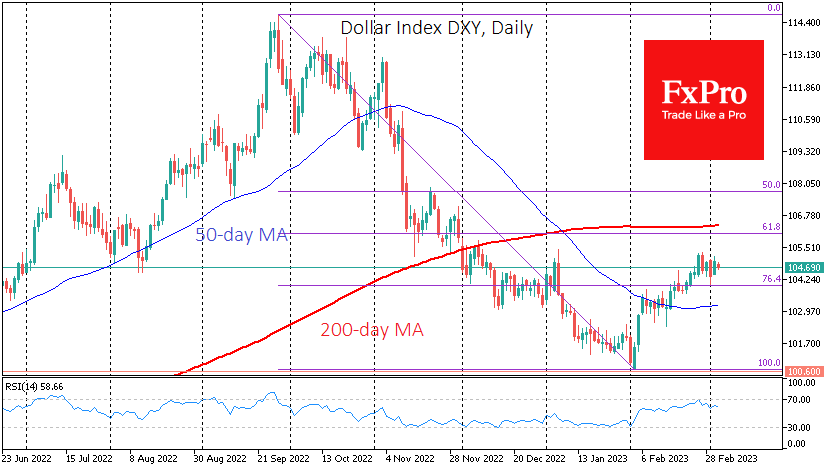

The S&P500 and Nasdaq100 indices staged a solid intraday rebound yesterday, digesting the initial drop and closing the day higher. Along with the rebound in equities, a reversal to the downside is forming in the Dollar Index. Technically, the dollar’s.

March 2, 2023

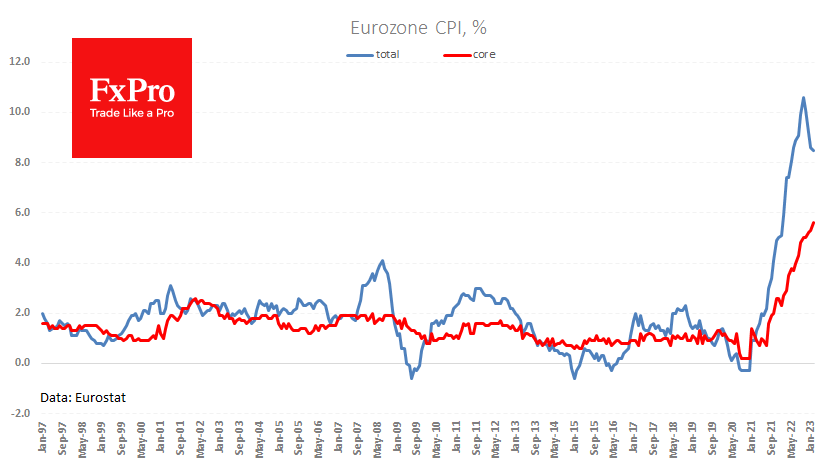

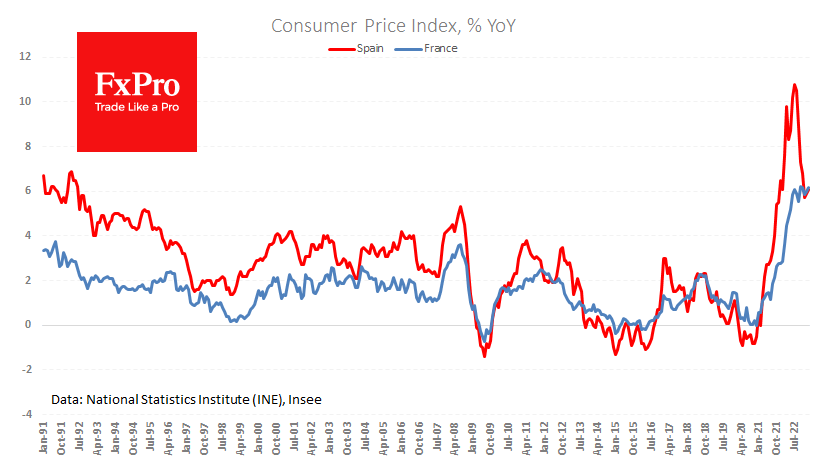

Although commodity and energy prices have retreated from their highs and supply chains have recovered over the past year, inflation remains a problem. This thesis was confirmed today for the eurozone. Eurostat estimated overall price growth in the Euro region.

March 2, 2023

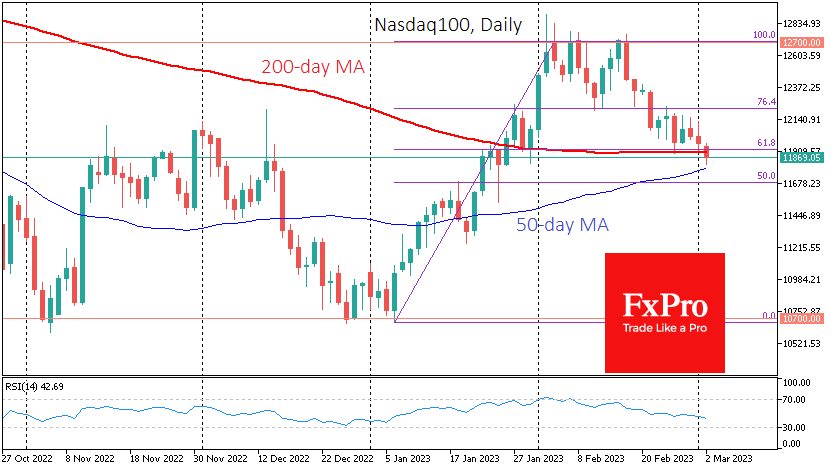

The major US indices are under pressure amid the ongoing reassessment of the Fed’s monetary policy outlook. The S&P500 and Nasdaq100 indices are testing key technical support again, returning to the crossroads they left over a month ago. Nasdaq100 futures.

March 1, 2023

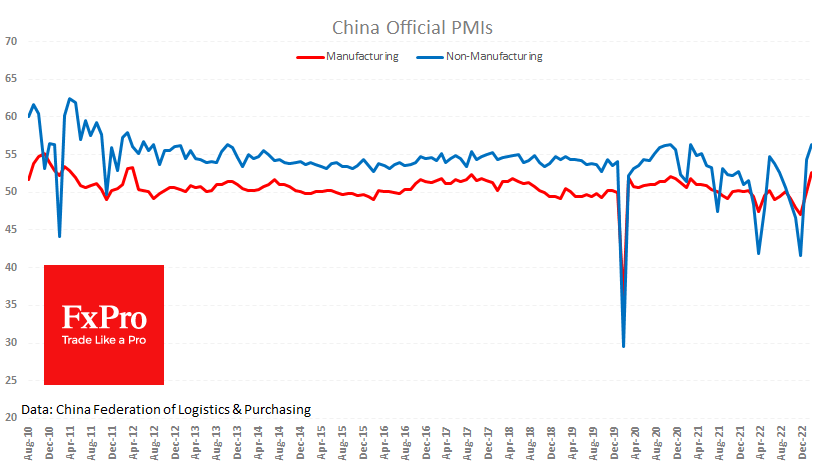

Lifting the lockdown and the end of the Lunar New Year celebrations led to a strong rebound in Chinese economic activity. The manufacturing PMI jumped to 52.6 in February from 50.1 the previous month, according to an official release from.

February 28, 2023

Spain’s CPI rose by 1% in February, and annual inflation accelerated from 5.9% to 6.1%. In France, prices rose 0.9% m/m, accelerating to 6.2% y/y. For forex traders, it is also important to note that the figure was higher than.

February 28, 2023

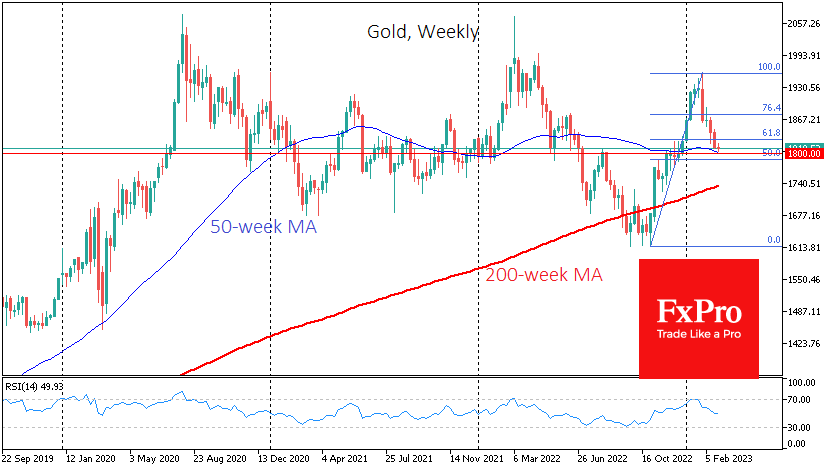

Gold continues to test the bottom and today fell back below $1810. Since the beginning of February, the dynamics suggest an almost perfect reversal of the uptrend, where the initial sharp pullback on the 2nd and 3rd was followed by.

February 27, 2023

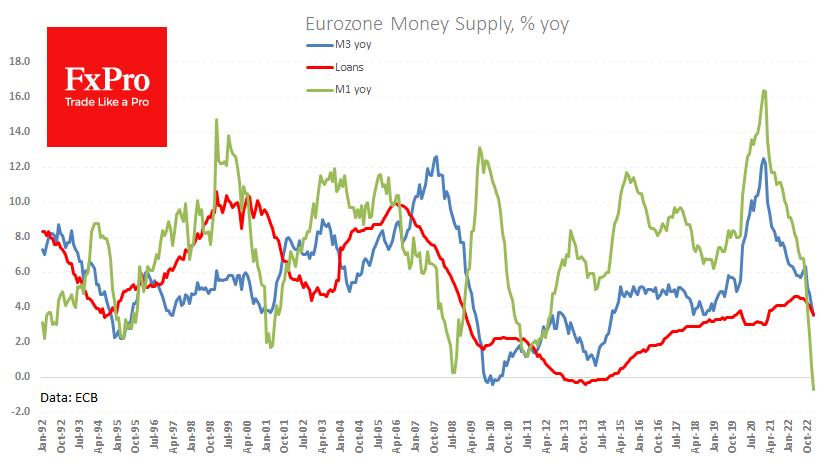

Money supply and lending in the eurozone are slowing faster than expected, indicating an imminent economic contraction. Data released on Monday morning pointed to a slowdown in new lending, coinciding with the start of the euro zone’s interest rate hike.

February 27, 2023

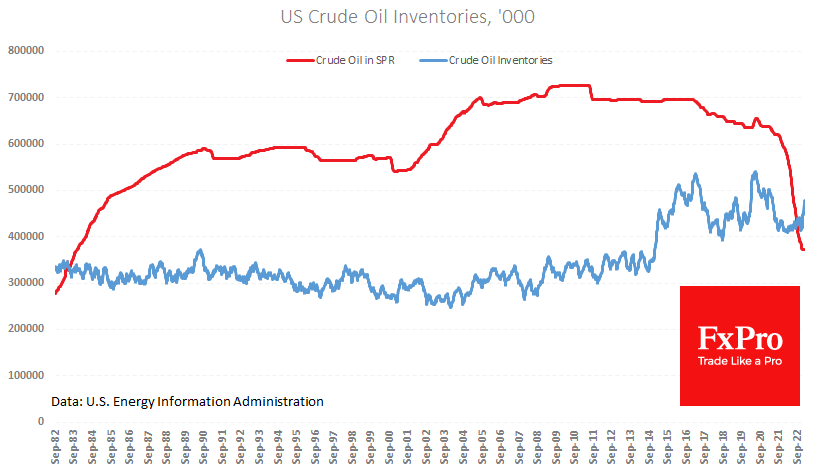

Oil remains stubbornly stuck in a sideways range despite the dollar’s rally and other risk assets’ retreat over the past week and a half, with weekly production and commercial inventory data painting a relatively contradictory picture. US commercial crude inventories.

February 24, 2023

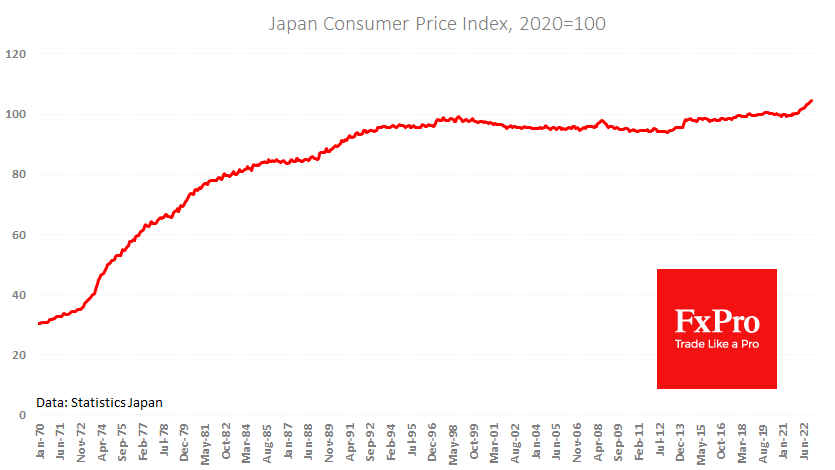

Consumer prices in Japan continue to rise steadily, but this is of little concern to the central bank – a brutal combination for the Yen, which could repeat last year’s alarming decline. Japan’s CPI rose 0.5% in January, the 15th.