ECB is two steps behind the Fed, digging a hole under the euro

June 10, 2022 @ 14:17 +03:00

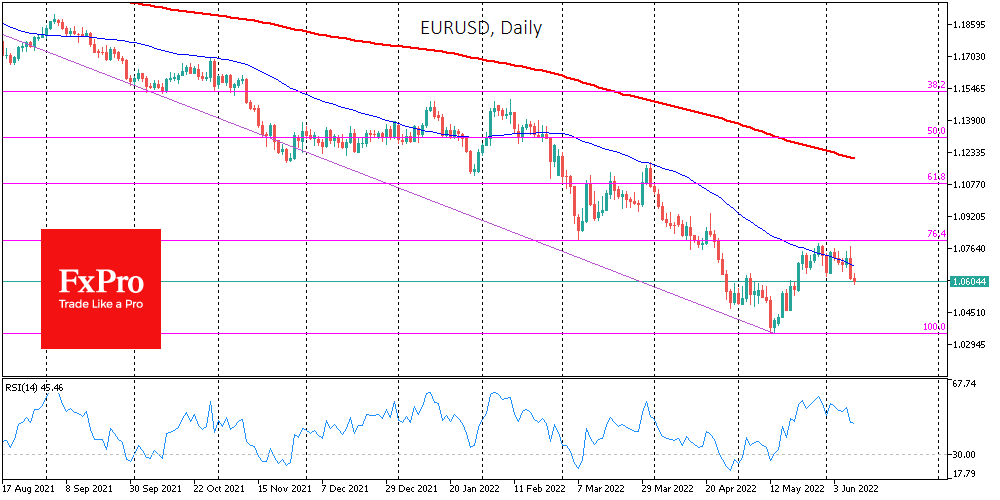

As expected, euro buyers’ optimism faded immediately after the ECB press conference began, returning EURUSD back below 1.0600.

Shortly after the initial surge in reports of an actual reversal in ECB policy, investors and traders delved into assessments of how slower the policy reversal in Europe was.

The ECB will only stop buying assets on its balance sheet later this month – two steps behind the US, where purchases were curtailed months ago and active sales are already due to begin in June.

The Fed raised its rate by 25 points in March and 50 points at the start of May, promising two more 50-point hikes in June and July. From the ECB, we see a conditional promise to consider a rate hike of more than 25 points in September in case of high inflation forecasts for 2023.

That said, inflation in the eurozone is comparable to the US, and economic growth is just as, if not more, vulnerable to logistical failures and energy prices.

Not only has the ECB started its policy turnaround later, but it is also doing so more slowly than the Fed so that the interest rate differential only widens over time.

Such differences are a fundamental reason to sell the euro against the dollar. Moreover, the EURUSD bounce in the second half of May erased the pair’s oversold conditions, clearing the way for another step down.

Yesterday’s comments from the ECB convinced us not to expect any hawkish surprises from Lagarde and Co, triggering a new sell-off impulse. It won’t be surprising if EURUSD makes another test of the May low at 1.0350 or if it makes a new 20-year low below that level during the next couple of weeks.

The FxPro Analyst Team