Market Overview - Page 75

May 12, 2023

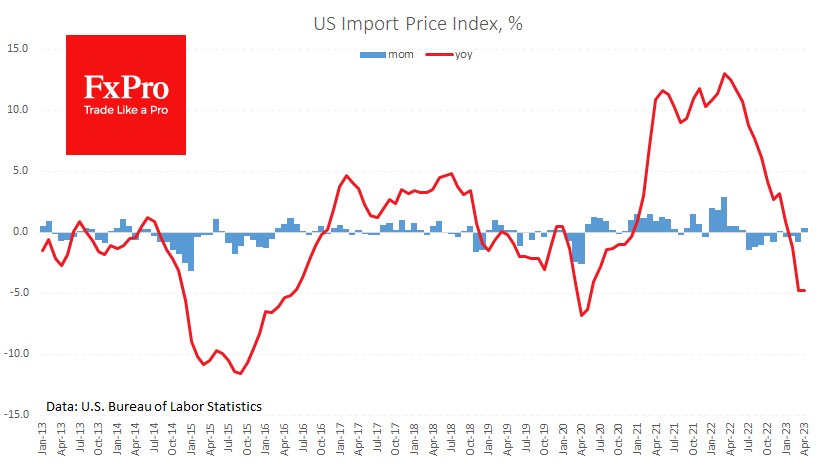

The US import price index came in much better than expected, with a decline of 4.8% y/y in April against expectations of -6.3% y/y. Last month the index rose by 0.4%, the biggest increase since May 2022. The US is.

May 12, 2023

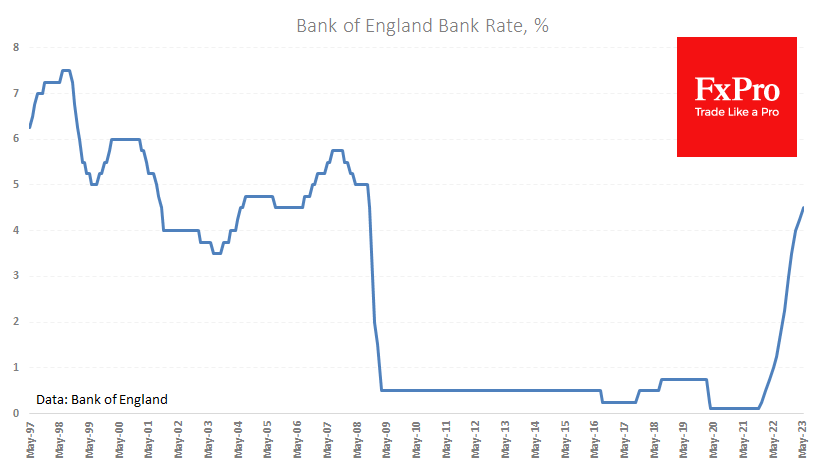

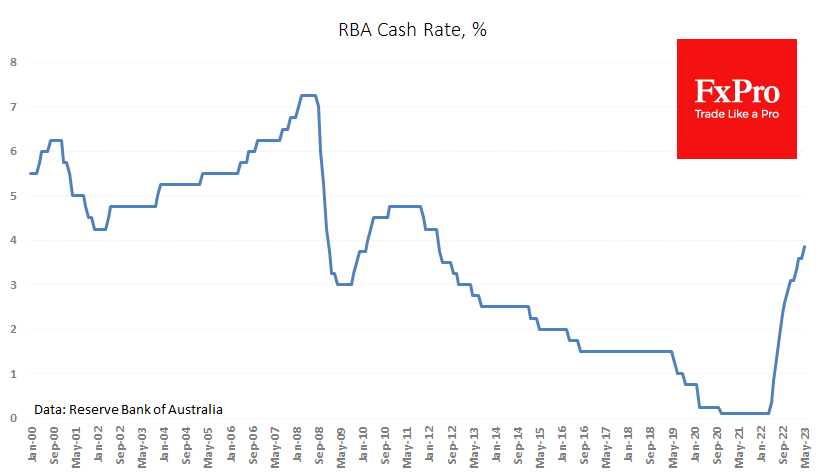

The Bank of England raised its key interest rate by 25 points to 4.5% on Thursday, marking the twelfth consecutive policy tightening. Two of the nine members have voted to keep rates on hold in the last four meetings. The.

May 11, 2023

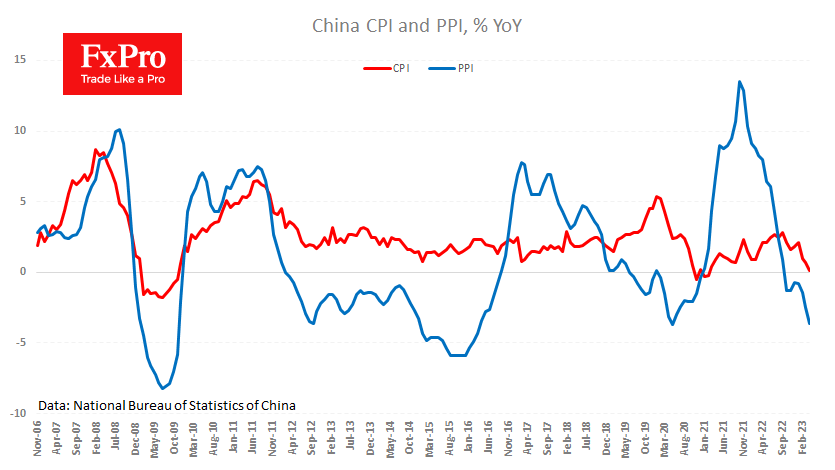

While slowing inflation in the US and Europe is being greeted with relief by financial markets, weak figures from China are causing concern. China’s consumer inflation slowed to just 0.1% y/y in April, down from 0.7% the previous month and.

May 11, 2023

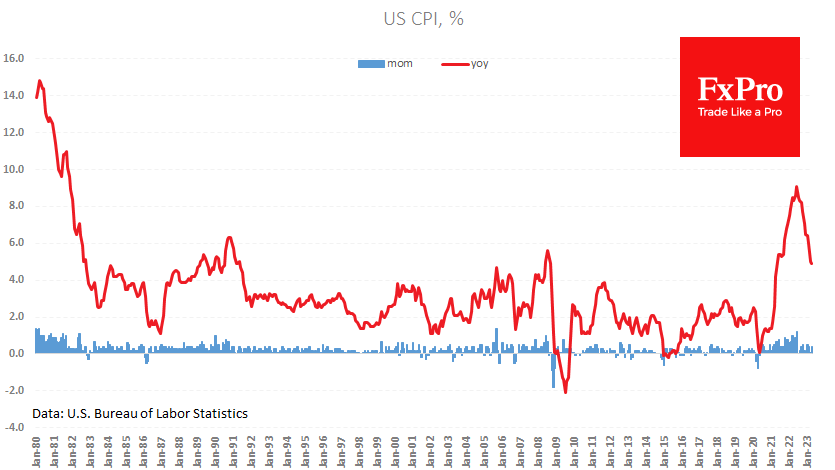

US consumer inflation slowed to 4.9%, just below the expected 5.0% and unchanged from the previous month. The initial market impulse was to sell the dollar and buy equities as the slowdown in price growth brings the end of the.

May 10, 2023

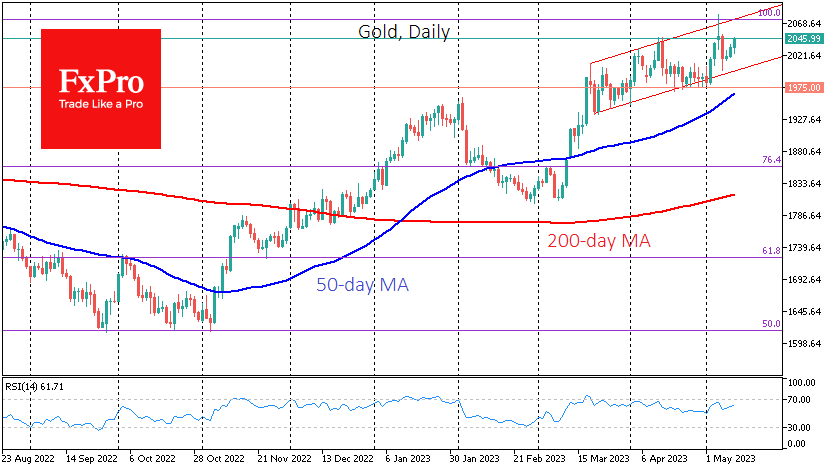

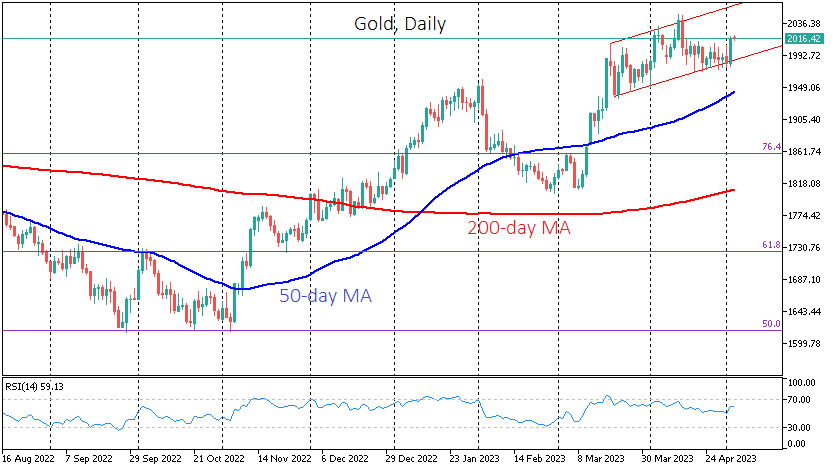

Gold showed very high volatility on Thursday and Friday, rising to $2081 and falling below $2000 in less than 48 hours. However, the price remained within the uptrend that has been in place since the second half of March. The.

May 10, 2023

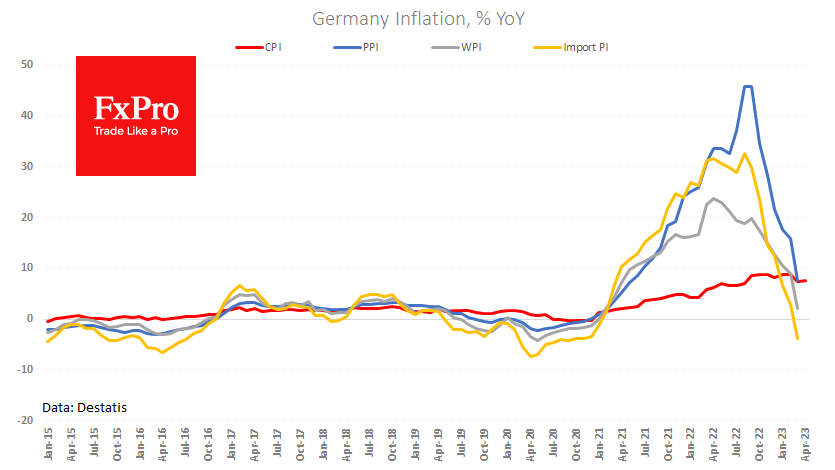

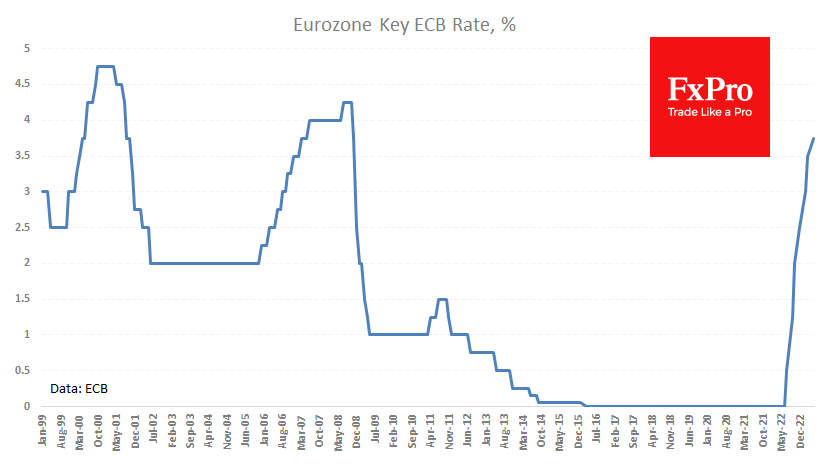

German consumer inflation slowed to 7.2% y/y in April, Destatis said in its final estimate. The trend of decelerating price increases continues, although it remains well above the ECB’s target. March data for other price indicators point to further easing.

May 9, 2023

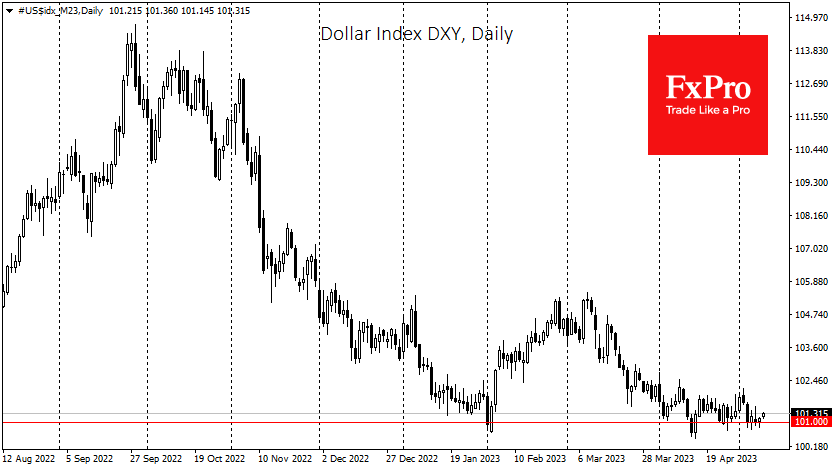

For the second month, the Dollar Index finds support from declines in the 101 area. Dollar bulls are defending critical levels in the major currency pairs, which could significantly increase the psychological pressure on the US currency. The resolution of.

May 5, 2023

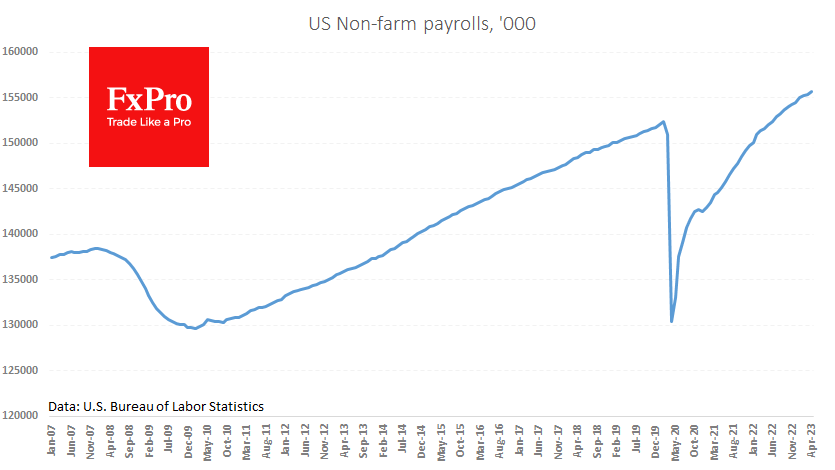

In April, the US economy added 253k jobs, surpassing expectations of 181k. Over the past 12 months, actual data has consistently exceeded expectations for this indicator. However, the previous month’s downward revision was considerable, from 71k to 165k. The unemployment.

May 5, 2023

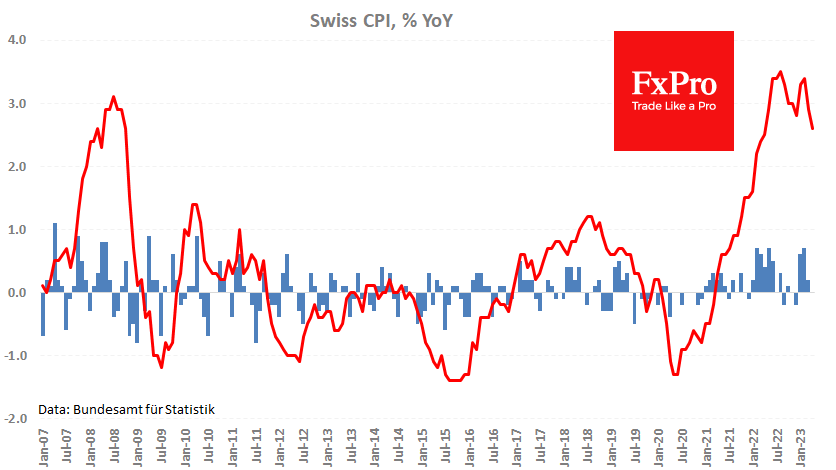

The Swiss franc declined, losing about 1% to 0.8920 after a fresh batch of macroeconomic data. The unemployment rate remains at 1.9%, a historic low. But at the same time, inflation is surprising, falling short of forecasts. The consumer price.

May 4, 2023

The European Central Bank raised interest rates by a quarter of a percentage point to 3.75%, duplicating the Fed’s move the day before. This was the move that market analysts had been predicting, although some central bank officials had been.

May 3, 2023

The price of gold rose by almost 2% on Tuesday after reports of another round of regional bank problems in the US. Quite quickly, the price stabilised around $2015. This surge allowed gold to bounce back from the lower end.