Market Overview - Page 74

May 23, 2023

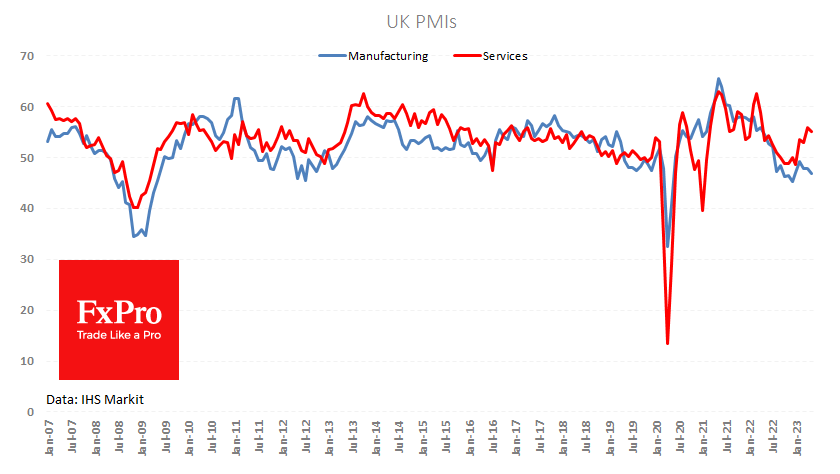

Weaker-than-expected PMI reports were released today from the Eurozone and the UK, adding to the global Dollar pullback seen in recent weeks. The manufacturing PMI fell to 46.9 in May from 47.8 in the previous month, in stark contrast to.

May 23, 2023

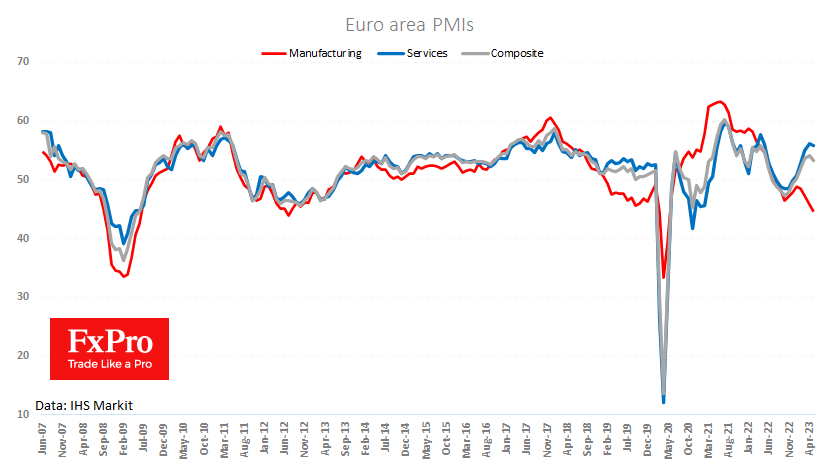

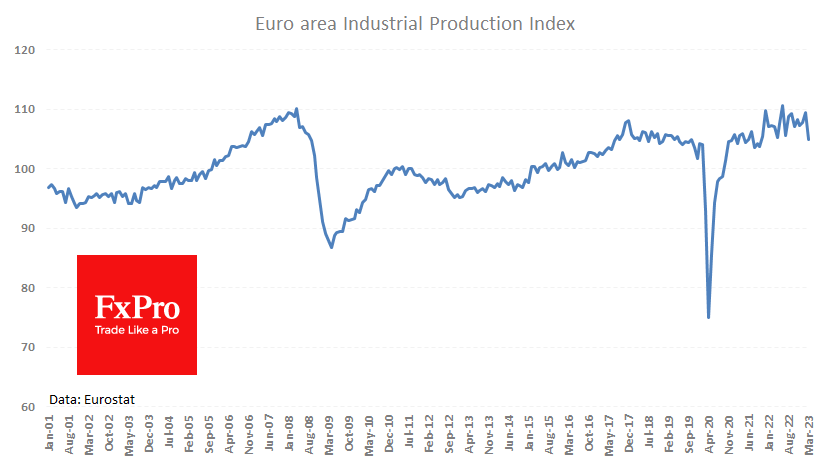

Preliminary readings of the PMIs for business activity in the euro area generally revealed a worse-than-expected deterioration. According to the composite index, the last time the euro area industry suffered this badly was in 2008-2009, when the economy was in.

May 22, 2023

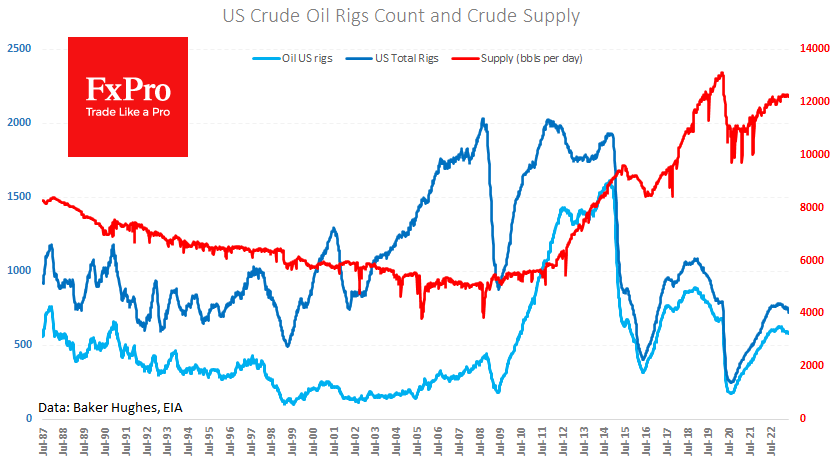

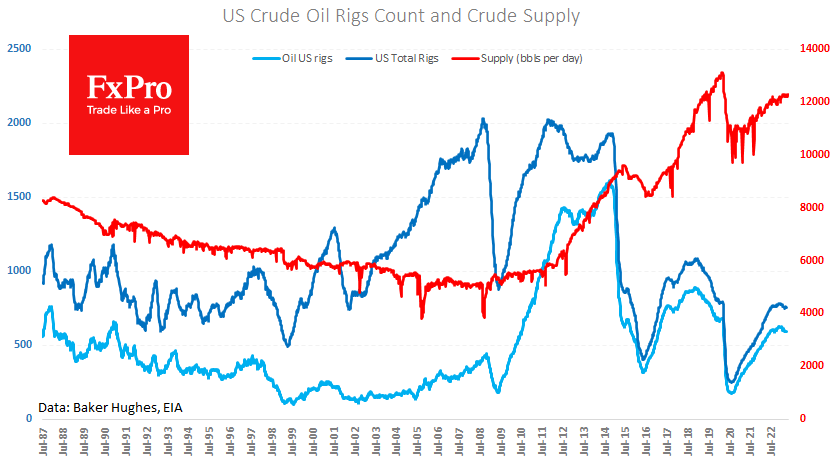

The number of active oil and gas drilling rigs in the US fell by 11 last week to 720, returning to a level seen a year ago. This indicates that producing companies focused on efficiency rather than on expansion. Lower.

May 22, 2023

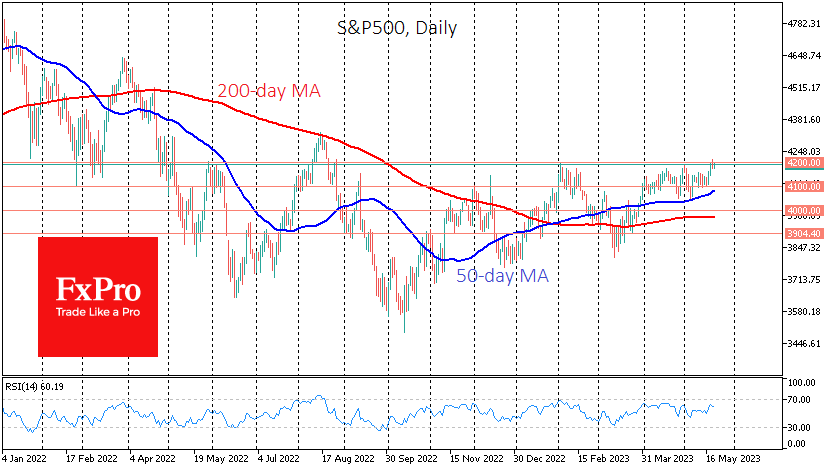

US markets made an impressive surge last week, taking the S&P500 to 4200, a crucial turning point. It is worth preparing for an upside stop or correction before the index steadily moves to the next level. The S&P500 index has.

May 18, 2023

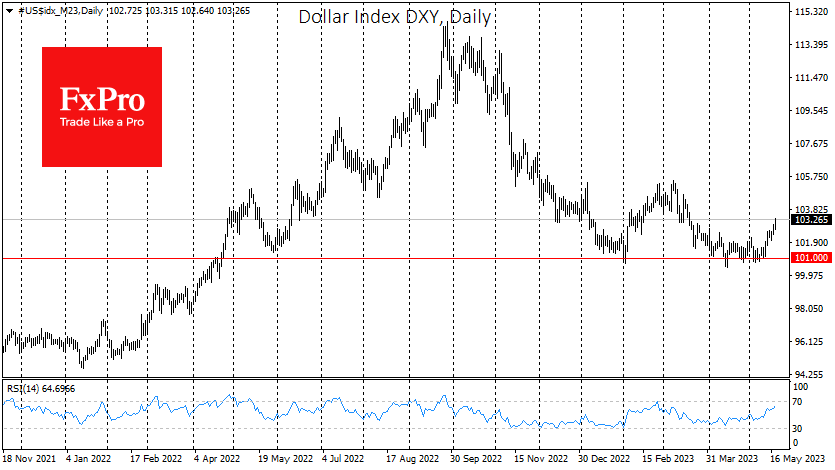

The dollar has strengthened against its major rivals over the past two weeks, gaining 2% against a basket of major currencies. The Dollar Index surpassed 103, a level not seen since the second half of March. Notably, the rally in.

May 17, 2023

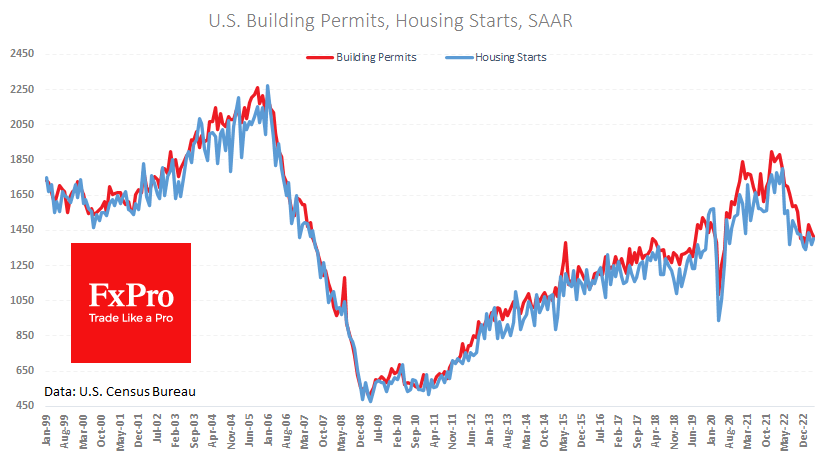

The US housing market continues to bear the brunt of high-interest rates. The number of building permits issued fell by 1.5% in April, following a 3.0% decline a month earlier. The last two months of decline erased almost half of.

May 17, 2023

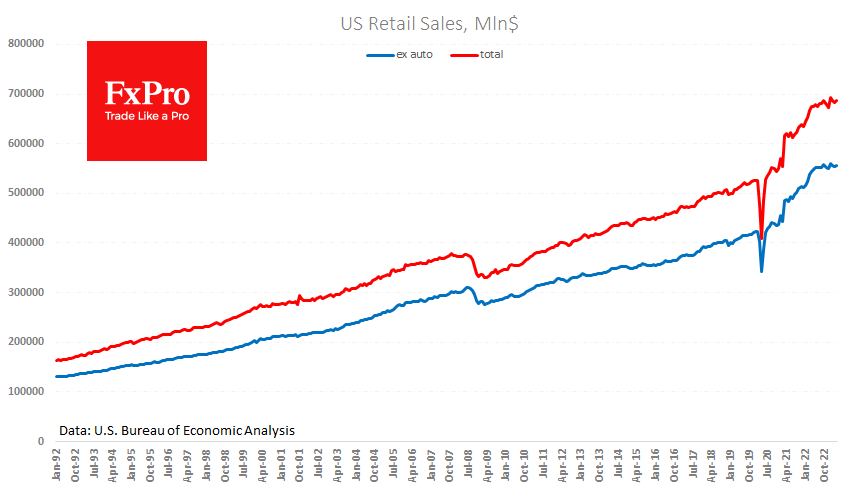

US retail sales rose 0.4% in April after falling 0.7% in the previous month, half as much as expected. Sales were 1.6% higher than a year earlier, well below the 4.9% inflation rate for the period, suggesting a decline in.

May 17, 2023

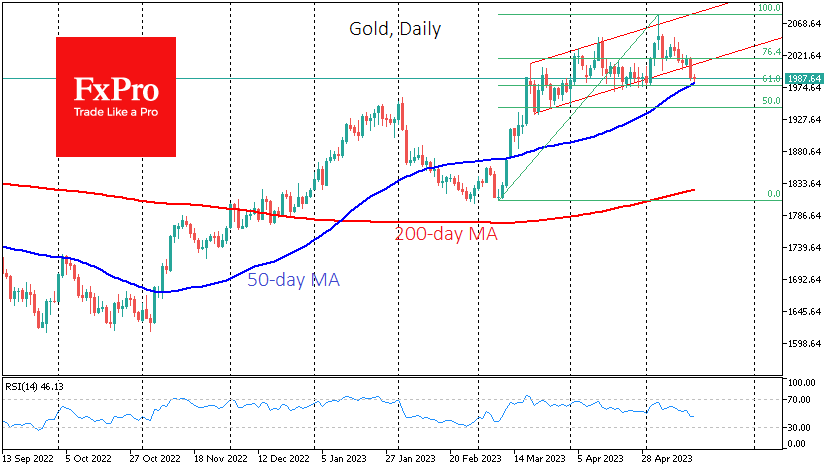

Gold had made impressive moves yesterday before active trading in New York. Still, comments from Fed officials, combined with the release of relatively strong industrial production data, pushed the price back almost $30 to $1990, where it remains at the.

May 16, 2023

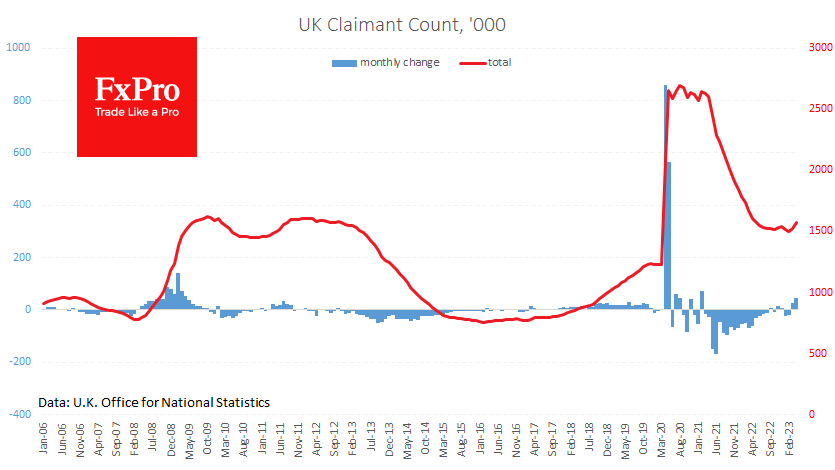

The UK labour market is deteriorating at an increasing rate. Data released this morning showed that jobless claims rose by 46.7k in April, following a 26.5k increase in March. Analysts had, on average, expected a rise of 31.2k. The unemployment.

May 16, 2023

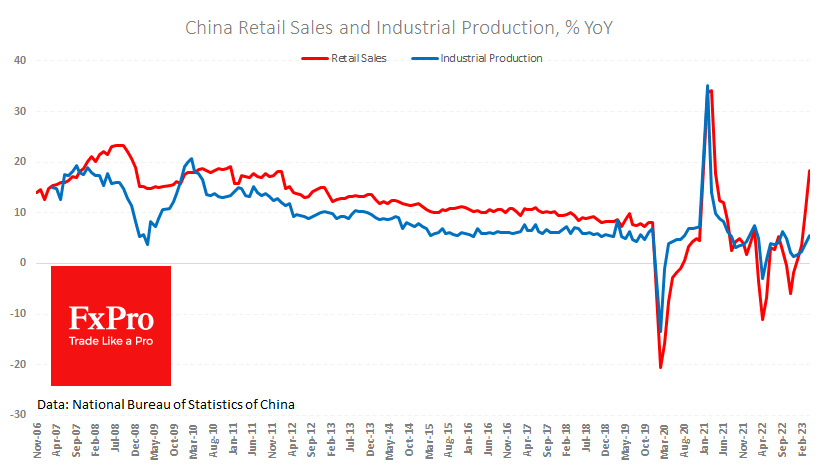

China’s economic growth is falling short of economists’ expectations, putting pressure on the yuan and raising questions about the sustainability of the national and global economies. Industrial production rose 5.6% y/y in April, but the average forecast was 10.9% y/y.

May 16, 2023

WTI crude oil rebounded on Monday after three sessions of declines in the second half of last week. Oil found support just before the start of active trading in Europe after falling to a 10-day low of $69.40. Today’s pullback.